Chapter 11 - Analysis of Financial Statements and Taxes

... operating CF,but changes in accounts payable ,accounts receivable ,inventories and accruals are also classified as operating CFs.( they are directly affected by the firm’s day-to-day operations) II. Investment CFs arise from the purchase or sale of plant ,property and equipment. III. Financing Cash ...

... operating CF,but changes in accounts payable ,accounts receivable ,inventories and accruals are also classified as operating CFs.( they are directly affected by the firm’s day-to-day operations) II. Investment CFs arise from the purchase or sale of plant ,property and equipment. III. Financing Cash ...

TIAA-CREF Global Natural Resources Fund

... The top 10 holdings are subject to change and may not be representative of the Fund's current or future investments. The holdings listed only include the Fund's long-term investments and may exclude any temporary cash investments and equity index products. Top holdings by issuer includes the underly ...

... The top 10 holdings are subject to change and may not be representative of the Fund's current or future investments. The holdings listed only include the Fund's long-term investments and may exclude any temporary cash investments and equity index products. Top holdings by issuer includes the underly ...

9 Ways to Increase Available Cash - Multi-SWAC

... On all overdue invoices, charge interest. Customers will pay up earlier rather than incur the interest charge. Ensure invoices show interest will be charged on all overdue accounts and the rate at which this is charged. 4. Ensure that there is a no nonsense program for going after slow paying custom ...

... On all overdue invoices, charge interest. Customers will pay up earlier rather than incur the interest charge. Ensure invoices show interest will be charged on all overdue accounts and the rate at which this is charged. 4. Ensure that there is a no nonsense program for going after slow paying custom ...

Rating Action: Moody`s assigns Aa3 rating to Connecticut`s Special

... For ratings issued on a program, series or category/class of debt, this announcement provides certain regulatory disclosures in relation to each rating of a subsequently issued bond or note of the same series or category/class of debt or pursuant to a program for which the ratings are derived exclus ...

... For ratings issued on a program, series or category/class of debt, this announcement provides certain regulatory disclosures in relation to each rating of a subsequently issued bond or note of the same series or category/class of debt or pursuant to a program for which the ratings are derived exclus ...

Are your bonds really `green`?

... Xetra, assuming normal market conditions and normally functioning computer systems. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary marke ...

... Xetra, assuming normal market conditions and normally functioning computer systems. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary marke ...

Mid-Term ACCT 5312 FALL 2008

... A. A listing of the organization's assets and liabilities. B. The ownership right of the owner(s) of the entity. C. Probable future sacrifices of economic benefits. D. All of the above. E. None of the above. 2. Accumulated depreciation on a balance sheet: A. Is part of owners' equity. B. Represents ...

... A. A listing of the organization's assets and liabilities. B. The ownership right of the owner(s) of the entity. C. Probable future sacrifices of economic benefits. D. All of the above. E. None of the above. 2. Accumulated depreciation on a balance sheet: A. Is part of owners' equity. B. Represents ...

Are your bonds really `green`?

... Xetra, assuming normal market conditions and normally functioning computer systems. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary marke ...

... Xetra, assuming normal market conditions and normally functioning computer systems. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary marke ...

AIF_Products Expanded Debt Capacity June 2010 Size

... ◦ Stable and resilient cash flows from business ◦ Control over cash flows through sale of assets or adequate legal structure ◦ Target investment grade rating to maximize access to investors and lower cost of capital Different leverage measurements Issues ◦ Favorable bankruptcy laws ◦ Inter-creditor ...

... ◦ Stable and resilient cash flows from business ◦ Control over cash flows through sale of assets or adequate legal structure ◦ Target investment grade rating to maximize access to investors and lower cost of capital Different leverage measurements Issues ◦ Favorable bankruptcy laws ◦ Inter-creditor ...

IRS Releases 871(m) Final Regulations – New Tests for Dividend

... reference to a single, fixed number of shares, provided that the number can be ascertained when the contract is issued, and for which there is a single maturity or exercise date with respect to which all amounts (other than an upfront payment and periodic payments) are required to be calculated with ...

... reference to a single, fixed number of shares, provided that the number can be ascertained when the contract is issued, and for which there is a single maturity or exercise date with respect to which all amounts (other than an upfront payment and periodic payments) are required to be calculated with ...

Exam #2 Review Material -

... b. a formal written contract outlining the terms by which the company will repay, typically including interest. c. an informal, verbal contract that outlines the terms by which the company will repay d. none of the above 29. What accounting principle is the reason we estimate and record the amount o ...

... b. a formal written contract outlining the terms by which the company will repay, typically including interest. c. an informal, verbal contract that outlines the terms by which the company will repay d. none of the above 29. What accounting principle is the reason we estimate and record the amount o ...

