CSL Limited Financial Report 1999-2000

... and allied products. No significant change in the nature of those activities has taken place during that period. ...

... and allied products. No significant change in the nature of those activities has taken place during that period. ...

International Diversification Versus Domestic Diversification: Mean

... Our study is based on daily data consisting of the prices of the 30 highest capitalization US stocks and 20 international market indices from Latin American and Asian financial markets and the G6. The purpose of this paper is to identify empirically preferences for international diversification vers ...

... Our study is based on daily data consisting of the prices of the 30 highest capitalization US stocks and 20 international market indices from Latin American and Asian financial markets and the G6. The purpose of this paper is to identify empirically preferences for international diversification vers ...

Focus Point_focus point

... The Malaysian Gross Domestic Products (GDP) grew 4.7% in 2013 compared with 5.6% in 2012. Malaysia’s growth was driven by domestic demand, through public spending supported by private consumption and investment. The national economy is expected to remain resilient at above 5% mark in 2014, backed by ...

... The Malaysian Gross Domestic Products (GDP) grew 4.7% in 2013 compared with 5.6% in 2012. Malaysia’s growth was driven by domestic demand, through public spending supported by private consumption and investment. The national economy is expected to remain resilient at above 5% mark in 2014, backed by ...

Household Debt, Adjustable-Rate Mortgages

... higher that in a state of low debt and ARM share. To shed light on the mechanism behind this result, I turn my analysis to credit market related variables such as mortgage default rates, financial intermediaries market value and credit spread, the federal funds rate, and non-financial leverage. The ...

... higher that in a state of low debt and ARM share. To shed light on the mechanism behind this result, I turn my analysis to credit market related variables such as mortgage default rates, financial intermediaries market value and credit spread, the federal funds rate, and non-financial leverage. The ...

KELLOGG CO (Form: 10-K, Received: 02/24/2014 16

... The trademarks listed above, among others, when taken as a whole, are important to our business. Certain individual trademarks are also important to our business. Depending on the jurisdiction, trademarks are generally valid as long as they are in use and/or their registrations are properly maintain ...

... The trademarks listed above, among others, when taken as a whole, are important to our business. Certain individual trademarks are also important to our business. Depending on the jurisdiction, trademarks are generally valid as long as they are in use and/or their registrations are properly maintain ...

exam3 - Trinity University

... 31. (03 Points) The following contract does not have a SFAS 133 Paragraph 6 notional in a clear sense. Company C pays $100,000 for an option to receive $2 million if the average LIBOR for the next 12 months exceeds 8%. Is this option contract subject to SFAS 133 rules? a. No. Paragraph 6a requires a ...

... 31. (03 Points) The following contract does not have a SFAS 133 Paragraph 6 notional in a clear sense. Company C pays $100,000 for an option to receive $2 million if the average LIBOR for the next 12 months exceeds 8%. Is this option contract subject to SFAS 133 rules? a. No. Paragraph 6a requires a ...

Amendments to the Capital Framework for Securitisation Exposures

... (a) the originator has an appropriate capital and liquidity plan in place to ensure that it has sufficient capital and liquidity available in the event of an early amortisation; (b) throughout the duration of the transaction there is a pro-rata sharing of interest and principal, expenses, losses an ...

... (a) the originator has an appropriate capital and liquidity plan in place to ensure that it has sufficient capital and liquidity available in the event of an early amortisation; (b) throughout the duration of the transaction there is a pro-rata sharing of interest and principal, expenses, losses an ...

Chapter 20

... issuer level, individually or together, can exercise or control the exercise of 10% or more of the voting power at the subsidiary’s general meeting. This 10% excludes any indirect interest in the subsidiary which is held by the connected person(s) through the listed issuer; or ...

... issuer level, individually or together, can exercise or control the exercise of 10% or more of the voting power at the subsidiary’s general meeting. This 10% excludes any indirect interest in the subsidiary which is held by the connected person(s) through the listed issuer; or ...

Prospectus of Zurich Investment Funds ICVC

... No person has been authorised by the Company or the ACD to give any information or to make any representations in connection with the offering of Shares other than those contained in this Prospectus and, if given or made, such information or representations must not be relied upon as having been mad ...

... No person has been authorised by the Company or the ACD to give any information or to make any representations in connection with the offering of Shares other than those contained in this Prospectus and, if given or made, such information or representations must not be relied upon as having been mad ...

Leverage and Corporate Performance: Evidence from Unsuccessful

... Our empirical evidence supports the view that higher leverage ratios deter takeovers because they are associated with performance improvements. In particular, we find that the operating performance of former targets following failed takeover attempts is positively related to the change in the target ...

... Our empirical evidence supports the view that higher leverage ratios deter takeovers because they are associated with performance improvements. In particular, we find that the operating performance of former targets following failed takeover attempts is positively related to the change in the target ...

UNITED TECHNOLOGIES CORP /DE/ (Form: 10

... entered into a long-term engineering and manufacturing agreement with MHI. The sale generated a pre-tax gain of approximately $193 million ( $132 million after tax). Cash received in connection with the sale was $432 million , excluding contingent consideration valued at approximately $200 million . ...

... entered into a long-term engineering and manufacturing agreement with MHI. The sale generated a pre-tax gain of approximately $193 million ( $132 million after tax). Cash received in connection with the sale was $432 million , excluding contingent consideration valued at approximately $200 million . ...

Front Cover Page - ICICI Prudential Mutual Fund

... companies, subsidiaries of the Sponsors, and the AMC may invest either directly or indirectly in the Scheme. The funds managed by these affiliates, associates, the Sponsors, subsidiaries of the Sponsors and /or the AMC may acquire a substantial portion of the Scheme‟s Units and collectively constitu ...

... companies, subsidiaries of the Sponsors, and the AMC may invest either directly or indirectly in the Scheme. The funds managed by these affiliates, associates, the Sponsors, subsidiaries of the Sponsors and /or the AMC may acquire a substantial portion of the Scheme‟s Units and collectively constitu ...

1 LOWLAND MORTGAGE BACKED SECURITIES 1 BV

... Class B Notes, the Mezzanine Class C Notes and the Junior Class D Notes, the "Notes"), to be issued by Lowland Mortgage Backed Securities 1 B.V. (the "Issuer"), on Euronext Amsterdam by NYSE Euronext ("Euronext Amsterdam"). This Prospectus has been approved by the Netherlands Authority for the Finan ...

... Class B Notes, the Mezzanine Class C Notes and the Junior Class D Notes, the "Notes"), to be issued by Lowland Mortgage Backed Securities 1 B.V. (the "Issuer"), on Euronext Amsterdam by NYSE Euronext ("Euronext Amsterdam"). This Prospectus has been approved by the Netherlands Authority for the Finan ...

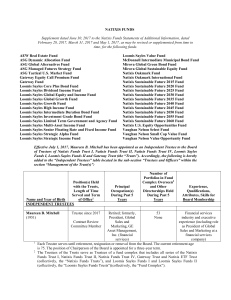

Close Strategic Alpha Prospectus - Close Brothers Asset Management

... Prospectus and accepts responsibility accordingly. It has taken all reasonable care to ensure that, to the best of its knowledge and belief, the information in this document does not contain any untrue or misleading statement or omit any matters required by the COLL Sourcebook to be included in it. ...

... Prospectus and accepts responsibility accordingly. It has taken all reasonable care to ensure that, to the best of its knowledge and belief, the information in this document does not contain any untrue or misleading statement or omit any matters required by the COLL Sourcebook to be included in it. ...