Chapter 4: International Financial Integration and Economic Growth

... of capital flows. In this regard, we use FDI inflows (as a share of GDP), FDI inflows and outflows (as a share of GDP), portfolio investment (equities and debts) inflows (as a share of GDP), gross portfolio investment inflows and outflows (as a share of GDP), gross private capital flows3 (as a share ...

... of capital flows. In this regard, we use FDI inflows (as a share of GDP), FDI inflows and outflows (as a share of GDP), portfolio investment (equities and debts) inflows (as a share of GDP), gross portfolio investment inflows and outflows (as a share of GDP), gross private capital flows3 (as a share ...

7. Equivalent Martingale Measures So far we have considered

... So far we have considered derivative asset pricing exploiting PDEs implied by arbitragefree portfolios. Another approach is to change the probability measure to another probability measure implied by arbitrage-free markets such that under that the (risk-free return discounted) prices become martinga ...

... So far we have considered derivative asset pricing exploiting PDEs implied by arbitragefree portfolios. Another approach is to change the probability measure to another probability measure implied by arbitrage-free markets such that under that the (risk-free return discounted) prices become martinga ...

Learning from stock prices and economic growth

... of information induces them to learn more. If the scale effect of information dominates the substitution effect, then investors produce more private information as their income grows, and, as a result, they allocate their labor income more efficiently across the various firms. This enhances the margina ...

... of information induces them to learn more. If the scale effect of information dominates the substitution effect, then investors produce more private information as their income grows, and, as a result, they allocate their labor income more efficiently across the various firms. This enhances the margina ...

Pindyck/Rubinfeld Microeconomics

... If a 1-percent rise in the market tends to result in a 2-percent rise in the asset price, the beta is 2. The Risk-Adjusted Discount Rate Given beta, we can determine the correct discount rate to use in computing an asset’s net present value. That discount rate is the expected return on the asset or ...

... If a 1-percent rise in the market tends to result in a 2-percent rise in the asset price, the beta is 2. The Risk-Adjusted Discount Rate Given beta, we can determine the correct discount rate to use in computing an asset’s net present value. That discount rate is the expected return on the asset or ...

Document

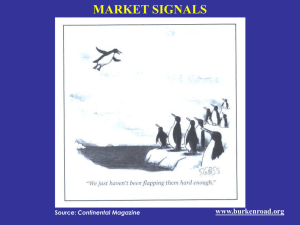

... Extraordinary Popular Delusions & the Madness of Crowds, Charles www.burkenroad.org ...

... Extraordinary Popular Delusions & the Madness of Crowds, Charles www.burkenroad.org ...

Investor Relations Communications Plan

... are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the portfolio above the weighted average of the S&P 500 for price-to-earnings ratio, dividend yield, ...

... are classified by the source of the data, the Carson Group. The Carson Group employs quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the portfolio above the weighted average of the S&P 500 for price-to-earnings ratio, dividend yield, ...

Capital Budgeting in Projects

... • What future money is worth today is called its Present Value, and what it will be worth when it finally arrives in the future is called, not surprisingly its Future Value. • Just how much present value should be discounted from future value is determined by two things: • the amount of time between ...

... • What future money is worth today is called its Present Value, and what it will be worth when it finally arrives in the future is called, not surprisingly its Future Value. • Just how much present value should be discounted from future value is determined by two things: • the amount of time between ...

Insights and Research | Russell Investments

... Cycle Index supports that view. And more fundamentally, we do not observe the types of economic imbalances today that would typically drive a recession. The labor market is nearly back to normal, but it isn’t overheating; business investment remains below trend (and well below the worrying levels of ...

... Cycle Index supports that view. And more fundamentally, we do not observe the types of economic imbalances today that would typically drive a recession. The labor market is nearly back to normal, but it isn’t overheating; business investment remains below trend (and well below the worrying levels of ...

Year of the Monkey

... reinvigorating domestic-based industrial companies by making the tax treatment of capital expenditures friendlier, as well as changing the tax code so as to only tax income earned in the United States. The view is that this specific change would not only help stem the increasing trend toward re-domi ...

... reinvigorating domestic-based industrial companies by making the tax treatment of capital expenditures friendlier, as well as changing the tax code so as to only tax income earned in the United States. The view is that this specific change would not only help stem the increasing trend toward re-domi ...

