Calamos Total Return Bond Fund

... bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are descri ...

... bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are descri ...

Topics – Student Loan Market – Financial Risk – Enrollment Risk

... Wales Grant, Pell, SEOG, Stafford Loan and State grants (each is set to meet a percentage of need) – Average institutional awards for freshmen $8215 • Junior and senior awards determined based on need, ...

... Wales Grant, Pell, SEOG, Stafford Loan and State grants (each is set to meet a percentage of need) – Average institutional awards for freshmen $8215 • Junior and senior awards determined based on need, ...

What Agencies Can Expect Accessing Bank Capital in

... make a loan to your agency secured by the assets of the business (rather than based on mortgages on the principal’s residences) here’s what you can expect: Acquisitions. For most acquisitions or internal purchases, a fully-amortizing five to seven-year term loan is standard. Usually an acquisition w ...

... make a loan to your agency secured by the assets of the business (rather than based on mortgages on the principal’s residences) here’s what you can expect: Acquisitions. For most acquisitions or internal purchases, a fully-amortizing five to seven-year term loan is standard. Usually an acquisition w ...

III.1 Guidelines on Debt Securities

... programs. These short-term credit ratings can therefore be used as the “credit rating of the security” in relation to all of the issuer’s senior unsecured obligations with an original maturity of less than one year, regardless of the currency or market in which the obligations are issued. ...

... programs. These short-term credit ratings can therefore be used as the “credit rating of the security” in relation to all of the issuer’s senior unsecured obligations with an original maturity of less than one year, regardless of the currency or market in which the obligations are issued. ...

Key Issues for Reporters

... by the DR issuer should not be reported by the DR issuer, as this would lead to double counting. ...

... by the DR issuer should not be reported by the DR issuer, as this would lead to double counting. ...

semester v cm05bba05 – investment management

... 43. The promoter of the mutual fund is called ………………….. a. Mutual fund trust b. AMC c. Sponsor d. Custodian 44. Among public sector mutual funds …………………. Or ……………… act as custodian a. Sponsor or trustee b. Sponsor or AMC c. Trustee or AMC d. Trustee or registar 45. The small fraction of mutual fund ...

... 43. The promoter of the mutual fund is called ………………….. a. Mutual fund trust b. AMC c. Sponsor d. Custodian 44. Among public sector mutual funds …………………. Or ……………… act as custodian a. Sponsor or trustee b. Sponsor or AMC c. Trustee or AMC d. Trustee or registar 45. The small fraction of mutual fund ...

Gaining Trust

... debt in those countries to trade at yields below zero. With almost all of the negative-yield debt concentrated in Europe and Japan, investors are flocking to Treasuries, which offer some of the highest yields among industrialized nations. This has caused the yield on the average 10-year security to ...

... debt in those countries to trade at yields below zero. With almost all of the negative-yield debt concentrated in Europe and Japan, investors are flocking to Treasuries, which offer some of the highest yields among industrialized nations. This has caused the yield on the average 10-year security to ...

PDF - Treasury Strategies

... All represent borrowing needs with longer terms than the deposits that are transformed to fund them. Inherently, the NSFR proposal detracts from this maturity transformation function of banks. It does so by creating a disincentive for longer-term (greater than one year) loans. It also establishes a ...

... All represent borrowing needs with longer terms than the deposits that are transformed to fund them. Inherently, the NSFR proposal detracts from this maturity transformation function of banks. It does so by creating a disincentive for longer-term (greater than one year) loans. It also establishes a ...

Annual Disclosure Statement

... pledged account(s). If the equity in your account falls below the maintenance margin or loan collateral requirements or UBS Financial Services Inc.’s or an affiliate’s higher “house” requirements, we can sell the securities or other assets in any of your account(s) held at UBS Financial Services Inc ...

... pledged account(s). If the equity in your account falls below the maintenance margin or loan collateral requirements or UBS Financial Services Inc.’s or an affiliate’s higher “house” requirements, we can sell the securities or other assets in any of your account(s) held at UBS Financial Services Inc ...

The Irresistible Case for Moveable Collateral

... were significantly correlated with increased bank lending and the impact was particularly strong if the country was highly ranked in terms of creditor rights. 8 ...

