Chapter 4: Using Futures Markets

... company and have silver stored. You own the commodity. 2. An anticipatory hedge: a commodity that you will acquire in the future. If you are a new silver mining company and just have initiated mining operations. You expect to acquire/have silver in the future. 3. An anticipatory hedge: a commodity t ...

... company and have silver stored. You own the commodity. 2. An anticipatory hedge: a commodity that you will acquire in the future. If you are a new silver mining company and just have initiated mining operations. You expect to acquire/have silver in the future. 3. An anticipatory hedge: a commodity t ...

Market Design with Blockchain Technology

... – one ID”) so that the size of an investor’s holdings cannot be inferred from the holdings that are attributed to each ID. We consider three regimes. In the first two, there is a one-to-one mapping between public IDs and investors, in the third there is a one-to-one mapping from public IDs to shares ...

... – one ID”) so that the size of an investor’s holdings cannot be inferred from the holdings that are attributed to each ID. We consider three regimes. In the first two, there is a one-to-one mapping between public IDs and investors, in the third there is a one-to-one mapping from public IDs to shares ...

“Mini-Tender” Offer

... unsolicited mini-tender offer by TRC Capital Corporation (TRC Capital) to purchase up to 2.5 million Thomson Reuters common shares, or approximately 0.31% of the common shares outstanding, at a price of C$39.75 per share. Thomson Reuters does not endorse this unsolicited mini-tender offer and recomm ...

... unsolicited mini-tender offer by TRC Capital Corporation (TRC Capital) to purchase up to 2.5 million Thomson Reuters common shares, or approximately 0.31% of the common shares outstanding, at a price of C$39.75 per share. Thomson Reuters does not endorse this unsolicited mini-tender offer and recomm ...

Stock Splits and Stock Dividends: Implications for Bid Ask Spread

... For this reason we use, the reverse of the trading volume calculated by the total number of the stock trading during the day, as proxy of the order processing costs. The inventory holding costs are related to the stock detention. They include the opportunity cost of the funds tied up and the risk of ...

... For this reason we use, the reverse of the trading volume calculated by the total number of the stock trading during the day, as proxy of the order processing costs. The inventory holding costs are related to the stock detention. They include the opportunity cost of the funds tied up and the risk of ...

THE BEST OF THE VALIDEA HOT LIST – 2010

... percentage of their investments in certain size or style stocks surely make good use of them, for example. And style-box categories that have been out of favor for long periods of time may present investors with buying opportunities. But in the dozen or so years I've spent studying history's most su ...

... percentage of their investments in certain size or style stocks surely make good use of them, for example. And style-box categories that have been out of favor for long periods of time may present investors with buying opportunities. But in the dozen or so years I've spent studying history's most su ...

“FILA SPA MARKET WARRANTS” REGULATION 1. 1.1

... The Exercise Period will automatically be suspended from the subsequent day (inclusive) to the date in which the Board of Directors has called a Shareholders’ Meeting of the company until the day (inclusive) in which the Shareholders’ Meeting has taken place, also in subsequent calls. In the case in ...

... The Exercise Period will automatically be suspended from the subsequent day (inclusive) to the date in which the Board of Directors has called a Shareholders’ Meeting of the company until the day (inclusive) in which the Shareholders’ Meeting has taken place, also in subsequent calls. In the case in ...

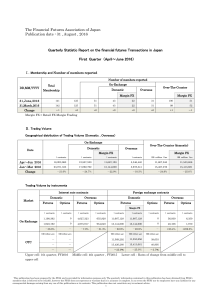

The Financial Futures Association of Japan Publication date : 31

... The overall trading volume of financial futures transaction during this term sharply dropped compared to the previous term. Trading volume of On-exchange financial futures transactions decreased by 21.0% and OTC financial futures transactions declined by 24.9% for a sluggish FX margin trading. While ...

... The overall trading volume of financial futures transaction during this term sharply dropped compared to the previous term. Trading volume of On-exchange financial futures transactions decreased by 21.0% and OTC financial futures transactions declined by 24.9% for a sluggish FX margin trading. While ...

Characterization of foreign exchange market using the threshold

... The market price is quoted between bid and ask prices. We assume that trading dealers have a minimum unit of yen or dollar. After a trade the seller and the buyer change places. For example, assume the i-th dealer; he is a buyer(σi = +1) and after making a purchase, becomes a seller(σi = −1). Althou ...

... The market price is quoted between bid and ask prices. We assume that trading dealers have a minimum unit of yen or dollar. After a trade the seller and the buyer change places. For example, assume the i-th dealer; he is a buyer(σi = +1) and after making a purchase, becomes a seller(σi = −1). Althou ...

Weather, Stock Returns, and the Impact of Localized Trading Behavior

... of less than five basis points per transaction. The authors’ analysis of trading strategies, however, is based on some strong assumptions. They assume that traders execute index futures trades at previous closing prices. They also assume that trading costs under five basis points are obtainable for ...

... of less than five basis points per transaction. The authors’ analysis of trading strategies, however, is based on some strong assumptions. They assume that traders execute index futures trades at previous closing prices. They also assume that trading costs under five basis points are obtainable for ...

Chapter 15 PPP

... • To protect investors, daily price change limits are set: – Daily price limit: restriction on the day-to-day change in price – Maximum daily price range: the amount a commodity price can change during the day; usually equal to twice the daily price limit ...

