Accruals, Financial Distress, and Debt Covenants Troy D. Janes

... performance, there is evidence that sophisticated users of accounting information do not fully utilize the information in accruals. Sloan (1996) shows that even though high accruals predict declining performance, stock prices behave as if the market does not understand this information. A study of a ...

... performance, there is evidence that sophisticated users of accounting information do not fully utilize the information in accruals. Sloan (1996) shows that even though high accruals predict declining performance, stock prices behave as if the market does not understand this information. A study of a ...

FORM 10-K - corporate

... The United States Medicare/Medicaid Fraud and Abuse Anti-kickback Statute (the “Anti-Kickback Statute”) prohibits “knowingly or willfully” paying money or providing remuneration of any sort in exchange for federally-funded referrals. Because the physician partners that have ownership interests in ce ...

... The United States Medicare/Medicaid Fraud and Abuse Anti-kickback Statute (the “Anti-Kickback Statute”) prohibits “knowingly or willfully” paying money or providing remuneration of any sort in exchange for federally-funded referrals. Because the physician partners that have ownership interests in ce ...

2016 年 11 月 1 日~2017 年 4 月 30 日

... This interim report and unaudited financial statements (the “Report and Accounts”) may be translated into other languages. Any such translation shall only contain the same information and have the same meaning as the English language Report and Accounts. To the extent that there is any inconsistency ...

... This interim report and unaudited financial statements (the “Report and Accounts”) may be translated into other languages. Any such translation shall only contain the same information and have the same meaning as the English language Report and Accounts. To the extent that there is any inconsistency ...

united states securities and exchange commission

... forward-looking statement. The forward-looking statements may use the words “expect,” “anticipate,” “plan,” “intend,” “project,” “may,” “believe,” “forecast,” and similar expressions. Forward-looking statements involve known or unknown risks, uncertainties and other factors, including changes in est ...

... forward-looking statement. The forward-looking statements may use the words “expect,” “anticipate,” “plan,” “intend,” “project,” “may,” “believe,” “forecast,” and similar expressions. Forward-looking statements involve known or unknown risks, uncertainties and other factors, including changes in est ...

Guidelines to Emerging Market Regulators

... towards a much more comprehensive approach designed to ensure proper management of all the risks associated with complex institutions. This evolving market scenario combined with the need for better allocation of limited supervisory resources, prompted regulators to find improved methods of identify ...

... towards a much more comprehensive approach designed to ensure proper management of all the risks associated with complex institutions. This evolving market scenario combined with the need for better allocation of limited supervisory resources, prompted regulators to find improved methods of identify ...

building today, for tomorrow - EZRA HOLDINGS LIMITED

... Through proactive marketing and leasing efforts, MLT continued to report a high portfolio occupancy of 96.7% with positive rental reversion of 8%, which was contributed mainly by leases in Hong Kong and Singapore. As compared to last year, the Singapore portfolio registered a lower occupancy rate of ...

... Through proactive marketing and leasing efforts, MLT continued to report a high portfolio occupancy of 96.7% with positive rental reversion of 8%, which was contributed mainly by leases in Hong Kong and Singapore. As compared to last year, the Singapore portfolio registered a lower occupancy rate of ...

Franklin Flexible Alpha Bond Fund Prospectus

... Franklin Fund Allocator Series Franklin Conservative Allocation Fund Franklin Corefolio Allocation Fund Franklin Founding Funds Allocation Fund Franklin Growth Allocation Fund Franklin Moderate Allocation Fund Franklin LifeSmartTM 2015 Retirement Target Fund Franklin LifeSmartTM 2020 Retirement Targ ...

... Franklin Fund Allocator Series Franklin Conservative Allocation Fund Franklin Corefolio Allocation Fund Franklin Founding Funds Allocation Fund Franklin Growth Allocation Fund Franklin Moderate Allocation Fund Franklin LifeSmartTM 2015 Retirement Target Fund Franklin LifeSmartTM 2020 Retirement Targ ...

Wordly - corporate

... projected to grow 4.3% in 2017, with a majority of the increase allocated to the two largest areas of state general funding expenditures, PreK-12 education and Medicaid. While there is significant variation within individual states, forty-one states have enacted budgets for fiscal 2017 with higher ...

... projected to grow 4.3% in 2017, with a majority of the increase allocated to the two largest areas of state general funding expenditures, PreK-12 education and Medicaid. While there is significant variation within individual states, forty-one states have enacted budgets for fiscal 2017 with higher ...

Government Guarantees and Fiscal Risk, April 1, 2005

... Some guarantees can be viewed as a response to the heavy costs that political and policy risks may impose on the private sector. This is especially the case under PPP contracts, because they usually relate to the provision of high-cost, single-use, long-lived assets. In the absence of protection aga ...

... Some guarantees can be viewed as a response to the heavy costs that political and policy risks may impose on the private sector. This is especially the case under PPP contracts, because they usually relate to the provision of high-cost, single-use, long-lived assets. In the absence of protection aga ...

CPI INTERNATIONAL, INC. (Form: 10-K

... We supply products used in various types of military radar systems, including search, fire control, tracking and weather radar systems. In radar systems, our products are used to generate or amplify electromagnetic energy pulses, which are transmitted via the radar system's antenna through the air u ...

