After the close recap The bean market set the pace

... The market received a rare treat this morning with a fresh export announcement of 191,000 tons of corn to Mexico. The last time there was a new corn announcement was back on September 1st also destined for Mexico. This morning’s export inspection data was good for corn, average for wheat, but disapp ...

... The market received a rare treat this morning with a fresh export announcement of 191,000 tons of corn to Mexico. The last time there was a new corn announcement was back on September 1st also destined for Mexico. This morning’s export inspection data was good for corn, average for wheat, but disapp ...

Document

... FUTURES CONTRACTS • WHAT ARE FUTURES? – Definition: an agreement between two investors under which the seller promises to deliver a specific asset on a specific future date to the buyer for a predetermined price to be paid on the delivery date ...

... FUTURES CONTRACTS • WHAT ARE FUTURES? – Definition: an agreement between two investors under which the seller promises to deliver a specific asset on a specific future date to the buyer for a predetermined price to be paid on the delivery date ...

Risk Analysis

... P0 = Current price of stock t = Number of years in future Pt = Price of stock at time t Random Variable!! Z = A standard normal random variable with mean 0 and standard deviation 1 Random Variable!! – μ = Mean percentage growth rate of stock per year expressed as a decimal – σ = Standard deviation ...

... P0 = Current price of stock t = Number of years in future Pt = Price of stock at time t Random Variable!! Z = A standard normal random variable with mean 0 and standard deviation 1 Random Variable!! – μ = Mean percentage growth rate of stock per year expressed as a decimal – σ = Standard deviation ...

REAL CLIENT MANAGED PORTFOLIOS MEMORANDUM

... Financial Analysis and Valuation Gentex has been sustaining a stable set of Return on Assets and Return on Equity, with approximately 15% and 13% from 2007 to 2011. Its profit margin declined quickly due to the economic crisis in 2008 and 2009, and immediately picked up again in 2010, which is 16.87 ...

... Financial Analysis and Valuation Gentex has been sustaining a stable set of Return on Assets and Return on Equity, with approximately 15% and 13% from 2007 to 2011. Its profit margin declined quickly due to the economic crisis in 2008 and 2009, and immediately picked up again in 2010, which is 16.87 ...

Risk Management

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

TTSE Rule 405 - Price Stabilisation Amended April 19th 2010

... Increasing the price band to 15% would allow investors to place orders within a wider price band making them more attractive to the market which should result in an increase in market activity and more flexible and efficient price discovery. The proposed amendment is also being submitted in order to ...

... Increasing the price band to 15% would allow investors to place orders within a wider price band making them more attractive to the market which should result in an increase in market activity and more flexible and efficient price discovery. The proposed amendment is also being submitted in order to ...

Navios Maritime Stock Opportunity for Strong Quarterly Return

... During 2Q, 2015 the dip was not so big, but did drop some and rebounded at the exdate. 1Q, 2015 displayed a drop of over $4. during the quarter. With the current price down, we are confident the stock price will recover leading to this ex-date. The dividend has increased over time as well, with the ...

... During 2Q, 2015 the dip was not so big, but did drop some and rebounded at the exdate. 1Q, 2015 displayed a drop of over $4. during the quarter. With the current price down, we are confident the stock price will recover leading to this ex-date. The dividend has increased over time as well, with the ...

Money and Investing - St. John the Baptist Diocesan High School

... banks, pension funds, credit unions, insurance company’s, finance company’s Mutual Funds ...

... banks, pension funds, credit unions, insurance company’s, finance company’s Mutual Funds ...

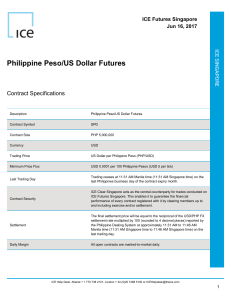

Philippine Peso/US Dollar Futures

... months. A new contract is listed for trading on the business day following the last trading day of the expiring month. ...

... months. A new contract is listed for trading on the business day following the last trading day of the expiring month. ...

Chapter 1: Introduction

... We will use stock short sales in many of strategies associated with options trading. In all of these strategies, we will assume that no cash flow occurs from the time the strategy is opened with the stock short sale until the time the strategy terminates and the stock is ...

... We will use stock short sales in many of strategies associated with options trading. In all of these strategies, we will assume that no cash flow occurs from the time the strategy is opened with the stock short sale until the time the strategy terminates and the stock is ...

INVESTMENT OPPORTUNITIES

... Higher risk usually means a chance at a higher return. Also means that you could lose more money. Lower risk usually means lower return. ...

... Higher risk usually means a chance at a higher return. Also means that you could lose more money. Lower risk usually means lower return. ...

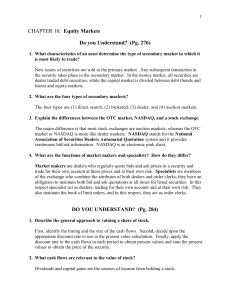

CHAPTER 10: Equity Markets

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

Brian developed his interest for the futures market, while growing up

... He graduated with a B.S. Social Studies from Minot State University. Brian began his career in the futures industry as an employee of the Minneapolis Grain Exchange. While at the MGEX, his duties allowed him to gain knowledge of the mechanism of futures trading. These duties included enforcement of ...

... He graduated with a B.S. Social Studies from Minot State University. Brian began his career in the futures industry as an employee of the Minneapolis Grain Exchange. While at the MGEX, his duties allowed him to gain knowledge of the mechanism of futures trading. These duties included enforcement of ...

Chapter 10

... another between the parties Usually associated with borrowing money The exchanges can be at a fixed or a variable rate of interest as negotiated in the contract, but the exchanges occur at a known currency exchange rate Used to hedge exchange rate risk from mismatched currencies of assets and ...

... another between the parties Usually associated with borrowing money The exchanges can be at a fixed or a variable rate of interest as negotiated in the contract, but the exchanges occur at a known currency exchange rate Used to hedge exchange rate risk from mismatched currencies of assets and ...

Financial Markets in Electricity: Introduction to Derivative Instruments

... Spread option: An option contract which gives the buyer the right to buy (call) or sell (put) a spread trade on a specific future date(s) for a specified price. Strike price: The price at which the buyer of an option will find it profitable to exercise his rights under the option contract. For examp ...

... Spread option: An option contract which gives the buyer the right to buy (call) or sell (put) a spread trade on a specific future date(s) for a specified price. Strike price: The price at which the buyer of an option will find it profitable to exercise his rights under the option contract. For examp ...

Gleadell Market Report

... placing the season cumulative figure down 18% year-on-year. In the EU, MATIF is up €4 due to weaker currency and firmer FOB premiums. Following recent trades to Egypt and Ethiopia, shipper shorts have been looking for cover in a thinly offered market. The EU Commission updated its EU crop forecast, ...

... placing the season cumulative figure down 18% year-on-year. In the EU, MATIF is up €4 due to weaker currency and firmer FOB premiums. Following recent trades to Egypt and Ethiopia, shipper shorts have been looking for cover in a thinly offered market. The EU Commission updated its EU crop forecast, ...