Selecting the appropriate structure

... personal assets to pay for the debts of the business. Partnerships normally consists of between two and 20 partners. Partnerships have unlimited liability. There are two types of companies, private and public. A private company has fewer than 50 private shareholders. Shares in public companies are b ...

... personal assets to pay for the debts of the business. Partnerships normally consists of between two and 20 partners. Partnerships have unlimited liability. There are two types of companies, private and public. A private company has fewer than 50 private shareholders. Shares in public companies are b ...

While technically an equity investment, shares of preferred stock pay

... key information on the type of preferred stock being issued by reading its prospectus, which will tell you the following: Cumulative vs. noncumulative -- Most preferred issues are cumulative, which means that the dividends will accrue even if they are not paid each quarter. Convertible vs. nonconver ...

... key information on the type of preferred stock being issued by reading its prospectus, which will tell you the following: Cumulative vs. noncumulative -- Most preferred issues are cumulative, which means that the dividends will accrue even if they are not paid each quarter. Convertible vs. nonconver ...

stocks and shares

... ANNUAL GENERAL MEETING is held every year buying a share → ownership → right to vote at AGM + a dividend ...

... ANNUAL GENERAL MEETING is held every year buying a share → ownership → right to vote at AGM + a dividend ...

Capital Market

... The stocks are listed and traded on stock exchanges which are entities of a corporation or mutual organization specialized in the business of bringing buyers and sellers of the organizations to a listing of stocks and securities together. ...

... The stocks are listed and traded on stock exchanges which are entities of a corporation or mutual organization specialized in the business of bringing buyers and sellers of the organizations to a listing of stocks and securities together. ...

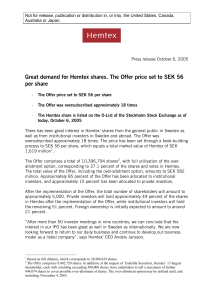

Great demand for Hemtex shares. The Offer price set to SEK

... Investment (www.priveq.se), that manages the venture capital fund Skandia Investement – Hemtex’ main owner. The Hemtex share is traded on the O-List of the Stockholm Stock Exchange under the short name “HEMX” as of today, October 6, 2005. Enskilda Securities is lead manager and sole bookrunner in th ...

... Investment (www.priveq.se), that manages the venture capital fund Skandia Investement – Hemtex’ main owner. The Hemtex share is traded on the O-List of the Stockholm Stock Exchange under the short name “HEMX” as of today, October 6, 2005. Enskilda Securities is lead manager and sole bookrunner in th ...

1 REVISION 2 I WHAT ARE THE OPPOSITES? income

... 1. Adjective describing a liability which has been incurred but not yet invoiced to the company. 2. The economic theory that government monetary and fiscal policy should stimulate business activity and increase employment in recession. 3. Assets whose value can only be turned into cash with difficul ...

... 1. Adjective describing a liability which has been incurred but not yet invoiced to the company. 2. The economic theory that government monetary and fiscal policy should stimulate business activity and increase employment in recession. 3. Assets whose value can only be turned into cash with difficul ...

Chapter 2.3

... purchase the security when it goes to market. This type of offering is most common with small companies that are owned by a small number of people. These types are companies are known as _______________________ or ___________________ corporations. Large companies may also use a private placement whe ...

... purchase the security when it goes to market. This type of offering is most common with small companies that are owned by a small number of people. These types are companies are known as _______________________ or ___________________ corporations. Large companies may also use a private placement whe ...

IMPORTANT TERMS 1. Accession Tax – 2. Active Market – 3

... This is a term used by stock exchange which specifies the particular stock or share which deals in frequent and regular transactions. It helps the buyers to obtain reasonably large amounts at any time. ...

... This is a term used by stock exchange which specifies the particular stock or share which deals in frequent and regular transactions. It helps the buyers to obtain reasonably large amounts at any time. ...

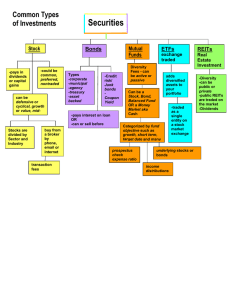

Securities

... fund, each ETF owns a group of investments, sometimes described as a basket, which reflects the composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading ...

... fund, each ETF owns a group of investments, sometimes described as a basket, which reflects the composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading ...

2 - JustAnswer

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

BoomandBust2

... The Coming Crash • Between Saturday 19th and Thursday 24th October millions of shares were sold. • Friday 25th October - Top bankers decide to support the market. • Banking firms buy millions of shares for more than they are worth. • Saturday 26th October - President Hoover said, “The fundamental b ...

... The Coming Crash • Between Saturday 19th and Thursday 24th October millions of shares were sold. • Friday 25th October - Top bankers decide to support the market. • Banking firms buy millions of shares for more than they are worth. • Saturday 26th October - President Hoover said, “The fundamental b ...

Stock Market Tycoons

... with facts and figures which represent dollars and centers to invest in companies around the world. Share holders, are people who buy parts of a company call shares to help companies grow. If a share holder buys part of a company and that company is successful, the shareholder will make money on the ...

... with facts and figures which represent dollars and centers to invest in companies around the world. Share holders, are people who buy parts of a company call shares to help companies grow. If a share holder buys part of a company and that company is successful, the shareholder will make money on the ...

