Stocks

... Key factor that serious investors as well as beginners can use to decide to invest in stock A low PE ratio indicates that a stock may be a good investment; the company has a lot of earnings compared to the price of the stock A high PE ratio indicates that a stock may not be a good investment; ...

... Key factor that serious investors as well as beginners can use to decide to invest in stock A low PE ratio indicates that a stock may be a good investment; the company has a lot of earnings compared to the price of the stock A high PE ratio indicates that a stock may not be a good investment; ...

Reading The Stock Market Table

... Then tell them that most brokers (people who buy and sell shares of stocks) require you to buy stocks in increments of 100 shares. Have them figure out what it would cost to buy 100 shares. Share some answers in class. ...

... Then tell them that most brokers (people who buy and sell shares of stocks) require you to buy stocks in increments of 100 shares. Have them figure out what it would cost to buy 100 shares. Share some answers in class. ...

Ch.13

... – An increase in the perceived riskiness of the bond. – Expectations of any of the above ...

... – An increase in the perceived riskiness of the bond. – Expectations of any of the above ...

Investing

... sums of cash is to sell stock in the company…if you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

... sums of cash is to sell stock in the company…if you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

OUT FROM UNDERNEATH Investor Strategies For Capitalizing On

... at $10 a share, it would be worth $25.93 10 years later. If you were to buy $1,000 worth of the stock at the beginning of each year, then you would have accumulated 714 shares at the end of 10 years. Dollar-cost averaging also allows investors to find a bright side to severe drops in the price of st ...

... at $10 a share, it would be worth $25.93 10 years later. If you were to buy $1,000 worth of the stock at the beginning of each year, then you would have accumulated 714 shares at the end of 10 years. Dollar-cost averaging also allows investors to find a bright side to severe drops in the price of st ...

Stocks and Bonds - NUS Investment Society

... and should not be considered investment advice or an offer of any security for sale. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be ...

... and should not be considered investment advice or an offer of any security for sale. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be ...

Test Your IQ (Investment Quotient)

... c. corporate money market debt d. municipality money market debt 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just rec ...

... c. corporate money market debt d. municipality money market debt 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just rec ...

Companies and their products

... Directions: Using the computer, or if you already know, locate the company that produces each of the products, or actually owns the company. These are known as Parent Companies, and will be KEY to the Stock Market. Write down Parent Companies & Ticker Symbol (if traded). ...

... Directions: Using the computer, or if you already know, locate the company that produces each of the products, or actually owns the company. These are known as Parent Companies, and will be KEY to the Stock Market. Write down Parent Companies & Ticker Symbol (if traded). ...

Note Guide

... 2. shares that are eligible to be sold 5. stock type with voting rights 11A. market in which shares are first sold 12. can be cumulative on non-cumulative 13. NASDAQ, for example 16. shares that have been put in to circulation 17. a bond issued by a local government (abbr) 20. the first time a compa ...

... 2. shares that are eligible to be sold 5. stock type with voting rights 11A. market in which shares are first sold 12. can be cumulative on non-cumulative 13. NASDAQ, for example 16. shares that have been put in to circulation 17. a bond issued by a local government (abbr) 20. the first time a compa ...

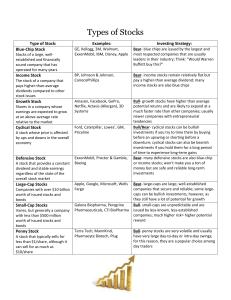

LO#3

... Issued by a large corporation that has a large amount of stock outstanding & a large amount of capitalization Capitalization The total amount of securities--stocks and bonds-issued by a corporation Small cap stocks Issued by a company that has a capitalization of $150 million or less Penny Sto ...

... Issued by a large corporation that has a large amount of stock outstanding & a large amount of capitalization Capitalization The total amount of securities--stocks and bonds-issued by a corporation Small cap stocks Issued by a company that has a capitalization of $150 million or less Penny Sto ...

Juan Ibarra 2/6/07 Professor Anu Vuorikoski Bus 173A

... 3. What is the stocks expected price 1 year from now? ^P1 = D2 / rs – g = $2.24 / (13% - 6%) = $32.00 4. What are the expected dividend yield, capital gains yield, and total return during the FIRST year? Expected Dividend Yield = D1 / P0 = $2.12 / $30.29 = 0.07 = 7% Capital Gains Yield (G) = (P1 – P ...

... 3. What is the stocks expected price 1 year from now? ^P1 = D2 / rs – g = $2.24 / (13% - 6%) = $32.00 4. What are the expected dividend yield, capital gains yield, and total return during the FIRST year? Expected Dividend Yield = D1 / P0 = $2.12 / $30.29 = 0.07 = 7% Capital Gains Yield (G) = (P1 – P ...

Tracking Your Investments Pre-Test (HS)

... 14. You want earnings to keep going up each year for any stock you own. a. True b. False 15. The stock market is influenced by the economy. a. True b. False 16. The price of a stock reflects the company’s value as well as a. the value of other companies in the same industry. b. the expected earnings ...

... 14. You want earnings to keep going up each year for any stock you own. a. True b. False 15. The stock market is influenced by the economy. a. True b. False 16. The price of a stock reflects the company’s value as well as a. the value of other companies in the same industry. b. the expected earnings ...

Types of Stocks

... dividend and stable earnings regardless of the state of the overall stock market ...

... dividend and stable earnings regardless of the state of the overall stock market ...