... were significantly correlated with increased bank lending and the impact was particularly strong if the country was highly ranked in terms of creditor rights. 8 ...

report - Blackpool Council

... The Council’s total borrowing powers at 31st March 2011 (the Authorised Limit) stood at £268m. New long-term loans totalling £15m were raised during 2010/11. Long-term borrowing of £10m was taken in April 2010 at a rate of 4.68% and will be repaid at maturity. A further £5m was borrowed in August 20 ...

... The Council’s total borrowing powers at 31st March 2011 (the Authorised Limit) stood at £268m. New long-term loans totalling £15m were raised during 2010/11. Long-term borrowing of £10m was taken in April 2010 at a rate of 4.68% and will be repaid at maturity. A further £5m was borrowed in August 20 ...

private placement bonds and commercial mortgage loans.

... about deteriorated credit, if the purpose of the sale is to avoid expected future losses from failure to pay interest and/or principal under the terms of the contract. ...

... about deteriorated credit, if the purpose of the sale is to avoid expected future losses from failure to pay interest and/or principal under the terms of the contract. ...

Commercial Mortgage_Private RE Debt Strategies_Global.indd

... surprised to learn that over the past 35 years commercial and multifamily mortgages delivered total returns comparable to real estate equity returns and in excess of corporate bond returns. Exhibit 7 illustrates the difference in returns for corporate equity, real estate equity, real estate debt and ...

... surprised to learn that over the past 35 years commercial and multifamily mortgages delivered total returns comparable to real estate equity returns and in excess of corporate bond returns. Exhibit 7 illustrates the difference in returns for corporate equity, real estate equity, real estate debt and ...

JETBLUE AIRWAYS CORP (Form: 3, Received: 03/02

... of JetBlue Airways Corporation, a Delaware corporation the Company) individually to execute for and on behalf of the undersigned, in the undersigned's capacity as an officer of the Company, Form ID, Forms 3,4 and 5, and any amendments thereto, and cause such form(s) to be filed with the United State ...

... of JetBlue Airways Corporation, a Delaware corporation the Company) individually to execute for and on behalf of the undersigned, in the undersigned's capacity as an officer of the Company, Form ID, Forms 3,4 and 5, and any amendments thereto, and cause such form(s) to be filed with the United State ...

CH. 4 KEY - Allen ISD

... How might political or national events affect the flow of deposits in the banking system? Events or political pressure could encourage the FEDS to buy or sell bonds (govt securities) or adjust the discount rate Give examples of daily economic activities that are more likely to have predictable effec ...

... How might political or national events affect the flow of deposits in the banking system? Events or political pressure could encourage the FEDS to buy or sell bonds (govt securities) or adjust the discount rate Give examples of daily economic activities that are more likely to have predictable effec ...

It is not appropriate to discount the cash flows of a bond by the yield

... strategy that produces an interest rate risk exposure if the expected return from the investment strategy or expected cost from borrowing strategy is sufficient to compensate for the additional interest rate risk exposure. The term structure theories discussed in the text (pages 111-116) are predica ...

... strategy that produces an interest rate risk exposure if the expected return from the investment strategy or expected cost from borrowing strategy is sufficient to compensate for the additional interest rate risk exposure. The term structure theories discussed in the text (pages 111-116) are predica ...

Chapter 19

... • Forecast of cash inflows and outflows over the next short-term planning period • Primary tool in short-term financial planning • Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover working-capital costs • Allows a company to plan ahead and begin ...

... • Forecast of cash inflows and outflows over the next short-term planning period • Primary tool in short-term financial planning • Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover working-capital costs • Allows a company to plan ahead and begin ...

Alternative Investment Exposures at Endowments

... Annualized monthly volatility is lower than daily volatility ...

... Annualized monthly volatility is lower than daily volatility ...

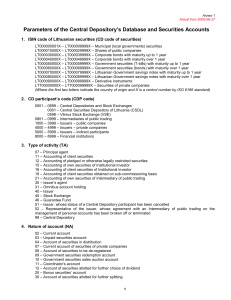

1. ISIN code of Lithuanian securities (CD code of securities)

... 10 – Government securities sales auction account 11 – Coordinator’s account 12 – Account of securities allotted for further choice of dividend 20 – Bonus securities’ account 30 – Account of securities allotted for further splitting ...

... 10 – Government securities sales auction account 11 – Coordinator’s account 12 – Account of securities allotted for further choice of dividend 20 – Bonus securities’ account 30 – Account of securities allotted for further splitting ...

Intercontinental Exchange, Inc. (Form: 4, Received: 03/14

... Note: File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number ...

... Note: File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number ...