REITs and Rising Interest Rates

... contrast, have shorter-term leases which are generally less vulnerable to rate increases. That said, the REITs in which Spectrum invests are investment-grade at the senior level, and typically fund themselves with moderate levels of debt with laddered maturities, and preferred stock. This funding mi ...

... contrast, have shorter-term leases which are generally less vulnerable to rate increases. That said, the REITs in which Spectrum invests are investment-grade at the senior level, and typically fund themselves with moderate levels of debt with laddered maturities, and preferred stock. This funding mi ...

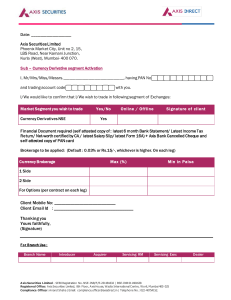

Client Email Id : Thanking you Yours faithfu

... A xis Securities Limited - SEBI Registration No. NSE-INB/F/E-231481632 | BSE-INB 011481638 Registered Office: Axis Securities Limited, 8th Floor, Axis House, Wadia International Centre, Worli, Mumbai 400 025 Compliance Officer: Anand Shaha | Email: compliance.officer@axisdirect.in | Telephone No.: 0 ...

... A xis Securities Limited - SEBI Registration No. NSE-INB/F/E-231481632 | BSE-INB 011481638 Registered Office: Axis Securities Limited, 8th Floor, Axis House, Wadia International Centre, Worli, Mumbai 400 025 Compliance Officer: Anand Shaha | Email: compliance.officer@axisdirect.in | Telephone No.: 0 ...

Biggest Player

... Corporate and Government Rating Services - Provides credit analysis services for corporates, project finances, public financings and financial service ...

... Corporate and Government Rating Services - Provides credit analysis services for corporates, project finances, public financings and financial service ...

Short-Term Finance and Planning

... Size of investments in current assets Flexible (conservative) policy – maintain a high ratio of current assets to sales Restrictive (aggressive) policy – maintain a low ratio of current assets to sales ...

... Size of investments in current assets Flexible (conservative) policy – maintain a high ratio of current assets to sales Restrictive (aggressive) policy – maintain a low ratio of current assets to sales ...

Flltext - Brunel University Research Archive

... Notably, a flawed innovation in the US in the 2000s was the private securitisation giving rise to lax underwriting that can in turn be traced to perverse incentives. It is evident that there is a great deal of “path dependence” in housing finance and therefore radical innovations from elsewhere are ...

... Notably, a flawed innovation in the US in the 2000s was the private securitisation giving rise to lax underwriting that can in turn be traced to perverse incentives. It is evident that there is a great deal of “path dependence” in housing finance and therefore radical innovations from elsewhere are ...

Chapter 9 - McGraw Hill Higher Education

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. 10. Pre ...

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. 10. Pre ...

November 2007 Testimony to Joint Economic Committee of Congress

... intensified investors' concerns about credit market developments and the implications of the downturn in the housing market for economic growth. In addition, further sharp increases in crude oil prices have put renewed upward pressure on inflation and may impose further restraint on economic activit ...

... intensified investors' concerns about credit market developments and the implications of the downturn in the housing market for economic growth. In addition, further sharp increases in crude oil prices have put renewed upward pressure on inflation and may impose further restraint on economic activit ...

Version A Exam 2 SAMPLE Problems FINAN420

... c. A decrease in the availability of short-term borrowed funds d. An increase in requests by depositors to withdraw large amounts of deposits e. A decrease in asset prices in securities held in the investment portfolio 4. Which of the following observations about the repricing model is correct? a. I ...

... c. A decrease in the availability of short-term borrowed funds d. An increase in requests by depositors to withdraw large amounts of deposits e. A decrease in asset prices in securities held in the investment portfolio 4. Which of the following observations about the repricing model is correct? a. I ...

Another Great Recession Possible?

... investors make money. This practice is like buying a life insurance on someone who is dying, hoping that he or she dies. Mortgage-backed securities (MBS), portrayed as the culprit behind the Great Recession, are complicated enough as is. In practice, the concept is even more complicated by encompas ...

