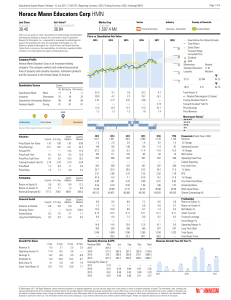

Horace Mann Educators Corp HMN

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

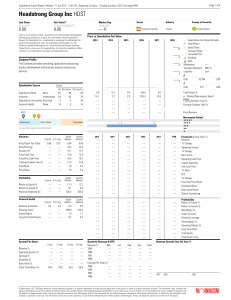

Headstrong Group Inc HDST

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

Understanding Counterparty Risk on Total Return

... in the Prospectus under the distribution policy and income tax consideration sections. Why are TRI ETFs not re-characterizing taxes? The pre-settlement of the swap during the redemption process may result in a taxable gain that is treated as regular income. However, through the process described abo ...

... in the Prospectus under the distribution policy and income tax consideration sections. Why are TRI ETFs not re-characterizing taxes? The pre-settlement of the swap during the redemption process may result in a taxable gain that is treated as regular income. However, through the process described abo ...

Compounding Rate Of Return

... The investor then would be taxed 31%, making his after tax earning into $323.83, which sounds great. However, the IRS also knows about this great trick and will not let you get away with this. But for Warren the IRS missed one very important point, that when buying company equity, (which to Warren i ...

... The investor then would be taxed 31%, making his after tax earning into $323.83, which sounds great. However, the IRS also knows about this great trick and will not let you get away with this. But for Warren the IRS missed one very important point, that when buying company equity, (which to Warren i ...

Value and Prices of Intangible Assets

... frustrated because we not really know what exactly these assets are. This point promp ts a caveat for the valuation of intangibles: appeal to hazy notions is a recipe for speculative valuation. Second, intangible assets, even when identified, usually generate value jointly with tangible assets and t ...

... frustrated because we not really know what exactly these assets are. This point promp ts a caveat for the valuation of intangibles: appeal to hazy notions is a recipe for speculative valuation. Second, intangible assets, even when identified, usually generate value jointly with tangible assets and t ...

Some Theoretical Considerations Regarding Net Asset Values for

... 2012, the Financial Stability Oversight Council (FSOC) made public a set of proposed recommendations to the SEC for further reform (Financial Stability Oversight Council 2012). The Council proposed three di¤erent avenues for reform. The …rst alternative is to remove the valuation and pricing provisi ...

... 2012, the Financial Stability Oversight Council (FSOC) made public a set of proposed recommendations to the SEC for further reform (Financial Stability Oversight Council 2012). The Council proposed three di¤erent avenues for reform. The …rst alternative is to remove the valuation and pricing provisi ...

Comparative Investigation of Income Smoothing and Earning Quality on... Valuation of Listed Companies in Tehran Stock Exchange

... earnings during successive periods at a level of earnings which is considered the company’s normal level. Generally, income smoothing refers to the application of the management preferences to determine the priority of costs and earnings accounting records and taking into account expenditures or tra ...

... earnings during successive periods at a level of earnings which is considered the company’s normal level. Generally, income smoothing refers to the application of the management preferences to determine the priority of costs and earnings accounting records and taking into account expenditures or tra ...

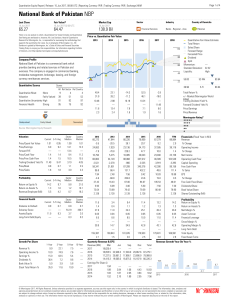

National Bank of Pakistan NBP

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

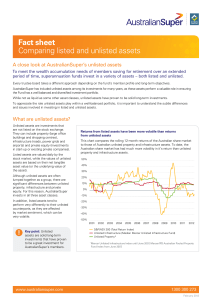

Fact sheet Comparing listed and unlisted assets

... AustralianSuper has included unlisted assets among its investments for many years, as these assets perform a valuable role in ensuring the Fund has a well balanced and diversified investment portfolio. While not as liquid as some other asset classes, unlisted assets have proven to be solid long-term ...