... • To protect investors, daily price change limits are set: – Daily price limit: restriction on the day-to-day change in price – Maximum daily price range: the amount a commodity price can change during the day; usually equal to twice the daily price limit ...

E-Margin is a leveraged trading facility. Positions

... (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ Rs.1500 on T day and applicable E-margin % for the scrip is 20%, you just need to pa ...

... (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ Rs.1500 on T day and applicable E-margin % for the scrip is 20%, you just need to pa ...

the structure of forward and futures markets

... the over-the-counter forward market is a highly regulated market forward contracts prevent the writer from assuming the credit risk of the buyer terms and conditions are tailored to the specific needs of the two parties involved transaction information between the two parties involved in the forward ...

... the over-the-counter forward market is a highly regulated market forward contracts prevent the writer from assuming the credit risk of the buyer terms and conditions are tailored to the specific needs of the two parties involved transaction information between the two parties involved in the forward ...

Hedge Accounts - Dorman Trading

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

Correlated Trading and Returns

... and options holdings and trades helps us to classify orders as likely non-speculative, i.e., driven by savings, dissavings, or risk sharing motives, and as likely speculative, i.e., driven by perceived information about the future stock price. For example, the transaction records contain a variable ...

... and options holdings and trades helps us to classify orders as likely non-speculative, i.e., driven by savings, dissavings, or risk sharing motives, and as likely speculative, i.e., driven by perceived information about the future stock price. For example, the transaction records contain a variable ...

Efficient market hypothesis: is the Croatian stock market as (in

... steps in testing its efficiency by measuring autocorrelation of returns started only recently (Barbić, 2010). The objective of this paper is to supplement traditional statistical testing with the assessment of a chosen trading rule (trading system) and compare the results obtained on the Croatian mar ...

... steps in testing its efficiency by measuring autocorrelation of returns started only recently (Barbić, 2010). The objective of this paper is to supplement traditional statistical testing with the assessment of a chosen trading rule (trading system) and compare the results obtained on the Croatian mar ...

AN ANALYSIS OF GLOBAL HFT REGULATION Motivations, Market

... There is little evidence that a market failure exists requiring additional aggressive regulation of HFT, or that government intervention will achieve market integrity or “fairness” goals better than existing market incentives. ...

... There is little evidence that a market failure exists requiring additional aggressive regulation of HFT, or that government intervention will achieve market integrity or “fairness” goals better than existing market incentives. ...

ethiopian commodity exchange - Making The Connection: Value

... Trading volume in 2010-11 totaled 504,000 tons for coffee, sesame seed, pea bean and maize, with a trading value of US$ 1.2 billion. On the ground, ECX has a network of over 50 warehouses spread across 17 sites, with a total storage capacity of 300,000 tons. Crops delivered to the warehouses are gra ...

... Trading volume in 2010-11 totaled 504,000 tons for coffee, sesame seed, pea bean and maize, with a trading value of US$ 1.2 billion. On the ground, ECX has a network of over 50 warehouses spread across 17 sites, with a total storage capacity of 300,000 tons. Crops delivered to the warehouses are gra ...

Stock prices volatility and trading volume

... Kingdom. Inter alia, he proved that major financial market crises had a significant impact on return volatility of investigated stock markets as well. Among them, the global financial crisis of 2007-2008 had the greatest and the most durable impact. His study also suggests strong comovement between ...

... Kingdom. Inter alia, he proved that major financial market crises had a significant impact on return volatility of investigated stock markets as well. Among them, the global financial crisis of 2007-2008 had the greatest and the most durable impact. His study also suggests strong comovement between ...

English - Seed System

... There may be many ways traders may help manage grain to be used as seed—either consciously or not. All of the features below help grain to become potential seed—so understanding whether traders use these practices is important to distinguish their stocks as grain or ‘potential seed, The checklist is ...

... There may be many ways traders may help manage grain to be used as seed—either consciously or not. All of the features below help grain to become potential seed—so understanding whether traders use these practices is important to distinguish their stocks as grain or ‘potential seed, The checklist is ...

Volatility trading in options market: How does it a ect where

... either by informed or liquidity traders. There are two kinds of informed traders: Directionaltraders who have information on the future underlying asset price and volatility-traders who have information on the future underlying asset volatility. To exploit their private information, while avoiding f ...

... either by informed or liquidity traders. There are two kinds of informed traders: Directionaltraders who have information on the future underlying asset price and volatility-traders who have information on the future underlying asset volatility. To exploit their private information, while avoiding f ...

Download attachment

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

Presentation

... Virtually no capital expenditure No additional operations or engineering resources With benefits of BT interconnect rates ...

... Virtually no capital expenditure No additional operations or engineering resources With benefits of BT interconnect rates ...

Mechanics of Futures Markets

... Opening and Closing Futures Position An investor could instruct a broker to buy for exp. one October oil futures contract. There is period of time during the delivery month when delivery can be made. Trading usually ends some time during the delivery period. The party with the short position choose ...

... Opening and Closing Futures Position An investor could instruct a broker to buy for exp. one October oil futures contract. There is period of time during the delivery month when delivery can be made. Trading usually ends some time during the delivery period. The party with the short position choose ...

Methodology of Exchange Design

... Generalized Uniform Price Call Market works very well with single-minded traders. – Open question: what if they are not single-minded? Conjecture from BFL: still ok. ...

... Generalized Uniform Price Call Market works very well with single-minded traders. – Open question: what if they are not single-minded? Conjecture from BFL: still ok. ...