Use SWIFT solutions to reduce your liquidity risk

... – “SWIFT for Payment Market Infrastructures: Efficient support to successfullyrenew payment clearing and settlement systems – Wed 27 Oct, 14 pm – “Transforming Collateral Management: How bi-lateral and tri-party messages can mitigate counterparty and credit risk” – Thur 28 Oct, 11 am PowerPoint Tool ...

... – “SWIFT for Payment Market Infrastructures: Efficient support to successfullyrenew payment clearing and settlement systems – Wed 27 Oct, 14 pm – “Transforming Collateral Management: How bi-lateral and tri-party messages can mitigate counterparty and credit risk” – Thur 28 Oct, 11 am PowerPoint Tool ...

THE OUTSOURCING OF FINANCIAL REGULATION TO RISK

... Abstract: The widespread use of computer-based risk models in the financial industry during the last two decades enabled the marketing of more complex financial products to consumers, the growth of securitization and derivatives, and the development of sophisticated risk-management strategies by fin ...

... Abstract: The widespread use of computer-based risk models in the financial industry during the last two decades enabled the marketing of more complex financial products to consumers, the growth of securitization and derivatives, and the development of sophisticated risk-management strategies by fin ...

2 Macroeconomic Variables and Term Structure of Interest

... In the analysis of the credit spread or spread short, Bernanke (1990) showed that a restrictive monetary policy by increasing the rates of fedfunds has the effect of increasing the cost of funds for banks. To avoid this increase in cost of funding, banks must choose between issuing certificates of d ...

... In the analysis of the credit spread or spread short, Bernanke (1990) showed that a restrictive monetary policy by increasing the rates of fedfunds has the effect of increasing the cost of funds for banks. To avoid this increase in cost of funding, banks must choose between issuing certificates of d ...

GQG Partners Emerging Markets Equity Fund

... As with all mutual funds, there is no guarantee that the Fund will achieve its investment objective. You could lose money by investing in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the FDIC or any government agency. The principal risk factors affecting shareh ...

... As with all mutual funds, there is no guarantee that the Fund will achieve its investment objective. You could lose money by investing in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the FDIC or any government agency. The principal risk factors affecting shareh ...

Financing US Debt: Is There Enough Money in the World and at

... under its large-scale asset purchases (LSAP) have that same quantitative impact. Given these results, and consensus projections for growth, budget deficits and interest rates, we conclude that it is technically possible for increases in the Federal debt to be financed by the foreign official sector. ...

... under its large-scale asset purchases (LSAP) have that same quantitative impact. Given these results, and consensus projections for growth, budget deficits and interest rates, we conclude that it is technically possible for increases in the Federal debt to be financed by the foreign official sector. ...

Sovereign yield spreads during the Euro-crisis

... virtual securities whose predefined pay-off is conditioned on the particular real-world event to occur until maturity of the security. The procedure for trading these securities is as follows: If one or more member countries declare their exit before the end of 2013, the holders receive 10 US-Dollar ...

... virtual securities whose predefined pay-off is conditioned on the particular real-world event to occur until maturity of the security. The procedure for trading these securities is as follows: If one or more member countries declare their exit before the end of 2013, the holders receive 10 US-Dollar ...

Download paper (PDF)

... investors to trade certain securities in one market may induce them to trade similar securities in another market. Based on these similarities in liquidity and pricing across markets, an understanding of the relationship between liquidity and efficiency on TradeSports complements the indirect eviden ...

... investors to trade certain securities in one market may induce them to trade similar securities in another market. Based on these similarities in liquidity and pricing across markets, an understanding of the relationship between liquidity and efficiency on TradeSports complements the indirect eviden ...

Australian REITs - Regulation and market trends

... Australia has a mature and increasingly sophisticated REIT market, which is characterised by strong but flexible regulation with a focus on disclosure. The Australian REIT market is the largest in Asia and the second largest in the world after the United States.2 REITs (commonly referred to as “list ...

... Australia has a mature and increasingly sophisticated REIT market, which is characterised by strong but flexible regulation with a focus on disclosure. The Australian REIT market is the largest in Asia and the second largest in the world after the United States.2 REITs (commonly referred to as “list ...

Growth and Productivity: the role of Government Debt

... slowdown in growth; iv) since March 2009 yield spreads are positively associated with real exchange rate appreciation and negatively associated with bond market liquidity; v) markets price fiscal risk, throughout the period under examination, through the fiscal balance. Since March 2009, however, th ...

... slowdown in growth; iv) since March 2009 yield spreads are positively associated with real exchange rate appreciation and negatively associated with bond market liquidity; v) markets price fiscal risk, throughout the period under examination, through the fiscal balance. Since March 2009, however, th ...

DOC - Douglas Dynamics Investor Relations

... December 31, 2013. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (Uni ...

