FUTURE // noun [C, usually pl

... contracts to buy or sell a particular amount of sth for a fixed price at a particular time in the future), options (= the right to buy or sell sth for a fixed price in the future), etc: They want to hedge their exposure to interest-rate risk. The airline has hedged 77% of its expected fuel requireme ...

... contracts to buy or sell a particular amount of sth for a fixed price at a particular time in the future), options (= the right to buy or sell sth for a fixed price in the future), etc: They want to hedge their exposure to interest-rate risk. The airline has hedged 77% of its expected fuel requireme ...

Chapter 11

... Shift risk from those who don’t want to carry risk to those who are willing to do so. Bring additional information into the market from hedgers, speculators, market expectations. Lower commissions and margin requirements than in spot market ...

... Shift risk from those who don’t want to carry risk to those who are willing to do so. Bring additional information into the market from hedgers, speculators, market expectations. Lower commissions and margin requirements than in spot market ...

Set 8 - Matt Will

... • On September 1 Merrill Lynch (ML) agrees to buy $10mil of HSE Corporate stock & resell it on Sept 4 • ML estimates a $100/share price • The S&P 500 Index contract is priced @ 1470 • 1470 x 250 = $367,500 • How can ML hedge its risk if HSE has a beta of 0.8? • What is their profit or loss if on Sep ...

... • On September 1 Merrill Lynch (ML) agrees to buy $10mil of HSE Corporate stock & resell it on Sept 4 • ML estimates a $100/share price • The S&P 500 Index contract is priced @ 1470 • 1470 x 250 = $367,500 • How can ML hedge its risk if HSE has a beta of 0.8? • What is their profit or loss if on Sep ...

Ride The Seller220512

... completely cleared. Unfortunately, as the RBA left rates on hold and the banks kept creeping their interest rates higher and higher, consumer confidence took another battering. The run-on in activity was not sustained and by March, last year’s gloom had all but taken back over. That was until early ...

... completely cleared. Unfortunately, as the RBA left rates on hold and the banks kept creeping their interest rates higher and higher, consumer confidence took another battering. The run-on in activity was not sustained and by March, last year’s gloom had all but taken back over. That was until early ...

State of the Family

... Price is related to risk in each transaction and willingness to pay There is no delivery risk for EU Allowances or allowance trading in any other cap and trade domestic regime There is currently significant regulatory risk in CDM/JI projects and there will always be project performance and del ...

... Price is related to risk in each transaction and willingness to pay There is no delivery risk for EU Allowances or allowance trading in any other cap and trade domestic regime There is currently significant regulatory risk in CDM/JI projects and there will always be project performance and del ...

Derivatives and Risk Management

... Long hedge: Involves the purchase of a futures contract to guard against a price increase. Short hedge: Involves the sale of a futures contract to protect against a price decline in commodities or financial securities. (More... ...

... Long hedge: Involves the purchase of a futures contract to guard against a price increase. Short hedge: Involves the sale of a futures contract to protect against a price decline in commodities or financial securities. (More... ...

Types of Transactions

... A Call (Put) on Futures The call (put) buyers pays the premium to the writer in order to acquire the right (but not obligation) to go long (short) an exchange —traded FX futures at the strike price. ...

... A Call (Put) on Futures The call (put) buyers pays the premium to the writer in order to acquire the right (but not obligation) to go long (short) an exchange —traded FX futures at the strike price. ...

Snímek 1

... • If spot-futures parity is not observed, then arbitrage is possible • If the futures price is too high, short the futures and acquire the stock by borrowing the money at the riskfree rate • If the futures price is too low, go long futures, short the stock and invest the proceeds at the riskfree rat ...

... • If spot-futures parity is not observed, then arbitrage is possible • If the futures price is too high, short the futures and acquire the stock by borrowing the money at the riskfree rate • If the futures price is too low, go long futures, short the stock and invest the proceeds at the riskfree rat ...

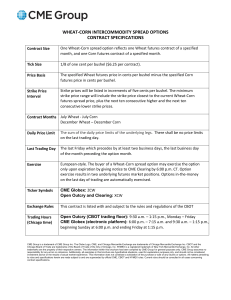

Wheat-Corn Intercommodity Spread Options Contract

... The sum of the daily price limits of the underlying legs. There shall be no price limits on the last trading day. ...

... The sum of the daily price limits of the underlying legs. There shall be no price limits on the last trading day. ...

Conventional Wisdom and the Impact of Market Volatility

... Point #2: Inventories Should Increase for Storable ...

... Point #2: Inventories Should Increase for Storable ...

pure competition is a situation in which the market for a product is

... perfect competition. Such as agricultural commodities like soybeans, oats and potatoes. In this market structure, price is determined solely by the forces of supply and demand. Monopolistic competition is a market in which many competitors provide similar products which can be distinguished on the b ...

... perfect competition. Such as agricultural commodities like soybeans, oats and potatoes. In this market structure, price is determined solely by the forces of supply and demand. Monopolistic competition is a market in which many competitors provide similar products which can be distinguished on the b ...

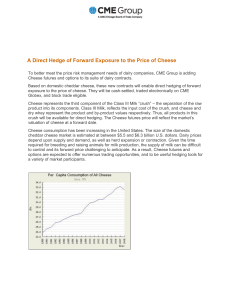

A Direct Hedge of Forward Exposure to the Price of Cheese

... dry whey represent the product and by-product values respectively. Thus, all products in this crush will be available for direct hedging. The Cheese futures price will reflect the market’s valuation of cheese at a forward date. Cheese consumption has been increasing in the United States. The size of ...

... dry whey represent the product and by-product values respectively. Thus, all products in this crush will be available for direct hedging. The Cheese futures price will reflect the market’s valuation of cheese at a forward date. Cheese consumption has been increasing in the United States. The size of ...

Introduction

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

... buy or sell an asset at a certain time in the future for a certain price • By contrast in a spot contract there is an agreement to buy or sell the asset immediately (or within a very short period of time) ...

Key Issues and Ideas - BYU Marriott School

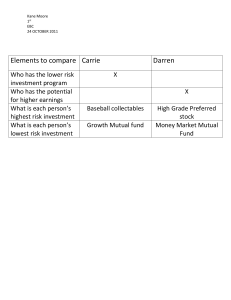

... Homework 3: Understand Chapter 2 Problems: 4, 6, 10, 13 Chapter 3 Problems: 1, 5, 16 Chapter 2 1. In what ways is preferred stock like long-term debt? In what ways is it like equity? 6. Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $4 ...

... Homework 3: Understand Chapter 2 Problems: 4, 6, 10, 13 Chapter 3 Problems: 1, 5, 16 Chapter 2 1. In what ways is preferred stock like long-term debt? In what ways is it like equity? 6. Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $4 ...