Chapter 15

... D. All prices are subject to daily move limits. See Table 15-4 on page 400. 1. When limits are reached, trading is stopped. 2. It is possible in volatile markets that it may take more than one day to offset a losing position. ...

... D. All prices are subject to daily move limits. See Table 15-4 on page 400. 1. When limits are reached, trading is stopped. 2. It is possible in volatile markets that it may take more than one day to offset a losing position. ...

Trading hours from 12 March 2017

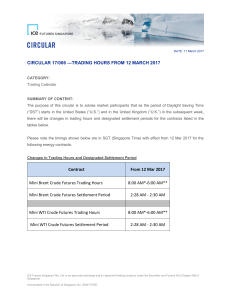

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

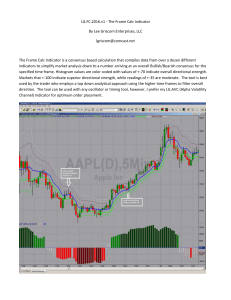

LG.FC.2016.v1

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

On Market Makers` Contribution to Trading Efficiency in Options

... in the TASE’s computerized option market. In response to this recommendation, the TASE decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes fo ...

... in the TASE’s computerized option market. In response to this recommendation, the TASE decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes fo ...

The fundamental drivers of recent volatility in

... delivery. Commodity index funds arose because most institutional investors do not have access to the sophisticated trading operations necessary to manage a diversified commodity index portfolio using futures contracts. Typically, the approach is to take a long position in a near-term futures contrac ...

... delivery. Commodity index funds arose because most institutional investors do not have access to the sophisticated trading operations necessary to manage a diversified commodity index portfolio using futures contracts. Typically, the approach is to take a long position in a near-term futures contrac ...

Outlook of the precious metals: Gold in 2011

... SPEAKER: MS ONG YI LING, Investment Analyst from Phillip Futures Pte Ltd Ms Ong graduated from the Nanyang Technological University (Singapore), with First Class Honours in Accountancy and second specialization in Banking and Finance. She is specializes on the gold and other precious metals market, ...

... SPEAKER: MS ONG YI LING, Investment Analyst from Phillip Futures Pte Ltd Ms Ong graduated from the Nanyang Technological University (Singapore), with First Class Honours in Accountancy and second specialization in Banking and Finance. She is specializes on the gold and other precious metals market, ...

Weekly Commentary 04-17-17

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index p ...

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index p ...

BAML Partners with Thesys on New High-Speed Trading

... to Osaka Securities Exchange The Osaka Securities Exchange, Japan’s largest derivatives exchange, can now provide U.S. market participants with direct access to its newly implemented J-Gate trading system without having to register as a U.S. futures exchange, following the issuance of a no-action le ...

... to Osaka Securities Exchange The Osaka Securities Exchange, Japan’s largest derivatives exchange, can now provide U.S. market participants with direct access to its newly implemented J-Gate trading system without having to register as a U.S. futures exchange, following the issuance of a no-action le ...

commodity trading and financial markets

... also have global risk management rules it employs in place that limit their exposure to particular markets and regions as well as overall restrictions imposed by the size of the balance sheet. By using hedging tools, they can determine which trades are likely to be most profitable no matter what hap ...

... also have global risk management rules it employs in place that limit their exposure to particular markets and regions as well as overall restrictions imposed by the size of the balance sheet. By using hedging tools, they can determine which trades are likely to be most profitable no matter what hap ...

Stock Trading Stock Trading

... PBHK Stock Trading is a mobile application provided by Public Bank (HK) Limited ...

... PBHK Stock Trading is a mobile application provided by Public Bank (HK) Limited ...

- Miller Capital Management

... * The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices. * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen a ...

... * The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices. * The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen a ...

Weekly Commentary 04-27-15 PAA

... Investors paid as much as $97 a share during the first day of trading. By the end of 2000, the stock price was worth less than a dollar a share. Things are different this time around, according to Financial Times, largely because a lot more economic activity takes place online today. About $50 billi ...

... Investors paid as much as $97 a share during the first day of trading. By the end of 2000, the stock price was worth less than a dollar a share. Things are different this time around, according to Financial Times, largely because a lot more economic activity takes place online today. About $50 billi ...

The Commodity Futures Modernization Act of 2000

... Under the CEA, as amended by the Act, the term Hybrid Instrument generally is dened as a security or depository instrument that has one or more payments indexed to the value, level or rate of one or more commodities. The CEA broadly denes the term ‘‘commodity’’ to include traditional agricultural ...

... Under the CEA, as amended by the Act, the term Hybrid Instrument generally is dened as a security or depository instrument that has one or more payments indexed to the value, level or rate of one or more commodities. The CEA broadly denes the term ‘‘commodity’’ to include traditional agricultural ...

Chapter 259 South African Rand/US Dollar (ZAR/USD)

... limits as set forth in Rule 589 and in the Special Price Fluctuation Limits Table in the Interpretations & Special Notices Section of Chapter 5. 25901.G. Termination of Trading Futures trading shall terminate on the second Business Day immediately preceding the third Wednesday of the contract month. ...

... limits as set forth in Rule 589 and in the Special Price Fluctuation Limits Table in the Interpretations & Special Notices Section of Chapter 5. 25901.G. Termination of Trading Futures trading shall terminate on the second Business Day immediately preceding the third Wednesday of the contract month. ...

Correlation Analysis Between Commodity Market And Stock Market

... The past few years have seen an unprecedented rise in the investments in the new types of financial instruments particularly being the commodity – by directly purchasing commodities, by taking outright positions in commodity futures, or by acquiring stakes in exchange-traded commodity funds (ETFs) a ...

... The past few years have seen an unprecedented rise in the investments in the new types of financial instruments particularly being the commodity – by directly purchasing commodities, by taking outright positions in commodity futures, or by acquiring stakes in exchange-traded commodity funds (ETFs) a ...

What derivatives tell us

... The OPEN INTEREST of FTASE20 Futures is crucial.. Generally speaking above 24 – 25,000 futures and certainly close to 30,000 futures means that selling pressure will increase in the short term at the spot market. ...

... The OPEN INTEREST of FTASE20 Futures is crucial.. Generally speaking above 24 – 25,000 futures and certainly close to 30,000 futures means that selling pressure will increase in the short term at the spot market. ...

Introduction

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

Derivatives: The Good, The Bad and … the Necessary?

... In the U.S., proposed legislation will address the credit risks posed by the nature of the bilateral agreement, as well as the risks posed to the financial system from fraud and market manipulation. The “Over-the-Counter Derivatives Markets Act of 2009” drafted by the U.S. administration in Augu ...

... In the U.S., proposed legislation will address the credit risks posed by the nature of the bilateral agreement, as well as the risks posed to the financial system from fraud and market manipulation. The “Over-the-Counter Derivatives Markets Act of 2009” drafted by the U.S. administration in Augu ...

Regulatory Analyst, Derivatives

... Oversight oversees the equity and derivatives exchanges, clearing agencies, trade repositories, selfregulatory organizations, the Canadian Investor Protection Fund and the MFDA Investor Protection Corporation regulated in Alberta. We are involved in leading-edge projects aimed at balancing effective ...

... Oversight oversees the equity and derivatives exchanges, clearing agencies, trade repositories, selfregulatory organizations, the Canadian Investor Protection Fund and the MFDA Investor Protection Corporation regulated in Alberta. We are involved in leading-edge projects aimed at balancing effective ...

April 24, 2017 - Portfolio Advisory Council

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.