RTF - OTC Markets

... legally designated officer of the State in which the Issuer maintains its principal place of business and any State in which this notice is filed, as its agents for service of process, and agreeing that these persons may accept service on its behalf, of any notice, process or pleading, and further a ...

... legally designated officer of the State in which the Issuer maintains its principal place of business and any State in which this notice is filed, as its agents for service of process, and agreeing that these persons may accept service on its behalf, of any notice, process or pleading, and further a ...

Simple Interest Name Homework Period ______ Find the interest

... 7) Paige deposited $1277 in a savings account. How much would she have in the account after 3 years at an annual simple interest rate of 4%? ...

... 7) Paige deposited $1277 in a savings account. How much would she have in the account after 3 years at an annual simple interest rate of 4%? ...

PROVIDENT FINANCIAL PLC £2,000,000,000 Euro Medium Term

... does develop, it may not be very liquid. Therefore, investors may not be able to sell their Notes easily or at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. This is particularly the case for Notes that are especially sensitive to ...

... does develop, it may not be very liquid. Therefore, investors may not be able to sell their Notes easily or at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. This is particularly the case for Notes that are especially sensitive to ...

The Role of Financial Markets and Institutions(1)

... Equity Securities: Claim with ownership rights and responsibilities ...

... Equity Securities: Claim with ownership rights and responsibilities ...

Key Investor Information Franklin Global Aggregate Investment

... or more rating agency, or if not rated be deemed comparable quality by the investment team. The Fund aims to maximise investment return over the medium to long term through a combination of income, capital appreciation and currency gains while approximating the benchmark (Bloomberg Barclays Global A ...

... or more rating agency, or if not rated be deemed comparable quality by the investment team. The Fund aims to maximise investment return over the medium to long term through a combination of income, capital appreciation and currency gains while approximating the benchmark (Bloomberg Barclays Global A ...

Schroder USD Bond Fund

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

Personal Finance and Portfolio Management Strategies Module Exam

... cash for a down payment, so he needs an $8,000 loan. In shopping at several banks for an installment loan, he learns that the interest is quoted on most automobile loans at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed, although a portion of the pri ...

... cash for a down payment, so he needs an $8,000 loan. In shopping at several banks for an installment loan, he learns that the interest is quoted on most automobile loans at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed, although a portion of the pri ...

Personal Finance and Portfolio Management Strategies Module Exam

... cash for a down payment, so he needs an $8,000 loan. In shopping at several banks for an installment loan, he learns that the interest is quoted on most automobile loans at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed, although a portion of the pri ...

... cash for a down payment, so he needs an $8,000 loan. In shopping at several banks for an installment loan, he learns that the interest is quoted on most automobile loans at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed, although a portion of the pri ...

Texans Credit Union names new Chief Operating Officer

... In this role, Ms. Chisnall will be overseeing several major areas of the credit union, including the management of Texans’ branch network and the full-service call center (e-Branch), Business Development, Marketing, Emerging Technology, Member Account Services, and Training and Development. Ms. Chis ...

... In this role, Ms. Chisnall will be overseeing several major areas of the credit union, including the management of Texans’ branch network and the full-service call center (e-Branch), Business Development, Marketing, Emerging Technology, Member Account Services, and Training and Development. Ms. Chis ...

Financial Reporting and Analysis Chapter 11 Web Solutions

... Continuing our discussion from requirement 2, the “underlying instrument” is the original fixed-rate debt. If the debt itself is settled (meaning retired) before the swap contract is settled, the swap becomes a speculative investment (not a hedging instrument) since there is no longer a “hedged item ...

... Continuing our discussion from requirement 2, the “underlying instrument” is the original fixed-rate debt. If the debt itself is settled (meaning retired) before the swap contract is settled, the swap becomes a speculative investment (not a hedging instrument) since there is no longer a “hedged item ...

ratio-presentation-2013-revised

... Based on the following factors, we decided to issue an RFP for a tax-exempt direct purchase bond financing rather than public market bond debt on Trinity’s credit rating: Costs to secure funds are lower for direct purchase No public market “red tape” and disclosure to deal with No need for or ...

