Top CEOs Make 300 Times More than Typical Workers

... as measured by the Dow Jones Industrial Average and S&P 500 index, and shown in Table 1, fell by roughly half between 1965 and 1978, CEO pay increased by 78.7 percent. Average worker pay saw relatively strong growth over that period (relative to subsequent periods, not relative to CEO pay or pay for ...

... as measured by the Dow Jones Industrial Average and S&P 500 index, and shown in Table 1, fell by roughly half between 1965 and 1978, CEO pay increased by 78.7 percent. Average worker pay saw relatively strong growth over that period (relative to subsequent periods, not relative to CEO pay or pay for ...

Liquidity and Market Crashes

... gains from trading are relatively small. As a result, all traders will stay out of the market and there is no need for liquidity. Only when the idiosyncratic shocks are sufficiently large, gains from trading exceed the participation cost and some potential traders start to enter the market. They en ...

... gains from trading are relatively small. As a result, all traders will stay out of the market and there is no need for liquidity. Only when the idiosyncratic shocks are sufficiently large, gains from trading exceed the participation cost and some potential traders start to enter the market. They en ...

The Business Context of Information Systems (D2) IMIS DIPLOMA QUALIFICATIONS

... A group of friends plan to start a new business and agree that this business should be in the form of a Partnership. Identify THREE disadvantages or risks that may occur in relation to this form of business structure. (5 marks) Answer A1 The individual partners may have unlimited liability for busin ...

... A group of friends plan to start a new business and agree that this business should be in the form of a Partnership. Identify THREE disadvantages or risks that may occur in relation to this form of business structure. (5 marks) Answer A1 The individual partners may have unlimited liability for busin ...

Managing Investment Risk (M)

... nonsystematic risk. For example, by thoroughly researching potential investments before committing your money, you may be able to avoid companies whose disappointing sales and earnings records suggest they aren’t poised for long‐term success. Research will also help you uncover companies with hig ...

... nonsystematic risk. For example, by thoroughly researching potential investments before committing your money, you may be able to avoid companies whose disappointing sales and earnings records suggest they aren’t poised for long‐term success. Research will also help you uncover companies with hig ...

Sun Pharmaceuticals (SUNPHA)

... share has substantially improved to 8.9% from 5.5% with a leadership in as many as 11 therapies. The management expects ~US$300 million synergy benefits by FY18. We expect US sales to grow at a CAGR of 6.7% to | 15381.7 crore in FY16P-18E. Similarly, Indian formulations business is likely to grow at ...

... share has substantially improved to 8.9% from 5.5% with a leadership in as many as 11 therapies. The management expects ~US$300 million synergy benefits by FY18. We expect US sales to grow at a CAGR of 6.7% to | 15381.7 crore in FY16P-18E. Similarly, Indian formulations business is likely to grow at ...

DOC - Valhi, Inc.

... interim periods ended June 30, 1999 and 2000, have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows have b ...

... interim periods ended June 30, 1999 and 2000, have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows have b ...

FY 2016 Results - Direct Line Group

... current expectations of the Directors concerning, among other things: the Group’s results of operations, financial condition, prospects, growth, strategies and the industry in which the Group operates. Examples of forward-looking statements include financial targets which are contained in this docum ...

... current expectations of the Directors concerning, among other things: the Group’s results of operations, financial condition, prospects, growth, strategies and the industry in which the Group operates. Examples of forward-looking statements include financial targets which are contained in this docum ...

Will “Velocity” Change the Conversation?

... before they leak into lending channels. The prominent fear of recent years that the Fed was simply pushing on a string would swiftly be replaced by angst over how the Fed overstayed its unprecedented and massive easing campaign. Rising apprehension that the multiplier (money velocity) on quantitativ ...

... before they leak into lending channels. The prominent fear of recent years that the Fed was simply pushing on a string would swiftly be replaced by angst over how the Fed overstayed its unprecedented and massive easing campaign. Rising apprehension that the multiplier (money velocity) on quantitativ ...

Macroeconomic Risk and Debt Overhang PRELIMINARY AND INCOMPLETE ∗ Hui Chen

... Myers (1977) argues that, in the presence of risky debt, equityholders of a levered firm underinvest, because a fraction of the value generated by their new investment will accrue to the existing debtholders. Thus, investment decisions not only depend on the cash flows from investment, but also the ...

... Myers (1977) argues that, in the presence of risky debt, equityholders of a levered firm underinvest, because a fraction of the value generated by their new investment will accrue to the existing debtholders. Thus, investment decisions not only depend on the cash flows from investment, but also the ...

Chapter 15

... Stocks Versus Flows Profit is also a flow number Must know what the capital stock will allow the firm to earn as a flow of profit Was the investment a sound decision ...

