Foreclosure Update and New Appraisal Regulations

... Questions regarding MERS’ capacity to pursue a foreclosure or even be in the chain of title Are recorded chain of assignments required? DC Attorney ...

... Questions regarding MERS’ capacity to pursue a foreclosure or even be in the chain of title Are recorded chain of assignments required? DC Attorney ...

4th yr Project - Department of Real Estate and Construction

... and social development. The residential housing sector is very important in any country because it provide shelter which is one of the basic needs. The overall demand for housing in Kenya according to UN Habitat survey and Kenya Vision 2030 is 150,000 housing units per year as compared to 35,000 hou ...

... and social development. The residential housing sector is very important in any country because it provide shelter which is one of the basic needs. The overall demand for housing in Kenya according to UN Habitat survey and Kenya Vision 2030 is 150,000 housing units per year as compared to 35,000 hou ...

PNC Capital Advisors, LLC

... management services. Pricing is based upon the nature of such services as determined by each client’s specific investment policies, permissible investments, and other portfolio management parameters. Account fees may be negotiable on a case-by-case basis based on various factors, including, but not ...

... management services. Pricing is based upon the nature of such services as determined by each client’s specific investment policies, permissible investments, and other portfolio management parameters. Account fees may be negotiable on a case-by-case basis based on various factors, including, but not ...

Proactive Financial Reporting Enforcement and Firm Value

... 2017 FARS meeting, and UCLA. Christensen, Liu, and Maffett gratefully acknowledge financial support from the University of Chicago Booth School of Business. This work is supported by the Centel Foundation/Robert P. Reuss Faculty Research Fund at the University of Chicago Booth School of Business. ...

... 2017 FARS meeting, and UCLA. Christensen, Liu, and Maffett gratefully acknowledge financial support from the University of Chicago Booth School of Business. This work is supported by the Centel Foundation/Robert P. Reuss Faculty Research Fund at the University of Chicago Booth School of Business. ...

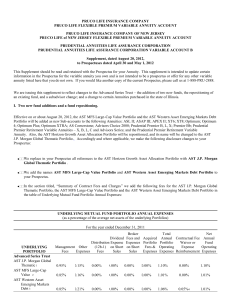

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... This Supplement should be read and retained with the Prospectus for your Annuity. This supplement is intended to update certain information in the Prospectus for the variable annuity you own and is not intended to be a prospectus or offer for any other variable annuity listed here that you do not ow ...

... This Supplement should be read and retained with the Prospectus for your Annuity. This supplement is intended to update certain information in the Prospectus for the variable annuity you own and is not intended to be a prospectus or offer for any other variable annuity listed here that you do not ow ...

OnePath Wholesale Blue Chip Imputation Trust

... The Trust generally distributes quarterly after the end of March, June, September and December each year. The amount (if any) distributed to each investor (including to your Service Operator) will be based on the number of units held at the end of each distribution period. Distributions may be compr ...

... The Trust generally distributes quarterly after the end of March, June, September and December each year. The amount (if any) distributed to each investor (including to your Service Operator) will be based on the number of units held at the end of each distribution period. Distributions may be compr ...

Comparing Compensation: Trends in Executive Pay

... etting the CEO’s pay package continues to be one of the most important and high-profile tasks with which a board is entrusted. Designing packages that are both palatable to shareholders and motivating to executives is a delicate balance and one that is all too easy to get wrong. The introduction of ...

... etting the CEO’s pay package continues to be one of the most important and high-profile tasks with which a board is entrusted. Designing packages that are both palatable to shareholders and motivating to executives is a delicate balance and one that is all too easy to get wrong. The introduction of ...

How Does the Market View Bank Regulatory Capital Forbearance

... measures of the market perceptions of the time-varying regulatory agencies’ implementation of the bank closure rule. Using Wells Fargo as a case study, we show that our model effectively captures the market view about the regulatory capital forbearance practice. To gauge the size of the capital for ...

