FTSE playing footsie with its 1999 record

... This time around there are many factors working in our favour; On valuation grounds the index looks more attractive; Research by Hargreaves Lansdown shows that back in 1999 the index was trading at x27 times earnings, today it is much lower 16x; in 1999 interest rates were at 5.50%, today they are a ...

... This time around there are many factors working in our favour; On valuation grounds the index looks more attractive; Research by Hargreaves Lansdown shows that back in 1999 the index was trading at x27 times earnings, today it is much lower 16x; in 1999 interest rates were at 5.50%, today they are a ...

MainStay Epoch Global Equity Yield SMA

... methods can be applied to the calculation of performance data. Past performance is not indicative of future results. An account could incur losses as well as gains. Epoch's Global Equity Shareholder Yield Composite is a diversified portfolio of global equity securities with a history of attractive d ...

... methods can be applied to the calculation of performance data. Past performance is not indicative of future results. An account could incur losses as well as gains. Epoch's Global Equity Shareholder Yield Composite is a diversified portfolio of global equity securities with a history of attractive d ...

Chapter 13 The Cost of Capital

... may suggest that a linear relationship can be assumed to exist between them. A series of comparative figures could be prepared (month by month) of the return from a company’s shares and the average return of the market as a whole. The results could be drawn on a scatter graph and a “line of best fit ...

... may suggest that a linear relationship can be assumed to exist between them. A series of comparative figures could be prepared (month by month) of the return from a company’s shares and the average return of the market as a whole. The results could be drawn on a scatter graph and a “line of best fit ...

productivity improvements, investment and the rate of

... Unfortunately, the real exchange rate of an economy responds to many different forces so one cannot say for sure that one particular causal chain will dominate at any given moment. For example, all observers of the Russian economy have noted that for a number of years there has been a steady outflow ...

... Unfortunately, the real exchange rate of an economy responds to many different forces so one cannot say for sure that one particular causal chain will dominate at any given moment. For example, all observers of the Russian economy have noted that for a number of years there has been a steady outflow ...

The Relationship between Firm Sizes and Stock Returns of Service

... 1997). While several assumption and modification were made, Banz (1981) indicated that the negative relationship has been reinforced throughout the time by practically observing 50-year performance of the New York Stock Exchange. However, Keim (1983) proved that the size effect only appears in Janua ...

... 1997). While several assumption and modification were made, Banz (1981) indicated that the negative relationship has been reinforced throughout the time by practically observing 50-year performance of the New York Stock Exchange. However, Keim (1983) proved that the size effect only appears in Janua ...

LO 3 Explain the accounting for stock investments.

... a. reported under Other Expenses and Losses in the income statement. b. closed-out at the end of the accounting period. c. reported as a separate component of stockholders' equity. d. deducted from the cost of the investment. ...

... a. reported under Other Expenses and Losses in the income statement. b. closed-out at the end of the accounting period. c. reported as a separate component of stockholders' equity. d. deducted from the cost of the investment. ...

forecasting financial statements: proforma analysis

... Industry: In a generic sense, the two main variables in sales revenue are unit price and volume. These two variables usually have a reciprocal relationship (i.e., a typical demand curve). Therefore, a statement that, "unit demand will increase by 20 percent over the next five years" need not mean th ...

... Industry: In a generic sense, the two main variables in sales revenue are unit price and volume. These two variables usually have a reciprocal relationship (i.e., a typical demand curve). Therefore, a statement that, "unit demand will increase by 20 percent over the next five years" need not mean th ...

IPKW - PowerShares International BuyBack Achievers Portfolio fact

... A higher Sharpe Ratio indicates better risk-adjusted performance. Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. Alpha is a measure of performance on a risk-adjusted basis. Weighted Harmonic Average Stock Price-to-Earnings Ratio ...

... A higher Sharpe Ratio indicates better risk-adjusted performance. Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. Alpha is a measure of performance on a risk-adjusted basis. Weighted Harmonic Average Stock Price-to-Earnings Ratio ...

Experience - Berkshire Asset Management, LLC

... For illustrative purposes only. Holdings, sector weightings, market capitalization and portfolio characteristics are based on representative portfolio and are subject to change at any time. Holdings, sector weightings, market capitalization and portfolio characteristics of individual client portfoli ...

... For illustrative purposes only. Holdings, sector weightings, market capitalization and portfolio characteristics are based on representative portfolio and are subject to change at any time. Holdings, sector weightings, market capitalization and portfolio characteristics of individual client portfoli ...

FYE March 2017 Financial Highlights

... ■Other/Corporate: Recorded ¥3.1 billion in expenses related to retirement benefit accounting actuarial losses (¥4.0 billion negative impact in prior year). *Posted retirement benefit actuarial loss of ¥3.1 billion at end of prior period, after revising the discount rate to reflect low market intere ...

... ■Other/Corporate: Recorded ¥3.1 billion in expenses related to retirement benefit accounting actuarial losses (¥4.0 billion negative impact in prior year). *Posted retirement benefit actuarial loss of ¥3.1 billion at end of prior period, after revising the discount rate to reflect low market intere ...