... Stocks Versus Flows Profit is also a flow number Must know what the capital stock will allow the firm to earn as a flow of profit Was the investment a sound decision ...

Stocks and the Stocks-to-Use Ratio: Are They

... the market, they do not in any way directly contribute to determination of prices (recall that a price is the mathematical product of the amount of money spent in the market divided by the number of units sold). Stocks can affect prices only indirectly. They can influence the amount of money market ...

... the market, they do not in any way directly contribute to determination of prices (recall that a price is the mathematical product of the amount of money spent in the market divided by the number of units sold). Stocks can affect prices only indirectly. They can influence the amount of money market ...

Forecasting the equity premium in the Australian market

... that if consumption falls by 1 per cent, then the marginal value of a dollar of income increases ...

... that if consumption falls by 1 per cent, then the marginal value of a dollar of income increases ...

Planning and Growth

... The break-even point represents the sales that a business must achieve to break even, or cover all costs. Calculating the break-even point: Helps a business owner predict how changes in costs and sales will affect the profit earned by the business Can determine how many units of a product must b ...

... The break-even point represents the sales that a business must achieve to break even, or cover all costs. Calculating the break-even point: Helps a business owner predict how changes in costs and sales will affect the profit earned by the business Can determine how many units of a product must b ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... Abstract: In this research paper I have tried to find out the effect of privatization on Pakistan’s corporations. Government has privatized PAKSAUDI fertilizer; which was a huge asset for Pakistan’s fertilizer industry. This industry has millions of tons of production capacity and was earning huge m ...

... Abstract: In this research paper I have tried to find out the effect of privatization on Pakistan’s corporations. Government has privatized PAKSAUDI fertilizer; which was a huge asset for Pakistan’s fertilizer industry. This industry has millions of tons of production capacity and was earning huge m ...

Should we still use the concept of potential growth?

... used for all three purposes. For instance, a country with deteriorated competitiveness may be obliged to accept, for a while, high unemployment, and therefore output below its potential level according to the first definition. But the fiscal effort assessment should be d ...

... used for all three purposes. For instance, a country with deteriorated competitiveness may be obliged to accept, for a while, high unemployment, and therefore output below its potential level according to the first definition. But the fiscal effort assessment should be d ...

Valuation of Emerging Economy Investments: Applying Real Options

... How to value an emerging economy investment? The research question as such is very broad and needs to be further specified. The more specific questions this research is in: What are the specific characteristics of the emerging economies that affect investment valuations? How the specific characteris ...

... How to value an emerging economy investment? The research question as such is very broad and needs to be further specified. The more specific questions this research is in: What are the specific characteristics of the emerging economies that affect investment valuations? How the specific characteris ...

No Slide Title

... Logic: maximal consistency with conventional accounting, and maximum consistency of the consolidated balance sheet with the parent’s and subsidiary’s accounts: - (subsidiary's accounts): any company’s value corresponds to its net worth (assets minus debts). And if net worth in the subsidiary’s books ...

... Logic: maximal consistency with conventional accounting, and maximum consistency of the consolidated balance sheet with the parent’s and subsidiary’s accounts: - (subsidiary's accounts): any company’s value corresponds to its net worth (assets minus debts). And if net worth in the subsidiary’s books ...

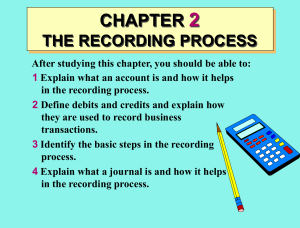

Trial Balance CHAPTER 2 THE RECORDING

... CHAPTER 2 THE RECORDING PROCESS After studying this chapter, you should be able to: 5 Explain what a ledger is and how it helps in the recording process. 6 Explain what posting is and how it helps in the recording process. 7 Prepare a trial balance and explain its purpose. Trial Balance ...

... CHAPTER 2 THE RECORDING PROCESS After studying this chapter, you should be able to: 5 Explain what a ledger is and how it helps in the recording process. 6 Explain what posting is and how it helps in the recording process. 7 Prepare a trial balance and explain its purpose. Trial Balance ...

Case Objectives - Trinity University

... and Hedging Activities (Norwalk, CT: Financial Accounting Standards Board (FASB), Product Code No. S133, 1998). Because SFAS 133 is so complex and confusing to corporate and public accountants, its implementation was postponed in June 1999 for another year. In 1999, the International Accounting Stan ...

... and Hedging Activities (Norwalk, CT: Financial Accounting Standards Board (FASB), Product Code No. S133, 1998). Because SFAS 133 is so complex and confusing to corporate and public accountants, its implementation was postponed in June 1999 for another year. In 1999, the International Accounting Stan ...