Financial Statements 2007 Fortis Bank

... Fortis Bank Consolidated Financial Statements 2007 ................................................................................................. 17 Consolidated balance sheet ......................................................................................................................... ...

... Fortis Bank Consolidated Financial Statements 2007 ................................................................................................. 17 Consolidated balance sheet ......................................................................................................................... ...

Capital structure and volatility of risk

... A second reason for conservative leverage choices by firms with high volatility of volatility may be that corporate insiders may have private information regarding their own earnings volatility and this is more likely in firms with stochastic volatility. In firms where volatility is not stochastic ...

... A second reason for conservative leverage choices by firms with high volatility of volatility may be that corporate insiders may have private information regarding their own earnings volatility and this is more likely in firms with stochastic volatility. In firms where volatility is not stochastic ...

Institutional Investors and Corporate Behavior

... control, there should in principle be no causal link between the use of a governance variable (for example, managerial ownership or board composition) and performance (for example, accounting measures of profitability or shareholder firms). Firms would substitute different mechanisms in different wa ...

... control, there should in principle be no causal link between the use of a governance variable (for example, managerial ownership or board composition) and performance (for example, accounting measures of profitability or shareholder firms). Firms would substitute different mechanisms in different wa ...

CATERPILLAR INC (Form: 10-K, Received: 02/22

... Caterpillar operates in a very competitive engine/turbine manufacturing and packaging environment. The company designs, manufactures, markets and sells diesel, heavy fuel and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, locomotives, marine, petroleu ...

... Caterpillar operates in a very competitive engine/turbine manufacturing and packaging environment. The company designs, manufactures, markets and sells diesel, heavy fuel and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, locomotives, marine, petroleu ...

Earnings Release 1Q17

... In order to address these certain shareholder concerns and to ensure that the Executive Board is able to continue to focus on the successful turnaround of Credit Suisse and the implementation of our strategy, the CEO and the Executive Board proposed to the Board of Directors that both the 2016 Short ...

... In order to address these certain shareholder concerns and to ensure that the Executive Board is able to continue to focus on the successful turnaround of Credit Suisse and the implementation of our strategy, the CEO and the Executive Board proposed to the Board of Directors that both the 2016 Short ...

VE Base Prospectus 2009 final

... the applicable Final Terms may over-allot Notes or effect transactions with a view to supporting the market price of the Notes at a level higher than that which might otherwise prevail. However, there is no assurance that the Stabilising Manager(s) (or persons acting on behalf of a Stabilising Manag ...

... the applicable Final Terms may over-allot Notes or effect transactions with a view to supporting the market price of the Notes at a level higher than that which might otherwise prevail. However, there is no assurance that the Stabilising Manager(s) (or persons acting on behalf of a Stabilising Manag ...

Macy's Inc. - Mark E. Moore

... for operating and capital leases. Like most of its competitors, Macy's uses a majority of operating leases. However, using an operating lease poses a problem because it grants the firm some flexibility in reporting expenses. To head this problem, Macy's discloses the future operating and capital lea ...

... for operating and capital leases. Like most of its competitors, Macy's uses a majority of operating leases. However, using an operating lease poses a problem because it grants the firm some flexibility in reporting expenses. To head this problem, Macy's discloses the future operating and capital lea ...

NEWMONT MINING CORP /DE/ (Form: 10-K

... Newmont’s Sales and long-lived assets are geographically distributed as follows: ...

... Newmont’s Sales and long-lived assets are geographically distributed as follows: ...

Prospectus - TransAlta

... The holders of Series G Shares will be entitled to receive, as and when declared by the board of directors of the Corporation out of moneys of the Corporation properly applicable to the payment of dividends, fixed cumulative preferential cash dividends for the initial period (the "Initial Fixed Rate ...

... The holders of Series G Shares will be entitled to receive, as and when declared by the board of directors of the Corporation out of moneys of the Corporation properly applicable to the payment of dividends, fixed cumulative preferential cash dividends for the initial period (the "Initial Fixed Rate ...

- Zodiac Aerospace

... emergency aircraft arresting systems activities. Its current operating income rose by 24.6% to €83.6 million based on reported figures, and by 19.2% at like-for-like consolidation scope and exchange rates. The Segment benefited from a positive overall exchange rate effect of €3.7 million (+€3.5 mill ...

... emergency aircraft arresting systems activities. Its current operating income rose by 24.6% to €83.6 million based on reported figures, and by 19.2% at like-for-like consolidation scope and exchange rates. The Segment benefited from a positive overall exchange rate effect of €3.7 million (+€3.5 mill ...

FLUXYS

... Groningen field in the Netherlands, up to 40 billion cubic metres of natural gas a year will gradually have to be sought from other sources between 2020 and 2035 and supplied to the German, Belgian and French markets. Thanks to its portfolio of infrastructure and capacity in ...

