Knowledge in a nutshell - UBS

... overall market will influence the stock price. Let’s take an investor who is convinced that one particular wellfinanced company has excellent prospects. They buy stock in it. The problem is this: the company could suffer if the stock markets take a dive. After all, every stock harbors not only non-s ...

... overall market will influence the stock price. Let’s take an investor who is convinced that one particular wellfinanced company has excellent prospects. They buy stock in it. The problem is this: the company could suffer if the stock markets take a dive. After all, every stock harbors not only non-s ...

The Dynamics of the Formal Urban Land market in South Africa

... subsidy regime to be more market-compatible and incentivising. Clearly this does not suggest that market-based approaches to pro-poor housing challenges are the only basis for state intervention. Widespread poverty and the skewed structure of incomes and employment fundamentally disable the market f ...

... subsidy regime to be more market-compatible and incentivising. Clearly this does not suggest that market-based approaches to pro-poor housing challenges are the only basis for state intervention. Widespread poverty and the skewed structure of incomes and employment fundamentally disable the market f ...

Does Gender and Age Affect Investor Performance and the

... portfolios, trade more intensively and make slightly larger trades than women, although they do not find difference in the performance of genders. Choe and Eom (2006) show that Korean individual investors are much more susceptible to the disposition effect than institutional and foreign investors. T ...

... portfolios, trade more intensively and make slightly larger trades than women, although they do not find difference in the performance of genders. Choe and Eom (2006) show that Korean individual investors are much more susceptible to the disposition effect than institutional and foreign investors. T ...

The determinants of cost/profit efficiency of Islamic banks

... massive resources of capital and have much more developed technologies (especially for derivatives and in research). However, for Islamic Banks, they share profits and losses with their customers through the principle of PLS (profit and loss sharing) that promotes partnership and more equitable shar ...

... massive resources of capital and have much more developed technologies (especially for derivatives and in research). However, for Islamic Banks, they share profits and losses with their customers through the principle of PLS (profit and loss sharing) that promotes partnership and more equitable shar ...

Chapter 11 Depreciation, Impairments

... As discussed in the opening story, the credit crisis starting in late 2008 has affected many financial and non-financial institutions. As a result of this global slump, many companies are considering write-offs of some of their long-lived assets. These write-offs are referred to as impairments. A lo ...

... As discussed in the opening story, the credit crisis starting in late 2008 has affected many financial and non-financial institutions. As a result of this global slump, many companies are considering write-offs of some of their long-lived assets. These write-offs are referred to as impairments. A lo ...

Direct Investing in Private Equity

... return for the LPs implied that “rents” were earned by private equity managers. Recently, using more comprehensive data, Harris, et al. (2013), Robinson and Sensoy (2013), and Axelson, et al. (2013a) show that on a net basis, private equity funds out-perform public benchmarks. However, the results a ...

... return for the LPs implied that “rents” were earned by private equity managers. Recently, using more comprehensive data, Harris, et al. (2013), Robinson and Sensoy (2013), and Axelson, et al. (2013a) show that on a net basis, private equity funds out-perform public benchmarks. However, the results a ...

Are Handouts Good for Growth

... institutions such as the EBRD could potentially play a crucial role during the transition from central planning to a market economy. Foreign investment and aid helps relieve financial market imperfections and lack of liquidity in emerging and transition economies. FDI can also be associated with tra ...

... institutions such as the EBRD could potentially play a crucial role during the transition from central planning to a market economy. Foreign investment and aid helps relieve financial market imperfections and lack of liquidity in emerging and transition economies. FDI can also be associated with tra ...

Analysing Foreign Market Entry: The Choice

... providing an eclectic framework which warrants the development of more detailed models based on it. This paper focuses on one particular question, namely a firm's choice between greenfield investment or acquisition as a means of market entry. Under the assumption that firms produce for domestic mark ...

... providing an eclectic framework which warrants the development of more detailed models based on it. This paper focuses on one particular question, namely a firm's choice between greenfield investment or acquisition as a means of market entry. Under the assumption that firms produce for domestic mark ...

