The Tallinn Stock Exchange

... world market and sustain the fixed exchange rate of the kroon, Estonian national currency. [www. fin. ee] Estonia has also been highly successful in eliminating both tariff and non-tariff barriers, and enjoys one of the most liberal external trade regimes in the world. With these policies and a comp ...

... world market and sustain the fixed exchange rate of the kroon, Estonian national currency. [www. fin. ee] Estonia has also been highly successful in eliminating both tariff and non-tariff barriers, and enjoys one of the most liberal external trade regimes in the world. With these policies and a comp ...

Crisis Averted—What`s Next?

... strength of recovery; • Monetary policy normalization should follow fiscal. And, confront a likely scenario of capital inflows in search for yield: • FX flexibility to avoid one-sided bets; • If inflows scale is large and problematic, step-up financial regulation/supervision; • Revisit the fiscal st ...

... strength of recovery; • Monetary policy normalization should follow fiscal. And, confront a likely scenario of capital inflows in search for yield: • FX flexibility to avoid one-sided bets; • If inflows scale is large and problematic, step-up financial regulation/supervision; • Revisit the fiscal st ...

Document

... - Or create more and more wealth? - But: successes only through globalisation; trade; not self-sufficiency or import substitution ...

... - Or create more and more wealth? - But: successes only through globalisation; trade; not self-sufficiency or import substitution ...

inflation as policy target

... practice, the 2 percent target was agreed on as a compromise between economists and policymakers who believed that inflation ought to be zero on average, and others who thought that substantially higher rates could be acceptable or even beneficial. The 2 percent target was also adopted because it ha ...

... practice, the 2 percent target was agreed on as a compromise between economists and policymakers who believed that inflation ought to be zero on average, and others who thought that substantially higher rates could be acceptable or even beneficial. The 2 percent target was also adopted because it ha ...

as a PDF

... jump the bandwagon and bid up the exchange rate. Along this line of reasoning, an intervention would generally be followed by increased volatility in the exchange rate. Reflecting these considerations, Galati and Melick (2002) argue that foreign exchange interventions could more recently have been a ...

... jump the bandwagon and bid up the exchange rate. Along this line of reasoning, an intervention would generally be followed by increased volatility in the exchange rate. Reflecting these considerations, Galati and Melick (2002) argue that foreign exchange interventions could more recently have been a ...

The Global Economic Recession and Industrial Structure: Evidence

... The economies of East Asia and Southeast Asia have historically featured generally sound developmental paths with considerable macroeconomic stability. Among them, the four dragons of the newly industrialized economies (NIEs) 1 were the best economic performers of the 1970s, 1980s, and 1990s, that i ...

... The economies of East Asia and Southeast Asia have historically featured generally sound developmental paths with considerable macroeconomic stability. Among them, the four dragons of the newly industrialized economies (NIEs) 1 were the best economic performers of the 1970s, 1980s, and 1990s, that i ...

Chapter 29

... economy’s net foreign investment always equals its net exports. An economy’s saving can be used to either finance investment at home or to buy assets abroad. ...

... economy’s net foreign investment always equals its net exports. An economy’s saving can be used to either finance investment at home or to buy assets abroad. ...

World Food Prices and Monetary Policy

... emerges as a welfare maximizing rule. In our model, however, the small open economy does not become isomorphic to a closed one even under the unit elasticity assumptions just mentioned (in such a case, output does equal natural output at all times and trade is balanced, but the RER, and therefore c ...

... emerges as a welfare maximizing rule. In our model, however, the small open economy does not become isomorphic to a closed one even under the unit elasticity assumptions just mentioned (in such a case, output does equal natural output at all times and trade is balanced, but the RER, and therefore c ...

NBER WORKING PAPER SERIES WORLD FOOD PRICES AND MONETARY POLICY Luis Catão

... emerges as a welfare maximizing rule. In our model, however, the small open economy does not become isomorphic to a closed one even under the unit elasticity assumptions just mentioned (in such a case, output does equal natural output at all times and trade is balanced, but the RER, and therefore c ...

... emerges as a welfare maximizing rule. In our model, however, the small open economy does not become isomorphic to a closed one even under the unit elasticity assumptions just mentioned (in such a case, output does equal natural output at all times and trade is balanced, but the RER, and therefore c ...

Lecture 1 - Department of Systems Engineering and Engineering

... purchase the assets in bulk with lower transaction costs. Risk of mismatching the maturities of assets and liabilities: By issuing new forms of financial contracts with different maturities. ...

... purchase the assets in bulk with lower transaction costs. Risk of mismatching the maturities of assets and liabilities: By issuing new forms of financial contracts with different maturities. ...

The Crisis Management of the ECB - Fritz Breuss

... European countries and Japan. Many factors may have contributed to the better performance in the USA than in Europe. In contrast, however, to the “Great Depression” in the 1930s the policy reaction was much better and more appropriate in the present crisis (see Eichengreen, 2015; Baldwin and Giavazz ...

... European countries and Japan. Many factors may have contributed to the better performance in the USA than in Europe. In contrast, however, to the “Great Depression” in the 1930s the policy reaction was much better and more appropriate in the present crisis (see Eichengreen, 2015; Baldwin and Giavazz ...

PDF Download

... in principle act as a lender of last resort for the sovereign, i.e. print money and buy government bonds (as the Federal Reserve, the Bank of England or the Bank of Japan did during the crisis). While the ECB has also started such a programme, it is extremely reluctant to do this and has said (so fa ...

