Atradius NV - Crédito y Caución

... shareholders' equity is very low at 20.6%, and is comprised mainly of equities, and money market mutual funds classified as equities for reporting purposes. The majority of the portfolio is comprised of high-quality short-term and fixed income securities, with no exposure to investments in Eurozone ...

... shareholders' equity is very low at 20.6%, and is comprised mainly of equities, and money market mutual funds classified as equities for reporting purposes. The majority of the portfolio is comprised of high-quality short-term and fixed income securities, with no exposure to investments in Eurozone ...

probability prediction with static Merton-D-Vine copula model

... and credit default swap prices etc.) and structural risk models (Merton model (1973), Longstaff and Schwartz (1995) etc.). Without any doubt these models are included among the influential methods for the credit risks measurement, which is used even in rating agencies (like KMV Moody’s methodology). ...

... and credit default swap prices etc.) and structural risk models (Merton model (1973), Longstaff and Schwartz (1995) etc.). Without any doubt these models are included among the influential methods for the credit risks measurement, which is used even in rating agencies (like KMV Moody’s methodology). ...

Capital Asset Pricing Model

... The model assumes that given a certain expected return investors will prefer lower risk (lower variance) to higher risk and conversely given a certain level of risk will prefer higher returns to lower ones. It does not allow for investors who will accept lower returns for higher risk. Casino gambler ...

... The model assumes that given a certain expected return investors will prefer lower risk (lower variance) to higher risk and conversely given a certain level of risk will prefer higher returns to lower ones. It does not allow for investors who will accept lower returns for higher risk. Casino gambler ...

Home Equity Lines of Credit: Market Trends and Consumer Issues

... the accrued interest is covered. ...

... the accrued interest is covered. ...

1934 Act - Cengage

... • A company that has never registered securities under the 1933 Act becomes subject to the reporting requirements of the 1934 Act when it has both: – More than 500 shareholders. – Assets of more than $10 million. • Deregistration from the 1934 Act is allowed if: – An entity has less than 300 shareho ...

... • A company that has never registered securities under the 1933 Act becomes subject to the reporting requirements of the 1934 Act when it has both: – More than 500 shareholders. – Assets of more than $10 million. • Deregistration from the 1934 Act is allowed if: – An entity has less than 300 shareho ...

Mortgages

... Consumers who take a 15-year mortgage have higher monthly payments, but save money in total interest paid over the life of the mortgage. You will save the interest money you would have spent in that extra 15 years of payments. Compare terms and interest rates when shopping for a mortgage. It is usua ...

... Consumers who take a 15-year mortgage have higher monthly payments, but save money in total interest paid over the life of the mortgage. You will save the interest money you would have spent in that extra 15 years of payments. Compare terms and interest rates when shopping for a mortgage. It is usua ...

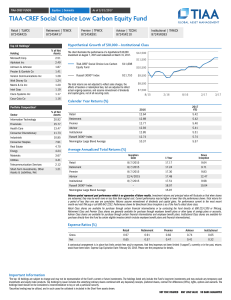

TIAA-CREF Social Choice Low Carbon Equity Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investmen ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investmen ...

Expected Return Standard Deviation

... CAPM Terminologies: Systematic and Unsystematic risk In the development of portfolio theory Markowitz (1958) defined the variance of the rate of return as the appropriate measure of risk. However this can be sub-divided into two general types of risk: systematic and unsystematic risk. William Sh ...

... CAPM Terminologies: Systematic and Unsystematic risk In the development of portfolio theory Markowitz (1958) defined the variance of the rate of return as the appropriate measure of risk. However this can be sub-divided into two general types of risk: systematic and unsystematic risk. William Sh ...

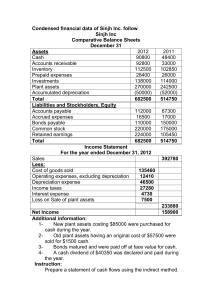

Condensed financial data of Sinjh Inc. follow Sinjh Inc Comparative

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...