... Groningen field in the Netherlands, up to 40 billion cubic metres of natural gas a year will gradually have to be sought from other sources between 2020 and 2035 and supplied to the German, Belgian and French markets. Thanks to its portfolio of infrastructure and capacity in ...

Advanced BioEnergy, LLC (Form: 10-K, Received: 12/29

... foreclosing on ABE’s equity interest in HGF, including a restructuring of the terms of the current borrowing arrangements with those lenders. These discussions are ongoing, and we now intend to pursue with HGF’s senior lenders, as well as the subordinated revenue bond holders, a restructuring of the ...

... foreclosing on ABE’s equity interest in HGF, including a restructuring of the terms of the current borrowing arrangements with those lenders. These discussions are ongoing, and we now intend to pursue with HGF’s senior lenders, as well as the subordinated revenue bond holders, a restructuring of the ...

PLI Text Article

... A modification is tested when the parties agree to a change, even if the change is not immediately effective.27 The regulations provide exceptions for a change in a term that is agreed to by the parties but is subject to reasonable closing conditions or that occurs as a result of bankruptcy proceedi ...

... A modification is tested when the parties agree to a change, even if the change is not immediately effective.27 The regulations provide exceptions for a change in a term that is agreed to by the parties but is subject to reasonable closing conditions or that occurs as a result of bankruptcy proceedi ...

FORM 10-K - corporate

... repayment of Title IV loans exceed specified rates, referred to as “cohort default rates.” The ED calculates a cohort default rate for each OPEID number. Kaplan University will be the only OPEID unit that will be continuing operations through 2016. If a school ’ s cohort default rate exceeds 40% for ...

... repayment of Title IV loans exceed specified rates, referred to as “cohort default rates.” The ED calculates a cohort default rate for each OPEID number. Kaplan University will be the only OPEID unit that will be continuing operations through 2016. If a school ’ s cohort default rate exceeds 40% for ...

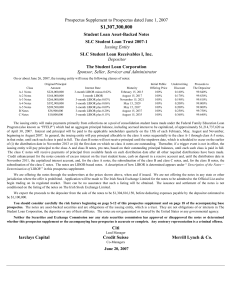

SLC STUDENT LOAN RECEIVABLES I INC

... in that order, until each such class is paid in full. The class B notes will not receive principal until the stepdown date, which is scheduled to occur on the earlier of (i) the distribution date in November 2013 or (ii) the first date on which no class A notes are outstanding. Thereafter, if a trig ...

... in that order, until each such class is paid in full. The class B notes will not receive principal until the stepdown date, which is scheduled to occur on the earlier of (i) the distribution date in November 2013 or (ii) the first date on which no class A notes are outstanding. Thereafter, if a trig ...

219.3 million 0.1875% convertible bonds due 15

... Convertible Bonds borrow money to the Issuer which undertakes to pay interests on an annual basis and to pay the principal amount at maturity. In addition, each Convertible Bond shall entitle the investor to convert such Convertible Bond into existing and/or new Ordinary Shares of the Issuer. In cas ...

... Convertible Bonds borrow money to the Issuer which undertakes to pay interests on an annual basis and to pay the principal amount at maturity. In addition, each Convertible Bond shall entitle the investor to convert such Convertible Bond into existing and/or new Ordinary Shares of the Issuer. In cas ...

Corporate Actions-- a Concise Guide : an Introduction to Securities

... time and meeting these challenges is important to the securities industry. Despite this corporate action practitioners have been left to themselves, carrying on their craft quietly behind a high wall. If knowledge of corporate actions brings us to fully understand the securities they relate to, some ...

... time and meeting these challenges is important to the securities industry. Despite this corporate action practitioners have been left to themselves, carrying on their craft quietly behind a high wall. If knowledge of corporate actions brings us to fully understand the securities they relate to, some ...

Rayonier 2015 10K

... As a REIT, we are focused on growing our asset base to support long-term growth in our cash flow, dividend and share price. In executing our growth strategy, we are focused on properties that are above-average in quality, complementary to our existing landholdings, and accretive to our Cash Availabl ...

... As a REIT, we are focused on growing our asset base to support long-term growth in our cash flow, dividend and share price. In executing our growth strategy, we are focused on properties that are above-average in quality, complementary to our existing landholdings, and accretive to our Cash Availabl ...

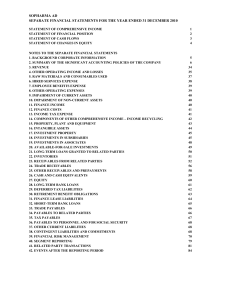

Financial Report

... assets or deferred tax liabilities, related to a particular basic asset, should be measured through the prism of the expectation and intents of the respective entity on how the investments will be recovered in the carrying amount of this asset – though a sale or through a continuous use. Specific ru ...

... assets or deferred tax liabilities, related to a particular basic asset, should be measured through the prism of the expectation and intents of the respective entity on how the investments will be recovered in the carrying amount of this asset – though a sale or through a continuous use. Specific ru ...