The U.S. current account deficit has been growing

... significant effect on the value of U.S. assets abroad and, therefore, have played a larger role in shaping the evolution of the NIIP. What is the NIIP, and what are its determinants? The U. S. NIIP reflects the U.S. international balance sheet. On one side of the ledger is the value of the accumulat ...

... significant effect on the value of U.S. assets abroad and, therefore, have played a larger role in shaping the evolution of the NIIP. What is the NIIP, and what are its determinants? The U. S. NIIP reflects the U.S. international balance sheet. On one side of the ledger is the value of the accumulat ...

1740-06 Varsity Rules - JSE Investment Challenge

... The difference is that in a healthy, growing company the dividend should increase by at least the inflation rate and, hopefully, faster. This means that if you hold on to a share for any length of time, within a few years the dividend return on the price you paid for the share should increase beyond ...

... The difference is that in a healthy, growing company the dividend should increase by at least the inflation rate and, hopefully, faster. This means that if you hold on to a share for any length of time, within a few years the dividend return on the price you paid for the share should increase beyond ...

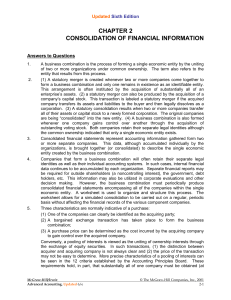

Answers to Questions

... owners earned any previous profits. h. The subsidiary’s Common Stock and Additional Paid-in Capital accounts have no impact on the consolidated totals. i. The subsidiary’s asset and liability accounts will be consolidated at their fair market values with any excess payment being attributed to goodwi ...

... owners earned any previous profits. h. The subsidiary’s Common Stock and Additional Paid-in Capital accounts have no impact on the consolidated totals. i. The subsidiary’s asset and liability accounts will be consolidated at their fair market values with any excess payment being attributed to goodwi ...

nikko am australian share concentrated fund

... • Overweight Insurance Australia Group. IAG outperformed after upgrading margin guidance. IAG announced that there would be materially larger than expected positive reserve releases into profit after better than expected claims experience. • Overweight IOOF. IOOF outperformed on the back of market d ...

... • Overweight Insurance Australia Group. IAG outperformed after upgrading margin guidance. IAG announced that there would be materially larger than expected positive reserve releases into profit after better than expected claims experience. • Overweight IOOF. IOOF outperformed on the back of market d ...

document

... Weekly Overview, but with a change in focus. The Weekly Overview was a catch-all document with special emphasis on the housing market, comments on most NZ data releases in the preceding week, and discussion on ups and downs in interest rate and exchange rate markets though with decreasing emphasis o ...

... Weekly Overview, but with a change in focus. The Weekly Overview was a catch-all document with special emphasis on the housing market, comments on most NZ data releases in the preceding week, and discussion on ups and downs in interest rate and exchange rate markets though with decreasing emphasis o ...

Financial Markets and International Risk Sharing Martin Schmitz

... payments which represents a “benign loss” for the domestic economy. This decreases domestic income and wealth commensurately, thus providing a smoothing or “hedging” of the economic performance across the different states of the world.5 Obviously, this smoothing mechanism also works when the econom ...

... payments which represents a “benign loss” for the domestic economy. This decreases domestic income and wealth commensurately, thus providing a smoothing or “hedging” of the economic performance across the different states of the world.5 Obviously, this smoothing mechanism also works when the econom ...

fair value hedges

... B. They are extensively used to hedge against various risks, particularly interest rate risk. C. Hedging means taking a risk position that is opposite to an actual position that is exposed to risk. (TA-2) 1. Interest rate futures are derivative contracts often bought and sold to hedge against risk. ...

... B. They are extensively used to hedge against various risks, particularly interest rate risk. C. Hedging means taking a risk position that is opposite to an actual position that is exposed to risk. (TA-2) 1. Interest rate futures are derivative contracts often bought and sold to hedge against risk. ...

passing the baton - RiverFront Investment Group

... RiverFront sees a positive environment for US equities in 2017, with tax reform, deregulation, and fiscal stimuli supporting corporate earnings. The only problem is that this good news is currently largely priced into US equity markets, in our view. RiverFront’s Price Matters® valuation framework su ...