Test Bank for Advanc..

... Full file at http://emailtestbank.com/ Test-Bank-for-Advanced-Financial-Accounting-10th-Edition-by-Christensen 22. Note: This is a Kaplan CPA Review Question Grant, Inc. acquired 30 percent of South Co.'s voting stock for $200,000 on January 2, 20X4. Grant's 30 percent interest in South gave Grant ...

... Full file at http://emailtestbank.com/ Test-Bank-for-Advanced-Financial-Accounting-10th-Edition-by-Christensen 22. Note: This is a Kaplan CPA Review Question Grant, Inc. acquired 30 percent of South Co.'s voting stock for $200,000 on January 2, 20X4. Grant's 30 percent interest in South gave Grant ...

Epsilon Fund - Fideuram Vita

... debt instruments, for example, involve credit risk. In the event that any issuer experiences difficulties related to the general condition of credit markets or more specific situations, the market price of the relevant securities subject to credit risk as well as the intermediate payments associated ...

... debt instruments, for example, involve credit risk. In the event that any issuer experiences difficulties related to the general condition of credit markets or more specific situations, the market price of the relevant securities subject to credit risk as well as the intermediate payments associated ...

summary note

... securities being offered pursuant to this document. This part is merely a summary and therefore should only be read as an introduction to the Prospectus. It is not and does not purport to be exhaustive and investors are warned that they should not rely on the information contained in this summary in ...

... securities being offered pursuant to this document. This part is merely a summary and therefore should only be read as an introduction to the Prospectus. It is not and does not purport to be exhaustive and investors are warned that they should not rely on the information contained in this summary in ...

TRADING VOLUME TREND AS THE INVESTOR`S SENTIMENT

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

... between the two groups of investors (Zweig (1973), Lee, Shleifer and Thaler (1991), Baker and Stein (2004), and Brown and Cliff (2005)). Miller (1977) argues that stock prices reflect only the most optimistic opinions among investors when short-sales constraints are present. When investors become mo ...

lloyds investment funds limited

... sterling interest rates. This policy will result in a gradual reduction in the capital value of the shares, except when bond prices generally are rising. The Fund will normally hold a relatively wide range of securities in order to keep a low level of exposure to individual bond issues other than go ...

... sterling interest rates. This policy will result in a gradual reduction in the capital value of the shares, except when bond prices generally are rising. The Fund will normally hold a relatively wide range of securities in order to keep a low level of exposure to individual bond issues other than go ...

GLOBAL INSIGHT

... In the U.S., RBC Wealth Management operates as a division of RBC Capital Markets, LLC. In Canada, RBC Wealth Management includes, without limitation, RBC Dominion Securities Inc., which is a foreign affiliate of RBC Capital Markets, LLC. This report has been prepared by RBC Capital Markets, LLC whic ...

... In the U.S., RBC Wealth Management operates as a division of RBC Capital Markets, LLC. In Canada, RBC Wealth Management includes, without limitation, RBC Dominion Securities Inc., which is a foreign affiliate of RBC Capital Markets, LLC. This report has been prepared by RBC Capital Markets, LLC whic ...

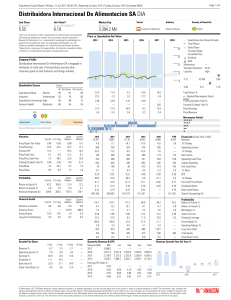

Distribuidora Internacional De Alimentacion SA DIA

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

Herd Behaviour and Cascading in Capital Markets: a Review and

... exploration of the proposition that irrational investor errors cause market misvaluation of assets. This includes some exploration of whether there is contagion in biases across different investor groups, or from analysts to investors; and exploration of whether firms take actions to exploit market ...

... exploration of the proposition that irrational investor errors cause market misvaluation of assets. This includes some exploration of whether there is contagion in biases across different investor groups, or from analysts to investors; and exploration of whether firms take actions to exploit market ...