... We supply products used in various types of military radar systems, including search, fire control, tracking and weather radar systems. In radar systems, our products are used to generate or amplify electromagnetic energy pulses, which are transmitted via the radar system's antenna through the air u ...

aecom

... determination of fair values of assets and liabilities acquired requires the Company to make estimates and use valuation techniques when market value is not readily available. Transaction costs associated with business acquisitions are expensed as they are incurred. On October 17, 2014, the Company ...

... determination of fair values of assets and liabilities acquired requires the Company to make estimates and use valuation techniques when market value is not readily available. Transaction costs associated with business acquisitions are expensed as they are incurred. On October 17, 2014, the Company ...

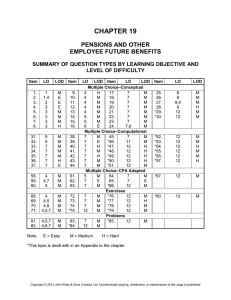

chapter study objectives

... plans that specify how contributions are determined rather than what benefits the individual will receive. They are accounted for similar to a cash basis. ...

... plans that specify how contributions are determined rather than what benefits the individual will receive. They are accounted for similar to a cash basis. ...

annual report 2014 - Investor Relations Solutions

... standard, offering on-demand access to HBO’s rich catalog. Last year, Turner expanded live streaming so all its major networks are now available to authenticated subscribers, started to make stacking rights available, allowing “binge viewing” for some of its biggest hits, and expanded its digital ri ...

... standard, offering on-demand access to HBO’s rich catalog. Last year, Turner expanded live streaming so all its major networks are now available to authenticated subscribers, started to make stacking rights available, allowing “binge viewing” for some of its biggest hits, and expanded its digital ri ...

Summary Note dated 3 November 2014

... as amended by Commission Delegated Regulation (EU) No. 486/2012 of 30 March 2012, Commission Delegated Regulation (EU) No. 862/2012 of 4 June 2012, Commission Delegated Regulation (EU) No. 759/2013 of 30 April 2013 and Commission Delegated Regulation (EU) No. 382/2014 of 7 March 2014. Summaries are ...

... as amended by Commission Delegated Regulation (EU) No. 486/2012 of 30 March 2012, Commission Delegated Regulation (EU) No. 862/2012 of 4 June 2012, Commission Delegated Regulation (EU) No. 759/2013 of 30 April 2013 and Commission Delegated Regulation (EU) No. 382/2014 of 7 March 2014. Summaries are ...

Financial Accounting II

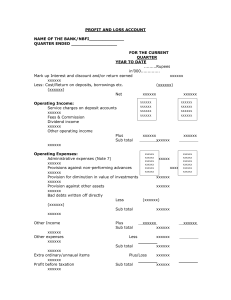

... 5. Branch Account • Method of recording branch transactions and issues regarding items in transit • Head office will keep all accounting records and each branch do have their own accounting record • Ledger are used for 3 purposes: – Record transaction of changes in assets, liabilities and capital – ...

... 5. Branch Account • Method of recording branch transactions and issues regarding items in transit • Head office will keep all accounting records and each branch do have their own accounting record • Ledger are used for 3 purposes: – Record transaction of changes in assets, liabilities and capital – ...

Disclosure Brochure - Total Investment Management

... management platform offerings. Prior to engaging TIM to provide any of the foregoing investment advisory services, the client is required to enter into one or more written agreements with TIM, setting forth the terms and conditions under which TIM renders its services (collectively the “Agreement”). ...

... management platform offerings. Prior to engaging TIM to provide any of the foregoing investment advisory services, the client is required to enter into one or more written agreements with TIM, setting forth the terms and conditions under which TIM renders its services (collectively the “Agreement”). ...

VILLA WORLD BONDS

... About this Base Prospectus There will be a separate Offer Specific Prospectus for each offer of Bonds during the life of this Base Prospectus, being the Covered Period. The disclosure document for each such offer of Bonds during the Covered Period will consist of this Base Prospectus and an Offer Sp ...

... About this Base Prospectus There will be a separate Offer Specific Prospectus for each offer of Bonds during the life of this Base Prospectus, being the Covered Period. The disclosure document for each such offer of Bonds during the Covered Period will consist of this Base Prospectus and an Offer Sp ...

Returning Cash to the Owners: Dividend Policy

... Assume that you run a phone company, and that you have historically paid large dividends. You are now planning to enter the telecommunications and media markets. Which of the following paths are you most likely to follow? Courageously announce to your stockholders that you plan to cut dividends and ...

... Assume that you run a phone company, and that you have historically paid large dividends. You are now planning to enter the telecommunications and media markets. Which of the following paths are you most likely to follow? Courageously announce to your stockholders that you plan to cut dividends and ...

RPM by the Numbers

... and market share gains achieved at the depth of Europe’s recession, along with expense cuts made during the downturn. Our performance in Europe was demonstratively better than the continent’s underlying economic conditions, which is a real testament to our European colleagues, in terms of both their ...

... and market share gains achieved at the depth of Europe’s recession, along with expense cuts made during the downturn. Our performance in Europe was demonstratively better than the continent’s underlying economic conditions, which is a real testament to our European colleagues, in terms of both their ...