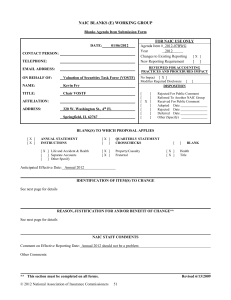

naic blanks (e) working group - National Association of Insurance

... This schedule should include a detailed listing of all securities that were purchased/acquired during the current reporting year that are still owned as of the end of the current reporting year (amounts purchased and sold during the current reporting year are reported in detail on Schedule D, Part 5 ...

... This schedule should include a detailed listing of all securities that were purchased/acquired during the current reporting year that are still owned as of the end of the current reporting year (amounts purchased and sold during the current reporting year are reported in detail on Schedule D, Part 5 ...

Foundation Business Policy

... change in purpose will require the establishment of a new fund and a transfer of the balance from the old fund to the new fund. Endowed or Non-endowed Status - Changing a fund's status from non-endowed to endowed involves three steps: 1) a new endowed fund must be established using the Fund Informat ...

... change in purpose will require the establishment of a new fund and a transfer of the balance from the old fund to the new fund. Endowed or Non-endowed Status - Changing a fund's status from non-endowed to endowed involves three steps: 1) a new endowed fund must be established using the Fund Informat ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... power with respect to the shares of the Issuer held by the The Gabelli Asset Fund, The Gabelli Equity Trust, Inc., The Gabelli Growth Fund, The Gabelli Convertible Securities Fund, The Gabelli Value Fund Inc., The Gabelli Small Cap Growth Fund , The Gabelli Equity Income Fund, ,The Gabelli ABC Fund, ...

... power with respect to the shares of the Issuer held by the The Gabelli Asset Fund, The Gabelli Equity Trust, Inc., The Gabelli Growth Fund, The Gabelli Convertible Securities Fund, The Gabelli Value Fund Inc., The Gabelli Small Cap Growth Fund , The Gabelli Equity Income Fund, ,The Gabelli ABC Fund, ...

The Malta Alternative Investment Funds

... restricted to the extent to which it can transfer shares and is prohibited from issuing any invitation to the public to subscribe to any of the shares or debentures of the company whilst a public company may offer its shares or debentures to the public. SICAVs allow for the introduction of additiona ...

... restricted to the extent to which it can transfer shares and is prohibited from issuing any invitation to the public to subscribe to any of the shares or debentures of the company whilst a public company may offer its shares or debentures to the public. SICAVs allow for the introduction of additiona ...

18. Investments 2: Creating Your Personal Investment Plan

... willing to take. In general, when people are younger, they are more willing to accept risk because their investments will have more time to grow and overcome losses. As people grow older, they usually become less willing to accept risk because they will need their investment funds sooner for retirem ...

... willing to take. In general, when people are younger, they are more willing to accept risk because their investments will have more time to grow and overcome losses. As people grow older, they usually become less willing to accept risk because they will need their investment funds sooner for retirem ...

FREE Sample Here - We can offer most test bank and

... Full file at http://textbooktestbank.eu/Foundations-of-Finance-8th-Edition-Test-Bank-Keown 37) Which of the following is an example of both a capital market and a primary market transaction? A) The U.S. Government sells 3-month Treasury Bills. B) Microsoft common stock owned by an individual invest ...

... Full file at http://textbooktestbank.eu/Foundations-of-Finance-8th-Edition-Test-Bank-Keown 37) Which of the following is an example of both a capital market and a primary market transaction? A) The U.S. Government sells 3-month Treasury Bills. B) Microsoft common stock owned by an individual invest ...

Organizational Decision-Making and Information: Angel Investments

... theory suggests that committees can more effectively aggregate information among informed parties than the parties acting individually (de Condorcet, 1785), so all else equal, we might expect a group decision-making process to outperform an individual decision-making process. We examine a particula ...

... theory suggests that committees can more effectively aggregate information among informed parties than the parties acting individually (de Condorcet, 1785), so all else equal, we might expect a group decision-making process to outperform an individual decision-making process. We examine a particula ...

MSCI ESG BUSINESS INVOLVEMENT SCREENING RESEARCH

... For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative ...

... For more than 40 years, MSCI’s research-based indexes and analytics have helped the world’s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative ...

