Portfolio Perspectives - Ryan Wealth Management

... profitability is more consistent than we might expect. Investors are always looking forward, so may not pay as much attention to what profitability is today as what they think it may be several years down the road. Additionally, many investors likely assume that current profitability may erode over ...

... profitability is more consistent than we might expect. Investors are always looking forward, so may not pay as much attention to what profitability is today as what they think it may be several years down the road. Additionally, many investors likely assume that current profitability may erode over ...

magna retirement savings plans stable value fund

... The Principal Stable Value Fund (Fund) is a Collective Investment Trust (CIT) maintained by Union Bond and Trust Company (UBT). UBT serves as the trustee and has retained Morley Capital Management (MCM) to serve as the investment adviser. Both MCM and UBT are wholly owned subsidiaries of Morley Fina ...

... The Principal Stable Value Fund (Fund) is a Collective Investment Trust (CIT) maintained by Union Bond and Trust Company (UBT). UBT serves as the trustee and has retained Morley Capital Management (MCM) to serve as the investment adviser. Both MCM and UBT are wholly owned subsidiaries of Morley Fina ...

Table of Contents - Baton Rouge Community College

... Grading: The College grading policy should be included in the course syllabus. Any special practices should also go here. This should include the instructor’s and/or the department’s policy for make-up work. For example in a speech course, “Speeches not given on due date will receive no grade higher ...

... Grading: The College grading policy should be included in the course syllabus. Any special practices should also go here. This should include the instructor’s and/or the department’s policy for make-up work. For example in a speech course, “Speeches not given on due date will receive no grade higher ...

Chapter 15 Powerpoint

... Debt relative to GDP • Table 15-1 on page 578 shows history of federal debt...it has grown considerably! • Over 50% of privately-held debt is foreignowned • Most federal debt has short-term maturity ...

... Debt relative to GDP • Table 15-1 on page 578 shows history of federal debt...it has grown considerably! • Over 50% of privately-held debt is foreignowned • Most federal debt has short-term maturity ...

A Credit Risk Model To Develop The Credit Insurance Market

... becoming more sophisticated. New tools are being developed to predict and manage credit risk. These tools are being employed effectively by community banks as well as large banks, not only to improve the management on their portfolio credit risk but also on building competitive advantage. It is impo ...

... becoming more sophisticated. New tools are being developed to predict and manage credit risk. These tools are being employed effectively by community banks as well as large banks, not only to improve the management on their portfolio credit risk but also on building competitive advantage. It is impo ...

Quantitative Easing - Cambridge Political Economy Society

... financial institutions including investment banks, money market funds, securitization vehicles, assetbacked commercial paper conduits, etc. These institutions were highly dependent on short-term funding, most of which came either from abroad or from large institutional investors. Similarly to commer ...

... financial institutions including investment banks, money market funds, securitization vehicles, assetbacked commercial paper conduits, etc. These institutions were highly dependent on short-term funding, most of which came either from abroad or from large institutional investors. Similarly to commer ...

IFLR Webcast - International Financial Law Review

... To the extent possible, CFTC and NFA should endeavor to address many questions and uncertainties that have arisen over the interplay of the NFA’s registration process for swap dealers and MSPs and the CFTC’s regulatory implementation schedule U.S. Treasury should finalize its proposed exemption ...

... To the extent possible, CFTC and NFA should endeavor to address many questions and uncertainties that have arisen over the interplay of the NFA’s registration process for swap dealers and MSPs and the CFTC’s regulatory implementation schedule U.S. Treasury should finalize its proposed exemption ...

Portfolio1 - people.bath.ac.uk

... • Indexing in practice – Passive strategies forces investors to identify the sources of investment risk, and design efficient portfolios – Active funds induce unrealistic expectations and cannot always deliver ...

... • Indexing in practice – Passive strategies forces investors to identify the sources of investment risk, and design efficient portfolios – Active funds induce unrealistic expectations and cannot always deliver ...

Back to the Future – A Round-Trip with Discounted Cash Flows

... When the valuation date of a business is in the past, historical cash flows may become certain, or risk free, with the passage of time. This certainty can arise when historical prices and quantities can be established reliably. Historical cash flows can then be seen as risk free cash flows. To match ...

... When the valuation date of a business is in the past, historical cash flows may become certain, or risk free, with the passage of time. This certainty can arise when historical prices and quantities can be established reliably. Historical cash flows can then be seen as risk free cash flows. To match ...

Book-introduction to derivatives

... ice”. This exactly applies on derivatives to explain what its dynamics are. The quantum of global derivatives market has surpassed an amount of 1.14 quadrillion dollars (one and 12 zeros) i.e. 548 trillion $ in listed credit derivatives and 596 trillion dollars in notional/Over the counter (OTC) der ...