... investors make money. This practice is like buying a life insurance on someone who is dying, hoping that he or she dies. Mortgage-backed securities (MBS), portrayed as the culprit behind the Great Recession, are complicated enough as is. In practice, the concept is even more complicated by encompas ...

Cost of borrowing and credit risk management

... to credit ratings using statistical models, hence further reducing judgmental flexibility. The IRM approach will generally have a number of effects on corporate borrowers and bond issuers. Significantly, the cost of borrowing for some higher-rated entities may fall, whereas the cost for lowly-rated ...

... to credit ratings using statistical models, hence further reducing judgmental flexibility. The IRM approach will generally have a number of effects on corporate borrowers and bond issuers. Significantly, the cost of borrowing for some higher-rated entities may fall, whereas the cost for lowly-rated ...

Weekly Commentary 07-05-11 PAA

... If that looks like Greek to you, that’s because, well, it is. It’s Greek for “extend and pretend” and that’s what happened last week to Greece’s debt problem. Deeply in debt, Greece’s parliament passed legislation filled with tax increases, spending cuts, and privatization plans “aimed at meeting Eu ...

... If that looks like Greek to you, that’s because, well, it is. It’s Greek for “extend and pretend” and that’s what happened last week to Greece’s debt problem. Deeply in debt, Greece’s parliament passed legislation filled with tax increases, spending cuts, and privatization plans “aimed at meeting Eu ...

Chapter Seven

... • This dividend is not enforceable but no payment to common stockholders can be made before the dividend to preferred stocks can be paid. • Small Company Offering Registration (SCOR) - allows small businesses to sell stocks to the public. ...

... • This dividend is not enforceable but no payment to common stockholders can be made before the dividend to preferred stocks can be paid. • Small Company Offering Registration (SCOR) - allows small businesses to sell stocks to the public. ...

A1.2 - DFSA

... (7) Asset backed Securities 7.1 Information on: a. Type of assets that back the Securities (i) securities and trading details; (ii) assets contain material proportion of equity securities; (iii) assets comprise obligations not traded on exchange; (iv) assets secured by or backed by real property; (v ...

... (7) Asset backed Securities 7.1 Information on: a. Type of assets that back the Securities (i) securities and trading details; (ii) assets contain material proportion of equity securities; (iii) assets comprise obligations not traded on exchange; (iv) assets secured by or backed by real property; (v ...

On June 23 the ECB allowed European banks and

... sector remains solvent – banks can essentially sit on the funds and pay 1% to remain afloat for the next year – the hope is that the money will help to ease credit availability. In theory the funds would bring banks well above minimum reserve requirements – cash that is required to be kept readily a ...

... sector remains solvent – banks can essentially sit on the funds and pay 1% to remain afloat for the next year – the hope is that the money will help to ease credit availability. In theory the funds would bring banks well above minimum reserve requirements – cash that is required to be kept readily a ...

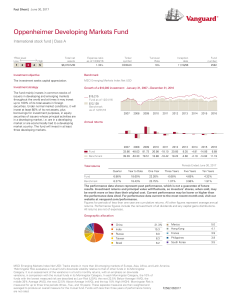

Oppenheimer Developing Markets Fund - Vanguard

... disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Concentrating assets in small-capitalization stocks may subject the portfolio to the risk that those stocks underperform other capitalizations or the market as a ...

... disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Concentrating assets in small-capitalization stocks may subject the portfolio to the risk that those stocks underperform other capitalizations or the market as a ...

Legg Mason Western Asset US Money Market Fund

... 2. Source: Legg Mason, as of 31 December 2014. Portfolio allocations, holdings and characteristics are subject to change at any time. 3. Source: Legg Mason, as of 31 December 2014. Weighted Average. Credit Quality: Nationally Recognised Statistical Rating Organisation’s (NRSRO’s) assess the likeliho ...

... 2. Source: Legg Mason, as of 31 December 2014. Portfolio allocations, holdings and characteristics are subject to change at any time. 3. Source: Legg Mason, as of 31 December 2014. Weighted Average. Credit Quality: Nationally Recognised Statistical Rating Organisation’s (NRSRO’s) assess the likeliho ...