EXAM FM FINANCIAL MATHEMATICS

... Strategy I is to buy the 1,050-strike call and to sell the 950-strike call. Strategy II is to buy the 1,050-strike put and to sell the 950-strike put. Strategy III is to buy the 950-strike call, sell the 1,000-strike call, sell the 950-strike put, and buy the 1,000-strike put. Assume that the price ...

... Strategy I is to buy the 1,050-strike call and to sell the 950-strike call. Strategy II is to buy the 1,050-strike put and to sell the 950-strike put. Strategy III is to buy the 950-strike call, sell the 1,000-strike call, sell the 950-strike put, and buy the 1,000-strike put. Assume that the price ...

Forecasting Financial Statements May05

... customers with weak financial positions. When the analyst suspects a policy change might occur or wants to see (on paper) the consequences of a recommended change, then the historical data can, at best, only serve as a starting place to make new estimates. A management decision to start purchasing i ...

... customers with weak financial positions. When the analyst suspects a policy change might occur or wants to see (on paper) the consequences of a recommended change, then the historical data can, at best, only serve as a starting place to make new estimates. A management decision to start purchasing i ...

Goodbody Global Leaders Fund

... This publication has been approved by Goodbody Stockbrokers. The information has been taken from sources we believe to be reliable, we do not guarantee their accuracy or completeness and any such information may be incomplete or condensed. All opinions and estimates constitute best judgement at the ...

... This publication has been approved by Goodbody Stockbrokers. The information has been taken from sources we believe to be reliable, we do not guarantee their accuracy or completeness and any such information may be incomplete or condensed. All opinions and estimates constitute best judgement at the ...

1 ITEM 8 UNDERSTANDING FINANCIAL STATEMENTS It is

... date. The balance sheet is divided into two parts, which are usually shown side by side. The totals of the items in the two parts are always in balance. In our examples, first are shown the ASSETS - all of the things owned by the company. Then are shown the LIABILITIES and NET WORTH. Under LIABILITI ...

... date. The balance sheet is divided into two parts, which are usually shown side by side. The totals of the items in the two parts are always in balance. In our examples, first are shown the ASSETS - all of the things owned by the company. Then are shown the LIABILITIES and NET WORTH. Under LIABILITI ...

QUESTIONS AND PROBLEMS

... standard deviation of that cash receipt? How often does the venture fail to generate sales in year 1? how often does it run out of cash by year 6 b. Using the same model and assumptions, what are the expected sales and standard deviations of year 6 sales and profit? What would expected sales have b ...

... standard deviation of that cash receipt? How often does the venture fail to generate sales in year 1? how often does it run out of cash by year 6 b. Using the same model and assumptions, what are the expected sales and standard deviations of year 6 sales and profit? What would expected sales have b ...

2-4 Financial Analysis-

... Calculate return on assets, given the following information: Total debt = $35,000 Net income = $10,000 Equity = $15,000 Revenue = $55,000 ...

... Calculate return on assets, given the following information: Total debt = $35,000 Net income = $10,000 Equity = $15,000 Revenue = $55,000 ...

Dynamic Efficiency & Hotelling`s Rule

... The profit created by resource scarcity in competitive markets is called Hotelling rent (also known as resource rent or by the Ricardian term scarcity rent). Hotelling rent is economic profit that can be earned and can persist in certain natural resource cases due to the fixed supply of the resource ...

... The profit created by resource scarcity in competitive markets is called Hotelling rent (also known as resource rent or by the Ricardian term scarcity rent). Hotelling rent is economic profit that can be earned and can persist in certain natural resource cases due to the fixed supply of the resource ...

Evidence Against Market Efficiency

... ─ If stock is predicted to rise, people will buy to equilibrium level; if stock is predicted to fall, people will sell to equilibrium level (both in concert with EMH) ─ Thus, if stock prices were predictable, thereby causing the above behavior, price changes would be near zero, which has not been th ...

... ─ If stock is predicted to rise, people will buy to equilibrium level; if stock is predicted to fall, people will sell to equilibrium level (both in concert with EMH) ─ Thus, if stock prices were predictable, thereby causing the above behavior, price changes would be near zero, which has not been th ...