T No Theory? No Evidence? No Problem!

... permit the buyer (seller) to take (or make) delivery of the underlying commodity. Such “cash-settled” contracts are purely financial instruments with a payoff that is derived from the price from some other market (which in energy is typically a delivery-settled futures contract). The mechanism where ...

... permit the buyer (seller) to take (or make) delivery of the underlying commodity. Such “cash-settled” contracts are purely financial instruments with a payoff that is derived from the price from some other market (which in energy is typically a delivery-settled futures contract). The mechanism where ...

Weekly Commentary 11-11-13 PAA

... representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * T ...

... representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * T ...

Regulatory Circular RG02-39 (RG02

... last business day of each month. On these days, the CME calculates the daily settlement price for its domestic stock index futures and options contracts on the basis of their fair value relative to the daily close of the underlying cash index as reflected at 3:15 p.m. (Chicago time). CBOE has conduc ...

... last business day of each month. On these days, the CME calculates the daily settlement price for its domestic stock index futures and options contracts on the basis of their fair value relative to the daily close of the underlying cash index as reflected at 3:15 p.m. (Chicago time). CBOE has conduc ...

Who are the end-users in the OTC derivatives market?

... from 2013). A further breakdown with respect to outstanding notional amounts of different derivative classes demonstrates the heterogeneity in terms of counterparties. Here, non-dealers account for as much as 82% of the total market. NFCs are parties to a relatively small proportion of all derivativ ...

... from 2013). A further breakdown with respect to outstanding notional amounts of different derivative classes demonstrates the heterogeneity in terms of counterparties. Here, non-dealers account for as much as 82% of the total market. NFCs are parties to a relatively small proportion of all derivativ ...

5th of February 2017 A Trading Shift: Back To Basics Last week was

... More generally, I will watch closely market developments and allocate risk accordingly. As I said before, we might be at some kind of turning point. What I also know is that I have for almost each single asset class a long list of PROs and CONs and sometimes the best trading is to watch and get the ...

... More generally, I will watch closely market developments and allocate risk accordingly. As I said before, we might be at some kind of turning point. What I also know is that I have for almost each single asset class a long list of PROs and CONs and sometimes the best trading is to watch and get the ...

Press Release

... ayondo specialises in Social Trading, with a sophisticated online trading platform and a leading Social Trading platform. Social Trading allows retail investors to automatically copy the trades of Top Traders. In recent years, ayondo has won several accolades, including Europe’s leading Financial Te ...

... ayondo specialises in Social Trading, with a sophisticated online trading platform and a leading Social Trading platform. Social Trading allows retail investors to automatically copy the trades of Top Traders. In recent years, ayondo has won several accolades, including Europe’s leading Financial Te ...

Snímek 1

... • Initial Margin - funds deposited to provide capital to absorb losses • Marking to Market - each day the profits or losses from the new futures price are reflected in the account. • Maintenance or variation margin - an established value below which a trader’s margin may not fall. ...

... • Initial Margin - funds deposited to provide capital to absorb losses • Marking to Market - each day the profits or losses from the new futures price are reflected in the account. • Maintenance or variation margin - an established value below which a trader’s margin may not fall. ...

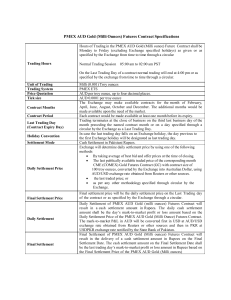

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

Derivative Markets By Robert Goodwin

... There are several types of derivatives: options, swaps, futures, and forwards. Options are contracts that give the right, but not the obligation, to buy or sell an asset. These types of derivatives occur when an investor wants to increase his exposure in a market but does not want to risk being in t ...

... There are several types of derivatives: options, swaps, futures, and forwards. Options are contracts that give the right, but not the obligation, to buy or sell an asset. These types of derivatives occur when an investor wants to increase his exposure in a market but does not want to risk being in t ...

Weekly Commentary 12-22-14 PAA

... * Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. *Corporate bonds a ...

... * Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. *Corporate bonds a ...

