Collective Investments

... provided when investing in collective funds rather than individual stocks. ...

... provided when investing in collective funds rather than individual stocks. ...

A Brief History of FE

... past record or the information published in financial press, must be absorbed and reflected quickly in the stock price. ...

... past record or the information published in financial press, must be absorbed and reflected quickly in the stock price. ...

Investment Analysis

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

... Despite the fact that we are afraid of risk, we will buy risky assets. Only if we hope to get a reward for it! If we want to make money, we have to buy equity, high-yield bonds of companies that are not so solvent, … It has risk, but we need to take on this risk in order to make money. ...

Starcomms explains share price drop as Qubain becomes advisory

... to solve that. We settled almost $70 million worth of debt. So company like Starcomms that owes like $165 million last year, today owes less than $110 million. So our debt profile has reduced significantly, also operational cost reduced drastically and with our data services growing year-on-year by ...

... to solve that. We settled almost $70 million worth of debt. So company like Starcomms that owes like $165 million last year, today owes less than $110 million. So our debt profile has reduced significantly, also operational cost reduced drastically and with our data services growing year-on-year by ...

Fianna Fáil`s 7 point plan to address dairy price volatility Ahead of

... Superlevy funds collected from farmers by the European Commission should be reinvested into the dairy sector as opposed to being put in the EU’s general budget. The total superlevy amount collected in the EU is under €1 billion, with Irish farmers having to pay €69 million for this fine. 2: Create a ...

... Superlevy funds collected from farmers by the European Commission should be reinvested into the dairy sector as opposed to being put in the EU’s general budget. The total superlevy amount collected in the EU is under €1 billion, with Irish farmers having to pay €69 million for this fine. 2: Create a ...

Diversifiable

... substantially because of changes in possible losses to bondholders from default (the default risk) and changes in the level of risk-free interest rates. However, a put option on a bond can provide insurance against losses stemming from either source of risk, and thus the bondholders are guaranteed a ...

... substantially because of changes in possible losses to bondholders from default (the default risk) and changes in the level of risk-free interest rates. However, a put option on a bond can provide insurance against losses stemming from either source of risk, and thus the bondholders are guaranteed a ...

Hot Weather, Hot Market We`ve had some beautiful weather here on

... below their peak. Genuine buyer enquiry is noticeably higher, sale numbers are increasing and there’s a real buzz in the air. In stark contrast to last year’s season of wild weather, holiday accommodation is virtually booked out and the anticipated high level of tourism is yet another sign that Chri ...

... below their peak. Genuine buyer enquiry is noticeably higher, sale numbers are increasing and there’s a real buzz in the air. In stark contrast to last year’s season of wild weather, holiday accommodation is virtually booked out and the anticipated high level of tourism is yet another sign that Chri ...

Download attachment

... The difference between the exercise price and the underlying stock price is covered by the reinsurer if the underlying stock value is lower than the guaranteed minimum death benefit (the exercise price). This is the reason why we apply the maximum of this difference and zero. We then determine the e ...

... The difference between the exercise price and the underlying stock price is covered by the reinsurer if the underlying stock value is lower than the guaranteed minimum death benefit (the exercise price). This is the reason why we apply the maximum of this difference and zero. We then determine the e ...

Document

... 28. The premium on a two-month call option on the TECHWIG index of the Warsaw Stock Exchange in Poland with an exercise price of 1050 is 9.30 Polish Złoty (PLN). Zbigniew, a well-known Polish political analyst, and a shrewd investor, borrows just enough to buy 100 such call options. The interest rat ...

... 28. The premium on a two-month call option on the TECHWIG index of the Warsaw Stock Exchange in Poland with an exercise price of 1050 is 9.30 Polish Złoty (PLN). Zbigniew, a well-known Polish political analyst, and a shrewd investor, borrows just enough to buy 100 such call options. The interest rat ...

Lecture 4 Nature and Measurement of Exposure and Risk

... • Contractual hedges and Natural hedges • Contractual hedge include forward market hedge, money market hedge, future market hedge and options market hedge • Money market hedge involve borrowing in local currency, convert the same into the currency of payables and then investing it for matching perio ...

... • Contractual hedges and Natural hedges • Contractual hedge include forward market hedge, money market hedge, future market hedge and options market hedge • Money market hedge involve borrowing in local currency, convert the same into the currency of payables and then investing it for matching perio ...

STAT 473. Practice Problems for Exam 2 Spring 2015 Description

... period binomial tree for modeling the price movements of a non-dividend-paying stock (the so-called forward tree). (i) The period is 3 months. (ii) The initial stock price is $100. (iii) The stocks volatility is 30%. (iv) The continuously compounded risk-free interest rate is 4%. At the beginning of ...

... period binomial tree for modeling the price movements of a non-dividend-paying stock (the so-called forward tree). (i) The period is 3 months. (ii) The initial stock price is $100. (iii) The stocks volatility is 30%. (iv) The continuously compounded risk-free interest rate is 4%. At the beginning of ...

on futures contracts

... • Convergence of Price: As maturity approaches the spot and futures price converge • Delivery: Specifications of when and where delivery takes place and what can be delivered • Cash Settlement: Some contracts are settled in cash rather than delivering the underlying assets ...

... • Convergence of Price: As maturity approaches the spot and futures price converge • Delivery: Specifications of when and where delivery takes place and what can be delivered • Cash Settlement: Some contracts are settled in cash rather than delivering the underlying assets ...

Appropriate Technology Post Harvest Handling and Storage

... The cooking tomato commonly known as Pomme d’Amour is considered the most important vegetable grown in the northern part of the island of Mauritius and is an important part of the traditional diet. Almost all the crop is grown by small farmers for their family and to sell in the local markets with t ...

... The cooking tomato commonly known as Pomme d’Amour is considered the most important vegetable grown in the northern part of the island of Mauritius and is an important part of the traditional diet. Almost all the crop is grown by small farmers for their family and to sell in the local markets with t ...

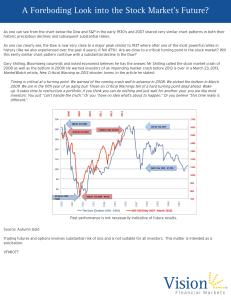

A Foreboding Look into the Stock Market`s Future?

... As one can see from the chart below the Dow and S&P in the early 1930’s and 2007 shared very similar chart patterns in both their historic precipitous declines and subsequent substantial rallies. As one can clearly see, the Dow is now very close to a major peak similar to 1937 where after one of the ...

... As one can see from the chart below the Dow and S&P in the early 1930’s and 2007 shared very similar chart patterns in both their historic precipitous declines and subsequent substantial rallies. As one can clearly see, the Dow is now very close to a major peak similar to 1937 where after one of the ...

stock market crash of 1929

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...

... Prices began to decline in September and early October, but speculation continued, fueled in many cases by individuals who had borrowed money to buy shares—a practice that could be sustained only as long as stock prices continued rising. On October 18 the market went into a free fall, and the wild r ...