Policy Space to Prevent and Mitigate Financial Crises in - G-24

... minimum stay requirements and end-use limitations. Many of these have been used by nations such as China and India. Examples of price-based controls include taxes on inflows (Brazil) or on outflows (Malaysia). Unremunerated reserve requirements (URR) are both. On one hand they are price-based restri ...

... minimum stay requirements and end-use limitations. Many of these have been used by nations such as China and India. Examples of price-based controls include taxes on inflows (Brazil) or on outflows (Malaysia). Unremunerated reserve requirements (URR) are both. On one hand they are price-based restri ...

PowerPoint for Chapter 8

... 8.1.2.1 Linear Utility Function and Risk It is useful now to consider how the shape of an individual’s utility function affects his or her reaction to risk. Assume that an individual who has $5,000 and whose behavior is a linear utility function [Figure 8-1(a)] is offered a chance to gain $10,000 w ...

... 8.1.2.1 Linear Utility Function and Risk It is useful now to consider how the shape of an individual’s utility function affects his or her reaction to risk. Assume that an individual who has $5,000 and whose behavior is a linear utility function [Figure 8-1(a)] is offered a chance to gain $10,000 w ...

Appendix - American Public Power Association

... The general idea of computing financial returns is to evaluate the returns earned by investors in a particular company relative to investments in other firms and relative to risks of the investment. In this study it is of particular interest to compare returns earned by investors from selling genera ...

... The general idea of computing financial returns is to evaluate the returns earned by investors in a particular company relative to investments in other firms and relative to risks of the investment. In this study it is of particular interest to compare returns earned by investors from selling genera ...

PCA Faces Suit Linked to CalPERS Bribery Scandal

... board member, respectively, of the largest pension fund in the United States, and Loglisci, the Chief Investment Officer of New York’s pension fund, the second largest in the country,” the complaint states. Instead, the lawsuit claims former CalPERS CIO Joe Dear, who began his tenure in 2009, alleg ...

... board member, respectively, of the largest pension fund in the United States, and Loglisci, the Chief Investment Officer of New York’s pension fund, the second largest in the country,” the complaint states. Instead, the lawsuit claims former CalPERS CIO Joe Dear, who began his tenure in 2009, alleg ...

Brochure - Grenada Dual Citizenship

... and the programs themselves have never been more competitive. There are many reasons for this worldwide phenomenon, but in the end it boils down to a mutual benefit; a country's ability to infuse its economy with foreign capital, and investors' desire to capitalize on the many advantages of a second ...

... and the programs themselves have never been more competitive. There are many reasons for this worldwide phenomenon, but in the end it boils down to a mutual benefit; a country's ability to infuse its economy with foreign capital, and investors' desire to capitalize on the many advantages of a second ...

Scope and Definition

... investment agreements (IIAs). IIAs must specify not only their geographical and temporal coverage, but, most importantly, their subject-matter coverage. This is done primarily through the definitions of the terms “investment” and “investor”, which form the main focus of this paper. The definition of ...

... investment agreements (IIAs). IIAs must specify not only their geographical and temporal coverage, but, most importantly, their subject-matter coverage. This is done primarily through the definitions of the terms “investment” and “investor”, which form the main focus of this paper. The definition of ...

BARCLAYS BANK PLC (Form: 424B2, Received: 12/30

... and not to its consolidated subsidiaries. In this document, “Securities” refers to the Trigger Performance Securities linked to the S&P 500 ® Index that are offered hereby, unless the context otherwise requires. Additional Information Regarding Our Estimated Value of the Securities Our internal pric ...

... and not to its consolidated subsidiaries. In this document, “Securities” refers to the Trigger Performance Securities linked to the S&P 500 ® Index that are offered hereby, unless the context otherwise requires. Additional Information Regarding Our Estimated Value of the Securities Our internal pric ...

Financial Advisor Botsford Marches to a Different Drummer

... clients’ needs—food, shelter, insurance premiums, for instance—are funded through income from a bucket of conservative investments. Typical investing instruments in that bucket right now include preferred stocks, dividendbearing bluechip stocks, and fixedindexed annuities featuring principal guar ...

... clients’ needs—food, shelter, insurance premiums, for instance—are funded through income from a bucket of conservative investments. Typical investing instruments in that bucket right now include preferred stocks, dividendbearing bluechip stocks, and fixedindexed annuities featuring principal guar ...

