Corporate Finance What - Hong Kong Securities and Investment

... In short, whatever your degree subject, if you want to work in the financial services industry and have the necessary skills and personal attributes, there is likely to be a job for you. ...

... In short, whatever your degree subject, if you want to work in the financial services industry and have the necessary skills and personal attributes, there is likely to be a job for you. ...

Adiós The long awaited correction finally occurred. Prior to the

... we made the decision to exit the space; however, we continue to evaluate the asset class. ...

... we made the decision to exit the space; however, we continue to evaluate the asset class. ...

PERSONAL FINANCE TEST B - Cardinal Spellman High School

... 105 dollars paid exactly one year from now both have the same value to the recipient who assumes 5 percent interest; using time value of money terminology, 100 dollars invested for one year at 5 percent interest has a future value of 105 dollars.[1] This notion dates at least to Martín de Azpilcueta ...

... 105 dollars paid exactly one year from now both have the same value to the recipient who assumes 5 percent interest; using time value of money terminology, 100 dollars invested for one year at 5 percent interest has a future value of 105 dollars.[1] This notion dates at least to Martín de Azpilcueta ...

IMIFC Newsletter What happened in the competition this week?

... revenue growth, progressively increasing margins, strong earnings growth, and a strong return on invested capital. Best of all, the business has done this consistently over the last decade through a variety of economic conditions and with negligible long term debt. ...

... revenue growth, progressively increasing margins, strong earnings growth, and a strong return on invested capital. Best of all, the business has done this consistently over the last decade through a variety of economic conditions and with negligible long term debt. ...

Why Do Stocks Keep Rising?

... annual average rate between Q4-2008 and Q2-2014. How come TV can’t capture that vibrancy in a way that attracts more viewers? The good news is that TV does not drive stock prices, profits do. Rising profits prove that resources are being utilized more efficiently and when resources are used more eff ...

... annual average rate between Q4-2008 and Q2-2014. How come TV can’t capture that vibrancy in a way that attracts more viewers? The good news is that TV does not drive stock prices, profits do. Rising profits prove that resources are being utilized more efficiently and when resources are used more eff ...

Stocks

... Blue-chip – large well known firms Growth – firms with growth above industry average (many times these are new firms) Income – Speculative – Defensive – stocks that tend not to be affected in economic swings Large caps - >$5 billion Small caps - <$1 billion ...

... Blue-chip – large well known firms Growth – firms with growth above industry average (many times these are new firms) Income – Speculative – Defensive – stocks that tend not to be affected in economic swings Large caps - >$5 billion Small caps - <$1 billion ...

File

... ◦ Example: Buyer agrees on the option to buy 100 shares of stock XYZ for $5 in the future. The stock’s value on that particular date turns out to be $10. If the buyer exercises his right to buy at $5, then his stock value is much greater than what he actually paid for it. ...

... ◦ Example: Buyer agrees on the option to buy 100 shares of stock XYZ for $5 in the future. The stock’s value on that particular date turns out to be $10. If the buyer exercises his right to buy at $5, then his stock value is much greater than what he actually paid for it. ...

CFA Outlook 4Q15

... goods. Ironically, the Federal Reserve has been trying for quite some time to trick the economy into growing faster than it probably can with its easy money policies of ZIRP (zero interest rate policies) and QE (quantitative easing). Theoretically, this is accomplished by lowering the risk-free rate ...

... goods. Ironically, the Federal Reserve has been trying for quite some time to trick the economy into growing faster than it probably can with its easy money policies of ZIRP (zero interest rate policies) and QE (quantitative easing). Theoretically, this is accomplished by lowering the risk-free rate ...

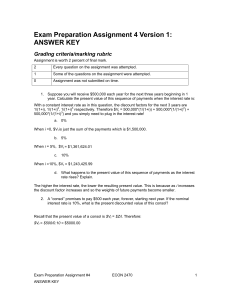

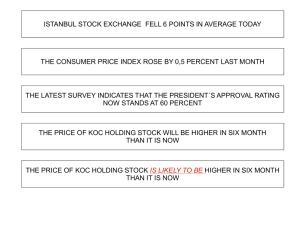

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... partially unexpected. Explain what effect this will have on stock prices. This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the present value of future dividends. The reduction in output will cause a reduction in expecte ...

... partially unexpected. Explain what effect this will have on stock prices. This contractionary monetary policy will cause the interest rate to rise and output to fall. The higher interest rate will reduce the present value of future dividends. The reduction in output will cause a reduction in expecte ...

The Destruction of King Cotton For many Georgians, the twenties

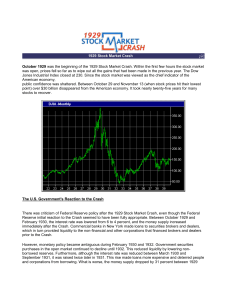

... inaugurated, the Federal Reserve Board began meeting daily. In March, a series of “minicrashes” had occurred in the stock market, the place where shares of ownership in corporations (stock) are bought and sold. Each time, the economy recovered. Summer seemed to bring back the good times—until the da ...