... AustralianSuper has included unlisted assets among its investments for many years, as these assets perform a valuable role in ensuring the Fund has a well balanced and diversified investment portfolio. While not as liquid as some other asset classes, unlisted assets have proven to be solid long-term ...

In-substance purchases/sales

... Update. Official pronouncements of the FASB or the IASB are published only after each board has completed its full due process, including appropriate public consultation and formal voting procedures. ...

... Update. Official pronouncements of the FASB or the IASB are published only after each board has completed its full due process, including appropriate public consultation and formal voting procedures. ...

prospectus - Cullen Funds

... The High Dividend Fund invests roughly similar amounts of its assets in each stock in the portfolio at the time of original purchase, although the portfolio is not systematically rebalanced. This approach avoids the overweighting of any individual security being purchased. The Adviser may sell portf ...

... The High Dividend Fund invests roughly similar amounts of its assets in each stock in the portfolio at the time of original purchase, although the portfolio is not systematically rebalanced. This approach avoids the overweighting of any individual security being purchased. The Adviser may sell portf ...

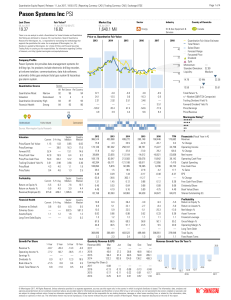

Pason Systems Inc PSI

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

New risks. New insights.

... Holdings-based analysis, a pillar of BlackRock’s risk-first approach, helps us better understand the real-time risk profile of the portfolio — based on current holdings instead of past returns. This technique is designed to complement other returns-based methodologies and help advisors in two keys w ...

... Holdings-based analysis, a pillar of BlackRock’s risk-first approach, helps us better understand the real-time risk profile of the portfolio — based on current holdings instead of past returns. This technique is designed to complement other returns-based methodologies and help advisors in two keys w ...

Financial Stability Report - November 2016

... increase in the latest period (Chart 2). It is therefore essential to maintain a fiscal consolidation trajectory which allows the sustained reduction in public indebtedness to start. The effective deleveraging of the public sector will allow the international financial markets' perception of the pub ...

... increase in the latest period (Chart 2). It is therefore essential to maintain a fiscal consolidation trajectory which allows the sustained reduction in public indebtedness to start. The effective deleveraging of the public sector will allow the international financial markets' perception of the pub ...

The EBA EU-wide Stress Test 2016

... Most European banks hold large portfolios of government debt. Figure 2 shows that for most banks the government debt portfolio is about twice the size of the total own funds. The portfolios have often low risk-weights and the diversification is limited. Hence, on average, about 60% of the government ...

... Most European banks hold large portfolios of government debt. Figure 2 shows that for most banks the government debt portfolio is about twice the size of the total own funds. The portfolios have often low risk-weights and the diversification is limited. Hence, on average, about 60% of the government ...

Comparing Individual Retirement Accounts in Asia: Singapore

... CPF Minimum Sum, he need to set aside the Medisave Required Amount which is currently S$8,300 (as at 1 Jan 2006), to be adjusted annually to take into account inflation and cost of healthcare. (See Appendix Table 3). ...

... CPF Minimum Sum, he need to set aside the Medisave Required Amount which is currently S$8,300 (as at 1 Jan 2006), to be adjusted annually to take into account inflation and cost of healthcare. (See Appendix Table 3). ...

OnePath Wholesale High Growth Trust

... exposure and other entities upon which the Trust’s investments depend, may default on their obligations, for instance by failing to make a payment when it becomes due or by failing to return capital. Counterparties to the Trust, including derivatives counterparties, may default on their contractual ...

... exposure and other entities upon which the Trust’s investments depend, may default on their obligations, for instance by failing to make a payment when it becomes due or by failing to return capital. Counterparties to the Trust, including derivatives counterparties, may default on their contractual ...

NBG PANGAEA R.E.I.C.

