Data Mining BS/MS Project

... allow investing companies to thrive • Identifying attributes that correlate with success in the stock market may lead to finding causation – If causes of success can be controlled, the economy can be pushed in a good direction ...

... allow investing companies to thrive • Identifying attributes that correlate with success in the stock market may lead to finding causation – If causes of success can be controlled, the economy can be pushed in a good direction ...

Chapter 2

... • Threat of new entrants and more competition • Industry indicators Copyright © 2009 Pearson Education Canada ...

... • Threat of new entrants and more competition • Industry indicators Copyright © 2009 Pearson Education Canada ...

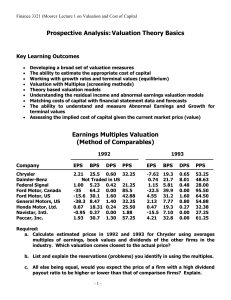

Finance 450

... Estimated future cash flows are discounted back to the present to provide some measure of the absolute value of the company or its stock With constant expected future growth, form of model is simple, though application can still be problematic ...

... Estimated future cash flows are discounted back to the present to provide some measure of the absolute value of the company or its stock With constant expected future growth, form of model is simple, though application can still be problematic ...

C14 S1 Cornell

... The gap between rich and poor __________. The wealthiest ____ saw their income rise _____. The rest of the population saw an increase of only ____. More than 70% of American families earned less than $2500 per year. HOOVER WINS 1928 ELECTION Republican _________________ ran against Democrat ________ ...

... The gap between rich and poor __________. The wealthiest ____ saw their income rise _____. The rest of the population saw an increase of only ____. More than 70% of American families earned less than $2500 per year. HOOVER WINS 1928 ELECTION Republican _________________ ran against Democrat ________ ...

Ride The Seller220512

... foolproof way to predict what will happen, it’s always best to act based on the current environment and take advantage of whatever opportunities are presented. That opportunity right now is for sellers to transact in an environment where there is an abundance of buyer activity and not a lot of compe ...

... foolproof way to predict what will happen, it’s always best to act based on the current environment and take advantage of whatever opportunities are presented. That opportunity right now is for sellers to transact in an environment where there is an abundance of buyer activity and not a lot of compe ...

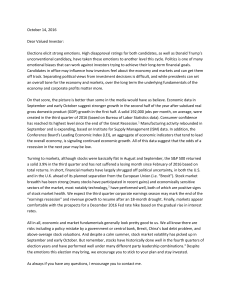

Client_Letter_Market_Watch_Oct_2016

... Elections elicit strong emotions. High disapproval ratings for both candidates, as well as Donald Trump’s unconventional candidacy, have taken these emotions to another level this cycle. Politics is one of many emotional biases that can work against investors trying to achieve their long-term financ ...

... Elections elicit strong emotions. High disapproval ratings for both candidates, as well as Donald Trump’s unconventional candidacy, have taken these emotions to another level this cycle. Politics is one of many emotional biases that can work against investors trying to achieve their long-term financ ...

investment strategy update

... to the top-line pricing pressures of a low inflation, increasingly competitive global- business environment. As for dividends, the current yield of the Standard & Poor’s 500 Stock Market Average is slightly less than 2%. So excluding changes in valuation and ignoring the interim fluctuations, we can ...

... to the top-line pricing pressures of a low inflation, increasingly competitive global- business environment. As for dividends, the current yield of the Standard & Poor’s 500 Stock Market Average is slightly less than 2%. So excluding changes in valuation and ignoring the interim fluctuations, we can ...

The Effect of Interest Rates on Market Valuation

... result of the first elements. For example, compared to historical averages, the S&P 500 is trading at a premium price multiple to next year’s earnings estimates. At the same time, the expected growth rate of earnings for the S&P 500 and/or the economy is quite modest, especially compared with the ra ...

... result of the first elements. For example, compared to historical averages, the S&P 500 is trading at a premium price multiple to next year’s earnings estimates. At the same time, the expected growth rate of earnings for the S&P 500 and/or the economy is quite modest, especially compared with the ra ...

