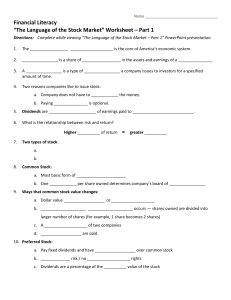

Language of the SM Notes

... 13. Income Stock: Company retains small portion of ____________________ a. Steady stream of _________________ such as ____________________ companies b. Beta less than _____________ 14. Value Stock: Have a ___________ market price considering historical ____________________ records and value of _____ ...

... 13. Income Stock: Company retains small portion of ____________________ a. Steady stream of _________________ such as ____________________ companies b. Beta less than _____________ 14. Value Stock: Have a ___________ market price considering historical ____________________ records and value of _____ ...

Bovespa

... Cross border trading Issuers and investors are expanding their horizons beyond their home markets ...

... Cross border trading Issuers and investors are expanding their horizons beyond their home markets ...

managed futures strategy fund

... may experience losses that exceed those experienced by funds that do not use futures contract, options and commodities. Changes in interest rates and the liquidity of certain investments could affect the Fund’s overall performance. The Fund is non-diversified and as a result, changes in the value of ...

... may experience losses that exceed those experienced by funds that do not use futures contract, options and commodities. Changes in interest rates and the liquidity of certain investments could affect the Fund’s overall performance. The Fund is non-diversified and as a result, changes in the value of ...

Alessandro Mauro - Black Swan Risk Advisors

... companies He has built and managed middle office functions, shaping business processes that have been monitoring trading activity and consistently delivering key risk indicators. In the nineties, Alessandro pioneered the application of modern risk measurement tecniques, Value-atRisk, to energy marke ...

... companies He has built and managed middle office functions, shaping business processes that have been monitoring trading activity and consistently delivering key risk indicators. In the nineties, Alessandro pioneered the application of modern risk measurement tecniques, Value-atRisk, to energy marke ...

Homework 1

... for this market using the profit Pt maximizing price and this marginal cost. Calculate the elasticity of demand (using the midpoint method) for this market by calculating the % effect on raising the price by $2 from the profit maximizing price. b. Considering that your company is the only one that p ...

... for this market using the profit Pt maximizing price and this marginal cost. Calculate the elasticity of demand (using the midpoint method) for this market by calculating the % effect on raising the price by $2 from the profit maximizing price. b. Considering that your company is the only one that p ...

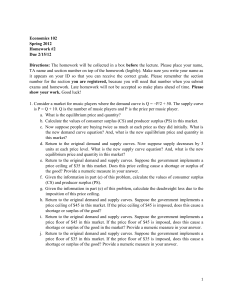

Economics 102 Spring 2012 Homework #2 Due 2/15/12 Directions

... number for the section you are registered, because you will need that number when you submit exams and homework. Late homework will not be accepted so make plans ahead of time. Please show your work. Good luck! 1. Consider a market for music players where the demand curve is Q = P/2 + 50. The suppl ...

... number for the section you are registered, because you will need that number when you submit exams and homework. Late homework will not be accepted so make plans ahead of time. Please show your work. Good luck! 1. Consider a market for music players where the demand curve is Q = P/2 + 50. The suppl ...

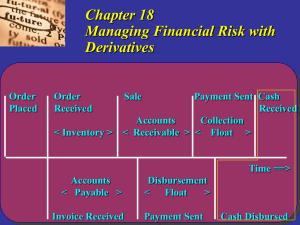

Soln Ch 21 Futures intro

... False. The parity relationship tells us that the futures price is determined by the stock price, the interest rate, and the dividend yield; it is not a function of beta. ...

... False. The parity relationship tells us that the futures price is determined by the stock price, the interest rate, and the dividend yield; it is not a function of beta. ...

Stocks

... You must invest most of your money in stocks You can not go into debt when you purchase the stocks After re-selling the stocks the person with the most money wins ...