Quiz 3

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

ECONOMICS CHAPTER 3

... – File incorporation papers – Charter – # shares (stock) – Stockholders – dividends Corporate structure: – Common stock-voting privileges for the Board of Directors. – Preferred stock-nonvoting owners, first recipients of dividends. – Voting by proxy Advantages: – Ease of raising capital • Sell more ...

... – File incorporation papers – Charter – # shares (stock) – Stockholders – dividends Corporate structure: – Common stock-voting privileges for the Board of Directors. – Preferred stock-nonvoting owners, first recipients of dividends. – Voting by proxy Advantages: – Ease of raising capital • Sell more ...

HELBOR EMPREENDIMENTOS S.A. Publicly

... profits and/or capital reserve to realize the buyback program of the book-entry registered common shares with no par value issued by the Company, in one trade or one series of trades, in accordance to Article 26, item (xvii) of the Company’s Bylaws and ICVM 567/15, complying with the conditions list ...

... profits and/or capital reserve to realize the buyback program of the book-entry registered common shares with no par value issued by the Company, in one trade or one series of trades, in accordance to Article 26, item (xvii) of the Company’s Bylaws and ICVM 567/15, complying with the conditions list ...

The Stock Exchange Corner

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

Investing Options

... • To grow or expand • To pay for ongoing business activities • It is popular because: – The company does not have to repay the money – Paying dividends is optional ...

... • To grow or expand • To pay for ongoing business activities • It is popular because: – The company does not have to repay the money – Paying dividends is optional ...

The Stock Market

... • Capital Gains-Sell the stock for more than he or she paid for it. – Capital Loss- Selling a stock at a lower price than it was purchased for. ...

... • Capital Gains-Sell the stock for more than he or she paid for it. – Capital Loss- Selling a stock at a lower price than it was purchased for. ...

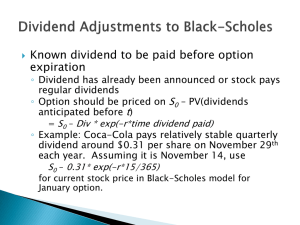

Option Price and Portfolio Simulation

... Discount the cash flow value back to time 0 by multiplying by e-rt to calculate the current value of the option. Select the current value of the option as the output variable to determine its mean price and other statistics. ...

... Discount the cash flow value back to time 0 by multiplying by e-rt to calculate the current value of the option. Select the current value of the option as the output variable to determine its mean price and other statistics. ...

Rights Offerings of Common Stock

... Rights Offerings of Common Stock When publicly traded firms issue new common stock, they have the following options: a) General Public Offering: stock is sold to any interested investor b) Private Placement: stock is placed with large investors, typically institutions. c) Rights Offering: existing s ...

... Rights Offerings of Common Stock When publicly traded firms issue new common stock, they have the following options: a) General Public Offering: stock is sold to any interested investor b) Private Placement: stock is placed with large investors, typically institutions. c) Rights Offering: existing s ...

Celebdaq Academy Lesson Plan

... 2. Dividends: That part of a company's/celebrity’s profits distributed to shareholders, usually expressed in pounds per share ...

... 2. Dividends: That part of a company's/celebrity’s profits distributed to shareholders, usually expressed in pounds per share ...

Penny Stocks: Low-priced stocks that typically sell

... Blue Chip Stocks: Refers to stocks of leading companies with a solid record of healthy dividend payments, good management, superior products/services and other strong investment qualities. Corporation: A legal entity that is separate and distinct from its owners. A corporation is allowed to own asse ...

... Blue Chip Stocks: Refers to stocks of leading companies with a solid record of healthy dividend payments, good management, superior products/services and other strong investment qualities. Corporation: A legal entity that is separate and distinct from its owners. A corporation is allowed to own asse ...

CHAPTER 10: Equity Markets

... Association of Securities Dealers Automated Quotation system and it provides continuous bid/ask information. NASDAQ is an electronic pink sheet. 4. What are the functions of market makers and specialists? How do they differ? Market makers are dealers who regularly quote bids and ask prices in a secu ...

... Association of Securities Dealers Automated Quotation system and it provides continuous bid/ask information. NASDAQ is an electronic pink sheet. 4. What are the functions of market makers and specialists? How do they differ? Market makers are dealers who regularly quote bids and ask prices in a secu ...

Common Stock Most shares of stock are called "common shares". If

... Since preferred shares carry fixed dividend payments, they tend to fluctuate in price far less than common shares. This means that the opportunity for both large capital gains and large capital losses is limited. Because preferred stock, like bonds, has fixed payments and small price fluctuations, i ...

... Since preferred shares carry fixed dividend payments, they tend to fluctuate in price far less than common shares. This means that the opportunity for both large capital gains and large capital losses is limited. Because preferred stock, like bonds, has fixed payments and small price fluctuations, i ...

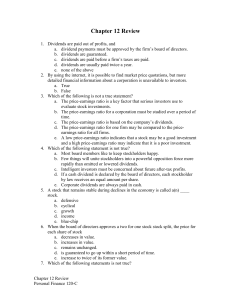

Chapter12Review

... 8. A small-cap stock is defined as a corporation that has total capitalization of a. more than $250 million. b. less than $300 million. c. less than $400 million. d. less than $500 millions. e. no capitalization. 9. The practice of churning usually increases investor profits. a. True b. False 10. A ...

... 8. A small-cap stock is defined as a corporation that has total capitalization of a. more than $250 million. b. less than $300 million. c. less than $400 million. d. less than $500 millions. e. no capitalization. 9. The practice of churning usually increases investor profits. a. True b. False 10. A ...