Why it pays to be diversified

... the same time it also reduces the potential for outperformance. In contrast, manager diversification in co-investment portfolios lowers downside risk – but does not reduce the upside potential. This combination renders manager diversification in co-investment portfolios a proverbial win-win. The succe ...

... the same time it also reduces the potential for outperformance. In contrast, manager diversification in co-investment portfolios lowers downside risk – but does not reduce the upside potential. This combination renders manager diversification in co-investment portfolios a proverbial win-win. The succe ...

The Asset Allocation Debate: Provocative Questions

... security selection and/or market-timing—played minor roles. These findings were subsequently confirmed by Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have generally interpreted this research to mean that selecting an appropriate asset allocation is more important ...

... security selection and/or market-timing—played minor roles. These findings were subsequently confirmed by Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have generally interpreted this research to mean that selecting an appropriate asset allocation is more important ...

1 this announcement is for information only and is not an offer to

... Italy. None of the Waterfall Offers, this announcement, the Offers to Purchase or any other documents or materials relating to the Waterfall Offers have been or will be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (“CONSOB”) pursuant to applicable Itali ...

... Italy. None of the Waterfall Offers, this announcement, the Offers to Purchase or any other documents or materials relating to the Waterfall Offers have been or will be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (“CONSOB”) pursuant to applicable Itali ...

The Trading Behavior of Institutions and Individuals in Chinese

... detect any systematic trading patterns of stocks by individual investors. We recognize that there might be many other important influences on any given trading activity, and some variation in trading activity might be driven by individual investors’ behavioral biases as well as economic events and n ...

... detect any systematic trading patterns of stocks by individual investors. We recognize that there might be many other important influences on any given trading activity, and some variation in trading activity might be driven by individual investors’ behavioral biases as well as economic events and n ...

T t l d p t t - The University of Chicago Booth School of Business

... 8 percentage points behind the market and is confronted by the flow-performance relationship described in Figure 1. If the fund holds its position relative to the market for the remainder of the year it will finish the year 8 points down and see an expected outflow of 14 percent of its value in year ...

... 8 percentage points behind the market and is confronted by the flow-performance relationship described in Figure 1. If the fund holds its position relative to the market for the remainder of the year it will finish the year 8 points down and see an expected outflow of 14 percent of its value in year ...

Skybridge Multi-Adviser Hedge Fund Portfolios LLC

... appointed to serve as the Company’s principal underwriter (the “Principal Underwriter”) with authority to sell Shares directly and to appoint third party placement agents or other intermediaries (the “Placement Agents”) to assist the Principal Underwriter in selling Shares, generally on a reasonable ...

... appointed to serve as the Company’s principal underwriter (the “Principal Underwriter”) with authority to sell Shares directly and to appoint third party placement agents or other intermediaries (the “Placement Agents”) to assist the Principal Underwriter in selling Shares, generally on a reasonable ...

Is a Limited Partnership Interest a Security

... used investment vehicles. Among investments which limit the investor's liability, corporate securities are generally more available and provide for greater ease of transfer. During the past decade, however, tax shelter programs, and particularly limited partnerships, have become increasingly popular ...

... used investment vehicles. Among investments which limit the investor's liability, corporate securities are generally more available and provide for greater ease of transfer. During the past decade, however, tax shelter programs, and particularly limited partnerships, have become increasingly popular ...

The Case for Dividend Growers in Volatile Markets

... (“dividend growers”) have historically held up relatively better than the overall market as measured by the S&P 500® Index during market drawdowns, while also providing an income cushion. Therefore, investors worried about volatility, but who want to remain invested in equities while generating some ...

... (“dividend growers”) have historically held up relatively better than the overall market as measured by the S&P 500® Index during market drawdowns, while also providing an income cushion. Therefore, investors worried about volatility, but who want to remain invested in equities while generating some ...

The Adequacy of Investment Choices Offered By 401(k) Plans Edwin

... that plans offer funds that have better performance than randomly selected funds but that the difference is about the same size as the expense difference between the funds they select and randomly selected funds. Third, we show that the portfolio of mutual funds offered by 401(k) plans is riskier th ...

... that plans offer funds that have better performance than randomly selected funds but that the difference is about the same size as the expense difference between the funds they select and randomly selected funds. Third, we show that the portfolio of mutual funds offered by 401(k) plans is riskier th ...