Small Business Financing at Big Banks and at

... Small business loan approval rates by big banks and institutional lenders reached post-recession highs in December 2014, according to the Biz2Credit Small Business Lending Index, a monthly analysis of 1,000 loan applications on Biz2Credit.com. Big banks ($10 billion+ in assets) approved 21.1% of sma ...

... Small business loan approval rates by big banks and institutional lenders reached post-recession highs in December 2014, according to the Biz2Credit Small Business Lending Index, a monthly analysis of 1,000 loan applications on Biz2Credit.com. Big banks ($10 billion+ in assets) approved 21.1% of sma ...

payment holiday - BondPlus Online

... consecutive repayments The additional funds will enable them to use the funds for an emergency, furnish their new home or use it for a holiday over the festive period. Example : Registration of a bond usually takes between 2 -3 months. If a client applies for a home loan and takes up the payment hol ...

... consecutive repayments The additional funds will enable them to use the funds for an emergency, furnish their new home or use it for a holiday over the festive period. Example : Registration of a bond usually takes between 2 -3 months. If a client applies for a home loan and takes up the payment hol ...

Measuring Efficiency in Corporate Law: The Role of Shareholder

... pension funds More than transactions half of all US households ownnovel stock, but most of them • These raise agency and own it indirectly investor protection concerns One third of US household assets are invested in retirement accounts • Dodd-Frank required study of a possible Recent Morningstar st ...

... pension funds More than transactions half of all US households ownnovel stock, but most of them • These raise agency and own it indirectly investor protection concerns One third of US household assets are invested in retirement accounts • Dodd-Frank required study of a possible Recent Morningstar st ...

THE ASSET ALLOCATION INVESTMENT PROCESS

... Fixed-income securities (Bonds): Bonds are promissory notes of a United States corporation or federal government entity (taxable bonds) or a state or local government entity (tax-exempt or municipal bonds). Bonds usually make a series of interest payments followed by a return of principal at maturit ...

... Fixed-income securities (Bonds): Bonds are promissory notes of a United States corporation or federal government entity (taxable bonds) or a state or local government entity (tax-exempt or municipal bonds). Bonds usually make a series of interest payments followed by a return of principal at maturit ...

Official PDF , 10 pages

... are available to offset the losses incurred on small scale loans), implying that credit is provided below its accounting cost; b) the provision of capital to agricultural lenders on soft terms, including an interest rate below going rates; or c) agricultural interest rates which are below those char ...

... are available to offset the losses incurred on small scale loans), implying that credit is provided below its accounting cost; b) the provision of capital to agricultural lenders on soft terms, including an interest rate below going rates; or c) agricultural interest rates which are below those char ...

Research Reports - American Institute for Economic Research

... risky for lenders. A credit card with a late payment, for example). Until increase annual fees and reduce a $5,500 credit limit allows the bornow, this is what credit card compabonus features such as rebates or airrower to get a loan of $5,000 on the nies have done. They gave cards to line miles. Th ...

... risky for lenders. A credit card with a late payment, for example). Until increase annual fees and reduce a $5,500 credit limit allows the bornow, this is what credit card compabonus features such as rebates or airrower to get a loan of $5,000 on the nies have done. They gave cards to line miles. Th ...

Credit analysis of general insurers and Lloyd`s syndicates (slides)

... assessed (the ‘black box’) • ‘PI’ vs full ratings • Combination of qualitative and quantitative factors, varies by agency • Usually a committee decision, with extensive discussion of the company, peers, industry • Ratings need to be comparative globally and ...

... assessed (the ‘black box’) • ‘PI’ vs full ratings • Combination of qualitative and quantitative factors, varies by agency • Usually a committee decision, with extensive discussion of the company, peers, industry • Ratings need to be comparative globally and ...

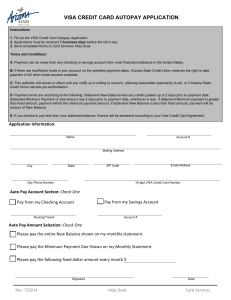

Visa Credit Card Auto Pay Application

... 1. Fill out the VISA Credit Card Autopay Application. 2. Applications must be received 7 business days before the bill is due. 3. Send completed forms to Card Services Help Desk. Terms and Conditions: A: Payment can be made from any checking or savings account from most financial institutions in the ...

... 1. Fill out the VISA Credit Card Autopay Application. 2. Applications must be received 7 business days before the bill is due. 3. Send completed forms to Card Services Help Desk. Terms and Conditions: A: Payment can be made from any checking or savings account from most financial institutions in the ...

CPWA Investment Policy - Clifton Park Water Authority

... CLIFTON PARK WATER AUTHORITY AND SUBSIDIARIES ...

... CLIFTON PARK WATER AUTHORITY AND SUBSIDIARIES ...