MBF 3CI Personal Finance: Some Investment Alternatives Basic

... Basic Investment Terminology: Investment: the use of money in hopes to make more money. One who invests money is an investor. Risk: The probability that an investment will lose its value. Note: High risk investments usually have a higher interest rate than low risk investments. (Do you know why?) Te ...

... Basic Investment Terminology: Investment: the use of money in hopes to make more money. One who invests money is an investor. Risk: The probability that an investment will lose its value. Note: High risk investments usually have a higher interest rate than low risk investments. (Do you know why?) Te ...

Customers benefit from the merger

... (to elect board members) HSR filing may be required prior to the conversion if thresholds are met ...

... (to elect board members) HSR filing may be required prior to the conversion if thresholds are met ...

A BEHAVIORAL MODEL OF THE PERFORMANCES FOR E

... high positive returns on long term bonds and along term interest rates will fall). The crisis leads to a jump in inflation that has a greater detrimental impact on long-term bonds, and so they imply a high risk premium relative to short-term bonds. This partially explains the upward slope of the nom ...

... high positive returns on long term bonds and along term interest rates will fall). The crisis leads to a jump in inflation that has a greater detrimental impact on long-term bonds, and so they imply a high risk premium relative to short-term bonds. This partially explains the upward slope of the nom ...

CAPSTEAD MORTGAGE CORP (Form: 8-K, Received: 01

... increasing 85 basis points to end the year at 2.45%. As a consequence, longer duration mortgage-backed securities lost considerable value. For instance, Fannie Mae 30-year fixed 3.0% mortgage securities declined in price by approximately 4.75% during this period. In contrast, Capstead’s ARM securiti ...

... increasing 85 basis points to end the year at 2.45%. As a consequence, longer duration mortgage-backed securities lost considerable value. For instance, Fannie Mae 30-year fixed 3.0% mortgage securities declined in price by approximately 4.75% during this period. In contrast, Capstead’s ARM securiti ...

Policies and Procedures

... It is the policy of [insert the name of your bank] to comply with the interagency guidance on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices, issued in December 2006 (see 71 FR 238, p. 74580), with our general loan policy relating to the origination of commercial r ...

... It is the policy of [insert the name of your bank] to comply with the interagency guidance on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices, issued in December 2006 (see 71 FR 238, p. 74580), with our general loan policy relating to the origination of commercial r ...

Intergrated Bank Corporation (IBC) is a medium

... costs totaling 40 basis points when originating new (zero-point) mortgages. Refinancing only makes economic sense if the future interest rate savings from refinancing at least cover the refinancing costs. Second, some homeowners may simply not be paying attention and, thus, don’t get around to refin ...

... costs totaling 40 basis points when originating new (zero-point) mortgages. Refinancing only makes economic sense if the future interest rate savings from refinancing at least cover the refinancing costs. Second, some homeowners may simply not be paying attention and, thus, don’t get around to refin ...

File

... Financial Instruments and Markets (Cont.) • Derivatives: Options and Futures Contracts – Contractual agreement between two parties to exchange a third asset in the future at a stated price – Often called derivative financial instruments because they derive value from underlying assets – Long—Buyer ...

... Financial Instruments and Markets (Cont.) • Derivatives: Options and Futures Contracts – Contractual agreement between two parties to exchange a third asset in the future at a stated price – Often called derivative financial instruments because they derive value from underlying assets – Long—Buyer ...

UNIT V

... book keeping, there will be credit for every debit and there will not be any debit without credit. When this principle is followed in writing journal entries, the total amount of all debits is equal to the total amount all credits. A trail balance is a statement of debit and credit balances. It is p ...

... book keeping, there will be credit for every debit and there will not be any debit without credit. When this principle is followed in writing journal entries, the total amount of all debits is equal to the total amount all credits. A trail balance is a statement of debit and credit balances. It is p ...

Evaluating the Australian Bond Market through a Global Lens

... While credit securities can provide additional yield to portfolios it is important not to fall into the trap of putting all your in eggs one basket. Historically credit cycles through time show that portfolios are likely to be exposed to similar risks / have a high correlation to equities during ine ...

... While credit securities can provide additional yield to portfolios it is important not to fall into the trap of putting all your in eggs one basket. Historically credit cycles through time show that portfolios are likely to be exposed to similar risks / have a high correlation to equities during ine ...

APPLICATION FOR REGULAR PREMIUM PAYMENT BY CREDIT

... All authorisations referred in this application shall remain in force until receipt of the Policyowner or Cardholder’s revocation to Prudential. 10. Each of the specific authorisations set out in this application shall be in addition to any other consent and/or disclosure that the Policyowner or Car ...

