New Perspectives on the Great Depression

... declared that the gold standard was among the ‘old fetishes of so-called international bankers’, and he made it clear that priority should be placed on stabilizing the purchasing power of money – that is, on raising the domestic price level (Rauchway, p. 71). In October 1933, Roosevelt announced tha ...

... declared that the gold standard was among the ‘old fetishes of so-called international bankers’, and he made it clear that priority should be placed on stabilizing the purchasing power of money – that is, on raising the domestic price level (Rauchway, p. 71). In October 1933, Roosevelt announced tha ...

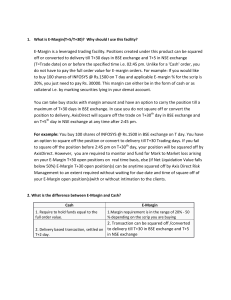

E-Margin is a leveraged trading facility. Positions

... mark hold on additional funds from your linked bank account. Once the order is converted to delivery, your available limits will be reduced for further trading. Example: You buy 100 shares of INFOSYS at the rate of Rs. 500 under E-Margin. Limit utilized is say Rs. 10,000 against total order value of ...

... mark hold on additional funds from your linked bank account. Once the order is converted to delivery, your available limits will be reduced for further trading. Example: You buy 100 shares of INFOSYS at the rate of Rs. 500 under E-Margin. Limit utilized is say Rs. 10,000 against total order value of ...

Oil Price, Exchange Rate Shock, and the Japanese Economy

... For many years, the most important exogenous shocks to the Japanese economy have been exchange rate ‡uctuations and energy price increases, particularly crude oil price increases. The impact of oil prices on macroeconomic activity has been an important research theme and policy concern in many devel ...

... For many years, the most important exogenous shocks to the Japanese economy have been exchange rate ‡uctuations and energy price increases, particularly crude oil price increases. The impact of oil prices on macroeconomic activity has been an important research theme and policy concern in many devel ...

turkey, 1980-2000: financial liberalization

... foreign exchange regime was liberalized early in 1984. Banks were allowed to accept foreign currency deposits from residents and to engage in specified external transactions. The Central Bank's control over commercial banks was simplified with a revision of the liquidity and reserve requirement syst ...

... foreign exchange regime was liberalized early in 1984. Banks were allowed to accept foreign currency deposits from residents and to engage in specified external transactions. The Central Bank's control over commercial banks was simplified with a revision of the liquidity and reserve requirement syst ...

China`s African financial engagement, real

... countries depreciated;5 the two extreme annual variations are the appreciation of the kwanza of Angola by 10 % and the depreciation of the franc of Democratic Republic of Congo by 6%. It is worth noting that the countries which experienced an appreciation of their real exchange rates relative to Ch ...

... countries depreciated;5 the two extreme annual variations are the appreciation of the kwanza of Angola by 10 % and the depreciation of the franc of Democratic Republic of Congo by 6%. It is worth noting that the countries which experienced an appreciation of their real exchange rates relative to Ch ...

Low Interest Rates and Housing Booms

... Previous work using VAR models to analyse the housing market has focused on the transmission of monetary policy shocks in advanced economies — for example, Assenmacher-Wesche and Gerlach (2010), Carstensen et al. (2009), Calza et al. (2009) and Goodhart and Ho¤mann (2008). At the same time, there is ...

... Previous work using VAR models to analyse the housing market has focused on the transmission of monetary policy shocks in advanced economies — for example, Assenmacher-Wesche and Gerlach (2010), Carstensen et al. (2009), Calza et al. (2009) and Goodhart and Ho¤mann (2008). At the same time, there is ...

International Trade Finance and the Cost Channel of Monetary

... (NOEM) paradigm of Obstfeld et al. (1996).7 The world economy is assumed to consist of two countries of equal size. Households have preferences over domestic and foreign goods and supply labor to firms elastically. There are two sets of firms in each economy– production firms and trade firms. Prices ...

... (NOEM) paradigm of Obstfeld et al. (1996).7 The world economy is assumed to consist of two countries of equal size. Households have preferences over domestic and foreign goods and supply labor to firms elastically. There are two sets of firms in each economy– production firms and trade firms. Prices ...

an evaluation of monetary policy instruments in achieving monetary

... assumption of a stable and predictable relationship between money supply and inflation. Consequently, the need to understand the dynamics of inflations is central to the success of monetary policy to ensure the achievement of price stability. In the economics literature, the concept of Inflation has ...

... assumption of a stable and predictable relationship between money supply and inflation. Consequently, the need to understand the dynamics of inflations is central to the success of monetary policy to ensure the achievement of price stability. In the economics literature, the concept of Inflation has ...

Korea`s Economic Crisis and Cultural Transition toward Individualism

... There did not seem to be significant signs of severe problems in Korea’s economy until mid-October 1997, about one month before the crisis. It is understandable that the IMF mission team assessed the Korean economy as fundamentally healthy. Balino and Ubide (1999), who studied the causes of the Kore ...

... There did not seem to be significant signs of severe problems in Korea’s economy until mid-October 1997, about one month before the crisis. It is understandable that the IMF mission team assessed the Korean economy as fundamentally healthy. Balino and Ubide (1999), who studied the causes of the Kore ...

Reactions of Canadian Interest Rates to

... “tactical” reasons, tighten monetary policy, not because tighter conditions were required to offset inflationary pressures, but to calm markets to avoid larger interest rate increases that would otherwise occur across the yield curve as a result of foreign exchange market instability. However, this ...