... VIOTECHNIAS KAI VIOMICHANIAS” (the “Company to be absorbed”). The Absorbing Company owns 100% of the share capital and voting rights of the Company to be absorbed . It has been proposed that the envisaged merger will take place through the consolidation of assets and liabilities of the above compani ...

... VIOTECHNIAS KAI VIOMICHANIAS” (the “Company to be absorbed”). The Absorbing Company owns 100% of the share capital and voting rights of the Company to be absorbed . It has been proposed that the envisaged merger will take place through the consolidation of assets and liabilities of the above compani ...

The Value Relevance of Regulatory Capital Components

... Empirical papers supporting Admati et al. (2013) include that by Mehran and Thakor (2011), who show that bank value increases with capital and thus respond to Modigliani and Miller (1958) and Miller (1995), who cling to capital structure irrelevance. Berger and Bouwman (2013) show that banks’ odds o ...

... Empirical papers supporting Admati et al. (2013) include that by Mehran and Thakor (2011), who show that bank value increases with capital and thus respond to Modigliani and Miller (1958) and Miller (1995), who cling to capital structure irrelevance. Berger and Bouwman (2013) show that banks’ odds o ...

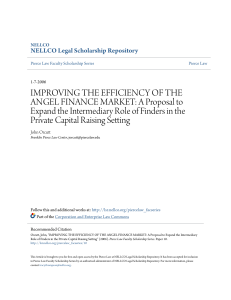

IMPROVING THE EFFICIENCY OF THE ANGEL FINANCE MARKET

... financing in order to fund their ventures. The media has focused predominantly on the role of institutional venture capital (“VC”) funds in providing this external equity funding.19 While the U.S. VC-fund market is a very valuable asset of the U.S. economy, it provides only a fraction of the equity ...

... financing in order to fund their ventures. The media has focused predominantly on the role of institutional venture capital (“VC”) funds in providing this external equity funding.19 While the U.S. VC-fund market is a very valuable asset of the U.S. economy, it provides only a fraction of the equity ...

Form ADV - Mirador Capital Partners

... accountant, attorney or other specialist, as necessary for non-advisory related services. For written financial planning engagements, we provide our clients with an online report and summary of their financial situation, observations, and recommendations. For financial consulting engagements, we usu ...

... accountant, attorney or other specialist, as necessary for non-advisory related services. For written financial planning engagements, we provide our clients with an online report and summary of their financial situation, observations, and recommendations. For financial consulting engagements, we usu ...

Frame - Frips

... framing can influence our choices. Tversky and Kahneman described "Prospect Theory" in 1979 using framed questions. They found that contrary to expected utility theory, people placed different weights on gains and losses and on different ranges of probability. They also found that individuals are mu ...

... framing can influence our choices. Tversky and Kahneman described "Prospect Theory" in 1979 using framed questions. They found that contrary to expected utility theory, people placed different weights on gains and losses and on different ranges of probability. They also found that individuals are mu ...

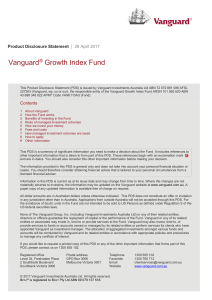

Vanguard Growth Index Fund

... Significant risks of investing in the Fund There is no guarantee that the value of your initial investment will be maintained. In other words, the value of your investment may rise or fall. Significant investment risks include: ▪ Market risk – Market risk is the possibility that market returns will ...

... Significant risks of investing in the Fund There is no guarantee that the value of your initial investment will be maintained. In other words, the value of your investment may rise or fall. Significant investment risks include: ▪ Market risk – Market risk is the possibility that market returns will ...

Using Pooled Model, Random Model And Fixed

... distance as an important factor of FDI. The foreign investors may be more likely to invest in a country where it has similarity in cultural distance. It may reduce the informational costs for business transactions taking place between two countries. In addition, it is easier for the foreign firms to ...

... distance as an important factor of FDI. The foreign investors may be more likely to invest in a country where it has similarity in cultural distance. It may reduce the informational costs for business transactions taking place between two countries. In addition, it is easier for the foreign firms to ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.