How did the stock market work?

... What was ‘playing on the stock market’? ‘Playing the stock market’ became a national craze where millions of people brought shares in all sorts of companies and sold them at a profit – then brought more shares to make even more money. ...

... What was ‘playing on the stock market’? ‘Playing the stock market’ became a national craze where millions of people brought shares in all sorts of companies and sold them at a profit – then brought more shares to make even more money. ...

2.03-PowerPoint

... corporations Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

... corporations Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

Geren. Con.SU.J:t1nlil

... of the company, the value of that stock will increase and the employee thus shares iu the company's success. However, mandatory expensing, as proposed by the FASB, would require a value to be placed on a stock option before it has been exercised, when in fact the value of that option cannot even be ...

... of the company, the value of that stock will increase and the employee thus shares iu the company's success. However, mandatory expensing, as proposed by the FASB, would require a value to be placed on a stock option before it has been exercised, when in fact the value of that option cannot even be ...

Warm Up - cloudfront.net

... Objective: Students will be able to assess ways to be a wise investor in the stock market and in other personal investment options. ...

... Objective: Students will be able to assess ways to be a wise investor in the stock market and in other personal investment options. ...

2.03 Federal Reserve & Stock Market

... issuing shares of stock to people who want to invest in the company. The sale of shares of stock is a way for the corporations to raise money. Provides a place for the buying, selling and trading of stocks (and other securities). ...

... issuing shares of stock to people who want to invest in the company. The sale of shares of stock is a way for the corporations to raise money. Provides a place for the buying, selling and trading of stocks (and other securities). ...

0538453990_268808

... Cross-8e: Question with Sample Answer Chapter 29: Investor Protection and Corporate ...

... Cross-8e: Question with Sample Answer Chapter 29: Investor Protection and Corporate ...

Video Q and A for Episode Two of No

... A stock is a share of ownership in a company; ownership in the company is equal to the number of shares owned by the shareholder relative to the total number of shares owned by all members. Stocks are often traded publicly. A publicly traded company issues stock that is traded on a stock exchange, s ...

... A stock is a share of ownership in a company; ownership in the company is equal to the number of shares owned by the shareholder relative to the total number of shares owned by all members. Stocks are often traded publicly. A publicly traded company issues stock that is traded on a stock exchange, s ...

Week10.2 Stocks - B-K

... – A market order instructs a brokerage firm to obtain the highest price possible – if the investor is selling – or the lowest price possible – if the investor is buying – A limit order instructs the brokerage firm not to pay more than a specified price for stock if the investor is buying, or accept ...

... – A market order instructs a brokerage firm to obtain the highest price possible – if the investor is selling – or the lowest price possible – if the investor is buying – A limit order instructs the brokerage firm not to pay more than a specified price for stock if the investor is buying, or accept ...

Financial Health- Understanding the Market

... Basics I Learned 1. Stockbrokers are salesmen 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...

... Basics I Learned 1. Stockbrokers are salesmen 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...

Language of the SM Notes

... A ________________ is a type of ________________ a company issues to investors for a specified amount of time. ...

... A ________________ is a type of ________________ a company issues to investors for a specified amount of time. ...

Stock Market

... Reasons for the Great Depression 1. Stock Market Crash • Bull Market - When stock sells are on the rise • Speculation/Margin buying stocks on credit • Margin Calls – Stockbrokers call in the credit and debt that is owed to the stock market • Black Tuesday – October 29, 1929 the stock market ...

... Reasons for the Great Depression 1. Stock Market Crash • Bull Market - When stock sells are on the rise • Speculation/Margin buying stocks on credit • Margin Calls – Stockbrokers call in the credit and debt that is owed to the stock market • Black Tuesday – October 29, 1929 the stock market ...

Business English -Stock Market Trading Vocabulary

... 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Trading stock is not an __________________________ science. exact faultless free from flaws 5. When a stock market _________________ ...

... 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Trading stock is not an __________________________ science. exact faultless free from flaws 5. When a stock market _________________ ...

Stock Market - ovient project

... company gets those proceeds. This adds to the company’s value, making the price of each stock rise a little. When people sell their stock, the price per share goes down a little, contrary to people buying shares. ...

... company gets those proceeds. This adds to the company’s value, making the price of each stock rise a little. When people sell their stock, the price per share goes down a little, contrary to people buying shares. ...