... measures of the market perceptions of the time-varying regulatory agencies’ implementation of the bank closure rule. Using Wells Fargo as a case study, we show that our model effectively captures the market view about the regulatory capital forbearance practice. To gauge the size of the capital for ...

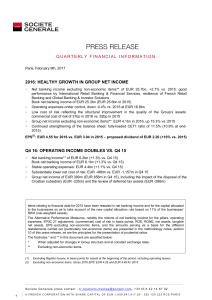

QUARTERLY FINANCIAL INFORMATION 2016: HEALTHY

... Group net income amounted to EUR 390 million in Q4 16, vs. EUR 656 million for the same period in 2015. It includes two non-recurring items: the result of the disposal of the Croatian subsidiary, amounting to EUR -235 million, and an adjustment of deferred taxes included in balance sheet assets for ...

... Group net income amounted to EUR 390 million in Q4 16, vs. EUR 656 million for the same period in 2015. It includes two non-recurring items: the result of the disposal of the Croatian subsidiary, amounting to EUR -235 million, and an adjustment of deferred taxes included in balance sheet assets for ...

AccountancyCyprus

... During the third quarter of 2013 the Accounting Standards Committee has carried out the following activities: The Committee continued its scheduled monthly meetings as well as several sub-committee meetings in the intervening periods. In accordance with the Committee’s action plan five subcommittees ...

... During the third quarter of 2013 the Accounting Standards Committee has carried out the following activities: The Committee continued its scheduled monthly meetings as well as several sub-committee meetings in the intervening periods. In accordance with the Committee’s action plan five subcommittees ...

Financing Infrastructure - Inter

... A regional and country-basis comparison supports the hypothesis that LAC is underinvesting in infrastructure. Investment in infrastructure averaged 2.4 percent between 1992 and 2013. Investment in other regions and countries was significantly higher: 8.5 percent in China, 5.0 percent in Japan and In ...

... A regional and country-basis comparison supports the hypothesis that LAC is underinvesting in infrastructure. Investment in infrastructure averaged 2.4 percent between 1992 and 2013. Investment in other regions and countries was significantly higher: 8.5 percent in China, 5.0 percent in Japan and In ...

The Diamond Investment Promise

... carats mined in 2007 and far below the +176 million carats per year mined prior to that. In addition, there is no certainty that the current quantity of production is sustainable. With the exception of the Russian miner Alrosa – the world's largest producer by volume – all of the other diamond miner ...

... carats mined in 2007 and far below the +176 million carats per year mined prior to that. In addition, there is no certainty that the current quantity of production is sustainable. With the exception of the Russian miner Alrosa – the world's largest producer by volume – all of the other diamond miner ...

Commercial Real Estate

... of capital into the US. This is compounded by the approximately $1.1 trillion in dollar-denominated bond debt owed by emerging-market economies that will be challenged by repayment with weakened currencies. Apprehension also exists in a number of major global economies, in which the central banks ha ...

... of capital into the US. This is compounded by the approximately $1.1 trillion in dollar-denominated bond debt owed by emerging-market economies that will be challenged by repayment with weakened currencies. Apprehension also exists in a number of major global economies, in which the central banks ha ...

The Anatomy of a Credit Crisis: The Boom and Bust in Farm Land

... Asset price booms and busts often center around changes in credit availability (see, for example, the descriptions in Kindleberger and Aliber (2005) and Minsky (1986), theories such as Geanakoplos (2009), and the evidence in Mian and Sufi (2008)). Some economists, however, claim that the availabili ...

... Asset price booms and busts often center around changes in credit availability (see, for example, the descriptions in Kindleberger and Aliber (2005) and Minsky (1986), theories such as Geanakoplos (2009), and the evidence in Mian and Sufi (2008)). Some economists, however, claim that the availabili ...

JP Morgan Securities LLC | Wrap Fee Program Brochure | Advisory

... Prior to opening a Program account (“Account”), the IAR meets with the prospective Client to create a “Client Profile” based upon the Client’s responses to questions regarding their financial situation, investment experience, investment objectives, time horizon and risk tolerance. The information is ...

