Weekly Commentary 09-21-15 PAA

... representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * T ...

... representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * T ...

Inflation is Having Its Effect, as Cycles Research Predicted Four

... the prediction was that the planetary cycles that had created the period of disinflation that began in the 1980s, simply expired in 1998-1999. The situation was analogous to a cork that is held at the bottom of a pool. When it is released, it pops to the surface. If this is true, then why have we no ...

... the prediction was that the planetary cycles that had created the period of disinflation that began in the 1980s, simply expired in 1998-1999. The situation was analogous to a cork that is held at the bottom of a pool. When it is released, it pops to the surface. If this is true, then why have we no ...

Introduction to the Mexican Derivative market (MexDer)

... Amount of gains in 2009: $5.085 billion from 2009 oil hedge after the credit crisis crushed oil prices (Source: Reuters(2009)) West Texas Intermediate (WTI) is a type of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange’s oil futures contracts. ...

... Amount of gains in 2009: $5.085 billion from 2009 oil hedge after the credit crisis crushed oil prices (Source: Reuters(2009)) West Texas Intermediate (WTI) is a type of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange’s oil futures contracts. ...

risk management and inter bank dealings

... time and A.P. (DIR Series) Circular no. 58 dated December 15, 2011 and A.P. (DIR Series) Circular no. 13 dated July 31, 2012. 2. Under the extant regulations, the facility of cancellation and rebooking is not permitted for forward contracts, involving Rupee as one of the currencies, booked by reside ...

... time and A.P. (DIR Series) Circular no. 58 dated December 15, 2011 and A.P. (DIR Series) Circular no. 13 dated July 31, 2012. 2. Under the extant regulations, the facility of cancellation and rebooking is not permitted for forward contracts, involving Rupee as one of the currencies, booked by reside ...

Winter 2015 - RBC Wealth Management

... considered along with the extreme volatility in other sectors as well. Very likely something big is going on and no one seems to have a handle on it just yet. We in Canada seem to be concerning ourselves with the collapse in energy prices and the negative effects on the Canadian economy. It will cer ...

... considered along with the extreme volatility in other sectors as well. Very likely something big is going on and no one seems to have a handle on it just yet. We in Canada seem to be concerning ourselves with the collapse in energy prices and the negative effects on the Canadian economy. It will cer ...

Investor Education: Investing globally can help your money grow

... performance in the global emerging markets. The MSCI World Index (ND) is an unmanaged index of equity securities from developed countries. The S&P 500 Index is an unmanaged index of common stock performance. All returns are quoted in U.S. dollars. Indexes assume reinvestment of distributions and do ...

... performance in the global emerging markets. The MSCI World Index (ND) is an unmanaged index of equity securities from developed countries. The S&P 500 Index is an unmanaged index of common stock performance. All returns are quoted in U.S. dollars. Indexes assume reinvestment of distributions and do ...

G-20 agriculture ministers meet in Paris with little result

... integrated into world markets. Price spikes and periods of excessive price volatility are both associated with low levels of stocks; indeed, if stocks are sufficient, neither price spikes nor excessive volatility will occur. Yet the G-20 refused to reconsider policy in this area, considering (and d ...

... integrated into world markets. Price spikes and periods of excessive price volatility are both associated with low levels of stocks; indeed, if stocks are sufficient, neither price spikes nor excessive volatility will occur. Yet the G-20 refused to reconsider policy in this area, considering (and d ...

Justin Byers - AP Scholar, 4

... I am highly organized and self-driven individual, passionate about developing my career as a Securities/Commodity Analyst. Over the past few years, I have developed an extreme interest in investing and trading equity stocks focusing on technical analysis, trend recognition, ETF correlations, and cat ...

... I am highly organized and self-driven individual, passionate about developing my career as a Securities/Commodity Analyst. Over the past few years, I have developed an extreme interest in investing and trading equity stocks focusing on technical analysis, trend recognition, ETF correlations, and cat ...

Knowledge Center

... A forward contract is a legally enforceable agreement for delivery of goods or the underlying asset on a specific date in future at a price agreed on the date of contract. What are standardized contracts? Futures contracts are standardized. In other words, the parties to the contracts do not decide ...

... A forward contract is a legally enforceable agreement for delivery of goods or the underlying asset on a specific date in future at a price agreed on the date of contract. What are standardized contracts? Futures contracts are standardized. In other words, the parties to the contracts do not decide ...

Emerging Derivative Markets

... Risk management issues EM lessons (Mexico, Thailand, Russia): FX and Credit D may not be compatible with fixed FX and credit policies OTC risk concentration: Public banks’ transparency, weak best practices, trend to central counterparties Disclosure (IAS39) essential for insurance solvency, dist ...

... Risk management issues EM lessons (Mexico, Thailand, Russia): FX and Credit D may not be compatible with fixed FX and credit policies OTC risk concentration: Public banks’ transparency, weak best practices, trend to central counterparties Disclosure (IAS39) essential for insurance solvency, dist ...

PART V - Georgia College & State University

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

Untitled

... ways. One strategy is to post buy and sell orders a few pennies from where the market is trading and wait until one of the orders is executed. If crude oil is selling for $90 on the CME, a firm might post an order to sell one contract for $90.03 and a ...

... ways. One strategy is to post buy and sell orders a few pennies from where the market is trading and wait until one of the orders is executed. If crude oil is selling for $90 on the CME, a firm might post an order to sell one contract for $90.03 and a ...

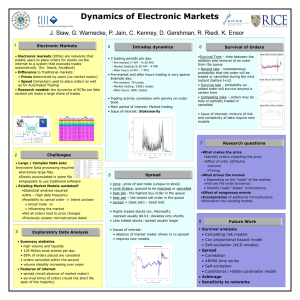

SciDAC Poster: INCITE

... added order will survive beyond a certain time • Competing risks – orders may be fully or partially traded or cancelled ...

... added order will survive beyond a certain time • Competing risks – orders may be fully or partially traded or cancelled ...

Get the flexibility to determine a futures price without

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

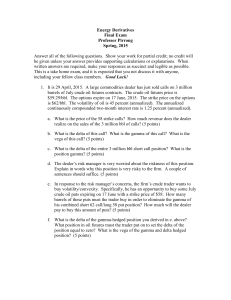

Risk Management

... Energy Derivatives Final Exam Professor Pirrong Spring, 2015 Answer all of the following questions. Show your work for partial credit; no credit will be given unless your answer provides supporting calculations or explanations. When written answers are required, make your responses as succinct and l ...

... Energy Derivatives Final Exam Professor Pirrong Spring, 2015 Answer all of the following questions. Show your work for partial credit; no credit will be given unless your answer provides supporting calculations or explanations. When written answers are required, make your responses as succinct and l ...

Weekly Market Commentary November 21, 2016

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index p ...

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index p ...

High-frequency trading

... volumes and high speeds aiming to capture sometimes a fraction of a cent in profit on every trade. • HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. • HFT traders often use stimulus-response methods (rapid fire placement and then immedi ...

... volumes and high speeds aiming to capture sometimes a fraction of a cent in profit on every trade. • HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. • HFT traders often use stimulus-response methods (rapid fire placement and then immedi ...

Paper Title (use style: paper title)

... commodity move in their favor, they make money. If price moves in the opposite direction, then they lose money. Commodity derivatives trading allow a person to use a small sum of money for the potential to earn substantial profits. This sort of investment, however, is considered high risk. When pric ...

... commodity move in their favor, they make money. If price moves in the opposite direction, then they lose money. Commodity derivatives trading allow a person to use a small sum of money for the potential to earn substantial profits. This sort of investment, however, is considered high risk. When pric ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.