FAQs - Motswedi Securities

... which listed companies must also abide at all times. (b) Over and above the BSE, there is another regulatory body called the Non-Bank Financial Institutions Regulatory Authority (NBFIRA) which has its own Act by which it regulates stockbrokers, together with other institutions that act on behalf of ...

... which listed companies must also abide at all times. (b) Over and above the BSE, there is another regulatory body called the Non-Bank Financial Institutions Regulatory Authority (NBFIRA) which has its own Act by which it regulates stockbrokers, together with other institutions that act on behalf of ...

Waiting can be a winning strategy

... Of course, one must have a reason for waiting, and not wait just for the sake of it. Mr Buffett is a long-term value investor. He spots companies whose share prices do not reflect their true value, as they might be unloved by mainstream investors or they could have suffered a crisis and been oversol ...

... Of course, one must have a reason for waiting, and not wait just for the sake of it. Mr Buffett is a long-term value investor. He spots companies whose share prices do not reflect their true value, as they might be unloved by mainstream investors or they could have suffered a crisis and been oversol ...

DOCX - Pluristem Therapeutics

... into definitive agreements, as well the expected approval of Innovative Medical shareholders of the term sheet. Shareholder approval may not obtained on the expected date or at all. Further, although Pluristem has signed a term sheet, it may not be successful in negotiating definitive documentation ...

... into definitive agreements, as well the expected approval of Innovative Medical shareholders of the term sheet. Shareholder approval may not obtained on the expected date or at all. Further, although Pluristem has signed a term sheet, it may not be successful in negotiating definitive documentation ...

9.2 How to invest in corporations

... An electronic system called the NASDAQ Transactions, sales or purchases of shares, are usually conducted through a: Stock brokerage firm- a company that specializes in helping people buy and sell stocks & bonds. Stockbroker- a person who handles the transfer of stocks & bonds between buyer & s ...

... An electronic system called the NASDAQ Transactions, sales or purchases of shares, are usually conducted through a: Stock brokerage firm- a company that specializes in helping people buy and sell stocks & bonds. Stockbroker- a person who handles the transfer of stocks & bonds between buyer & s ...

Common Stock Held i

... Common Stock Held in Treasury Common Stock held in treasury is accounted for at average cost. Gains resulting from the reissuance of “Common Stock held in treasury” are credited to “Additional paid-in capital.” Losses resulting from the reissuance of “Common Stock held in treasury” are charged first ...

... Common Stock Held in Treasury Common Stock held in treasury is accounted for at average cost. Gains resulting from the reissuance of “Common Stock held in treasury” are credited to “Additional paid-in capital.” Losses resulting from the reissuance of “Common Stock held in treasury” are charged first ...

Stocks

... borrowing stock from the broker and sell borrowed stock Betting stock will go down in value Must replace stock you borrowed—so you want stock to go down. This allows you to buy it back at lower rate and make a profit If stock rises, you lose. You need to buy it back at higher price than you ...

... borrowing stock from the broker and sell borrowed stock Betting stock will go down in value Must replace stock you borrowed—so you want stock to go down. This allows you to buy it back at lower rate and make a profit If stock rises, you lose. You need to buy it back at higher price than you ...

of 6 CIRCULAR CIR/CFD/POLICYCELL/1/2015 April 13, 2015

... facilitate tendering of shares by the shareholders and settlement of the same, through the stock exchange mechanism as specified by the Board. ...

... facilitate tendering of shares by the shareholders and settlement of the same, through the stock exchange mechanism as specified by the Board. ...

Stocks: An Introduction

... From their early days, stocks had two important characteristics : The shares are issued in small denominations and The shares are transferable Until recently, stockowners received a certificate from the issuing company, but now it is a computerized process where the shares are registered in the name ...

... From their early days, stocks had two important characteristics : The shares are issued in small denominations and The shares are transferable Until recently, stockowners received a certificate from the issuing company, but now it is a computerized process where the shares are registered in the name ...

CP World History (Unit 7, #2)

... taking a risk of losing money as well. B. ____________________________ 1. The greater the risk you are willing to take the higher the potential rewards you can earn C. ____________________________ 1. The lower the risk you are willing to take the lower the potential rewards you will earn V. Risk and ...

... taking a risk of losing money as well. B. ____________________________ 1. The greater the risk you are willing to take the higher the potential rewards you can earn C. ____________________________ 1. The lower the risk you are willing to take the lower the potential rewards you will earn V. Risk and ...

Economic problems of the 1920s were hid by this.

... Many Americans believed this economic system was failing, and turned ...

... Many Americans believed this economic system was failing, and turned ...

Securities and Exchange Commission v. Ralston Purina Co

... Securities and Exchange Commission v. Ralston Purina Co [346 U.S. 119] Court Supreme Court of the United States Judicial History United States Court of Appeals affirmed a decision of the District Court which dismissed Petitioner’s action to enjoin respondent from issuing unregistered shares of stock ...

... Securities and Exchange Commission v. Ralston Purina Co [346 U.S. 119] Court Supreme Court of the United States Judicial History United States Court of Appeals affirmed a decision of the District Court which dismissed Petitioner’s action to enjoin respondent from issuing unregistered shares of stock ...

Practice Test

... bought a total of 110 cows a year ago, with the expectation of a 20 percent annual return on their money. [I]nitially, there were 63 investors who agreed to finance the purchase of a cow—which the company then cares for—in return for a piece of the company’s profits.18 ...

... bought a total of 110 cows a year ago, with the expectation of a 20 percent annual return on their money. [I]nitially, there were 63 investors who agreed to finance the purchase of a cow—which the company then cares for—in return for a piece of the company’s profits.18 ...