... Based on the following factors, we decided to issue an RFP for a tax-exempt direct purchase bond financing rather than public market bond debt on Trinity’s credit rating: Costs to secure funds are lower for direct purchase No public market “red tape” and disclosure to deal with No need for or ...

Slides

... – Encompass the analysis by Laubach (2009) including fiscal deficits/debt and expand to also consider CB balance sheet size • Result: An increase in CB assets is associated with a decline in long-term forward rates (c.p.) 11/21 ...

... – Encompass the analysis by Laubach (2009) including fiscal deficits/debt and expand to also consider CB balance sheet size • Result: An increase in CB assets is associated with a decline in long-term forward rates (c.p.) 11/21 ...

general investment information

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

... ISSUER AGREES TO REPAY THE BONDHOLDER AT THE MATURITY DATE. (face value) THE COUPON RATE IS THE RATE OF INTEREST THAT THE ISSUER AGREES TO PAY EACH YEAR. (Example : a bond with an 8% coupon and a principal of $1000 will pay annual interest of $ 80 ) WHAT ARE ZERO-COUPON BONDS ? ...

Main features of Regulatory Capital instruments

... General reserve for credit losses; and Member investment securities (MIS). Retained profits Represents the accumulated net earnings of the Credit Union less any dividends paid on MIS. Retained profits are primarily used by the Credit Union to be reinvested in its primary activities. Redeemed share c ...

... General reserve for credit losses; and Member investment securities (MIS). Retained profits Represents the accumulated net earnings of the Credit Union less any dividends paid on MIS. Retained profits are primarily used by the Credit Union to be reinvested in its primary activities. Redeemed share c ...

ageing and financial stability

... slow growing EMEs…but also central bank vigilance during overall process ...

... slow growing EMEs…but also central bank vigilance during overall process ...

What`s Ahead for EU Mortgage Markets? ELRA General Assembly

... Margins left little room for further price reductions Market completeness level: could be improved in principle However, the crisis has changed the landscape: Lenders tend to avoid new risky undertakings, to fall back on markets they know best; Prices are increasing (re-evaluation of risk, ...

... Margins left little room for further price reductions Market completeness level: could be improved in principle However, the crisis has changed the landscape: Lenders tend to avoid new risky undertakings, to fall back on markets they know best; Prices are increasing (re-evaluation of risk, ...

FIN-121 Personal Finance

... financial opportunities, resolve personal financial problems, achieve self-satisfactions and strive towards financial security. ...

... financial opportunities, resolve personal financial problems, achieve self-satisfactions and strive towards financial security. ...

The cost of capital reflects the cost of funds

... 32. ________ ratios are a measure of the speed with which various accounts are converted into sales or cash. A) Activity B) Liquidity C) Debt D) Profitability 33. The ________ ratio measures the firm's ability to pay contractual interest payments. A) times interest earned B) fixed-payment coverage C ...

... 32. ________ ratios are a measure of the speed with which various accounts are converted into sales or cash. A) Activity B) Liquidity C) Debt D) Profitability 33. The ________ ratio measures the firm's ability to pay contractual interest payments. A) times interest earned B) fixed-payment coverage C ...

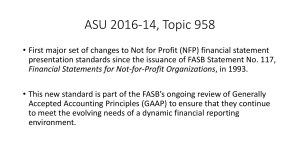

Slides - AWSCPA Houston

... presentation standards since the issuance of FASB Statement No. 117, Financial Statements for Not-for-Profit Organizations, in 1993. • This new standard is part of the FASB’s ongoing review of Generally Accepted Accounting Principles (GAAP) to ensure that they continue to meet the evolving needs of ...

... presentation standards since the issuance of FASB Statement No. 117, Financial Statements for Not-for-Profit Organizations, in 1993. • This new standard is part of the FASB’s ongoing review of Generally Accepted Accounting Principles (GAAP) to ensure that they continue to meet the evolving needs of ...