... December 31, 2013. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (Uni ...

MLC Investment Trust Product Guide

... smooth a portfolio’s returns. That’s because different types of investments perform well in different times and circumstances. When some are providing good returns, others may not be. Portfolios can be diversified across types of investments, industries and countries as well as across investment man ...

... smooth a portfolio’s returns. That’s because different types of investments perform well in different times and circumstances. When some are providing good returns, others may not be. Portfolios can be diversified across types of investments, industries and countries as well as across investment man ...

banco safra sa - Safra Net Banking

... stable, and are shielded against party politics. The transfer of “natural” monopolies to the private sector is a highly complex political and technical matter, and it is contaminated by the fact that if such monopolies are uncontrolled they are even more cruel in private hands. It must be acknowledg ...

... stable, and are shielded against party politics. The transfer of “natural” monopolies to the private sector is a highly complex political and technical matter, and it is contaminated by the fact that if such monopolies are uncontrolled they are even more cruel in private hands. It must be acknowledg ...

chapter 12—special industries: banks, utilities, oil and gas

... 34. A review of the disclosure of allowance for loan losses for a bank may indicate significant losses charged. ANS: T 35. Electric utilities that have substantial construction work in progress are usually viewed as being less risky investments than electric utilities that do not have substantial co ...

... 34. A review of the disclosure of allowance for loan losses for a bank may indicate significant losses charged. ANS: T 35. Electric utilities that have substantial construction work in progress are usually viewed as being less risky investments than electric utilities that do not have substantial co ...

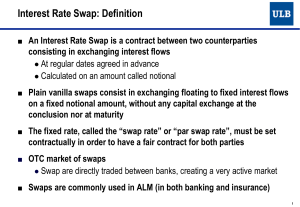

Interest Rate Swap

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

Annual Report - San Francisco Employees` Retirement System

... voluntary IRC §457(b) plan, was adopted in 1976, and allows eligible City employees to elect to voluntarily defer receipt and taxation of a portion of their regular earnings until after they retire or separate from service. The SFDCP also offers a Roth after-tax contribution option. These ...

... voluntary IRC §457(b) plan, was adopted in 1976, and allows eligible City employees to elect to voluntarily defer receipt and taxation of a portion of their regular earnings until after they retire or separate from service. The SFDCP also offers a Roth after-tax contribution option. These ...

Marginal leverage ratio as a monitoring tool of

... banking system. […] During the most severe part of the crisis, the banking sector was forced to reduce its leverage in a manner that amplified downward pressure on asset prices, further exacerbating the positive feedback loop between losses, declines in bank capital, and the contraction in credit av ...

... banking system. […] During the most severe part of the crisis, the banking sector was forced to reduce its leverage in a manner that amplified downward pressure on asset prices, further exacerbating the positive feedback loop between losses, declines in bank capital, and the contraction in credit av ...

SAST - VCP Value Portfolio Summary Prospectus

... The Portfolio invests primarily in equity and fixed income securities, derivatives and other instruments that have economic characteristics similar to such securities that it believes will decrease the volatility level of the Portfolio’s annual returns. Under normal circumstances, the Portfolio inve ...

... The Portfolio invests primarily in equity and fixed income securities, derivatives and other instruments that have economic characteristics similar to such securities that it believes will decrease the volatility level of the Portfolio’s annual returns. Under normal circumstances, the Portfolio inve ...

a comparison of basic and extended markowitz model on croatian

... www.zse.hr [Accessed 30/08/2012] ...

... www.zse.hr [Accessed 30/08/2012] ...

Australia`s Authorised Depository Institutions The Capital–Assets Ratio

... • The P/E of an FI influences the attractiveness of issuing additional equity. • The higher the P/E, the more investors are willing to pay for a dollar of earnings. • The higher the P/E, the cheaper for an FI to issue equity. Copyright 2007 McGraw-Hill Australia Pty Ltd PPTs t/a Financial Institut ...

... • The P/E of an FI influences the attractiveness of issuing additional equity. • The higher the P/E, the more investors are willing to pay for a dollar of earnings. • The higher the P/E, the cheaper for an FI to issue equity. Copyright 2007 McGraw-Hill Australia Pty Ltd PPTs t/a Financial Institut ...

catalytic first-loss capital - Global Impact Investing Network

... of certain social and/or environmental outcomes. In addition, often—though not always—the purpose can be to demonstrate the commercial viability of investing into a new market. CFLC is a tool that can be incorporated into a capital structure via a range of instruments (see Table 1). Commonly used CF ...

... of certain social and/or environmental outcomes. In addition, often—though not always—the purpose can be to demonstrate the commercial viability of investing into a new market. CFLC is a tool that can be incorporated into a capital structure via a range of instruments (see Table 1). Commonly used CF ...