stock market project

... • A corporation is a business that has it’s own identity. • A corporation can be a private corporation meaning it is owned by an individual or a group. This corporation does not sell stock. • A public corporation means you can buy a piece of the corporation. This piece of ownership is called a share ...

... • A corporation is a business that has it’s own identity. • A corporation can be a private corporation meaning it is owned by an individual or a group. This corporation does not sell stock. • A public corporation means you can buy a piece of the corporation. This piece of ownership is called a share ...

TA Pai Management Institute - Xavier Institute of Management

... The buyer of a forward, futures, or options contract is known as the Long. He is said to have taken a Long Position. The seller of a forward, futures, or options contract, is known as the Short. He is said to have taken a Short Position. In the case of options, a Short is also known as the option Wr ...

... The buyer of a forward, futures, or options contract is known as the Long. He is said to have taken a Long Position. The seller of a forward, futures, or options contract, is known as the Short. He is said to have taken a Short Position. In the case of options, a Short is also known as the option Wr ...

Monopolistic competition and oligopoly

... Regulation and Deregulation • Markets dominated by one or a few large firms tend to have higher prices and lower output than competitive markets • Mergers and cartels can lead to anticompetitive behavior • Predatory pricing-setting market prices below costs for the short term to drive competitors o ...

... Regulation and Deregulation • Markets dominated by one or a few large firms tend to have higher prices and lower output than competitive markets • Mergers and cartels can lead to anticompetitive behavior • Predatory pricing-setting market prices below costs for the short term to drive competitors o ...

Golden rules of investing in stock market

... net worth and what it may not be able to do. constant fluctuations of the securities markets and what they can reasonably expect to earn on their investments. hat historical trends show that over time, securities, stocks in particular, tend to go up in value. But the shorter the time horizon, the mo ...

... net worth and what it may not be able to do. constant fluctuations of the securities markets and what they can reasonably expect to earn on their investments. hat historical trends show that over time, securities, stocks in particular, tend to go up in value. But the shorter the time horizon, the mo ...

Regulatory Focus on Market Structure and Trading Issues

... Trillium Settlement with FINRA Trillium Brokerage Services and several individuals settled with FINRA for a total of $2,300,000 in September 2010 FINRA found that the traders were using an improper trading strategy which used orders that were immediately cancelled to create a false appearance o ...

... Trillium Settlement with FINRA Trillium Brokerage Services and several individuals settled with FINRA for a total of $2,300,000 in September 2010 FINRA found that the traders were using an improper trading strategy which used orders that were immediately cancelled to create a false appearance o ...

Document

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

Prediction Using back Propagation And k-Nearest neighbor

... technique for how would they increase their profit with less risk. data, primary analysis, technical analysis are all used to go to predict and profits from markets trend. complex event process is processing system which has capability to extract multiple statistics from different source. Investors, ...

... technique for how would they increase their profit with less risk. data, primary analysis, technical analysis are all used to go to predict and profits from markets trend. complex event process is processing system which has capability to extract multiple statistics from different source. Investors, ...

FUTURES TRADING week two: recap and lessons

... at 441.5 USDA boosted its inventory estimates by 25%. “The market is going to be dealing with big corn supplies for the next year, and that’s going to limit rallies” Dale Durcholz (taken from bloomberg.com) There is talk of corn hitting a low of almost 400?! ...

... at 441.5 USDA boosted its inventory estimates by 25%. “The market is going to be dealing with big corn supplies for the next year, and that’s going to limit rallies” Dale Durcholz (taken from bloomberg.com) There is talk of corn hitting a low of almost 400?! ...

Money_Quest_2014 MAINE

... • Do good research or buy good research. • Sell covered calls expiring each month on holdings. • Re-populate portfolio if called away with stocks that meet your criteria. I call my investment advisor each month to find out what they like at that moment. • Money Market Alternative, Buy XLE or SLB or ...

... • Do good research or buy good research. • Sell covered calls expiring each month on holdings. • Re-populate portfolio if called away with stocks that meet your criteria. I call my investment advisor each month to find out what they like at that moment. • Money Market Alternative, Buy XLE or SLB or ...

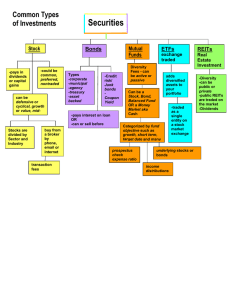

What are stocks? - Buncombe County Schools

... bonds, and futures are bought and sold (or traded). (Can be electronic.) • The stock exchange is the actual physical location where stocks are listed and traded. – New York Stock Exchange (NYSE) – American Stock Exchange – NASDAQ—virtual exchange ...

... bonds, and futures are bought and sold (or traded). (Can be electronic.) • The stock exchange is the actual physical location where stocks are listed and traded. – New York Stock Exchange (NYSE) – American Stock Exchange – NASDAQ—virtual exchange ...

Savings and Investment

... 401k or 403b contributions are tax deductible and funds are taxed as regular income when they are withdrawn after age 59 ½. Roth IRA contributions are not tax deductible, but investment gains and all funds on which taxes are prepaid are tax free when they are withdrawn after age 59 ½. ...

... 401k or 403b contributions are tax deductible and funds are taxed as regular income when they are withdrawn after age 59 ½. Roth IRA contributions are not tax deductible, but investment gains and all funds on which taxes are prepaid are tax free when they are withdrawn after age 59 ½. ...

Will Brexit spark a much-needed market revaluation?

... Will Brexit spark a much-needed market revaluation? Markets globally have reacted negatively to the British having voted to leave the European Union (EU) after more than four decades. The night before the vote, UK betting markets reflected that the “remain” camp was heavily favored to win. In a 2015 ...

... Will Brexit spark a much-needed market revaluation? Markets globally have reacted negatively to the British having voted to leave the European Union (EU) after more than four decades. The night before the vote, UK betting markets reflected that the “remain” camp was heavily favored to win. In a 2015 ...

Allan Thomson, CEO, Dreadnought Capital, South Africa

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

General Disclosures based on PFRS 7

... (a) A sensitivity analysis of each type of market risk to which the entity is exposed; (b) Additional information if the sensitivity analysis is not representative of the entity’s risk exposure (for instance, interest risk and foreign currency risk combined), it may disclose that analysis instead of ...

... (a) A sensitivity analysis of each type of market risk to which the entity is exposed; (b) Additional information if the sensitivity analysis is not representative of the entity’s risk exposure (for instance, interest risk and foreign currency risk combined), it may disclose that analysis instead of ...