Economics 330 Money and Banking Lecture 18

... Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market and margin requirements: avoids default risk 4. Don’t have to deliver: netting ...

... Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market and margin requirements: avoids default risk 4. Don’t have to deliver: netting ...

Back to basics on Risk Management – Futures

... Margin deposits are automatically amended as the market moves. If there are insufficient funds deposited to cover this, the trader’s accounts will be suspended until they have made payments to cover it. This can reduce the appeal to producers of using futures markets directly as cash flow problems m ...

... Margin deposits are automatically amended as the market moves. If there are insufficient funds deposited to cover this, the trader’s accounts will be suspended until they have made payments to cover it. This can reduce the appeal to producers of using futures markets directly as cash flow problems m ...

File

... • With the same process and stock, intention and definition of objectives separate trading from investing ...

... • With the same process and stock, intention and definition of objectives separate trading from investing ...

Broad Market Gains Power Historic Rally

... the S&P 500 set up those assets for rebounds. "We are in a Goldilocks-like age at the moment,'' said asset manager Jack Flaherty, referring to markets perceived as not too hot and not too cold—just right. Mr. Flaherty is head of U.S. fixed income at GAM, which has over $120 billion in global assets ...

... the S&P 500 set up those assets for rebounds. "We are in a Goldilocks-like age at the moment,'' said asset manager Jack Flaherty, referring to markets perceived as not too hot and not too cold—just right. Mr. Flaherty is head of U.S. fixed income at GAM, which has over $120 billion in global assets ...

Brian developed his interest for the futures market, while growing up

... Account Executive, Market Analyst Archer Financial Services 1600A Board of Trade Building 141 W. Jackson Blvd Chicago, IL 60604 ...

... Account Executive, Market Analyst Archer Financial Services 1600A Board of Trade Building 141 W. Jackson Blvd Chicago, IL 60604 ...

Changes to Result in Better Framework and Incentive Structure for

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

Derivative (finance)

... selling, and short-selling of stocks, bonds, commodities, currencies, collectibles, real estate, derivatives or any valuable financial instrument to profit from fluctuations in its price as opposed to buying it for use or for income via methods such as dividends or interest. Speculation or agiotage ...

... selling, and short-selling of stocks, bonds, commodities, currencies, collectibles, real estate, derivatives or any valuable financial instrument to profit from fluctuations in its price as opposed to buying it for use or for income via methods such as dividends or interest. Speculation or agiotage ...

Derivative (finance)

... selling, and short-selling of stocks, bonds, commodities, currencies, collectibles, real estate, derivatives or any valuable financial instrument to profit from fluctuations in its price as opposed to buying it for use or for income via methods such as dividends or interest. Speculation or agiotage ...

... selling, and short-selling of stocks, bonds, commodities, currencies, collectibles, real estate, derivatives or any valuable financial instrument to profit from fluctuations in its price as opposed to buying it for use or for income via methods such as dividends or interest. Speculation or agiotage ...

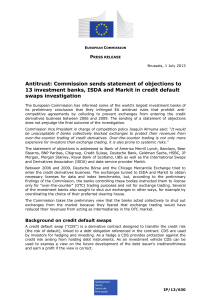

European Commission

... A credit default swap ("CDS") is a derivative contract designed to transfer the credit risk (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from ho ...

... A credit default swap ("CDS") is a derivative contract designed to transfer the credit risk (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from ho ...

Weekly Commentary 10-13-14 PAA

... * Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. *Corporate bonds ar ...

... * Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. *Corporate bonds ar ...

Securities Markets

... sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

... sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

Just Another Commodity: Reasons for Including Gold in a

... it therefore can reduce portfolio volatility. In fact, the last time I discussed gold, I received a large amount of mail from professionals who said I misunderstood the need for gold. They said it wasn’t supposed to have a long-term yield. Instead, it reduces portfolio risk since it tends to go up w ...

... it therefore can reduce portfolio volatility. In fact, the last time I discussed gold, I received a large amount of mail from professionals who said I misunderstood the need for gold. They said it wasn’t supposed to have a long-term yield. Instead, it reduces portfolio risk since it tends to go up w ...

File - BSC Economics

... b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the following can be described as involving direct finance? a) A corp ...

... b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the following can be described as involving direct finance? a) A corp ...

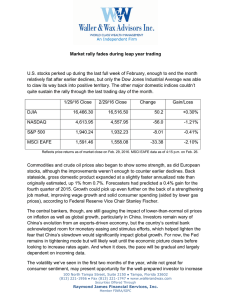

Market rally fades during leap year trading U.S. stocks perked up

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

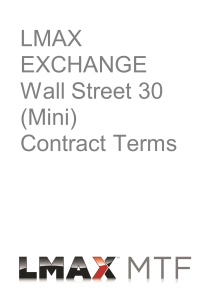

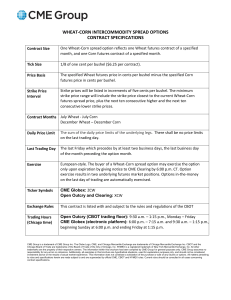

Wheat-Corn Intercommodity Spread Options Contract

... The last Friday which precedes by at least two business days, the last business day of the month preceding the option month. ...

... The last Friday which precedes by at least two business days, the last business day of the month preceding the option month. ...

Weekly Commentary 01-25-16

... central bank seeks to normalize policy. Instead, traders put the odds on just one rate rise this year.” A late-week rally in oil prices also helped push stock markets higher. The Financial Times reported crude oil hit a 12-year low midweek and then bounced more than 18 percent. While improving oil p ...

... central bank seeks to normalize policy. Instead, traders put the odds on just one rate rise this year.” A late-week rally in oil prices also helped push stock markets higher. The Financial Times reported crude oil hit a 12-year low midweek and then bounced more than 18 percent. While improving oil p ...

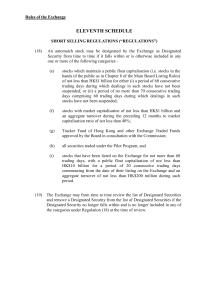

Amendments to the Rules of the Exchange in relation to the

... hands of the public as in Chapter 8 of the Main Board Listing Rules) of not less than HK$1 billion for either (i) a period of 60 consecutive trading days during which dealings in such stocks have not been suspended; or (ii) a period of no more than 70 consecutive trading days comprising 60 trading d ...

... hands of the public as in Chapter 8 of the Main Board Listing Rules) of not less than HK$1 billion for either (i) a period of 60 consecutive trading days during which dealings in such stocks have not been suspended; or (ii) a period of no more than 70 consecutive trading days comprising 60 trading d ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.