The Post-2008 Economic Soft Depression and Your Portfolio

... ENR 2015 Investment Summary • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • In the four times since 1970 when the S&P 500 ...

... ENR 2015 Investment Summary • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • In the four times since 1970 when the S&P 500 ...

NTX - New Europe Blue Chip Index

... New Europe Blue Chip Index (NTX) is a free float weighted price index made up of the top blue chip stocks (ranked by freefloat adjusted market capitalisation) traded on stock exchanges in Central, Eastern and South-Eastern Europe and Austria. The index is calculated in EUR and disseminated in real t ...

... New Europe Blue Chip Index (NTX) is a free float weighted price index made up of the top blue chip stocks (ranked by freefloat adjusted market capitalisation) traded on stock exchanges in Central, Eastern and South-Eastern Europe and Austria. The index is calculated in EUR and disseminated in real t ...

Commodity Price Crash: Risks to ... Economic Growth in Asia-Pacific LDCs ... LLDCs

... likely to disrupt global trade flows in 2015. These events have substantial implications for economies in the Asia-Pacific region – which account for around a third of global commodity imports and exports. The impact on least developed countries (LDCs) and landlocked developing countries (LLDCs) is ...

... likely to disrupt global trade flows in 2015. These events have substantial implications for economies in the Asia-Pacific region – which account for around a third of global commodity imports and exports. The impact on least developed countries (LDCs) and landlocked developing countries (LLDCs) is ...

Chapter 10

... A futures contract is a standardized, exchange-traded version of a forward contract Futures contracts differ from forwards in that futures are: marketable have no default risk employ margin requirements and daily marking to market ...

... A futures contract is a standardized, exchange-traded version of a forward contract Futures contracts differ from forwards in that futures are: marketable have no default risk employ margin requirements and daily marking to market ...

Weekly Commentary 08-27-12 PAA

... Last week, the U.S stock market hit an intra-day four-year high, but it couldn’t hold the gain and closed slightly lower for the week, according to MarketWatch. As usual, news flow from Europe and the Federal Reserve helped move prices. While we often look at the broad market indexes to gauge progre ...

... Last week, the U.S stock market hit an intra-day four-year high, but it couldn’t hold the gain and closed slightly lower for the week, according to MarketWatch. As usual, news flow from Europe and the Federal Reserve helped move prices. While we often look at the broad market indexes to gauge progre ...

Weekly Commentary 08-08-16

... representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * T ...

... representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. * T ...

addressing emerging risks in the nigerian

... income market) declined by about 50% from N14.54 trillion in October 2015 to N7.43 trillion by the end of that year. This drop in liquidity has continued into the early parts of 2016 ...

... income market) declined by about 50% from N14.54 trillion in October 2015 to N7.43 trillion by the end of that year. This drop in liquidity has continued into the early parts of 2016 ...

Portfolio Advisory Council, LLC presents:

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

Chapter 9 Sources of Capital

... gold are seen as being safe investments (demand always for these) When the stock market declines, people will often sell stocks and put their money into futures or other “safe” investments to prevent themselves from losing money. ...

... gold are seen as being safe investments (demand always for these) When the stock market declines, people will often sell stocks and put their money into futures or other “safe” investments to prevent themselves from losing money. ...

Naira Pressure Continues

... Slowing manufacturing and a depressed equity market likely to limit Q3 growth to 6.4% China is being advised to embrace a consumer driven growth strategy Chinese imports have fallen by 20.4% to $145.2 billion Leading to softness in global commodities Outlook for global economy dampened Chinese growt ...

... Slowing manufacturing and a depressed equity market likely to limit Q3 growth to 6.4% China is being advised to embrace a consumer driven growth strategy Chinese imports have fallen by 20.4% to $145.2 billion Leading to softness in global commodities Outlook for global economy dampened Chinese growt ...

April 17, 2017 - Portfolio Advisory Council

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

Weekly Commentary 01-20-14 PAA

... * You cannot invest directly in an index. * Consult your financial professional before making any investment decision. ...

... * You cannot invest directly in an index. * Consult your financial professional before making any investment decision. ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.