primary dealership in ghana

... Multiple-price Auction – A competitive auction whereby securities are sold at the highest price / lowest yield and each successful bidder pays the price that was bid. Notional Bond Holding Limit – The minimum amount a PD is required for trading in GoG securities. Primary Dealer - Any entity duly lic ...

... Multiple-price Auction – A competitive auction whereby securities are sold at the highest price / lowest yield and each successful bidder pays the price that was bid. Notional Bond Holding Limit – The minimum amount a PD is required for trading in GoG securities. Primary Dealer - Any entity duly lic ...

Canadian Securities Traders Association, Inc.

... protection would apply to “protected orders’. We believe that the fact that FX rates are continually changing and the fact that there is no assurance that a favorable FX trade could be executed, such that a trade on a foreign exchange is in fact at a “better” price, implies that orders on a foreign ...

... protection would apply to “protected orders’. We believe that the fact that FX rates are continually changing and the fact that there is no assurance that a favorable FX trade could be executed, such that a trade on a foreign exchange is in fact at a “better” price, implies that orders on a foreign ...

National Institute of Securities Markets

... Know the classification of fixed-income securities based on cash flow pattern, tenor, etc. Understand the difference between fixed-income security and fixed-return security Compare Debt securities versus equity securities Understand debt market and equity market as components of capital market Expla ...

... Know the classification of fixed-income securities based on cash flow pattern, tenor, etc. Understand the difference between fixed-income security and fixed-return security Compare Debt securities versus equity securities Understand debt market and equity market as components of capital market Expla ...

Investment policy statement - Giving to CU

... Asset Classes and other Investments used in the LTIP Equity-Like: 1. Domestic Equities: Equity investments in US companies are typically among the most liquid and well-researched opportunities. This class will typically be diversified in terms of style and capitalization and may use both active and ...

... Asset Classes and other Investments used in the LTIP Equity-Like: 1. Domestic Equities: Equity investments in US companies are typically among the most liquid and well-researched opportunities. This class will typically be diversified in terms of style and capitalization and may use both active and ...

Use of Ratings in Insurance Industry

... Risk of default of assets for affiliated investments (e.g., downstream insurance subsidiaries) Parent is required to hold an equivalent amount of risk-based capital to protect against financial downturns of affiliates. For life companies, off-balance sheet items are included in this risk component i ...

... Risk of default of assets for affiliated investments (e.g., downstream insurance subsidiaries) Parent is required to hold an equivalent amount of risk-based capital to protect against financial downturns of affiliates. For life companies, off-balance sheet items are included in this risk component i ...

Quantitative Investment Analysis by Richard A. DeFusco/ CFA

... • Although it might seem reasonable for the variance of a portfolio to be the weighted average of the variances of the securities in the portfolio, this is incorrect. • Portfolio variance consists of the variances of the individual securities, but must also consist of a factor that measures the inte ...

... • Although it might seem reasonable for the variance of a portfolio to be the weighted average of the variances of the securities in the portfolio, this is incorrect. • Portfolio variance consists of the variances of the individual securities, but must also consist of a factor that measures the inte ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... Stories in the Journal of Financial Planning or Financial Planning Magazine suggest that use of the 4% rule is pervasive. Hardly a month goes by without an article about the 4% rule or some variant of it. But I wonder how often the 4% rule is actually used in day-to-day financial planning practice. ...

... Stories in the Journal of Financial Planning or Financial Planning Magazine suggest that use of the 4% rule is pervasive. Hardly a month goes by without an article about the 4% rule or some variant of it. But I wonder how often the 4% rule is actually used in day-to-day financial planning practice. ...

The Impact of Student Debt on the Ability to Buy A House

... Some can, if they qualify, enter programs like income-based repayment, which extend the length of repayment of a loan, but limit the monthly payment to a manageable 15 percent of adjusted gross income.30 Policymakers can help borrowers struggling with private lenders to find fair repayment terms tha ...

... Some can, if they qualify, enter programs like income-based repayment, which extend the length of repayment of a loan, but limit the monthly payment to a manageable 15 percent of adjusted gross income.30 Policymakers can help borrowers struggling with private lenders to find fair repayment terms tha ...

Payment of Management Fee

... OUE Hospitality REIT Management Pte. Ltd., as manager of OUE Hospitality Real Estate Investment Trust (“OUE H-REIT”, and the manager of OUE H-REIT, the “REIT Manager”), and OUE Hospitality Trust Management Pte. Ltd., as trustee-manager of OUE Hospitality Business Trust (“OUE H-BT”, and the trustee-m ...