... “tactical” reasons, tighten monetary policy, not because tighter conditions were required to offset inflationary pressures, but to calm markets to avoid larger interest rate increases that would otherwise occur across the yield curve as a result of foreign exchange market instability. However, this ...

Gayrimenkul Yatırım Ortaklıkları - İlk Halka Arz

... been made excessively from the same institution and the lesser one will be cancelled and it will not be included in the transaction of distribution. In cases where equal numbers of demand are made from different institutions or no decision can be taken due to incomplete data input, the demand includ ...

... been made excessively from the same institution and the lesser one will be cancelled and it will not be included in the transaction of distribution. In cases where equal numbers of demand are made from different institutions or no decision can be taken due to incomplete data input, the demand includ ...

The impact of the price of oil and the US dollar exchange rate on

... Arabica, for they vary between 0.55 and 0.59 both on the New York futures market but also for the three groups of physically traded Arabica coffee. On the other hand, the coefficients of correlation between the price index of crude oil and the price of Robusta are weak, in the order of 0.43. Even th ...

... Arabica, for they vary between 0.55 and 0.59 both on the New York futures market but also for the three groups of physically traded Arabica coffee. On the other hand, the coefficients of correlation between the price index of crude oil and the price of Robusta are weak, in the order of 0.43. Even th ...

areas has begun to rise, but major initiatives are

... modity prices. Domestic demand also played an important role, with retail turnover growing at double digit rates in most of the economies. However, increases in the prices of fuel and food products, and higher domestic utility tariffs, pushed up consumer price inflation in virtually all the countrie ...

... modity prices. Domestic demand also played an important role, with retail turnover growing at double digit rates in most of the economies. However, increases in the prices of fuel and food products, and higher domestic utility tariffs, pushed up consumer price inflation in virtually all the countrie ...

Peltonen-del05 1039031 en

... Before the financial crises of the 1990s, it was commonly held that currency crises could be, to some extent, predictable with variables derived from the first generation models of currency crisis stemming from Krugman (1979).8 Authors such as Blanco and Garber (1986), Cumby and van Wijnbergen (1989 ...

... Before the financial crises of the 1990s, it was commonly held that currency crises could be, to some extent, predictable with variables derived from the first generation models of currency crisis stemming from Krugman (1979).8 Authors such as Blanco and Garber (1986), Cumby and van Wijnbergen (1989 ...

Separating Monetary and Structural Causes of Inflation

... causes of inflation in Nigerian using an Autoregressive Distributed Lag model concludes that exchange rate depreciation, monetary growth and real output constraints are the main explanatory factors for the behavior of inflation in that country. On the relationship between inflation and money supply ...

... causes of inflation in Nigerian using an Autoregressive Distributed Lag model concludes that exchange rate depreciation, monetary growth and real output constraints are the main explanatory factors for the behavior of inflation in that country. On the relationship between inflation and money supply ...

Amsterdam and London as financial centers in the eighteenth century

... the s, with consequences that persist to the present.3 All of these analyses consider a center as a complete financial system, comprising a variety of institutions ranging from a central bank to credit cooperatives combined with a variety of markets ranging from government debt to exotic derivat ...

... the s, with consequences that persist to the present.3 All of these analyses consider a center as a complete financial system, comprising a variety of institutions ranging from a central bank to credit cooperatives combined with a variety of markets ranging from government debt to exotic derivat ...

The Law of One Price and Arbitrage on China`s Dual

... The rest of the paper is organised into four sections. A brief review of literature is attempted to show that there is very little consensus that there is arbitrage-free trades in the cases of dual-listed Chinese shares despite there being evidence of no arbitrage profits in trades of dual-listed sh ...

... The rest of the paper is organised into four sections. A brief review of literature is attempted to show that there is very little consensus that there is arbitrage-free trades in the cases of dual-listed Chinese shares despite there being evidence of no arbitrage profits in trades of dual-listed sh ...

Macroeconomic Policy Responses to Financial

... Kosta Josifidisa Jean-Pierre Allegretb, Céline Gimetc, Emilija Beker Pucard, September, 2013 Abstract This paper contributes to the literature on monetary policy responses in emerging economies to international financial crises. Such issue is especially relevant for these countries insofar as they t ...

... Kosta Josifidisa Jean-Pierre Allegretb, Céline Gimetc, Emilija Beker Pucard, September, 2013 Abstract This paper contributes to the literature on monetary policy responses in emerging economies to international financial crises. Such issue is especially relevant for these countries insofar as they t ...

IOSR Journal of Economics and Finance (IOSR-JEF) e-ISSN: 2321-5933, p-ISSN: 2321-5925.

... equation, as well as to estimate the short-run and long-run elasticities. The ARDL Model has main advantage over the other common procedures to co integration analysis. This advantage stems from the fact that the other methods focused on the estimation of long-run relationships among I (1) variables ...

... equation, as well as to estimate the short-run and long-run elasticities. The ARDL Model has main advantage over the other common procedures to co integration analysis. This advantage stems from the fact that the other methods focused on the estimation of long-run relationships among I (1) variables ...

Daily Stock Market Movements - Pakistan Institute of Development

... Movements in stock market are presented in the Figure 2. It shows that there are several episodes of positive and negative changes during the last five years. The average is positive (20) though the standard deviation is too high (186), reported in Table 1. The maximum drop recorded is more than the ...

... Movements in stock market are presented in the Figure 2. It shows that there are several episodes of positive and negative changes during the last five years. The average is positive (20) though the standard deviation is too high (186), reported in Table 1. The maximum drop recorded is more than the ...