MacroMarkets Announces Collaboration with WisdomTree To

... government efforts to better serve individual home owners and improve financial institutions.” ...

... government efforts to better serve individual home owners and improve financial institutions.” ...

Attachment 1 : Liberalization of Securities Business Licensing

... for domestic and outbound businesses, while the SEC will focus its roles on the prevention of conflicts of interest. For example, the securities companies will be able to exercise their own judgments whether to operate every type of securities businesses within one entity or among separate subsidiar ...

... for domestic and outbound businesses, while the SEC will focus its roles on the prevention of conflicts of interest. For example, the securities companies will be able to exercise their own judgments whether to operate every type of securities businesses within one entity or among separate subsidiar ...

CU Capital Market Solutions Workshop

... Nothing beats our member share deposit business for consistent funding, however, we sometimes simply need more funding due to loan growth or we need longer term funding to meet the interest rate risk longer term assets can create. This session will focus on new funding sources that provide solutions ...

... Nothing beats our member share deposit business for consistent funding, however, we sometimes simply need more funding due to loan growth or we need longer term funding to meet the interest rate risk longer term assets can create. This session will focus on new funding sources that provide solutions ...

CEE Local Currency Bond Markets - The Institute of International

... Post-Crisis Development Has Been Rapid… • Cross-border inflows to emerging market local currency bonds have surged over the past few years • Rapid market development underpinned by very low yields on U.S. Treasuries—can this be sustained? • LC bonds as a class have been moving more in line with saf ...

... Post-Crisis Development Has Been Rapid… • Cross-border inflows to emerging market local currency bonds have surged over the past few years • Rapid market development underpinned by very low yields on U.S. Treasuries—can this be sustained? • LC bonds as a class have been moving more in line with saf ...

The “Unknown Unknowns”: Risks of Higher Public Debt Levels in

... Investment managers today, however risky their businesses may be, tend to care about their reputations and tend to have their money on the line.... I have a pretty easy time looking at funds and figuring out what they are doing. It is nearly impossible to know what the large financial institutions w ...

... Investment managers today, however risky their businesses may be, tend to care about their reputations and tend to have their money on the line.... I have a pretty easy time looking at funds and figuring out what they are doing. It is nearly impossible to know what the large financial institutions w ...

This PDF is a selection from a published volume from... Economic Research

... helps lenders manage their interest rate risk and duration risk. An additional benefit of securitization is that it improves financial stability by removing risk from lenders’ balance sheets and dispersing it more widely among a large number of less-leveraged domestic and nonresident institutional i ...

... helps lenders manage their interest rate risk and duration risk. An additional benefit of securitization is that it improves financial stability by removing risk from lenders’ balance sheets and dispersing it more widely among a large number of less-leveraged domestic and nonresident institutional i ...

top of the line thinking - Northern Funds

... now available to retail investors, who can share the advantages of an approach that annually updates strategic exposures to stocks, bonds, cash and real assets, makes tactical bets to over- and underweight these strategic norms and rebalances regularly. The Fund is designed to provide easy and compe ...

... now available to retail investors, who can share the advantages of an approach that annually updates strategic exposures to stocks, bonds, cash and real assets, makes tactical bets to over- and underweight these strategic norms and rebalances regularly. The Fund is designed to provide easy and compe ...

Debt crisis hits Europe`s retail credit markets

... The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household debt levels. This suggests/means? that the trend in deleveraging is mainly caused by the pre-crisis credit ex ...

... The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household debt levels. This suggests/means? that the trend in deleveraging is mainly caused by the pre-crisis credit ex ...

With new “Vaccine Bonds” Japanese Investors will have the

... commission* for each transaction as agreed beforehand with you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the commission for each transaction. In some cases, our company also may charge a maximum of ¥3,150 (i ...

... commission* for each transaction as agreed beforehand with you. Since commissions may be included in the purchase price or may not be charged for certain transactions, we recommend that you confirm the commission for each transaction. In some cases, our company also may charge a maximum of ¥3,150 (i ...

RTF

... HERZOGENAURACH, September 7, 2016. Today, IHO Holding, a group of holding companies indirectly owned by the Schaeffler Family, announces a EUR 3.3 billion equivalent refinancing of existing indebtedness. The objective of the refinancing is to refinance all EUR 1.7 billion equivalent existing IHO Hol ...

