Managing Risk Through Diversification Video Transcript

... managing risk. And that’s through diversification. Historically, I’ve found that individual stock prices can vary widely over time. But when investors retain a diverse mix of assets in their portfolios two things can happen: One: portfolios can exhibit lower volatility. Two: they have the potential ...

... managing risk. And that’s through diversification. Historically, I’ve found that individual stock prices can vary widely over time. But when investors retain a diverse mix of assets in their portfolios two things can happen: One: portfolios can exhibit lower volatility. Two: they have the potential ...

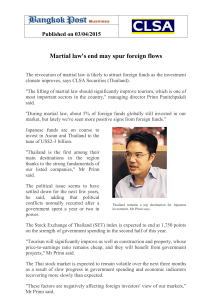

Martial law`s end may spur foreign flows

... The political issue seems to have settled down for the next few years, he said, adding that political conflicts normally recurred after a government spent a year or two in power. ...

... The political issue seems to have settled down for the next few years, he said, adding that political conflicts normally recurred after a government spent a year or two in power. ...

New York Mercantile Exchange

... sufficient to allow everyone to meet his needs for hedging, or even speculating. In 1993, the Exchange opened its NYMEX ACCESS® electronic trading system. NYMEX ACCESS® allows buyers and sellers to trade futures and options contracts for crude oil, heating oil, gasoline, natural gas, electricity, an ...

... sufficient to allow everyone to meet his needs for hedging, or even speculating. In 1993, the Exchange opened its NYMEX ACCESS® electronic trading system. NYMEX ACCESS® allows buyers and sellers to trade futures and options contracts for crude oil, heating oil, gasoline, natural gas, electricity, an ...

Electricity Markets Market Power Definition Monopoly Power

... So low-cost units lose their scarcity rent when GT s are block-loaded and SMC set to 20$/MWh GT are compensated, so block-loading makes no difference in GT fixed cost recovery Thus a positive investment signal for low-cost unit is lost ...

... So low-cost units lose their scarcity rent when GT s are block-loaded and SMC set to 20$/MWh GT are compensated, so block-loading makes no difference in GT fixed cost recovery Thus a positive investment signal for low-cost unit is lost ...

AC ALTERNATIVES® Equity Market Neutral

... Alternative mutual funds often hold a variety of non-traditional investments, and also often employ more complex trading strategies than traditional mutual funds. Each of these different alternative asset classes and investment strategies have unique risks making them more suitable for investors wit ...

... Alternative mutual funds often hold a variety of non-traditional investments, and also often employ more complex trading strategies than traditional mutual funds. Each of these different alternative asset classes and investment strategies have unique risks making them more suitable for investors wit ...

progressive green Pty Ltd - Australian Energy Market Commission

... will impact the whole market as well as our customers. This rule change may prevent some behaviours in the market (like late trading interval re-bidding by large generators), but will undoubtedly create new rebidding behaviours, meaning the impact on spot price outcomes may be mixed. Flow Power cust ...

... will impact the whole market as well as our customers. This rule change may prevent some behaviours in the market (like late trading interval re-bidding by large generators), but will undoubtedly create new rebidding behaviours, meaning the impact on spot price outcomes may be mixed. Flow Power cust ...

Buy Price higher than Sell Price on SSG or Portfolio/Stock

... Buy Price higher than Sell Price on SSG or Portfolio/Stock Management Guide. After applying the automatic judgment (also called First Impression) to a stock in Toolkit 6, you might notice that the Buy price is higher than the Sell price on the back page of the ssg, or on the Portfolio/Stock Manageme ...

... Buy Price higher than Sell Price on SSG or Portfolio/Stock Management Guide. After applying the automatic judgment (also called First Impression) to a stock in Toolkit 6, you might notice that the Buy price is higher than the Sell price on the back page of the ssg, or on the Portfolio/Stock Manageme ...

1 January 2016 Commentary Most major US stock market

... Heightened terrorism and geopolitical risk make the world a less stable place, and the upcoming U.S. presidential election will add to that uncertainty. No investor can safely predict the future direction of the stock market, but 2016 could be a more challenging environment for investors than we hav ...

... Heightened terrorism and geopolitical risk make the world a less stable place, and the upcoming U.S. presidential election will add to that uncertainty. No investor can safely predict the future direction of the stock market, but 2016 could be a more challenging environment for investors than we hav ...

The Missing Money Problem Nora Schindler, WU University of

... wind, solar) lead to lower prices at the spot exchanges and fewer number of hours running (NOHR) for conventional fuel sources (i.e. coal, gas, oil) which is said to lower investment incentives for the latter types. This is in line with the value of waiting theory by Dixit and Pindyck (1994) who cla ...

... wind, solar) lead to lower prices at the spot exchanges and fewer number of hours running (NOHR) for conventional fuel sources (i.e. coal, gas, oil) which is said to lower investment incentives for the latter types. This is in line with the value of waiting theory by Dixit and Pindyck (1994) who cla ...

Lecture 2 - Leeds Maths

... In this situation, an arbitrageur can buy A and sell B. This does not cost anything at t = 0. At t = 1, the arbitrageur either makes a profit of £1 (if the market goes down) or breaks even (if the market goes up). Thus, there is zero initial cost, no risk of a future loss and a non-zero probability ...

... In this situation, an arbitrageur can buy A and sell B. This does not cost anything at t = 0. At t = 1, the arbitrageur either makes a profit of £1 (if the market goes down) or breaks even (if the market goes up). Thus, there is zero initial cost, no risk of a future loss and a non-zero probability ...