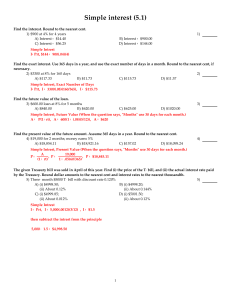

Simple interest (5.1)

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

Chap025 - U of L Class Index

... • To a firm, a warrant is substantially different from a call option. - A call option sold on the firm’s stock is a private transaction between investors, in which the firm is not directly involved. - When a call option is exercised, existing stock merely changes hands, but when a warrant is exercis ...

... • To a firm, a warrant is substantially different from a call option. - A call option sold on the firm’s stock is a private transaction between investors, in which the firm is not directly involved. - When a call option is exercised, existing stock merely changes hands, but when a warrant is exercis ...

Earnings management is a manager`s choice of accounting policies

... specific objective. Even under GAAP, managers still retain some flexibility in accounting policy selection that may be able to positively impact their personal satisfaction and/or the market value of their firm. Accounting policy choice can be divided into two categories: accounting policies per se ...

... specific objective. Even under GAAP, managers still retain some flexibility in accounting policy selection that may be able to positively impact their personal satisfaction and/or the market value of their firm. Accounting policy choice can be divided into two categories: accounting policies per se ...

ppt - Thomas Piketty

... • Will the rise of capital income-ratio β also lead to a rise of the capital share α in national income? • If the capital stock equals β=6 years of income and the average return to capital is equal r=5% per year, then the share of capital income (rent, dividends, interest, profits, etc.) in nation ...

... • Will the rise of capital income-ratio β also lead to a rise of the capital share α in national income? • If the capital stock equals β=6 years of income and the average return to capital is equal r=5% per year, then the share of capital income (rent, dividends, interest, profits, etc.) in nation ...

An Assessment of APT`s Performance on Portfolios

... found any association of the given factor in their model. Similarly, the exchange rate was negatively priced for one portfolio and when lag effect of 1 month was incorporated, a positive relationship was obtained for one industry. A similar scenario was reproduced for the risk premium and unexpected ...

... found any association of the given factor in their model. Similarly, the exchange rate was negatively priced for one portfolio and when lag effect of 1 month was incorporated, a positive relationship was obtained for one industry. A similar scenario was reproduced for the risk premium and unexpected ...

A Tour of The World

... What Triggered the Slump? The trigger for the slump of the 1990s can be found in the striking movements in Japanese stock prices from the mid-1980s to the early 1990s. In general, stock prices move for one of two reasons: The fundamentals. Anticipation of higher expected profits lead investors to ...

... What Triggered the Slump? The trigger for the slump of the 1990s can be found in the striking movements in Japanese stock prices from the mid-1980s to the early 1990s. In general, stock prices move for one of two reasons: The fundamentals. Anticipation of higher expected profits lead investors to ...

Chapter 1

... What Triggered the Slump? The trigger for the slump of the 1990s can be found in the striking movements in Japanese stock prices from the mid-1980s to the early 1990s. In general, stock prices move for one of two reasons: The fundamentals. Anticipation of higher expected profits lead investors to ...

... What Triggered the Slump? The trigger for the slump of the 1990s can be found in the striking movements in Japanese stock prices from the mid-1980s to the early 1990s. In general, stock prices move for one of two reasons: The fundamentals. Anticipation of higher expected profits lead investors to ...

Downlaod File

... The current ratio performance was better than quick ratio, Toyota did well comparing it with GM. The best performance was in 2010 with 1.0903 for Toyota, however GM did well in 2011 than in 2010. 2. Activity Ratio: Activity ratios determine the ability of a firm or company to turn it’s accounts to r ...

... The current ratio performance was better than quick ratio, Toyota did well comparing it with GM. The best performance was in 2010 with 1.0903 for Toyota, however GM did well in 2011 than in 2010. 2. Activity Ratio: Activity ratios determine the ability of a firm or company to turn it’s accounts to r ...

Pure Leverage Increases: An Empirical Investigation

... • This focus is justified because investors make decisions based on what financial ratios indicate. • All parties concerned with financial ratio analysis need to understand how accountingbase ratios can be used to assess relevant revenue and costs factors. • A key tool used in this paper’s financial ...

... • This focus is justified because investors make decisions based on what financial ratios indicate. • All parties concerned with financial ratio analysis need to understand how accountingbase ratios can be used to assess relevant revenue and costs factors. • A key tool used in this paper’s financial ...

Morgan Stanley - Investment Management

... previous bull market and assume that they would re-emerge as winners in the next bull run. Markets in their own characteristic fashion offer early signals that reinforce this flawed belief. Stocks that have been the biggest beneficiaries of the previous bull run, appear to be regaining their leaders ...

... previous bull market and assume that they would re-emerge as winners in the next bull run. Markets in their own characteristic fashion offer early signals that reinforce this flawed belief. Stocks that have been the biggest beneficiaries of the previous bull run, appear to be regaining their leaders ...