... HERZOGENAURACH, September 7, 2016. Today, IHO Holding, a group of holding companies indirectly owned by the Schaeffler Family, announces a EUR 3.3 billion equivalent refinancing of existing indebtedness. The objective of the refinancing is to refinance all EUR 1.7 billion equivalent existing IHO Hol ...

Chapter 1

... 13. The REIT manager pools the resources of many investors and uses these resources to buy a portfolio of real estate assets. Each investor in the REIT owns a fraction of the total portfolio, in accordance with the size of the individual investment. The REIT gives the investor the ability to hold a ...

... 13. The REIT manager pools the resources of many investors and uses these resources to buy a portfolio of real estate assets. Each investor in the REIT owns a fraction of the total portfolio, in accordance with the size of the individual investment. The REIT gives the investor the ability to hold a ...

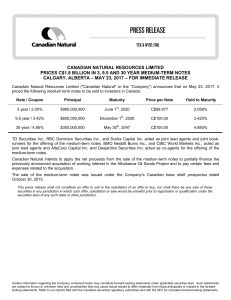

CANADIAN NATURAL RESOURCES LIMITED PRICES C$1.8

... TD Securities Inc., RBC Dominion Securities Inc., and Scotia Capital Inc. acted as joint lead agents and joint bookrunners for the offering of the medium-term notes. BMO Nesbitt Burns Inc., and CIBC World Markets Inc., acted as joint lead agents and AltaCorp Capital Inc. and Desjardins Securities In ...

... TD Securities Inc., RBC Dominion Securities Inc., and Scotia Capital Inc. acted as joint lead agents and joint bookrunners for the offering of the medium-term notes. BMO Nesbitt Burns Inc., and CIBC World Markets Inc., acted as joint lead agents and AltaCorp Capital Inc. and Desjardins Securities In ...

JAMES M. SANFORD, CFA 107 STONEY HILL ROAD SAG

... Managing Director : Credit and Convertible Bond Sales -Market high yield, preferred/tier 1/hybrid securities, investment grade corporate, and convertible bonds to hedge funds and prop desks using firm-wide credit and equity research. -Spearhead expansion of ...

... Managing Director : Credit and Convertible Bond Sales -Market high yield, preferred/tier 1/hybrid securities, investment grade corporate, and convertible bonds to hedge funds and prop desks using firm-wide credit and equity research. -Spearhead expansion of ...

02.11.2016 Issue of Debt NOT FOR DISTRIBUTION, DIRECTLY OR

... the account or benefit of, U.S. persons (as such term is defined in Regulation S under the Securities Act), except pursuant to an exemption from the registration requirements of the Securities Act. No public offering of securities will be made in the United States or in any other jurisdiction where ...

... the account or benefit of, U.S. persons (as such term is defined in Regulation S under the Securities Act), except pursuant to an exemption from the registration requirements of the Securities Act. No public offering of securities will be made in the United States or in any other jurisdiction where ...

Saving and Capital Formation

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

use the following information for the next two problems

... return on assets (ROA). Each company has a 40 percent tax rate. Bedford, however, has a higher debt ratio and higher interest expense. Which of the following statements is most correct? a. The two companies have the same return on equity (ROE). b. Bedford has a higher return on equity (ROE). c. Bedf ...

... return on assets (ROA). Each company has a 40 percent tax rate. Bedford, however, has a higher debt ratio and higher interest expense. Which of the following statements is most correct? a. The two companies have the same return on equity (ROE). b. Bedford has a higher return on equity (ROE). c. Bedf ...

Fair Value Hierarchy In determining fair value, we utilize various

... various assumptions, such as credit spreads, the terms and liquidity of the instrument, the financial condition, operating results and credit ratings of the issuer or underlying company, the quoted market price of publicly traded securities with similar duration and yield, time value, yield curve, a ...

... various assumptions, such as credit spreads, the terms and liquidity of the instrument, the financial condition, operating results and credit ratings of the issuer or underlying company, the quoted market price of publicly traded securities with similar duration and yield, time value, yield curve, a ...

Disclosure of G-SIB indicators

... b. Unused portion of committed lines extended to other financial institutions c. Holdings of securities issued by other financial institutions: (1) Secured debt securities (2) Senior unsecured debt securities (3) Subordinated debt securities (4) Commercial paper (5) Equity securities (6) Offsetting ...

... b. Unused portion of committed lines extended to other financial institutions c. Holdings of securities issued by other financial institutions: (1) Secured debt securities (2) Senior unsecured debt securities (3) Subordinated debt securities (4) Commercial paper (5) Equity securities (6) Offsetting ...