... All authorisations referred in this application shall remain in force until receipt of the Policyowner or Cardholder’s revocation to Prudential. 10. Each of the specific authorisations set out in this application shall be in addition to any other consent and/or disclosure that the Policyowner or Car ...

Investment Policy

... The investment officers must review the City’s existing assets within a reasonable time after becoming the investment officers. The investment officers then, as a prudent investor, must make decisions concerning the retention or disposition of the existing assets. The investment officers are require ...

... The investment officers must review the City’s existing assets within a reasonable time after becoming the investment officers. The investment officers then, as a prudent investor, must make decisions concerning the retention or disposition of the existing assets. The investment officers are require ...

Fixed Income in a Rising Rate Enviornment

... of economic expansion that cause rates to rise, market risk premiums typically decline. When times are good, investors demand less of a risk premium because they are more confident they will get their money back. Wider starting credit spread levels have more room to tighten. This may help reduce the ...

... of economic expansion that cause rates to rise, market risk premiums typically decline. When times are good, investors demand less of a risk premium because they are more confident they will get their money back. Wider starting credit spread levels have more room to tighten. This may help reduce the ...

investing in swaziland government treasury bills

... on behalf of the Government of Swaziland. When Tbills are bought, one cannot cash them before maturity but one can sell them in the secondary market either to a primary dealer or the Central Bank of Swaziland. Because they are government-backed securities, they can be and are recognized as collatera ...

... on behalf of the Government of Swaziland. When Tbills are bought, one cannot cash them before maturity but one can sell them in the secondary market either to a primary dealer or the Central Bank of Swaziland. Because they are government-backed securities, they can be and are recognized as collatera ...

Covered Bonds: FDIC Action Might Spur US Covered

... The cover pool must provide sufficient collateral to satisfy bondholder claims throughout the entire term of the covered bond. While in a typical securitization, the collateral consists of a fixed pool of mortgages that is constantly amortizing and pre-paying, in a covered bond transaction, the mort ...

... The cover pool must provide sufficient collateral to satisfy bondholder claims throughout the entire term of the covered bond. While in a typical securitization, the collateral consists of a fixed pool of mortgages that is constantly amortizing and pre-paying, in a covered bond transaction, the mort ...

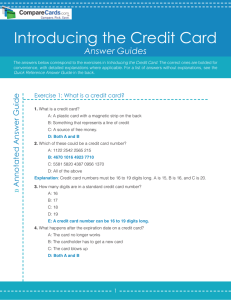

Introduction to Credit Card Answer Guide | CompareCards.com

... 1. B: False 2. C: The merchant, the acquirer, and the issuer 3. D: Authorization, batching, clearing, and funding 4. D: All of these will work as credit card payment options 5. B: $20 ...

... 1. B: False 2. C: The merchant, the acquirer, and the issuer 3. D: Authorization, batching, clearing, and funding 4. D: All of these will work as credit card payment options 5. B: $20 ...

Short-term financing

... 2. Secured Loans – requires a collateral back-up usually for accounts receivable financing or inventory financing. (a collateral is usually required when the credit standing of the borrower is inadequate to permit unsecured loan). Page 13 ...

... 2. Secured Loans – requires a collateral back-up usually for accounts receivable financing or inventory financing. (a collateral is usually required when the credit standing of the borrower is inadequate to permit unsecured loan). Page 13 ...

Aucun titre de diapositive

... compared with non bank fund managers due to the operational risk capital they will now have to maintain • If a bank can structure a loan to reduce LGD by half, the capital requirement falls by half. Banks may respond by giving more emphasis to LGD. This is called “lending on collateral”. It has been ...

... compared with non bank fund managers due to the operational risk capital they will now have to maintain • If a bank can structure a loan to reduce LGD by half, the capital requirement falls by half. Banks may respond by giving more emphasis to LGD. This is called “lending on collateral”. It has been ...

BANK INTEREST RATE MARGINS

... other sources of funds (for example, by issues of securities such as promissory notes, convertible notes, or preference shares) and will generally be prepared to pay only a small premium to an intermediary for finance. For smaller borrowers, customer margins are wider reflecting the fact that, on av ...

... other sources of funds (for example, by issues of securities such as promissory notes, convertible notes, or preference shares) and will generally be prepared to pay only a small premium to an intermediary for finance. For smaller borrowers, customer margins are wider reflecting the fact that, on av ...