Introduction to Stripped Yield

... About half the traded issues have a floating coupon Fixed- and floating-rate issues trade side by side and are purchased by the same investors “Unusual” features are common Many bonds have principal collateral and rolling interest guarantees ...

... About half the traded issues have a floating coupon Fixed- and floating-rate issues trade side by side and are purchased by the same investors “Unusual” features are common Many bonds have principal collateral and rolling interest guarantees ...

A CRITIQUE OF THE QUANTITY THEORY OF MONEY

... was destroying society’s capital, has been ignored. The budding financial crisis was explained away through ad hoc reasoning, such as blaming it on loose credit standards, subprime mortgages, and the like. Nothing was done to stop the real cause of the disaster, the fast-breeder of debt. On the cont ...

... was destroying society’s capital, has been ignored. The budding financial crisis was explained away through ad hoc reasoning, such as blaming it on loose credit standards, subprime mortgages, and the like. Nothing was done to stop the real cause of the disaster, the fast-breeder of debt. On the cont ...

Generation Y`s steep financial hurdles: Huge debt, no savings

... But many who are just graduating from college are having trouble starting out with an entry-level job in their field. Some can find only unpaid internships. And because entry-level jobs generally offer low pay, graduates who are overwhelmed with debt may have to seek better-paying, non-professional ...

... But many who are just graduating from college are having trouble starting out with an entry-level job in their field. Some can find only unpaid internships. And because entry-level jobs generally offer low pay, graduates who are overwhelmed with debt may have to seek better-paying, non-professional ...

Selecting sources of finance for business

... working capital requirements are expected to grow by 10% in the coming year. The corporation tax bill is expected to be $120m. Tax and dividends are paid nine months after the year end. Required: Calculate ABC’s expected net cash flow for the year ending 30 June 20X4 without the new investment. Com ...

... working capital requirements are expected to grow by 10% in the coming year. The corporation tax bill is expected to be $120m. Tax and dividends are paid nine months after the year end. Required: Calculate ABC’s expected net cash flow for the year ending 30 June 20X4 without the new investment. Com ...

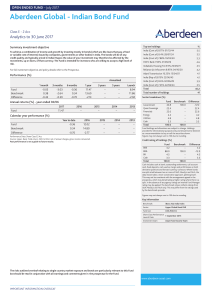

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... PURCHASE, N.Y., July 19, 2002 – PepsiCo announced today that its Board of Directors has authorized the company to buy back up to $5 billion of common stock over the next three years. The new program goes into effect immediately, and PepsiCo said it expects to begin buying back shares next week. Peps ...

... PURCHASE, N.Y., July 19, 2002 – PepsiCo announced today that its Board of Directors has authorized the company to buy back up to $5 billion of common stock over the next three years. The new program goes into effect immediately, and PepsiCo said it expects to begin buying back shares next week. Peps ...

Chapter 22: Borrowing Models Simple Interest

... Simple Interest Borrowing One side of consumer finance is saving money, and the other side is borrowing money—both involve interest accumulation. If a consumer wants to buy a large item but does not have the money to pay for it, he/she may choose to borrow the money, which will result in havin ...

... Simple Interest Borrowing One side of consumer finance is saving money, and the other side is borrowing money—both involve interest accumulation. If a consumer wants to buy a large item but does not have the money to pay for it, he/she may choose to borrow the money, which will result in havin ...

2017 2018 policy i borrowing framework policy

... A Bond is an instrument used by Government and Parastatals such as Telkom, Eskom, Transnet, Corporates and Municipalities to raise loan capital on the open market. Bond holders have the right to interest, usually paid on a semi annual basis, and the repayment of the capital amount reflected on the s ...

... A Bond is an instrument used by Government and Parastatals such as Telkom, Eskom, Transnet, Corporates and Municipalities to raise loan capital on the open market. Bond holders have the right to interest, usually paid on a semi annual basis, and the repayment of the capital amount reflected on the s ...

The Trialogue on Key Information Documents for Investment Products

... Deutsches Aktieninstitut follows the legislative process on “Key information documents for investment products” with close interest. We expressed our concern against the extension of the regulation’s scope to financial instruments which are not “packaged” – e.g. corporate bonds and shares. Such an e ...

... Deutsches Aktieninstitut follows the legislative process on “Key information documents for investment products” with close interest. We expressed our concern against the extension of the regulation’s scope to financial instruments which are not “packaged” – e.g. corporate bonds and shares. Such an e ...

Falling US Mortgage Rates

... Economic jitters have pushed mortgage rates back down to levels not seen since July. That's good news both for procrastinators who missed out on last year's refinancing boom and for home buyers looking to keep costs down. Rates on 30-year fixed rate mortgages currently average 5.82 percent, accordin ...

... Economic jitters have pushed mortgage rates back down to levels not seen since July. That's good news both for procrastinators who missed out on last year's refinancing boom and for home buyers looking to keep costs down. Rates on 30-year fixed rate mortgages currently average 5.82 percent, accordin ...

Financial Ratios and Meanings

... Meaning: Measures the ability to meet current obligations in a timely manner. A healthy current ratio is greater than 2. Improve by: Increase current assets by increasing profit, selling additional capital stock, borrowing additional long term debt, or disposing of unproductive fixed assets and reta ...

... Meaning: Measures the ability to meet current obligations in a timely manner. A healthy current ratio is greater than 2. Improve by: Increase current assets by increasing profit, selling additional capital stock, borrowing additional long term debt, or disposing of unproductive fixed assets and reta ...

Understanding Your Credit Report

... report. "Hard" inquiries are ones that you initiate when you fill out a credit application, and "soft" inquiries are generated in two ways: by promotional companies that want to pre-qualify you for an offer, and by current creditors who are looking in on your account. Your credit scores ignore any i ...

... report. "Hard" inquiries are ones that you initiate when you fill out a credit application, and "soft" inquiries are generated in two ways: by promotional companies that want to pre-qualify you for an offer, and by current creditors who are looking in on your account. Your credit scores ignore any i ...

Personal Strategy Balanced Portfolio

... While the fund’s bond investments are expected to primarily be investment grade, the fund may invest in bonds that are rated below investment grade, also known as high yield or “junk” bonds, including those with the lowest credit rating. High yield bond issuers are more likely to suffer an adverse c ...

... While the fund’s bond investments are expected to primarily be investment grade, the fund may invest in bonds that are rated below investment grade, also known as high yield or “junk” bonds, including those with the lowest credit rating. High yield bond issuers are more likely to suffer an adverse c ...

BlackRock US Corporate Bond Index Fund

... Under Irish law, BFIDF has segregated liability between its sub-funds (i.e. the Fund’s assets will not be used to discharge the liabilities of other sub-funds within BFIDF). In addition, the Fund’s assets are held separately from the assets of other sub-funds. Investors may switch their shares in th ...

... Under Irish law, BFIDF has segregated liability between its sub-funds (i.e. the Fund’s assets will not be used to discharge the liabilities of other sub-funds within BFIDF). In addition, the Fund’s assets are held separately from the assets of other sub-funds. Investors may switch their shares in th ...