Snímek 1

... holding period is literally true only for discount bonds and zero-coupon bonds that make no intermediate cash payments before the holding period is over. A coupon bond that makes an intermediate cash payment before the holding period is over requires that this payment be reinvested is uncertain, the ...

... holding period is literally true only for discount bonds and zero-coupon bonds that make no intermediate cash payments before the holding period is over. A coupon bond that makes an intermediate cash payment before the holding period is over requires that this payment be reinvested is uncertain, the ...

A Brief Postwar History of US Consumer Finance

... existed prior to World War II, some of the most popular investment innovations occurred in the postwar period. Those include money market funds (first offered in 1971), index funds (1976), index-linked CDs (1987) exchange-traded funds (1993) and a host of corporate securities aimed at retail invest ...

... existed prior to World War II, some of the most popular investment innovations occurred in the postwar period. Those include money market funds (first offered in 1971), index funds (1976), index-linked CDs (1987) exchange-traded funds (1993) and a host of corporate securities aimed at retail invest ...

Private Placements - Canadian Structured Finance Law

... – Conclusion – Private term issuance is becoming a significantly greater proportion of a smaller Canadian ABS market ...

... – Conclusion – Private term issuance is becoming a significantly greater proportion of a smaller Canadian ABS market ...

RTF

... The Board of Directors of the North Carolina Self-Insurance Security Association shall notify the Commissioner of the individual self-insurers that are excluded from participating in the Association Aggregate Security System. (b) Repealed by Session Laws 2003-115, s. 3, effective January 1, 2004. (b ...

... The Board of Directors of the North Carolina Self-Insurance Security Association shall notify the Commissioner of the individual self-insurers that are excluded from participating in the Association Aggregate Security System. (b) Repealed by Session Laws 2003-115, s. 3, effective January 1, 2004. (b ...

901KB - Australian Government Bonds

... Coupon Payment Date. If this day is not a Business Day, the preceding Business Day is the Record Date. ...

... Coupon Payment Date. If this day is not a Business Day, the preceding Business Day is the Record Date. ...

UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS General Certificate of Education Ordinary Level 7110/01

... Write your name, Centre number and candidate number on the Answer Sheet in the spaces provided unless this has been done for you. There are thirty questions on this paper. Answer all questions. For each question there are four possible answers A, B, C and D. Choose the one you consider correct and r ...

... Write your name, Centre number and candidate number on the Answer Sheet in the spaces provided unless this has been done for you. There are thirty questions on this paper. Answer all questions. For each question there are four possible answers A, B, C and D. Choose the one you consider correct and r ...

Risk, Return and Capital Budgeting

... asset and equity β’s and thus it is more difficult to use comparable firms’ data to determine the overall cost of capital for a specific project. The reason is that debt interest payments reduce taxes; thus, holding fixed the risk of the before-tax cash flows, more debt makes total after-tax cash fl ...

... asset and equity β’s and thus it is more difficult to use comparable firms’ data to determine the overall cost of capital for a specific project. The reason is that debt interest payments reduce taxes; thus, holding fixed the risk of the before-tax cash flows, more debt makes total after-tax cash fl ...

market risk - U of L Class Index

... expected returns from one asset are offset by better than expected returns from another ...

... expected returns from one asset are offset by better than expected returns from another ...

Underlying - UBS

... Regulations 2005 of Singapore. UK – For the purpose of non-discretionary accounts, this Product should not be sold with a consideration of less than EUR 100,000 or equivalent. USA - This Product may not be sold or offered within the United States or to U.S. persons. ...

... Regulations 2005 of Singapore. UK – For the purpose of non-discretionary accounts, this Product should not be sold with a consideration of less than EUR 100,000 or equivalent. USA - This Product may not be sold or offered within the United States or to U.S. persons. ...

Financial Accounting END SEMESTER Examination

... b. The salvage value of a fixed asset c. The part of the cost of the fixed asset consumed during its period of use by the firm d. The amount of money spent on replacing asset ...

... b. The salvage value of a fixed asset c. The part of the cost of the fixed asset consumed during its period of use by the firm d. The amount of money spent on replacing asset ...

A Financial Risk and Fraud Model Comparison of Bear Stearns and

... Six different emerging models and ratios have been used to develop a red flag approach in screening for and identifying financial risk problems in publicly held companies in addition to traditional ratios. The models are available from the authors in an Excel file. 1. Quality of Earnings The quality ...

... Six different emerging models and ratios have been used to develop a red flag approach in screening for and identifying financial risk problems in publicly held companies in addition to traditional ratios. The models are available from the authors in an Excel file. 1. Quality of Earnings The quality ...

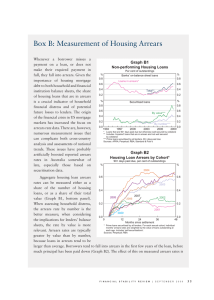

Box B: Measurement of Housing Arrears Graph B1

... amplified because average new loan sizes tend to increase over time, relative to the average size of loans already outstanding, as nominal housing prices and incomes rise. The criteria for defining a given loan as being in arrears can differ across countries and lenders. In Australia, housing loans ...

... amplified because average new loan sizes tend to increase over time, relative to the average size of loans already outstanding, as nominal housing prices and incomes rise. The criteria for defining a given loan as being in arrears can differ across countries and lenders. In Australia, housing loans ...

LoneStar 529 Fund Allocation Sheet

... 2. For Portfolios that invest in more than one Underlying Investment, based on a weighted average of each Underlying Investment’s expense ratio, in accordance with the Portfolio’s target asset allocation as of January 11, 2012; and for Portfolios that invest in one Underlying Investment, based on th ...

... 2. For Portfolios that invest in more than one Underlying Investment, based on a weighted average of each Underlying Investment’s expense ratio, in accordance with the Portfolio’s target asset allocation as of January 11, 2012; and for Portfolios that invest in one Underlying Investment, based on th ...

What should we make of the negative interest rates that

... Holding cash could seem to make more sense in many cases, however. For example, even if negative inflation is anticipated, holding cash at 0% interest could be a way of obtaining a better real return compared with that of an investment with a negative nominal interest rate. But this reasoning does n ...

... Holding cash could seem to make more sense in many cases, however. For example, even if negative inflation is anticipated, holding cash at 0% interest could be a way of obtaining a better real return compared with that of an investment with a negative nominal interest rate. But this reasoning does n ...

Word 2002 Format

... budget authority and the power to set fees, levy property taxes, and issue debt consistent with provisions of state statutes, also rests with the board of directors. (Add explanations of blended or discretely presented component units, if applicable.) For financial reporting purposes, the __________ ...

... budget authority and the power to set fees, levy property taxes, and issue debt consistent with provisions of state statutes, also rests with the board of directors. (Add explanations of blended or discretely presented component units, if applicable.) For financial reporting purposes, the __________ ...

Section 1042: A tax deferred sale to an ESOP

... IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, any U.S. federal tax information in this article is not intended, or written to be used, for the purpose of (1) avoiding penalties under the Internal Revenue Code, or (2) promoting, marketing or recommending to a ...

... IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, any U.S. federal tax information in this article is not intended, or written to be used, for the purpose of (1) avoiding penalties under the Internal Revenue Code, or (2) promoting, marketing or recommending to a ...

English

... pay an interest amount on the loan amount. The interest amount is a portion of the total loan amount. Credit cards can sometimes have high interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan am ...

... pay an interest amount on the loan amount. The interest amount is a portion of the total loan amount. Credit cards can sometimes have high interest rates sometimes upwards of 20%! In these cases the amount of interest you must pay can be very large. Simple Interest is calculated based on the loan am ...