Stock-Alerts-Risk-Guidelines

... proven trading system in real-time so you can be aware of the best trades even when you are at work or school. We will text or email you the stock, the price to buy and 2 sell prices -- one if the stock is a winner and one if it is a loser. Place your stop-loss order so you are protected and sell th ...

... proven trading system in real-time so you can be aware of the best trades even when you are at work or school. We will text or email you the stock, the price to buy and 2 sell prices -- one if the stock is a winner and one if it is a loser. Place your stop-loss order so you are protected and sell th ...

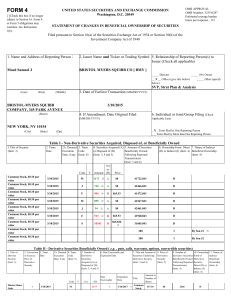

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

chapter 32

... shareholders of Dietech who would realize the additional value. The shareholders of Enbonpoint would be paying market value for the real estate as part of the higher price of acquiring Dietech and thus would not realize any gain from the acquisition. ...

... shareholders of Dietech who would realize the additional value. The shareholders of Enbonpoint would be paying market value for the real estate as part of the higher price of acquiring Dietech and thus would not realize any gain from the acquisition. ...

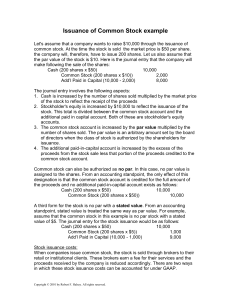

Issuance of Common Stock example

... The accounting for stock dividends is divided into two categories: small stock dividends (generally less than 20-25% of the outstanding shares) and large stock dividends (greater than 25% of the outstanding shares). Furthermore, two dates are important: the declaration date (when the dividend is dec ...

... The accounting for stock dividends is divided into two categories: small stock dividends (generally less than 20-25% of the outstanding shares) and large stock dividends (greater than 25% of the outstanding shares). Furthermore, two dates are important: the declaration date (when the dividend is dec ...

Placing and Subscription

... Kareevlei mine in South Africa, is pleased to announce that it has raised an aggregate of £366,000 (before expenses) via the issue of 12,200,000 new ordinary shares of 1 pence each in the capital of the Company (“the New Shares”) at a price of 3 pence per New Share. The proceeds of the fundraising w ...

... Kareevlei mine in South Africa, is pleased to announce that it has raised an aggregate of £366,000 (before expenses) via the issue of 12,200,000 new ordinary shares of 1 pence each in the capital of the Company (“the New Shares”) at a price of 3 pence per New Share. The proceeds of the fundraising w ...

The Economy of the 1920s

... investor accepts either price, a trade occurs. The price at which the trade occurs becomes the stock's new price. ...

... investor accepts either price, a trade occurs. The price at which the trade occurs becomes the stock's new price. ...

Chapter 25 - U of L Class Index

... shares at the option of the security holder The conversion price is the effective price paid for the stock The conversion ratio is the number of shares received when the bond is converted Convertible bonds will be worth at least as much as the straight bond value or the conversion value, which ...

... shares at the option of the security holder The conversion price is the effective price paid for the stock The conversion ratio is the number of shares received when the bond is converted Convertible bonds will be worth at least as much as the straight bond value or the conversion value, which ...

The Summary of Financials Explained

... This is an indicator of how the stock market assesses the company and enables potential investors to form an opinion on whether the expected future earnings make the share a worthwhile investment. In this week’s financials, BTI has a P/E ratio of 9.8 calculated as: Market price per share ($75.00) di ...

... This is an indicator of how the stock market assesses the company and enables potential investors to form an opinion on whether the expected future earnings make the share a worthwhile investment. In this week’s financials, BTI has a P/E ratio of 9.8 calculated as: Market price per share ($75.00) di ...

stock

... consistent history of paying high dividends. Investors choose income stocks in order to receive current income in the form of dividends. Preferred stocks pay the mast certain and predictable dividends ...

... consistent history of paying high dividends. Investors choose income stocks in order to receive current income in the form of dividends. Preferred stocks pay the mast certain and predictable dividends ...

Chap. 5 How Securities are Traded Buying and Selling Securities

... investor usually issues an order to buy or sell “at market”. This market order, means the investor will accept the best price available at the time. A certain trade but maybe at an uncertain price. • In contrast, some investors hope to improve the price they accept by placing limit orders. Limit ord ...

... investor usually issues an order to buy or sell “at market”. This market order, means the investor will accept the best price available at the time. A certain trade but maybe at an uncertain price. • In contrast, some investors hope to improve the price they accept by placing limit orders. Limit ord ...

Story 1

... • Long ago, "bear skin jobbers" were known for selling bear skins that they did not own; i.e., the bears had not yet been caught. This was the original source of the term "bear." This term eventually was used to describe short sellers, speculators who sold shares that they did not own, bought after ...