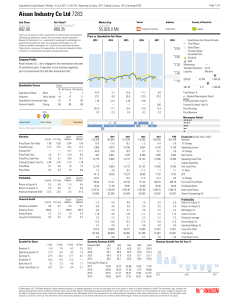

Aisan Industry Co Ltd 7283

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

A Model of Competition Between Multinational Firms

... …rm to export), the multinational …rm either acquires a …rm or stays out of the market. Consequently, the acquisition price increases and deters the multinational …rm from entering the market. Müller (2007) also shows that the multinational …rm is better o¤ by undertaking green…eld investment if th ...

... …rm to export), the multinational …rm either acquires a …rm or stays out of the market. Consequently, the acquisition price increases and deters the multinational …rm from entering the market. Müller (2007) also shows that the multinational …rm is better o¤ by undertaking green…eld investment if th ...

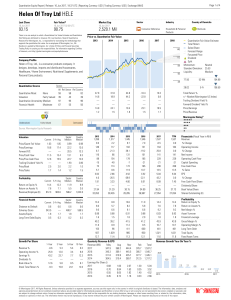

Helen Of Troy Ltd HELE

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

Understanding Short-termism: the Role of Corporate Governance.

... This report to the Glasshouse Forum will outline a theoretical framework for understanding short-termism and its relation to corporate governance. Social scientific approaches to short-termism have been hindered by a number of conceptual, methodological, and empirical barriers. This report will revi ...

... This report to the Glasshouse Forum will outline a theoretical framework for understanding short-termism and its relation to corporate governance. Social scientific approaches to short-termism have been hindered by a number of conceptual, methodological, and empirical barriers. This report will revi ...

III. Types of Listing Agreements

... comparison of prices of properties similar to the seller’s property that recently have been sold. 3. Brokers are allowed by law to partake in preliminary negotiations and the drafting of documents leading to an agreement between the parties. Brokers may draft memoranda, deposit receipts, and in som ...

... comparison of prices of properties similar to the seller’s property that recently have been sold. 3. Brokers are allowed by law to partake in preliminary negotiations and the drafting of documents leading to an agreement between the parties. Brokers may draft memoranda, deposit receipts, and in som ...

PDF - Publications

... that are vital for the financing of investment and firms. One of the key functions of the financial system is notably that of market making. A recent report by the Committee on the Global Financial System (CGFS)2 highlights the impact of certain reforms on banks’ market making activities. The sharp ...

... that are vital for the financing of investment and firms. One of the key functions of the financial system is notably that of market making. A recent report by the Committee on the Global Financial System (CGFS)2 highlights the impact of certain reforms on banks’ market making activities. The sharp ...

The Role of Regulation in Incentivizing Investment in New

... the incumbents’ incentives to invest and does not incentivize additional investment from other market players such as cable operators. A symmetric regime, replacing asymmetric regulation, is all the more pertinent when some firms (such as cable operators) have substantial cost advantages deploying n ...

... the incumbents’ incentives to invest and does not incentivize additional investment from other market players such as cable operators. A symmetric regime, replacing asymmetric regulation, is all the more pertinent when some firms (such as cable operators) have substantial cost advantages deploying n ...

all in the family or public? law and appropriative costs as

... Nations, Adam Smith seemed to have been right about the survival potential of joint stock companies. Since then, however, corporations have taken o¤ as by far the most dominant form of …rm organization. What occurred in mid-nineteenth century United States to change the conditions so favorable for c ...

... Nations, Adam Smith seemed to have been right about the survival potential of joint stock companies. Since then, however, corporations have taken o¤ as by far the most dominant form of …rm organization. What occurred in mid-nineteenth century United States to change the conditions so favorable for c ...

Macroprudential tools, transmission and modelling

... specifically developed to mitigate systemic risk.3 There are additional tools that may be relevant at times such as capital controls and limits on system wide currency mismatches. We also examine specific tools targeted to sectors such as housing. These were often not originally developed with syste ...

... specifically developed to mitigate systemic risk.3 There are additional tools that may be relevant at times such as capital controls and limits on system wide currency mismatches. We also examine specific tools targeted to sectors such as housing. These were often not originally developed with syste ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.