The Discounted Cash Flow (DCF) Model -- Chart School

... flow equals after-tax operating earnings plus non-cash charges, less investments in working capital or other assets.) Fundamental analysts usually value companies as a multiple of their free cash flow, earnings or even revenues. For example: if a company is valued at 10 times free cash flow of 3$ pe ...

... flow equals after-tax operating earnings plus non-cash charges, less investments in working capital or other assets.) Fundamental analysts usually value companies as a multiple of their free cash flow, earnings or even revenues. For example: if a company is valued at 10 times free cash flow of 3$ pe ...

MCCA Performance Metrics

... 40% of AIPC survey respondents feel that currently the government is less inclined to invest in the convention and congress centre industry, especially in terms of facilities and infrastructure. In North America, this figure jumps to 47.1% ...

... 40% of AIPC survey respondents feel that currently the government is less inclined to invest in the convention and congress centre industry, especially in terms of facilities and infrastructure. In North America, this figure jumps to 47.1% ...

- Mark E. Moore

... EV = Market Value of Equity + Value Liabilities – (Cash and Financial Investments) Compute Industry Average EV/FCF or EV/EBITDA and then value your firm ...

... EV = Market Value of Equity + Value Liabilities – (Cash and Financial Investments) Compute Industry Average EV/FCF or EV/EBITDA and then value your firm ...

GM stock plunges as products slip behind

... cars, but its new offerings just aren't selling at the volumes or the prices that GM had hoped for and built its business plan around. ...

... cars, but its new offerings just aren't selling at the volumes or the prices that GM had hoped for and built its business plan around. ...

third quarter 2015 update 10/15/16

... cash we’ve reduced risk and preserved capital. Although we can never time when the market will bottom (or top), we turn to technical indicators, historical prices and valuation metrics for re-entry points. Our strategy has been to dollar-cost average back into the market with limit orders for strong ...

... cash we’ve reduced risk and preserved capital. Although we can never time when the market will bottom (or top), we turn to technical indicators, historical prices and valuation metrics for re-entry points. Our strategy has been to dollar-cost average back into the market with limit orders for strong ...

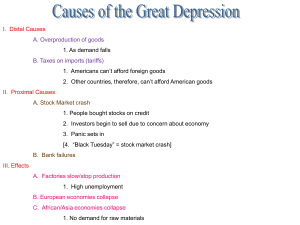

The Causes of the Great Depression

... By 1929 10% of American households owned stocks Buyers engaged in speculation, betting market would climb Buyer then sold stock, making money quickly ...

... By 1929 10% of American households owned stocks Buyers engaged in speculation, betting market would climb Buyer then sold stock, making money quickly ...

American Private Enterprise System College of Agriculture, Food and Environment

... Stock Market “Hub of the Investment World” More than 40 Million individuals own shares in the U.S. corporations (valued at $1 Trillion) Stocks can provide: Dividend- profits a firm distributes to its shareholders Capital gain- investor reaps when a stock is sold for more than the original P ...

... Stock Market “Hub of the Investment World” More than 40 Million individuals own shares in the U.S. corporations (valued at $1 Trillion) Stocks can provide: Dividend- profits a firm distributes to its shareholders Capital gain- investor reaps when a stock is sold for more than the original P ...

Post-War United States of America

... France could not agree on set limits….so each just lessened amount of arms. ...

... France could not agree on set limits….so each just lessened amount of arms. ...

Double Double - Dana Investment Advisors

... recently weighed in on that very topic in a meeting with Christine Lagarde, the managing director of the IMF (International Monetary Fund). Ms. Lagarde asked Janet Yellen, Chairwoman at the Federal Reserve, about the Fed’s policy of low interest rates leading to bubbles in financial markets. Ms. Yel ...

... recently weighed in on that very topic in a meeting with Christine Lagarde, the managing director of the IMF (International Monetary Fund). Ms. Lagarde asked Janet Yellen, Chairwoman at the Federal Reserve, about the Fed’s policy of low interest rates leading to bubbles in financial markets. Ms. Yel ...