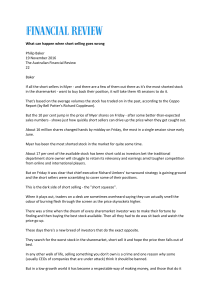

What can happen when short selling goes wrong Philip

... The stock is a pure growth play and, with a forward price earnings ratio of more than 50 times forward earnings, was a red rag to the short sellers who know that with those sorts of PE multiples, it can only be sustained if the outlook for growth remains in double-digit figures. It would take the sh ...

... The stock is a pure growth play and, with a forward price earnings ratio of more than 50 times forward earnings, was a red rag to the short sellers who know that with those sorts of PE multiples, it can only be sustained if the outlook for growth remains in double-digit figures. It would take the sh ...

Stock Market

... Feelings of confidence where high during this time. It was not necessary to have a lot of money to play the stock market. You could buy stocks on credit, just as you could by a car or a washing machine. All that you needed was a small cash down payment, usually 10 percent (this was called buying on ...

... Feelings of confidence where high during this time. It was not necessary to have a lot of money to play the stock market. You could buy stocks on credit, just as you could by a car or a washing machine. All that you needed was a small cash down payment, usually 10 percent (this was called buying on ...

Chapter 15 - Salem State University

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

Jim Carroll in BizWest on the Winners and Losers in Stock

... as the result of stock pump-and-dump scheme to drive up the company's share prices. Stock pump-and-dump schemes usually involve those behind them making false or exaggerated claims about stocks to drive up trading and share price. When the stock has risen, the perpetrators dump their shares for a ma ...

... as the result of stock pump-and-dump scheme to drive up the company's share prices. Stock pump-and-dump schemes usually involve those behind them making false or exaggerated claims about stocks to drive up trading and share price. When the stock has risen, the perpetrators dump their shares for a ma ...

Key Vocabulary List

... 3. When talking about economic resources, capital refers to ____________________. 4. One economic principle is that __________ are limited. ...

... 3. When talking about economic resources, capital refers to ____________________. 4. One economic principle is that __________ are limited. ...

The Great Depression

... company’s stocks would rise, buy a whole bunch of that stock, then turn around & sell at a higher price for quick investment. This would continue. A company’s value was being artificially inflated. • Scams in the stock market as well; creating a buying frenzy in generic company then selling quickly. ...

... company’s stocks would rise, buy a whole bunch of that stock, then turn around & sell at a higher price for quick investment. This would continue. A company’s value was being artificially inflated. • Scams in the stock market as well; creating a buying frenzy in generic company then selling quickly. ...

Stocks and the Stock Market

... receives on the amount he or she originally invested in the company Paid only when a company makes a profit 2. Sell the stock You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

... receives on the amount he or she originally invested in the company Paid only when a company makes a profit 2. Sell the stock You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

Chapter 12.2 notes - Effingham County Schools

... • You make money when the price goes up • Called capital gains ...

... • You make money when the price goes up • Called capital gains ...

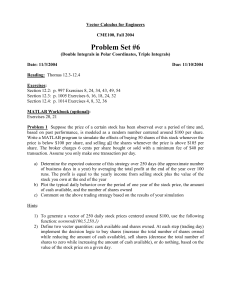

Word

... based on past performance, is modeled as a random number centered around $100 per share. Write a MATLAB program to simulate the effects of buying 50 shares of this stock whenever the price is below $100 per share, and selling all the shares whenever the price is above $105 per share. The broker char ...

... based on past performance, is modeled as a random number centered around $100 per share. Write a MATLAB program to simulate the effects of buying 50 shares of this stock whenever the price is below $100 per share, and selling all the shares whenever the price is above $105 per share. The broker char ...

DATE - Manhasset Public Schools

... A (1) _______________________ is an organized system for buying and selling shares in corporations. Many investors lacked the money to continue purchasing stock, so they bought (2) _________________. Stock prices began to fall in September 1929 and declined steadily until (3) ____________________. P ...

... A (1) _______________________ is an organized system for buying and selling shares in corporations. Many investors lacked the money to continue purchasing stock, so they bought (2) _________________. Stock prices began to fall in September 1929 and declined steadily until (3) ____________________. P ...