... ice”. This exactly applies on derivatives to explain what its dynamics are. The quantum of global derivatives market has surpassed an amount of 1.14 quadrillion dollars (one and 12 zeros) i.e. 548 trillion $ in listed credit derivatives and 596 trillion dollars in notional/Over the counter (OTC) der ...

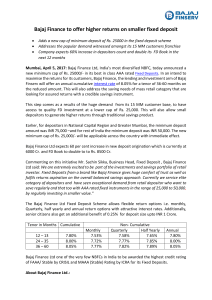

Bajaj Finance to offer higher returns on smaller fixed

... Mumbai, April 5, 2017: Bajaj Finance Ltd, India’s most diversified NBFC, today announced a new minimum cap of Rs. 25000/- in its best in class AAA rated Fixed Deposits. In an intend to maximise the returns for its customers, Bajaj Finance, the lending and investment arm of Bajaj Finserv will offer a ...

... Mumbai, April 5, 2017: Bajaj Finance Ltd, India’s most diversified NBFC, today announced a new minimum cap of Rs. 25000/- in its best in class AAA rated Fixed Deposits. In an intend to maximise the returns for its customers, Bajaj Finance, the lending and investment arm of Bajaj Finserv will offer a ...

Assignment-77 - The complete management portal

... 154) That part of the inventory which does not become a part of final product but are required for production process is termed as=> Stores and supplies 155) The inputs purchased and stored to be converted into finished products, this constitutes investment of inventory in the form of=> Raw Material ...

... 154) That part of the inventory which does not become a part of final product but are required for production process is termed as=> Stores and supplies 155) The inputs purchased and stored to be converted into finished products, this constitutes investment of inventory in the form of=> Raw Material ...

FYE March 2017 Financial Highlights

... ■ Functional Materials: Lower segment sales, mainly due to a decrease in naphtha prices driving sales of coating raw materials and urethane Functional Materials: Lower segment sales, mainly due to a decrease in naphtha prices driving sales of coating raw materials and urethane materials lower. At t ...

... ■ Functional Materials: Lower segment sales, mainly due to a decrease in naphtha prices driving sales of coating raw materials and urethane Functional Materials: Lower segment sales, mainly due to a decrease in naphtha prices driving sales of coating raw materials and urethane materials lower. At t ...

Risk and Return

... How the financial markets may price risky assets How to measure a risky asset’s risk How to calculate expected rate of return. ...

... How the financial markets may price risky assets How to measure a risky asset’s risk How to calculate expected rate of return. ...

FORWARD LOOKING STATEMENTS

... to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Any of the assumptions underlying the forward-looking statements contained herein could b ...

... to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Any of the assumptions underlying the forward-looking statements contained herein could b ...

"Why Interest Rates Will Rise," Funds Society

... cause some erosion in value. The effect will depend on what happens to the credit spread – the interest paid to investors for assuming credit risk. If the credit spread narrows, the overall effect may be slight. If it widens, the market could be hit with a double whammy. Historically, the credit spr ...

... cause some erosion in value. The effect will depend on what happens to the credit spread – the interest paid to investors for assuming credit risk. If the credit spread narrows, the overall effect may be slight. If it widens, the market could be hit with a double whammy. Historically, the credit spr ...

Risk-Based Capital Adequacy Framework for the Philippine Banking

... It is acceptable for the deferred coupon to bear interest but the interest rate payable must not exceed market rates; i) The coupon rate, or the formulation for calculating coupon payments must be fixed at the time of issuance and must not be linked to the credit standing of the bank; j) It may allo ...

... It is acceptable for the deferred coupon to bear interest but the interest rate payable must not exceed market rates; i) The coupon rate, or the formulation for calculating coupon payments must be fixed at the time of issuance and must not be linked to the credit standing of the bank; j) It may allo ...

first name

... b) (5 marks) Using the ratios calculated in part a) comment on General Motors' liquidity in 2007 as compared to 2006. Please identify the ratios that you are using as a reference. Do not exceed 45 sentences in your answer! Cash to Total Debt Coverage using Current Liabilities Measures short-term deb ...

... b) (5 marks) Using the ratios calculated in part a) comment on General Motors' liquidity in 2007 as compared to 2006. Please identify the ratios that you are using as a reference. Do not exceed 45 sentences in your answer! Cash to Total Debt Coverage using Current Liabilities Measures short-term deb ...

TIPS Index Fund - Get Retirement Right

... Additionally, Morningstar accepts foreign credit ratings from widely recognized or registered rating agencies. If two rating organizations/agencies have rated a security, fund companies are to report the lower rating; if three or more organizations/ agencies have rated a security, fund companies are ...

... Additionally, Morningstar accepts foreign credit ratings from widely recognized or registered rating agencies. If two rating organizations/agencies have rated a security, fund companies are to report the lower rating; if three or more organizations/ agencies have rated a security, fund companies are ...