The market environment for 2015

... In prior years, companies with increased profitability have been nervous about adding workers or increasing long-term expansion by increasing capital expenditures except when absolutely necessary. Businesses seemed to feel very uncertain about the recovery, and with that they tended to redirect the ...

... In prior years, companies with increased profitability have been nervous about adding workers or increasing long-term expansion by increasing capital expenditures except when absolutely necessary. Businesses seemed to feel very uncertain about the recovery, and with that they tended to redirect the ...

Causes of the Great Depression

... • 5) Credit begins drying up so less people buying companies’ product leading to decrease sales • 6) Professional investors sense danger and begin selling stocks ...

... • 5) Credit begins drying up so less people buying companies’ product leading to decrease sales • 6) Professional investors sense danger and begin selling stocks ...

Financial Markets - North Clackamas School District

... What Kind of Return Do You Want? ◦ Safe investments have lowest return through fixed interest rates ◦ Stocks, bonds—no guaranteed rates; stocks—higher return over time ◦ If investing over long period, can risk losses in stock some years if less time and money, may want safer investment ...

... What Kind of Return Do You Want? ◦ Safe investments have lowest return through fixed interest rates ◦ Stocks, bonds—no guaranteed rates; stocks—higher return over time ◦ If investing over long period, can risk losses in stock some years if less time and money, may want safer investment ...

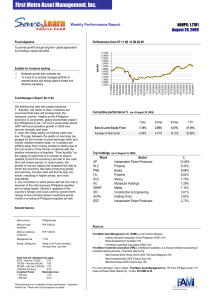

08.20.09-salef - First Metro Asset Management Inc

... Fund Manager’s Report 08.11.09 We believe this rally will sustain because: 1. “liquidity” will return to Asia. Investors are convinced that Asia will emerge from the recession sooner. Inasfar as the Philippine economy is concerned, global economists expect the Philippines to be 1 of only 4 economies ...

... Fund Manager’s Report 08.11.09 We believe this rally will sustain because: 1. “liquidity” will return to Asia. Investors are convinced that Asia will emerge from the recession sooner. Inasfar as the Philippine economy is concerned, global economists expect the Philippines to be 1 of only 4 economies ...

Presentation to the University of California at Santa Barbara Forecasting... Lobero Theatre, Santa Barbara, California

... This January, for example, the outages—which mainly hit customers with interruptible contracts—amounted to about 1 percent of electricity usage for the month. ...

... This January, for example, the outages—which mainly hit customers with interruptible contracts—amounted to about 1 percent of electricity usage for the month. ...

Fidelity Commentary-China Views by Martha Wang_Oct

... recommendation to buy or sell the same. This document is for information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive it. Potential investors should seek advice from a financial adviser before dec ...

... recommendation to buy or sell the same. This document is for information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive it. Potential investors should seek advice from a financial adviser before dec ...

Newsletter April 2015CN1

... disturbing. While the final numbers have not yet been released, it appears the core consumer rate, which excludes food and energy, will rise in March about the same as in February, 1.4%. A big piece of the core inflation rate is consumer housing. This number is basically taken from the cost of apart ...

... disturbing. While the final numbers have not yet been released, it appears the core consumer rate, which excludes food and energy, will rise in March about the same as in February, 1.4%. A big piece of the core inflation rate is consumer housing. This number is basically taken from the cost of apart ...

IMIFC Newsletter What happened in the competition this week?

... mature Instagram business will bring in more than $5 billion in annual revenue, and affirm that Instagram should continue to drive growth in 2016. The continued 5%+ Y/Y MAU (Monthly Average Users) growth in the US and Canada shows that Facebook's popularity domestically is being assisted by Twitter ...

... mature Instagram business will bring in more than $5 billion in annual revenue, and affirm that Instagram should continue to drive growth in 2016. The continued 5%+ Y/Y MAU (Monthly Average Users) growth in the US and Canada shows that Facebook's popularity domestically is being assisted by Twitter ...

Causes of the Depression

... get by using the money for conventional loans. ▪ When stocks dropped, the banks lost money on their investments and the speculators defaulted on their loans. Result 2: Some banks closed due to losses. The govt didn’t insure bank deposits SO customers lost their savings! This caused a crisis of con ...