... You must invest most of your money in stocks You can not go into debt when you purchase the stocks After re-selling the stocks the person with the most money wins ...

the structure of forward and futures markets

... those holding long/short positions are credited/debited appropriately; differences between today’s settlement price and the previous days settlement price are determined b. clearinghouse officials establish a settlement price; each account is marked to market; differences between today’s settlement ...

... those holding long/short positions are credited/debited appropriately; differences between today’s settlement price and the previous days settlement price are determined b. clearinghouse officials establish a settlement price; each account is marked to market; differences between today’s settlement ...

How to Make Millions in the Stock Market

... if an asset was overvalued, investors would sell the asset and, in the process, force the price down until it also was accurately priced. In summary, you should have learned that there are no easy "twenty dollar bills" just lying around waiting for you to come by and pick them up. The following les ...

... if an asset was overvalued, investors would sell the asset and, in the process, force the price down until it also was accurately priced. In summary, you should have learned that there are no easy "twenty dollar bills" just lying around waiting for you to come by and pick them up. The following les ...

Knowledge Center

... Exchange. Any person desirous of being a member of the Exchange may approach the contact persons whose names, telephone numbers, fax numbers, email addresses etc. are available on the website of ndex:www.ndex.com.np. They may also refer to the Bye-law and Articles of Association of the concerned Exc ...

... Exchange. Any person desirous of being a member of the Exchange may approach the contact persons whose names, telephone numbers, fax numbers, email addresses etc. are available on the website of ndex:www.ndex.com.np. They may also refer to the Bye-law and Articles of Association of the concerned Exc ...

Foreign Exchange Risk in International Transactions

... dramatically in a short period of time, leaving the unprepared business exposed to potentially crippling losses. The efficient management of this risk is essential for the survival of a company and any business that is exposed to such a risk should ensure that it is fully prepared to manage it. Old ...

... dramatically in a short period of time, leaving the unprepared business exposed to potentially crippling losses. The efficient management of this risk is essential for the survival of a company and any business that is exposed to such a risk should ensure that it is fully prepared to manage it. Old ...

How did the stock market work?

... What was ‘playing on the stock market’? ‘Playing the stock market’ became a national craze where millions of people brought shares in all sorts of companies and sold them at a profit – then brought more shares to make even more money. ...

... What was ‘playing on the stock market’? ‘Playing the stock market’ became a national craze where millions of people brought shares in all sorts of companies and sold them at a profit – then brought more shares to make even more money. ...

OUT FROM UNDERNEATH Investor Strategies For Capitalizing On

... While the government currently only allows taxpayers to deduct the lesser of net realized losses or $3,000 in any one tax year, the amount not deductible can be carried forward for use in future tax years. With income tax rates likely going up in future years, the value of these carried-forward loss ...

... While the government currently only allows taxpayers to deduct the lesser of net realized losses or $3,000 in any one tax year, the amount not deductible can be carried forward for use in future tax years. With income tax rates likely going up in future years, the value of these carried-forward loss ...

SINA distribution 41273

... The underlying price for the SINA2D/SINA6M/SINA6T/SINA6W/SINA6H/SINA6F Futures contract deliverable, expressed in term of current market value, would be calculated as follows: SINA2D = SINA + 0.10 (WB) Please note that the valuation would apply only to the SINA2D/SINA6M/SINA6T/SINA6W/SINA6H/SINA6F d ...

... The underlying price for the SINA2D/SINA6M/SINA6T/SINA6W/SINA6H/SINA6F Futures contract deliverable, expressed in term of current market value, would be calculated as follows: SINA2D = SINA + 0.10 (WB) Please note that the valuation would apply only to the SINA2D/SINA6M/SINA6T/SINA6W/SINA6H/SINA6F d ...

Keeping Up with the (Paul Tudor) Joneses: a Hedge

... fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverage. ...

... fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverage. ...