10 Min Options Strategy Handout - MarketClub

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

- Cambridge Capital Group

... Internet bubble went “boom” and many of you perhaps remember the outcome. Investors kept making up reasons to push stocks higher and higher with no fundamental basis. Like now, we felt very uncomfortable when managing previous portfolios during that period with the upside potential for equities and ...

... Internet bubble went “boom” and many of you perhaps remember the outcome. Investors kept making up reasons to push stocks higher and higher with no fundamental basis. Like now, we felt very uncomfortable when managing previous portfolios during that period with the upside potential for equities and ...

FINANCIAL RISK MANAGEMENT

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

Risk management through introduction of futures contracts in tea

... variability. Theoretically, trading futures in tea would be a useful hedging instrument available to producers to insure themselves against price risk. • However, informal systems of entering into forward contracts with reputed buyers of bulk tea already exist in the Indian market and for futures co ...

... variability. Theoretically, trading futures in tea would be a useful hedging instrument available to producers to insure themselves against price risk. • However, informal systems of entering into forward contracts with reputed buyers of bulk tea already exist in the Indian market and for futures co ...

How can Hedge Funds take advantage of inefficiencies and

... investment opportunities by studying such factors as the global economy, government policies, interest rates, inflation and market trends. ...

... investment opportunities by studying such factors as the global economy, government policies, interest rates, inflation and market trends. ...

pdf

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

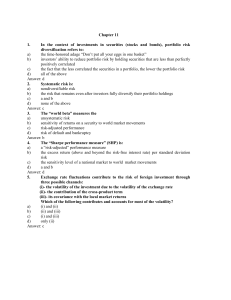

TEST BANK

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

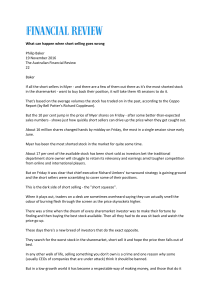

What can happen when short selling goes wrong Philip

... odour of burning flesh through the screen as the price skyrockets higher. There was a time when the dream of every sharemarket investor was to make their fortune by finding and then buying the best stock available. Then all they had to do was sit back and watch the price go up. These days there's a ...

... odour of burning flesh through the screen as the price skyrockets higher. There was a time when the dream of every sharemarket investor was to make their fortune by finding and then buying the best stock available. Then all they had to do was sit back and watch the price go up. These days there's a ...

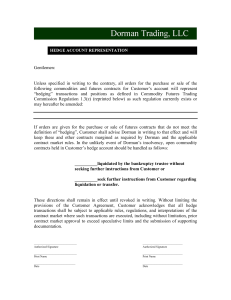

Hedge Accounts - Dorman Trading

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

Chapter 7: Perfect Competition

... Price Takers A price taker is a seller that can only sell its output at equilibrium price. A firm produces Q at which MR = MC at E (equilibrium price) Price takers will not sell for less than equilibrium. ...

... Price Takers A price taker is a seller that can only sell its output at equilibrium price. A firm produces Q at which MR = MC at E (equilibrium price) Price takers will not sell for less than equilibrium. ...

Natural Gas Price/Supply Assessment Information Wholesale Market

... that “tomorrow” for up to three days here) and a financial futures market for defining prices and quantities to guide contracts for future physical delivery next month, next winter, or next year (the market actually goes out three years, but the out months are not heavily traded contracts). The fina ...

... that “tomorrow” for up to three days here) and a financial futures market for defining prices and quantities to guide contracts for future physical delivery next month, next winter, or next year (the market actually goes out three years, but the out months are not heavily traded contracts). The fina ...

The International Spillover effects of pension finance in an EMU

... capturing the fraction of stocks held by the buyand-hold investor, η(t), and the “exchange rate” between the consumption of both investors, λ(t) ...

... capturing the fraction of stocks held by the buyand-hold investor, η(t), and the “exchange rate” between the consumption of both investors, λ(t) ...

Transaction Exposure

... Operating (Economic) Exposure – change in firm PV resulting from change in expected future operating cash flows due to unexpected forex change ...

... Operating (Economic) Exposure – change in firm PV resulting from change in expected future operating cash flows due to unexpected forex change ...