Chapter 15 - Salem State University

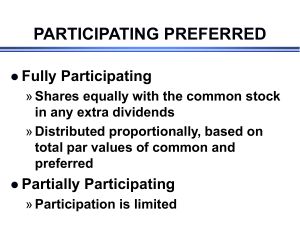

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

info.cba.ksu.edu

... Analysis of Management • Top managers are of high quality and their interests are closely aligned with that of long term shareholders due to the compensation structure and high levels of ...

... Analysis of Management • Top managers are of high quality and their interests are closely aligned with that of long term shareholders due to the compensation structure and high levels of ...

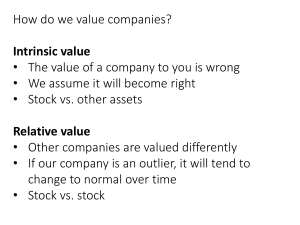

Intro to valuation

... – Net amount that can be realized by selling the assets of a firm and paying off the debt. Replacement Cost – Costs to replace a firm’s assets. ...

... – Net amount that can be realized by selling the assets of a firm and paying off the debt. Replacement Cost – Costs to replace a firm’s assets. ...