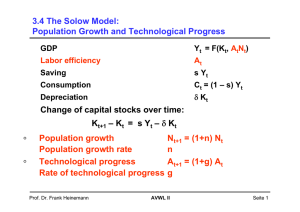

3.4 The Solow Model: Population Growth and Technological

... market. Clear measure of value. Patents hinder product competition and lead to higher price, lower consumer surplus, and monopolistic profit of firms. => inefficiency An the same time, monopolistic profit stimulates firms to invest in R&D. Optimal patent protection must balance the tradeoff between ...

... market. Clear measure of value. Patents hinder product competition and lead to higher price, lower consumer surplus, and monopolistic profit of firms. => inefficiency An the same time, monopolistic profit stimulates firms to invest in R&D. Optimal patent protection must balance the tradeoff between ...

Security Futures

... which include futures contracts on common stocks and futures contracts on a narrow-based index of securities. Security futures, which have been authorized by Congress, can be bought and sold for either price risk management or for speculative purposes. For many reasons, security futures may or may n ...

... which include futures contracts on common stocks and futures contracts on a narrow-based index of securities. Security futures, which have been authorized by Congress, can be bought and sold for either price risk management or for speculative purposes. For many reasons, security futures may or may n ...

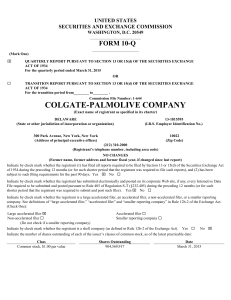

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark wh ...

... Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark wh ...

CONSIGNMENT STOCK AGREEMENT

... discretion of the supplier but absent any stipulation to the contrary the said inventory level shall not at any time be not less than the equivalent of two (2) weeks’ demand: Methode shall communicate such demand level to the Supplier from time to time allowing a reasonable lead time for replenishme ...

... discretion of the supplier but absent any stipulation to the contrary the said inventory level shall not at any time be not less than the equivalent of two (2) weeks’ demand: Methode shall communicate such demand level to the Supplier from time to time allowing a reasonable lead time for replenishme ...

Target price forecasts: Fundamentals and behavioural factor

... they make a reduced contribution to the optimistic bias in target price. Arguably, this is as expected given that there is little theoretical basis for a relation between the behavioral factors and future returns. Overall, we view our results as consistent with the nature of a target price, which is ...

... they make a reduced contribution to the optimistic bias in target price. Arguably, this is as expected given that there is little theoretical basis for a relation between the behavioral factors and future returns. Overall, we view our results as consistent with the nature of a target price, which is ...

Treatment of VOBA, Goodwill and Other Intangible Assets under

... If an FVL is available (or can reasonably be determined), VOBA can also be derived as described in ASC 944-805-30-1, by subtracting FVL from the PGAAP liability. This approach appears as Method 2 in this practice note. With the same market-based assumptions and reflection of risk, both methods will ...

... If an FVL is available (or can reasonably be determined), VOBA can also be derived as described in ASC 944-805-30-1, by subtracting FVL from the PGAAP liability. This approach appears as Method 2 in this practice note. With the same market-based assumptions and reflection of risk, both methods will ...

Liquidity Provision, Information, and Inventory - cfr

... actualize this competitive advantage. Further, financial institutional traders use order revisions to mitigate the incremental execution costs on earnings announcements days, when information uncertainty and the value of private information are high. Bloomfield et al. (2005) show that, in an experi ...

... actualize this competitive advantage. Further, financial institutional traders use order revisions to mitigate the incremental execution costs on earnings announcements days, when information uncertainty and the value of private information are high. Bloomfield et al. (2005) show that, in an experi ...

NBER WORKING PAPER SERIES JUNIOR IS RICH: BEQUESTS AS CONSUMPTION George Constantinides

... earlier. In the third and final period of their lives, as elderly, they consume out of their pension income and savings and themselves leave the residual as a bequest of securities, the value of which is modeled as directly providing them utility. We further refine the behavior of the elderly in a n ...

... earlier. In the third and final period of their lives, as elderly, they consume out of their pension income and savings and themselves leave the residual as a bequest of securities, the value of which is modeled as directly providing them utility. We further refine the behavior of the elderly in a n ...

NBER WORKING PAPER SERIES Hanno Lustig Yi-Li Chien

... Alvarez and Jermann (2000) decentralize constrained efficient allocations using solvency constraints that are not too tight and make contact with the literature on risk sharing with limited commitment. Our model fits in this tradition, but it brings out the importance of collateralizable wealth. Pa ...

... Alvarez and Jermann (2000) decentralize constrained efficient allocations using solvency constraints that are not too tight and make contact with the literature on risk sharing with limited commitment. Our model fits in this tradition, but it brings out the importance of collateralizable wealth. Pa ...

NIHON CHOUZAI Co., Ltd.

... In the FY3/17 results, net sales were ¥223,468mn (up 1.9% YoY) and operating income was ¥8,519mn (down 18.8%). With regards to the revisions to the drug prices and dispensing fees, in the Dispensing Pharmacy business, the technical fee unit price was recovered, but a significant reduction in the pri ...

... In the FY3/17 results, net sales were ¥223,468mn (up 1.9% YoY) and operating income was ¥8,519mn (down 18.8%). With regards to the revisions to the drug prices and dispensing fees, in the Dispensing Pharmacy business, the technical fee unit price was recovered, but a significant reduction in the pri ...

NBER WORKING PAPER SERIES QUANTITATIVE IMPLICATION OF A DEBT-DEFLATION

... constraints. The paper develops a numerical solution method to explore these nonlinear dynamics using a recursive representation of the model’s competitive equilibrium. The quantitative results show that a baseline scenario calibrated to Mexican data and with minimal trading costs can produce revers ...

... constraints. The paper develops a numerical solution method to explore these nonlinear dynamics using a recursive representation of the model’s competitive equilibrium. The quantitative results show that a baseline scenario calibrated to Mexican data and with minimal trading costs can produce revers ...

CEO Pay and Corporate Governance

... erage, half of a CEO’s total compensation. We may think that a CEO is paid a bonus for better performance. But the evidence suggests otherwise. Kevin Murphy has combed through the research of his fellow economists and finds no evidence of a significant relationship between the size of a CEO’s cash ...

... erage, half of a CEO’s total compensation. We may think that a CEO is paid a bonus for better performance. But the evidence suggests otherwise. Kevin Murphy has combed through the research of his fellow economists and finds no evidence of a significant relationship between the size of a CEO’s cash ...

colgate-palmolive company

... and are included in the accompanying Condensed Consolidated Financial Statements in proportion with estimated annual tax rates, the passage of time or estimated annual sales. ...

... and are included in the accompanying Condensed Consolidated Financial Statements in proportion with estimated annual tax rates, the passage of time or estimated annual sales. ...