... in principle act as a lender of last resort for the sovereign, i.e. print money and buy government bonds (as the Federal Reserve, the Bank of England or the Bank of Japan did during the crisis). While the ECB has also started such a programme, it is extremely reluctant to do this and has said (so fa ...

DENTSPLY SIRONA Inc. - corporate

... contained in this press release are based on information presently available to the Company and assumptions that the Company believe to be reasonable. The Company is not assuming any duty to update this information if those facts change or if the assumptions are no longer believed to be reasonable. ...

... contained in this press release are based on information presently available to the Company and assumptions that the Company believe to be reasonable. The Company is not assuming any duty to update this information if those facts change or if the assumptions are no longer believed to be reasonable. ...

An Overview

... The most commonly used underlying assets for financial derivative contracts are interest rates, stock indices, individual stocks, and foreign currencies. ...

... The most commonly used underlying assets for financial derivative contracts are interest rates, stock indices, individual stocks, and foreign currencies. ...

Yip, Paul SL, (2005). The Exchange Rate Systems in Hong

... channeled to the US, helping to finance its huge current account deficit and exacerbating “global imbalances”. This calls for the strengthening of the financial system of the regional countries that would facilitate the unwinding of Asia’s savings-investment imbalance. The limited development of reg ...

... channeled to the US, helping to finance its huge current account deficit and exacerbating “global imbalances”. This calls for the strengthening of the financial system of the regional countries that would facilitate the unwinding of Asia’s savings-investment imbalance. The limited development of reg ...

ma_eco_pre_pap2_bl3 - Madhya Pradesh Bhoj Open University

... However, it is not only the people employed in agriculture who benefit from increases in agricultural productivity. Those employed in other sectors also enjoy lower food prices and a more stable food supply. At the same time, they may see their wages rise as well. Agricultural productivity is becomi ...

... However, it is not only the people employed in agriculture who benefit from increases in agricultural productivity. Those employed in other sectors also enjoy lower food prices and a more stable food supply. At the same time, they may see their wages rise as well. Agricultural productivity is becomi ...

The impact of trade finance on international trade

... Finally, the interaction of the trade finance proxy with the financial development dummy (FIN*DUMMY) is added to Model 4.2. Across all three specifications, the estimated coefficient on the interaction term is positive and significant. For example, Table 4 Model 4.3 shows that the estimated coeffici ...

... Finally, the interaction of the trade finance proxy with the financial development dummy (FIN*DUMMY) is added to Model 4.2. Across all three specifications, the estimated coefficient on the interaction term is positive and significant. For example, Table 4 Model 4.3 shows that the estimated coeffici ...

The Effect of Exchange Rate Movements on Heterogeneous Plants

... set of independent variables and the conditional quantiles of the dependent variable. This approach enables the evaluation of the effect of movements in the real exchange rate at different points of the conditional productivity distribution, which gives insight into how heterogeneous plants react to ...

... set of independent variables and the conditional quantiles of the dependent variable. This approach enables the evaluation of the effect of movements in the real exchange rate at different points of the conditional productivity distribution, which gives insight into how heterogeneous plants react to ...

on futures contracts

... Key Terms for Futures Contracts • The Futures price: agreed-upon price paid at maturity • Long position: Agrees to purchase the underlying asset at the stated futures price at contract maturity • Short position: Agrees to deliver the underlying asset at the stated futures price at contract maturity ...

... Key Terms for Futures Contracts • The Futures price: agreed-upon price paid at maturity • Long position: Agrees to purchase the underlying asset at the stated futures price at contract maturity • Short position: Agrees to deliver the underlying asset at the stated futures price at contract maturity ...

4. Supply and Demand Developments

... GDP data for the third quarter of 2015 show that economic activity was stronger than anticipated in the October Inflation Report. The GDP posted a quarterly and annual growth of 1.3 and 4.0 percent, respectively. The annual GDP growth was mainly driven by agriculture and net taxes. Thanks to a robus ...

... GDP data for the third quarter of 2015 show that economic activity was stronger than anticipated in the October Inflation Report. The GDP posted a quarterly and annual growth of 1.3 and 4.0 percent, respectively. The annual GDP growth was mainly driven by agriculture and net taxes. Thanks to a robus ...

The Rise of German Protectionism in the 1870s: A Macroeconomic

... The table clearly shows that the degree of price decline varies with the choice of price deflator: for both countries the largest declines are recorded when the GDP deflator is used to derive real prices, followed by the CPI and then the WPI. The dependence of results on the choice of deflator tend ...

... The table clearly shows that the degree of price decline varies with the choice of price deflator: for both countries the largest declines are recorded when the GDP deflator is used to derive real prices, followed by the CPI and then the WPI. The dependence of results on the choice of deflator tend ...

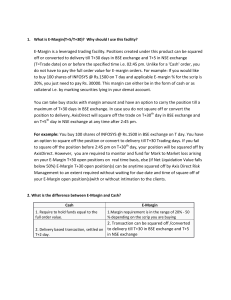

E-Margin is a leveraged trading facility. Positions

... mark hold on additional funds from your linked bank account. Once the order is converted to delivery, your available limits will be reduced for further trading. Example: You buy 100 shares of INFOSYS at the rate of Rs. 500 under E-Margin. Limit utilized is say Rs. 10,000 against total order value of ...

... mark hold on additional funds from your linked bank account. Once the order is converted to delivery, your available limits will be reduced for further trading. Example: You buy 100 shares of INFOSYS at the rate of Rs. 500 under E-Margin. Limit utilized is say Rs. 10,000 against total order value of ...