... get by using the money for conventional loans. ▪ When stocks dropped, the banks lost money on their investments and the speculators defaulted on their loans. Result 2: Some banks closed due to losses. The govt didn’t insure bank deposits SO customers lost their savings! This caused a crisis of con ...

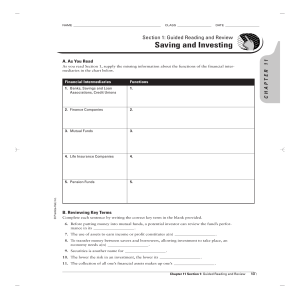

Section 1 - Analy High School Faculty

... As you read Section 1, supply the missing information about the functions of the financial intermediaries in the chart below. ...

... As you read Section 1, supply the missing information about the functions of the financial intermediaries in the chart below. ...

Charting and Technical Analysis

... stocks in the market which have advanced relative to those that have declined. A market advance with less breadth is an indication of a demand shift (down). 2. Support & Resistance Lines: If either is broken, the market is poised for a major move. 3. Moving averages: A moving average line smooths ou ...

... stocks in the market which have advanced relative to those that have declined. A market advance with less breadth is an indication of a demand shift (down). 2. Support & Resistance Lines: If either is broken, the market is poised for a major move. 3. Moving averages: A moving average line smooths ou ...

WWI and Over-Production - Mr. Longacre`s US History Website

... many Americans rushed to invest every penny in the markets. Banks only further fueled this frenzy by dramatically easing their credit restrictions and loaning practices. ...

... many Americans rushed to invest every penny in the markets. Banks only further fueled this frenzy by dramatically easing their credit restrictions and loaning practices. ...

A Closer Look at FOP`s

... • Few entrepreneurs can fund all the expenses of a business, so they must find investors. • Venture Capital is the money loaned by investors to entrepreneurs in expectation of a ...

... • Few entrepreneurs can fund all the expenses of a business, so they must find investors. • Venture Capital is the money loaned by investors to entrepreneurs in expectation of a ...

HIST 1312 Office: UH 209 Phone: 817-272-2338

... C. POPULAR DEMAND FOR BALANCED BUDGETS AT ALL GOV’T LEVELS D. THE REPUBLICAN PARTY’S COMMITMENT TO LAISSEZ-FAIRE II. THE STOCK MARKET CRASH A. THREE ECONOMIC SECTORS THAT BEGAN TO FEEL PAIN BY 1929: 1. Real estate: the Florida real estate boom went bust in 1926. 2. Corporate America: business invent ...

... C. POPULAR DEMAND FOR BALANCED BUDGETS AT ALL GOV’T LEVELS D. THE REPUBLICAN PARTY’S COMMITMENT TO LAISSEZ-FAIRE II. THE STOCK MARKET CRASH A. THREE ECONOMIC SECTORS THAT BEGAN TO FEEL PAIN BY 1929: 1. Real estate: the Florida real estate boom went bust in 1926. 2. Corporate America: business invent ...

HW Assignment 2

... Problem 2.4. An investor buys 10 shares of stock wich pays a continuous dividend with the dividend yield equal to 0.05. Assume continuous and immediate reinvestment of dividend into the same asset. How many shares does the investor own 2 years from the original purchase? ...

... Problem 2.4. An investor buys 10 shares of stock wich pays a continuous dividend with the dividend yield equal to 0.05. Assume continuous and immediate reinvestment of dividend into the same asset. How many shares does the investor own 2 years from the original purchase? ...

New Logo Newsletter 114.pub - Lodestar Investment Counsel

... inflation? With economic growth and spending cuts less effective these days in driving stocks higher, will ‘deconglomeration’ (where large companies sell assets or split into separate entities) become an increasingly popular means of driving shareholder value? ...

... inflation? With economic growth and spending cuts less effective these days in driving stocks higher, will ‘deconglomeration’ (where large companies sell assets or split into separate entities) become an increasingly popular means of driving shareholder value? ...

Investing Options

... Medium risk/Medium return • Stock – Stock is a share of ownership in the assets and earnings of a company – core of America’s economic system ...

... Medium risk/Medium return • Stock – Stock is a share of ownership in the assets and earnings of a company – core of America’s economic system ...