... OUE Hospitality REIT Management Pte. Ltd., as manager of OUE Hospitality Real Estate Investment Trust (“OUE H-REIT”, and the manager of OUE H-REIT, the “REIT Manager”), and OUE Hospitality Trust Management Pte. Ltd., as trustee-manager of OUE Hospitality Business Trust (“OUE H-BT”, and the trustee-m ...

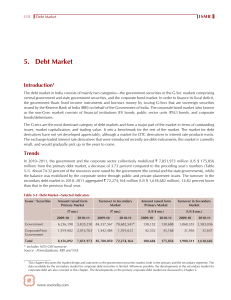

5. Debt Market

... Fixed Rate Bonds: These are bonds on which the coupon rate is fixed for the entire life of the bond. Most government bonds are issued as fixed rate bonds. Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, ...

... Fixed Rate Bonds: These are bonds on which the coupon rate is fixed for the entire life of the bond. Most government bonds are issued as fixed rate bonds. Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, ...

assessment of investment portfolios of jordanian banks

... - Systematic Risk: The risk inherent to the entire market or entire market segment. It is the risk which is due to the factors which are beyond the control of the people working in the market and that's why risk free rate of return in used to just compensate this type of risk in market Also known as ...

... - Systematic Risk: The risk inherent to the entire market or entire market segment. It is the risk which is due to the factors which are beyond the control of the people working in the market and that's why risk free rate of return in used to just compensate this type of risk in market Also known as ...

ASSET CLASS SUB ASSET CLASS Equity Large-Cap Large

... Fixed Maturity Short-Term Bond funds have a fixed horizon of existence ranging from one to three years. They primarily invest in investment-grade fixed-income securities whose average effective maturities coincide with the investment horizon. Given their focus on instruments with a short duration, t ...

... Fixed Maturity Short-Term Bond funds have a fixed horizon of existence ranging from one to three years. They primarily invest in investment-grade fixed-income securities whose average effective maturities coincide with the investment horizon. Given their focus on instruments with a short duration, t ...

Systemic Risk and the Financial System

... policymakers have sought to discourage the assumption that large banks are “too big to fail” and instead have worked to ensure that such banks maintain a strong financial condition and adopt rigorous risk management policies and procedures. This last point reflects a concern that ineffective public ...

... policymakers have sought to discourage the assumption that large banks are “too big to fail” and instead have worked to ensure that such banks maintain a strong financial condition and adopt rigorous risk management policies and procedures. This last point reflects a concern that ineffective public ...

Financial Instruments

... • Bonds provide a higher return than short-term investments, with a lower risk than equity investments. Generally the lower the issuer’s rating (which implies a higher risk) the more attractive the return. • Bonds allow investors who are looking for returns to generate an attractive yield. • Investm ...

... • Bonds provide a higher return than short-term investments, with a lower risk than equity investments. Generally the lower the issuer’s rating (which implies a higher risk) the more attractive the return. • Bonds allow investors who are looking for returns to generate an attractive yield. • Investm ...

MATHEMATICS OF BUSINESS AND PERSONAL FINANCE (236)

... amortization schedule. 5. Identify when mortgage insurance premiums are required and how these premiums affect payment amount. 6. Understand different types of mortgages (e.g., ARM, Balloon, Home Equity Line). Calculate the costs associated with mortgages. 1. Calculate how principal and interest are ...

... amortization schedule. 5. Identify when mortgage insurance premiums are required and how these premiums affect payment amount. 6. Understand different types of mortgages (e.g., ARM, Balloon, Home Equity Line). Calculate the costs associated with mortgages. 1. Calculate how principal and interest are ...

Waiting Wednesday! Neither here, nor there Life was always a

... We expect IndusInd bank to deliver industry‐best 30% earnings CAGR over FY17‐19 driven by sustained robust balance sheet growth, firm margins, optimization of cost/income ratio and moderation in credit cost. Rich valuation at 3.4x FY19 P/ABV should not dissuade long term invest ...

... We expect IndusInd bank to deliver industry‐best 30% earnings CAGR over FY17‐19 driven by sustained robust balance sheet growth, firm margins, optimization of cost/income ratio and moderation in credit cost. Rich valuation at 3.4x FY19 P/ABV should not dissuade long term invest ...

International Public Sector Accounting Standard 29 Financial

... through a non-exchange transaction, i.e., they are issued for no consideration or for nominal consideration, often in order to further the issuer’s broad social policy objectives, rather than for commercial purposes. While entities may issue guarantees at below fair value in the private sector, this ...

... through a non-exchange transaction, i.e., they are issued for no consideration or for nominal consideration, often in order to further the issuer’s broad social policy objectives, rather than for commercial purposes. While entities may issue guarantees at below fair value in the private sector, this ...