LMAX EXCHANGE Wall Street 30 (Mini) Contract Terms

... Rulebook, unless the context otherwise requires or unless separately defined herein. The same rules of interpretation set out in the LMAX Rulebook apply. ...

... Rulebook, unless the context otherwise requires or unless separately defined herein. The same rules of interpretation set out in the LMAX Rulebook apply. ...

March 2015 - Warnke/Nichols Ltd.

... This brings us back to the NASDAQ Composite of March 2nd of this year and the lessons it presents. A NASDAQ investor in March of 2000 has experienced zero return over the last 15 years. And, adjusted for inflation, he’d still be about 25% below the 2000 highs. This is what happens when markets get e ...

... This brings us back to the NASDAQ Composite of March 2nd of this year and the lessons it presents. A NASDAQ investor in March of 2000 has experienced zero return over the last 15 years. And, adjusted for inflation, he’d still be about 25% below the 2000 highs. This is what happens when markets get e ...

Chapter 15 - Salem State University

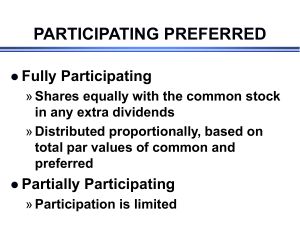

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

pdf

... taking a position in assets you think will go down in value or taking positions that reflect views on relative performance (long one set of assets and short another set; you may not have an opinion as to whether either will increase or decrease in value but you do believe the first set will outperfo ...

... taking a position in assets you think will go down in value or taking positions that reflect views on relative performance (long one set of assets and short another set; you may not have an opinion as to whether either will increase or decrease in value but you do believe the first set will outperfo ...

International financial and foreign exchange markets Tentative

... The Balance of Payments (quick recap from a financial perspective) and the models of exchange rate determination – I (A. Ziliotto) The flow and the stock models Textbook chapters: VII, VIII, IX The Balance of Payments (quick recap from a financial perspective) and the models of exchange rate determi ...

... The Balance of Payments (quick recap from a financial perspective) and the models of exchange rate determination – I (A. Ziliotto) The flow and the stock models Textbook chapters: VII, VIII, IX The Balance of Payments (quick recap from a financial perspective) and the models of exchange rate determi ...

Note on the Current Global Wheat Market Situation

... The wheat futures price rises were fuelled by downward revisions of the harvest estimates due to the severe drought in Russia and other Eastern European countries and the announcement of the Russian export ban. Ukraine has considered also introducing similar measures. Volatility in the cereals ma ...

... The wheat futures price rises were fuelled by downward revisions of the harvest estimates due to the severe drought in Russia and other Eastern European countries and the announcement of the Russian export ban. Ukraine has considered also introducing similar measures. Volatility in the cereals ma ...

File

... during WWI to meet the demands for food (1/4 of the U.S. Workforce). Farms were getting bigger and yielding bigger ...

... during WWI to meet the demands for food (1/4 of the U.S. Workforce). Farms were getting bigger and yielding bigger ...

Are Financial Markets Efficient?

... investors such as George Soros increased [15]. These cases are evidence, consistent with the implication of the efficient market hypothesis, that is, investors cannot consistently outperform their benchmark. Similarly, aren’t documented market anomalies associated with recurrent excess returns such ...

... investors such as George Soros increased [15]. These cases are evidence, consistent with the implication of the efficient market hypothesis, that is, investors cannot consistently outperform their benchmark. Similarly, aren’t documented market anomalies associated with recurrent excess returns such ...

Another Year, Another Stock Market Increase

... indicative of the skill of the advisor. 2. The results portrayed are net of investment advisory fees. A fee of 1.0% per annum was used to calculate the net of fees results. The fee schedule is in Part 2A Form ADV. 3. The results portrayed reflect the reinvestment of dividends and other earnings. ...

... indicative of the skill of the advisor. 2. The results portrayed are net of investment advisory fees. A fee of 1.0% per annum was used to calculate the net of fees results. The fee schedule is in Part 2A Form ADV. 3. The results portrayed reflect the reinvestment of dividends and other earnings. ...

Sumitomo Corporation Announces the Exercise Price of Stock Options

... share acquisition rights in the form of stock options to the Company’s Directors, Executive Officers and Corporate Officers who qualify under the qualification system of the Company pursuant under Articles 236, 238 and 240 of the Company Law of Japan. 1. Value of the assets to be contributed upon ex ...

... share acquisition rights in the form of stock options to the Company’s Directors, Executive Officers and Corporate Officers who qualify under the qualification system of the Company pursuant under Articles 236, 238 and 240 of the Company Law of Japan. 1. Value of the assets to be contributed upon ex ...