structured life insurance and investment products for retail investors

... contracts where the benefits of the insured depend on the performance of an investment strategy and which guarantee a certain interest rate on the contributions made by the insured. The insured has to decide simultaneously on the investment strategy and the guarantee scheme, i.e. the particular stru ...

... contracts where the benefits of the insured depend on the performance of an investment strategy and which guarantee a certain interest rate on the contributions made by the insured. The insured has to decide simultaneously on the investment strategy and the guarantee scheme, i.e. the particular stru ...

Regulatory Guide RG 196 Short selling

... In Australia, securities lending arrangements typically involve the transfer of securities from the owner (lender) to another party (the borrower), with the borrower obliged to return the securities (or their equivalent) either on demand or at the end of the loan term. The borrower usually gives the ...

... In Australia, securities lending arrangements typically involve the transfer of securities from the owner (lender) to another party (the borrower), with the borrower obliged to return the securities (or their equivalent) either on demand or at the end of the loan term. The borrower usually gives the ...

the impact of foreign direct investment on economic

... Over the years countries of the world have mutually helped each other in growing and developing. This has been made possible through the instrument of international trade. This trade is necessitated by the fact that no country is an island therefore is naturally endowed with all her needed resources ...

... Over the years countries of the world have mutually helped each other in growing and developing. This has been made possible through the instrument of international trade. This trade is necessitated by the fact that no country is an island therefore is naturally endowed with all her needed resources ...

annual report

... yields to even lower levels. However, risk assets recovered swiftly in July as economic data suggested that the consequences had thus far been contained to the United Kingdom. ...

... yields to even lower levels. However, risk assets recovered swiftly in July as economic data suggested that the consequences had thus far been contained to the United Kingdom. ...

MARKETING ARITHMETIC

... The inventory figures merely show the cost of goods on hand at the beginning and end of the period the statement covers. These figures may be obtained by a physical count of the goods on hand on these dates or they may be estimated by ‘perpetual inventory’ records that show the inventory balance at ...

... The inventory figures merely show the cost of goods on hand at the beginning and end of the period the statement covers. These figures may be obtained by a physical count of the goods on hand on these dates or they may be estimated by ‘perpetual inventory’ records that show the inventory balance at ...

Ashmore Emerging Markets Liquid Investment Portfolio Ashmore

... frequently associated with a sell-off of fixed income assets; however, the effects of a weaker than expected economic recovery in most of the world and accommodative policy makers meant that fixed income assets also performed well. Towards the end of the fiscal year, most EM assets underperformed du ...

... frequently associated with a sell-off of fixed income assets; however, the effects of a weaker than expected economic recovery in most of the world and accommodative policy makers meant that fixed income assets also performed well. Towards the end of the fiscal year, most EM assets underperformed du ...

A Model of Competitive Stock Trading Volume Jiang Wang

... relations between volume and returns. Without information asymmetry, investors trade only to rebalance their portfolios when their private investment opportunity changes. In this case, trading is always accompanied by changes in the current price, which are followed by price changes in the opposite ...

... relations between volume and returns. Without information asymmetry, investors trade only to rebalance their portfolios when their private investment opportunity changes. In this case, trading is always accompanied by changes in the current price, which are followed by price changes in the opposite ...

ING Property Trust

... significant acquisition of the $283 million MFL/SIL portfolio comprising 71 buildings located in Auckland, Wellington and Christchurch. This acquisition greatly improved the diversification, risk profile and scale of the Trust, while maintaining an attractive gross yield for unitholders. The ANZ Bui ...

... significant acquisition of the $283 million MFL/SIL portfolio comprising 71 buildings located in Auckland, Wellington and Christchurch. This acquisition greatly improved the diversification, risk profile and scale of the Trust, while maintaining an attractive gross yield for unitholders. The ANZ Bui ...

the future of the belgian financial sector

... up capital markets to SMEs have so far not been very successful in Belgium. The Capital Market Union could therefore be an opportunity for Belgium. ...

... up capital markets to SMEs have so far not been very successful in Belgium. The Capital Market Union could therefore be an opportunity for Belgium. ...

Banking Industry Private Banking Specification of

... Monetary Authority (HKMA) issued a circular in 2012 4 to provide further clarification to private banks on the regulatory requirements governing the sales of investment products. The circular promulgated a definition of “Private Banking Customer”. Moreover, the circular also introduced “portfolio ba ...

... Monetary Authority (HKMA) issued a circular in 2012 4 to provide further clarification to private banks on the regulatory requirements governing the sales of investment products. The circular promulgated a definition of “Private Banking Customer”. Moreover, the circular also introduced “portfolio ba ...

Crouhy et al. - IME-USP

... of migrating from one credit rating to another. In fact, the ultimate framework to analyze credit risk calls for the full integration of market risk and credit risk. So far no existing practical approach has yet reached this stage of sophistication. During the last two years a number of initiatives ...

... of migrating from one credit rating to another. In fact, the ultimate framework to analyze credit risk calls for the full integration of market risk and credit risk. So far no existing practical approach has yet reached this stage of sophistication. During the last two years a number of initiatives ...

III. Size of FDI flows

... advantage allows foreign direct investors to elicit the best investment opportunities in the host country. The advantage stems, for instance, from the ability of FDI investors to apply superior industry-specific micro-management standards (a form of that “intangible capital”). This element is captur ...