... Prior to opening a Program account (“Account”), the IAR meets with the prospective Client to create a “Client Profile” based upon the Client’s responses to questions regarding their financial situation, investment experience, investment objectives, time horizon and risk tolerance. The information is ...

Your guide to our funds

... For example you may want a regular investment income to top up your income if you no longer receive a wage. The length of time you plan to invest for should influence your attitude to risk, and therefore your potential return. For example, if you wish to invest for 25 years you may be willing to tak ...

... For example you may want a regular investment income to top up your income if you no longer receive a wage. The length of time you plan to invest for should influence your attitude to risk, and therefore your potential return. For example, if you wish to invest for 25 years you may be willing to tak ...

Optimal Consumption and Portfolio Choices with Risky

... everything else equal, investors prefer owning a house to renting in our model. However, a down payment is required to buy a house. Further, homeowners are required to maintain a positive home equity position and incur a significant transaction cost when selling their house. Our results indicate tha ...

... everything else equal, investors prefer owning a house to renting in our model. However, a down payment is required to buy a house. Further, homeowners are required to maintain a positive home equity position and incur a significant transaction cost when selling their house. Our results indicate tha ...

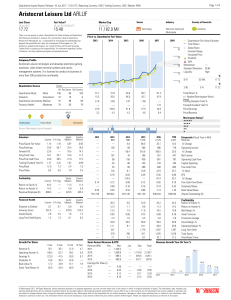

Aristocrat Leisure Ltd ARLUF

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

Trading Is Hazardous to Your Wealth: The Common Stock

... not explicitly address whether such a tilt exists among the individual investors they analyze, but we suspect that it does. This small-stock tilt is likely to be extremely important because small stocks outperform large stocks by 67 basis points per month during their sample period. As do Schlarbaum ...

... not explicitly address whether such a tilt exists among the individual investors they analyze, but we suspect that it does. This small-stock tilt is likely to be extremely important because small stocks outperform large stocks by 67 basis points per month during their sample period. As do Schlarbaum ...

the fragile capital structure of hedge funds and the

... that were fundamentally sound, at least with asset fundamentals and capital requirements that appeared adequate before collapse. Even so, investors still decided to run, worried that the liquidity of these …nancial institutions was insu¢ cient to meet massive withdrawals and assets would have to be ...

... that were fundamentally sound, at least with asset fundamentals and capital requirements that appeared adequate before collapse. Even so, investors still decided to run, worried that the liquidity of these …nancial institutions was insu¢ cient to meet massive withdrawals and assets would have to be ...

PRESS RELEASE

... believe that these adjustments appropriately reflect current and potential loan market conditions. In particular, we believe that these changes are consistent with an expected near-term decline in defaults with heightened risks remaining in the mid-term as a result of both macro-economic uncertainty ...

... believe that these adjustments appropriately reflect current and potential loan market conditions. In particular, we believe that these changes are consistent with an expected near-term decline in defaults with heightened risks remaining in the mid-term as a result of both macro-economic uncertainty ...

Market-Consistent Valuations of Life Insurance Business

... Insurers can use risk-free rates and asset volatilities, deduced from market prices, to help calibrate the model they are using. However, we can see that there are differences between firms in their modelling, because each insurer has to report what its model produces for specimen put option prices. ...

... Insurers can use risk-free rates and asset volatilities, deduced from market prices, to help calibrate the model they are using. However, we can see that there are differences between firms in their modelling, because each insurer has to report what its model produces for specimen put option prices. ...

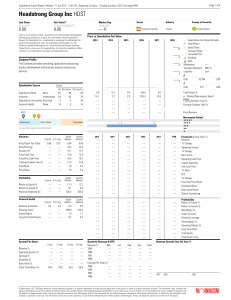

Headstrong Group Inc HDST

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

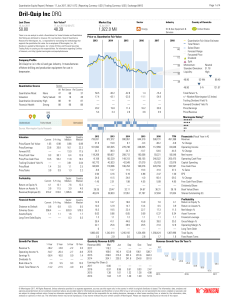

Dril-Quip Inc DRQ

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.