... RiverFront sees a positive environment for US equities in 2017, with tax reform, deregulation, and fiscal stimuli supporting corporate earnings. The only problem is that this good news is currently largely priced into US equity markets, in our view. RiverFront’s Price Matters® valuation framework su ...

Exercise 1

... J) The Star signed an agreement with the Moon Company to receive transport services. According to the agreement, The Star must pay in advance of an annual fee (2.400 k€). Cost related to 2011 are ...

... J) The Star signed an agreement with the Moon Company to receive transport services. According to the agreement, The Star must pay in advance of an annual fee (2.400 k€). Cost related to 2011 are ...

I Human Environment Relationship

... • the benefits of res/env preservation happens in the future: e.g. preserving a piece of wetland helps biodiversity that may yield benefits way in the future • the benefit of destroying these resources provides more immediate gains • a low discount rate helps preservation (iv) Now another argument: ...

... • the benefits of res/env preservation happens in the future: e.g. preserving a piece of wetland helps biodiversity that may yield benefits way in the future • the benefit of destroying these resources provides more immediate gains • a low discount rate helps preservation (iv) Now another argument: ...

assets - Wiley

... Common stock Retained earnings Equipment Insurance expense Supplies Supplies expense Cash Dividends ...

... Common stock Retained earnings Equipment Insurance expense Supplies Supplies expense Cash Dividends ...

Financial Markets and the Financing Choice of Firms

... very dissimilar. So in order to avoid differences across firms, we have aggregated the data for all firms in a given country for a particular year. Since the database also provided information both on short-term debt/equity and long-term debt/equity ratios we introduce these variables separately ins ...

... very dissimilar. So in order to avoid differences across firms, we have aggregated the data for all firms in a given country for a particular year. Since the database also provided information both on short-term debt/equity and long-term debt/equity ratios we introduce these variables separately ins ...

Kahan - NYU School of Law

... corporation’s assets. What could the company get if it were to sell all of its assets? Often used when successor is likely to sell assets in the near future. c. Earnings Value - construction of the firm’s investment or earnings value. Ct hears experts on both sides project the future earnings of the ...

... corporation’s assets. What could the company get if it were to sell all of its assets? Often used when successor is likely to sell assets in the near future. c. Earnings Value - construction of the firm’s investment or earnings value. Ct hears experts on both sides project the future earnings of the ...

PPT - Canadian Evaluation Society

... Innovation firms highly levered Innovation firms seeking equity financing Export firms profitable/weak cash flow Firms with >50% Export Sales highest employment generators ...

... Innovation firms highly levered Innovation firms seeking equity financing Export firms profitable/weak cash flow Firms with >50% Export Sales highest employment generators ...

Way2Wealth Updates Subros Ltd. 09 February 2017

... Muted capex plans for the next 2 years –Subros has planned a capital expenditure of `400-450mn 450mn each year for the next 2 years which is significantly less than the capex Subros has incurred in the past years. This is likely to lead to better return and profitability ratios going forward. ...

... Muted capex plans for the next 2 years –Subros has planned a capital expenditure of `400-450mn 450mn each year for the next 2 years which is significantly less than the capex Subros has incurred in the past years. This is likely to lead to better return and profitability ratios going forward. ...

Filed pursuant to Rule 424(b)(3) Registration File No. 333

... with any person relative to distribution of these securities. We have agreed with the selling shareholders to register the Common Stock and Underlying Common Stock. We also agreed with the selling shareholders to use our best efforts to keep the registration statement effective until the earlier of ...

... with any person relative to distribution of these securities. We have agreed with the selling shareholders to register the Common Stock and Underlying Common Stock. We also agreed with the selling shareholders to use our best efforts to keep the registration statement effective until the earlier of ...

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 1

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...