... advantage allows foreign direct investors to elicit the best investment opportunities in the host country. The advantage stems, for instance, from the ability of FDI investors to apply superior industry-specific micro-management standards (a form of that “intangible capital”). This element is captur ...

acknowledgement - Entrance Exams Notifications 2017

... solving his needs will be the one way to success. The customer are paying for the product or service, so has the right to select the best one as per his requirement and he has various alternative in front of him. The concept of consumerism is being developed. Every time consumer is demanding somethi ...

... solving his needs will be the one way to success. The customer are paying for the product or service, so has the right to select the best one as per his requirement and he has various alternative in front of him. The concept of consumerism is being developed. Every time consumer is demanding somethi ...

Eron Mortgage Study

... This is the first systematic study of a single investment fraud, focussed on responses drawn from more than 2,200 Eron Mortgage investors. After reviewing relevant research literature and the specific findings of the B.C. Securities Commission in Eron, the research team held focus groups and developed ...

... This is the first systematic study of a single investment fraud, focussed on responses drawn from more than 2,200 Eron Mortgage investors. After reviewing relevant research literature and the specific findings of the B.C. Securities Commission in Eron, the research team held focus groups and developed ...

British and German Banking Strategies

... The British and German financial systems constitute a significant part of the European financial system(s). Banks are important institutional pillars of any financial system. The largest British and German banks are therefore agents that determine the structure of these financial systems. By studyin ...

... The British and German financial systems constitute a significant part of the European financial system(s). Banks are important institutional pillars of any financial system. The largest British and German banks are therefore agents that determine the structure of these financial systems. By studyin ...

Enhancing affordable rental housing investment via an intermediary

... Australian state and territory governments. AHURI Limited gratefully acknowledges the financial and other support it has received from these governments, without which this work would not have been possible. AHURI comprises a network of university Research Centres across Australia. Research Centre c ...

... Australian state and territory governments. AHURI Limited gratefully acknowledges the financial and other support it has received from these governments, without which this work would not have been possible. AHURI comprises a network of university Research Centres across Australia. Research Centre c ...

Establishing resolution arrangements for investment banks

... made the case for further action clear. The UK, and London in particular, has a well-deserved reputation as one of the world’s key centres for conducting investment banking business, and the Government is determined to protect and enhance this reputation. It is committed therefore to implementing a ...

... made the case for further action clear. The UK, and London in particular, has a well-deserved reputation as one of the world’s key centres for conducting investment banking business, and the Government is determined to protect and enhance this reputation. It is committed therefore to implementing a ...

Avison Young 2016 Forecast Commercial Real Estate Canada, U.S.

... asset sale velocity as large investors seek to deploy capital through joint-venture partnerships and mergers and acquisitions (M&A). In 2015, public (REIT) markets gave back some prior gains, largely in anticipation of interest rate increases, which have been slow to arrive. We believe this situatio ...

... asset sale velocity as large investors seek to deploy capital through joint-venture partnerships and mergers and acquisitions (M&A). In 2015, public (REIT) markets gave back some prior gains, largely in anticipation of interest rate increases, which have been slow to arrive. We believe this situatio ...

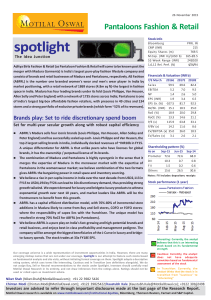

Pantaloons Fashion

... Our coverage universe is a wide representation of investment opportunities in India. However, there are many emerging midcap names that are not under our coverage. Spotlight is our attempt to feature such stocks based on fundamental analysis and site visits, without initiating formal coverage on the ...

... Our coverage universe is a wide representation of investment opportunities in India. However, there are many emerging midcap names that are not under our coverage. Spotlight is our attempt to feature such stocks based on fundamental analysis and site visits, without initiating formal coverage on the ...

Towards a new framework for banking crisis management

... case, the new tools employed by governments and central banks as well as their possible drawbacks. The paper includes a comprehensive reconstruction of institutional frameworks as they were before and after the reforms that followed the financial crisis. In this context, a special focus is given to ...

... case, the new tools employed by governments and central banks as well as their possible drawbacks. The paper includes a comprehensive reconstruction of institutional frameworks as they were before and after the reforms that followed the financial crisis. In this context, a special focus is given to ...

Mutual fund intermediation, equity issues, and the real

... Since fund flows and equity issues are cyclical in nature, I test the model separately on the overall growth in output as well as the cyclical component of output. The results predominantly show up in the cyclical component of output, rather than the long-run trend.3 Further analysis at the industry ...

... Since fund flows and equity issues are cyclical in nature, I test the model separately on the overall growth in output as well as the cyclical component of output. The results predominantly show up in the cyclical component of output, rather than the long-run trend.3 Further analysis at the industry ...

Knowledge in a nutshell - UBS

... overall market will influence the stock price. Let’s take an investor who is convinced that one particular wellfinanced company has excellent prospects. They buy stock in it. The problem is this: the company could suffer if the stock markets take a dive. After all, every stock harbors not only non-s ...

... overall market will influence the stock price. Let’s take an investor who is convinced that one particular wellfinanced company has excellent prospects. They buy stock in it. The problem is this: the company could suffer if the stock markets take a dive. After all, every stock harbors not only non-s ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.