... inaugurated, the Federal Reserve Board began meeting daily. In March, a series of “minicrashes” had occurred in the stock market, the place where shares of ownership in corporations (stock) are bought and sold. Each time, the economy recovered. Summer seemed to bring back the good times—until the da ...

Causes of the Great Depression in Canada: Underlying or Immediate

... not need the world’s raw materials nearly as much as other great powers, it became protectionist. This meant that the government protected home industries from the competition of foreign goods, by discouraging imports through tariffs. American protectionism caused other countries to lose their expor ...

... not need the world’s raw materials nearly as much as other great powers, it became protectionist. This meant that the government protected home industries from the competition of foreign goods, by discouraging imports through tariffs. American protectionism caused other countries to lose their expor ...

VALUATION

... market value of the firm exceeds the value of its existing capital when investors’ perceive its expected earnings as high or increasing firm can be worth less than its existing capital when its prospects are considered uncertain or low investment in new real capital is profitable if q exceeds one ...

... market value of the firm exceeds the value of its existing capital when investors’ perceive its expected earnings as high or increasing firm can be worth less than its existing capital when its prospects are considered uncertain or low investment in new real capital is profitable if q exceeds one ...

Stock Analysis: Feb. 15, 2001 Joel Bauman

... networks (fixed, mobile, and IP) • Keen sense of consumer and business trends • Possibly undervalued company due to investor anxiety over recent growth ...

... networks (fixed, mobile, and IP) • Keen sense of consumer and business trends • Possibly undervalued company due to investor anxiety over recent growth ...

27 part ii item 5. market for the registrant`s common equity, related

... repurchased under the program will be determined by the Company’s management based on its evaluation of market conditions and other factors. The Repurchase Program may be suspended or discontinued at any time. Any repurchased shares will be available for use in connection with the Company’s equity c ...

... repurchased under the program will be determined by the Company’s management based on its evaluation of market conditions and other factors. The Repurchase Program may be suspended or discontinued at any time. Any repurchased shares will be available for use in connection with the Company’s equity c ...

Transfer pricing of intangibles

... Income Based Example: Price Premium Theory: an intangible can warrant a price premium over and above a generic product In practice: how much more you can charge for a bike with a Batman logo on it compared to the same bike without the logo premium ...

... Income Based Example: Price Premium Theory: an intangible can warrant a price premium over and above a generic product In practice: how much more you can charge for a bike with a Batman logo on it compared to the same bike without the logo premium ...

UIF Performance 2015 Q4 Alesco Market Review

... expanding quantitative easing programs. Growth in the U.S. was also higher than most other developed countries, and the combination of higher growth and increasing interest rates resulted in a 9% gain for the U.S. dollar in 2015, negatively impacting foreign sales for American companies. Despite the ...

... expanding quantitative easing programs. Growth in the U.S. was also higher than most other developed countries, and the combination of higher growth and increasing interest rates resulted in a 9% gain for the U.S. dollar in 2015, negatively impacting foreign sales for American companies. Despite the ...

The State of the Nigerian Economy

... recording the 9th consecutive month of rise in prices Increases were recorded in most of the key divisions that make up the CPI Major increase recorded in the food and core sub-indices High energy prices and imported inflation The rise highlights the macroeconomic uncertainty and high cost o ...

... recording the 9th consecutive month of rise in prices Increases were recorded in most of the key divisions that make up the CPI Major increase recorded in the food and core sub-indices High energy prices and imported inflation The rise highlights the macroeconomic uncertainty and high cost o ...

commentary_economic_..

... one factor which confounded market timing efforts—because in early July we anticipated that the market was going to take it on the chin during the 3rd quarter. As some investment pundits noted, the analysts who follow these companies have never gotten their predictions so wrong. Those profits have c ...

... one factor which confounded market timing efforts—because in early July we anticipated that the market was going to take it on the chin during the 3rd quarter. As some investment pundits noted, the analysts who follow these companies have never gotten their predictions so wrong. Those profits have c ...

WWI and Over-Production - Mr. Longacre`s US History Website

... many Americans rushed to invest every penny in the markets. Banks only further fueled this frenzy by dramatically easing their credit restrictions and loaning practices. ...

... many Americans rushed to invest every penny in the markets. Banks only further fueled this frenzy by dramatically easing their credit restrictions and loaning practices. ...

The Stock Market

... buyers and sellers of stock. Advises them to buy or sell particular stocks. Brokerage Firm-businesses that specialize in trading stocks. Stockbrokers and brokerage firms cover their costs and earn a profit by charging a commission, or fee for each transaction. ...

... buyers and sellers of stock. Advises them to buy or sell particular stocks. Brokerage Firm-businesses that specialize in trading stocks. Stockbrokers and brokerage firms cover their costs and earn a profit by charging a commission, or fee for each transaction. ...