... • Long ago, "bear skin jobbers" were known for selling bear skins that they did not own; i.e., the bears had not yet been caught. This was the original source of the term "bear." This term eventually was used to describe short sellers, speculators who sold shares that they did not own, bought after ...

Securities Markets

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

ECOSCIENCES, INC. (Form: 8-K, Received: 06/23

... Effective June 23, 2014, our Articles of Incorporation on file with the Nevada Secretary of State were amended as follows: 1. Our name was changed from “On-Air Impact, Inc.” to “Ecosciences, Inc.” (the “ Name Change ”). 2. Our authorized capital stock was increased from One Hundred Million (100,000, ...

... Effective June 23, 2014, our Articles of Incorporation on file with the Nevada Secretary of State were amended as follows: 1. Our name was changed from “On-Air Impact, Inc.” to “Ecosciences, Inc.” (the “ Name Change ”). 2. Our authorized capital stock was increased from One Hundred Million (100,000, ...

Sam Strother and Shawna Tibbs are senior vice

... pension fund management division, with Strother having responsibility for fixed income securities (primarily bonds) and Tibbs responsible for equity investments. A major new client, the Northwestern Municipal Alliance, has requested that Mutual of Seattle present an investment seminar to the mayors ...

... pension fund management division, with Strother having responsibility for fixed income securities (primarily bonds) and Tibbs responsible for equity investments. A major new client, the Northwestern Municipal Alliance, has requested that Mutual of Seattle present an investment seminar to the mayors ...

Exercise of last warrants at specific issue price

... ("Jubilee" or "Company") Exercise of last warrants at the specific issue price Jubilee, the AIM-quoted and AltX-listed Mine-to-Metals specialist announces that it has received the final notification to exercise all outstanding warrants priced at 2.0p and 2.5p being, 625 000 warrants at a price of 2. ...

... ("Jubilee" or "Company") Exercise of last warrants at the specific issue price Jubilee, the AIM-quoted and AltX-listed Mine-to-Metals specialist announces that it has received the final notification to exercise all outstanding warrants priced at 2.0p and 2.5p being, 625 000 warrants at a price of 2. ...

Document

... • Second oldest form of analysis, also called “technical”. Back in favour in the 1990s and thriving in currency markets • Chartists are technicians who look for trend indicators in graphical charts, usually depicting price as a function of time, but often including information on intraday highs & lo ...

... • Second oldest form of analysis, also called “technical”. Back in favour in the 1990s and thriving in currency markets • Chartists are technicians who look for trend indicators in graphical charts, usually depicting price as a function of time, but often including information on intraday highs & lo ...

FIN 303 Chap 9 Fall 2009

... In equilibrium, stock prices are stable and there is no general tendency for people to buy versus to sell. In equilibrium, two conditions hold: The current market stock price equals what the “marginal investor” thinks it is worth. ...

... In equilibrium, stock prices are stable and there is no general tendency for people to buy versus to sell. In equilibrium, two conditions hold: The current market stock price equals what the “marginal investor” thinks it is worth. ...

Advantages and disadvantages of investing in the Stock

... 150,000 shares. A share holder who owned 100 shares will now own 150 shares worth the same. The company does not receive any funds, and hence, there is no change in the value of the firm. The only change is that the company will transfer the value of the new shares from revenue reserves to share cap ...

... 150,000 shares. A share holder who owned 100 shares will now own 150 shares worth the same. The company does not receive any funds, and hence, there is no change in the value of the firm. The only change is that the company will transfer the value of the new shares from revenue reserves to share cap ...

FASB Statement 149 and Redeemable Preferred

... obligation to repurchase the company’s equity shares that requires or could require settlement by transfer of assets (e.g., written put options or forward contracts), that are physically settled or net cash settled and (ii) financial instruments embodying an obligation that the issuer must or could ...

... obligation to repurchase the company’s equity shares that requires or could require settlement by transfer of assets (e.g., written put options or forward contracts), that are physically settled or net cash settled and (ii) financial instruments embodying an obligation that the issuer must or could ...

Which is NOT a basic function of money?

... managed by a financial expert. These funds often contain stocks and bonds from many different companies. ...

... managed by a financial expert. These funds often contain stocks and bonds from many different companies. ...

Investing

... When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

... When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

Chapter 10

... LO5. Describe the accounting issues related to retained earnings and accumulated other comprehensive income. ...

... LO5. Describe the accounting issues related to retained earnings and accumulated other comprehensive income. ...

Chapter 10

... LO5. Describe the accounting issues related to retained earnings and accumulated other comprehensive income. ...

... LO5. Describe the accounting issues related to retained earnings and accumulated other comprehensive income. ...

![smgclassroompresentation[1]](http://s1.studyres.com/store/data/021802581_1-1933bb9c9a7cfb38987e81a50d5e9b34-300x300.png)