Financial Research Company

... models, see recent factor performance highlights for any of our equity models and generate cumulative return charts for either risk index or industry factors. ...

... models, see recent factor performance highlights for any of our equity models and generate cumulative return charts for either risk index or industry factors. ...

A World with Higher Interest Rates

... but could unfold rather quickly, impacting virtually every major sector of the economy. This study attempts to take a more cautious and global approach in examining one possible future path of interest rates and their impact on selected sectors. Based on an analysis of global savings supply and inve ...

... but could unfold rather quickly, impacting virtually every major sector of the economy. This study attempts to take a more cautious and global approach in examining one possible future path of interest rates and their impact on selected sectors. Based on an analysis of global savings supply and inve ...

Lesson: "Applications: Growth and Decay"

... Andy invests $2,700.00 in a CD at an interest rate of 4.6% for 9 months. If the interest gets compounded continuously, how much will he have at the end of the term? How many years will it take for an initial investment of $7,000.00 to grow to $9,500.00 at a rate of 6% compounded quarterly? ...

... Andy invests $2,700.00 in a CD at an interest rate of 4.6% for 9 months. If the interest gets compounded continuously, how much will he have at the end of the term? How many years will it take for an initial investment of $7,000.00 to grow to $9,500.00 at a rate of 6% compounded quarterly? ...

Banks` loan rejection rates and thecreditworthiness of the banks

... the case both prior to but especially during the financial crisis 2009-2010, where firms with higher profit ratios, solvency ratios and liquidity ratios had a significantly higher probability of having their loan application accepted than firms with poor economic performance. The banks tightened the ...

... the case both prior to but especially during the financial crisis 2009-2010, where firms with higher profit ratios, solvency ratios and liquidity ratios had a significantly higher probability of having their loan application accepted than firms with poor economic performance. The banks tightened the ...

April - sibstc

... US vs CHINA - Whether the ongoing currency war- A cause for concern? Tensions have been rising over China’s Yuan policy ever since the US President depicted China as “currency manipulator,” during his earlier days in office. Western countries along with some emerging economies are of the view that C ...

... US vs CHINA - Whether the ongoing currency war- A cause for concern? Tensions have been rising over China’s Yuan policy ever since the US President depicted China as “currency manipulator,” during his earlier days in office. Western countries along with some emerging economies are of the view that C ...

Financing Options for Your Small Business Guide

... loan processing needs of small community/rural-based lenders by simplifying and streamlining loan application process and procedures, particularly for smaller SBA loans. It is part of a broader SBA initiative to promote the economic development of local communities, particularly those facing the cha ...

... loan processing needs of small community/rural-based lenders by simplifying and streamlining loan application process and procedures, particularly for smaller SBA loans. It is part of a broader SBA initiative to promote the economic development of local communities, particularly those facing the cha ...

Terry`s Place is currently experiencing a bad debt ratio of 4%. Terry

... beyond. If the weighted average cost of capital is 10%, calculate the value of the firm. B. $801.12 million If a firm grants credit with terms of 3/10 net 30, the creditor: C. Receives a discount of 3% when payment is made in less than 10 days after the sale The payback period rule accepts all proje ...

... beyond. If the weighted average cost of capital is 10%, calculate the value of the firm. B. $801.12 million If a firm grants credit with terms of 3/10 net 30, the creditor: C. Receives a discount of 3% when payment is made in less than 10 days after the sale The payback period rule accepts all proje ...

Investment Terminology and Concepts

... • Similar to an I.O.U. When you purchase a bond, you are making a loan to a corporation, local, state or federal government, federal government agency or other entity known as the issuer. • The issuer promises to pay you a specified rate of interest during the life of the bond and to repay the princ ...

... • Similar to an I.O.U. When you purchase a bond, you are making a loan to a corporation, local, state or federal government, federal government agency or other entity known as the issuer. • The issuer promises to pay you a specified rate of interest during the life of the bond and to repay the princ ...

Slide 1

... ... imply improved debt composition and less risk, so debt tolerance has increased But: • Need to maintain a balance between local and foreign currency debt, to reduce temptation to inflate away local debt—and to establish borrowing benchmarks • Ensure government borrowing from the banking system d ...

... ... imply improved debt composition and less risk, so debt tolerance has increased But: • Need to maintain a balance between local and foreign currency debt, to reduce temptation to inflate away local debt—and to establish borrowing benchmarks • Ensure government borrowing from the banking system d ...

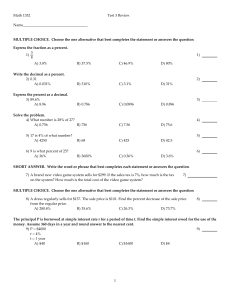

Math 1332 T3Rs11 - HCC Learning Web

... A) amount in account: $11,387.87; interest earned: $2387.87 B) amount in account: $10,135.46; interest earned: $1135.46 C) amount in account: $10,123.78; interest earned: $1123.78 D) amount in account: $9550.87; interest earned: $550.87 Solve the problem. 12) A mother invests $5000 in a bank account ...

... A) amount in account: $11,387.87; interest earned: $2387.87 B) amount in account: $10,135.46; interest earned: $1135.46 C) amount in account: $10,123.78; interest earned: $1123.78 D) amount in account: $9550.87; interest earned: $550.87 Solve the problem. 12) A mother invests $5000 in a bank account ...

An Overview of Personal Finance

... • A Present Value Example: – You have been offered a guaranteed investment which will pay you $50,000 at the end of 15 years. This is the amount you expect to pay to send your child to college. You need to make a reasonable offer for the investment so that you can purchase it today. You expect that ...

... • A Present Value Example: – You have been offered a guaranteed investment which will pay you $50,000 at the end of 15 years. This is the amount you expect to pay to send your child to college. You need to make a reasonable offer for the investment so that you can purchase it today. You expect that ...

Short-term financing

... buyers for use in manufacturing, processing, or reselling goods for profit. (from firm to another firm) - usually unsecured - also known as trade credit, commercial credit, mercantile credit or accounts receivable credit. - appears as accounts receivable/ notes receivable in the books of the credito ...

... buyers for use in manufacturing, processing, or reselling goods for profit. (from firm to another firm) - usually unsecured - also known as trade credit, commercial credit, mercantile credit or accounts receivable credit. - appears as accounts receivable/ notes receivable in the books of the credito ...

Derivatives issues to consider at the outset of a restructuring

... they are exposed in the normal course of their business. Corporates are often required by their lenders to establish various derivative hedges linked to their borrowing arrangements. For instance, if the base rate of a borrower’s loan facility is floating,2 the lender may require the borrower to ente ...

... they are exposed in the normal course of their business. Corporates are often required by their lenders to establish various derivative hedges linked to their borrowing arrangements. For instance, if the base rate of a borrower’s loan facility is floating,2 the lender may require the borrower to ente ...

Sovereign Default and Banking - Western University Economics

... The only equilibrium in the environment described so far is “excessive risk-taking” by all banks. All banks create portfolios of perfectly correlated risky projects, promise return i = R − 1, and repay depositors only with probability p. Note that while depositors would prefer to receive a lower int ...

... The only equilibrium in the environment described so far is “excessive risk-taking” by all banks. All banks create portfolios of perfectly correlated risky projects, promise return i = R − 1, and repay depositors only with probability p. Note that while depositors would prefer to receive a lower int ...

The EuroZone “Debt” Crisis: Another “Center” – “Periphery” Crisis

... entering at the same time and independently of their own circumstances in a wave of borrowing (Rey 2013). 2 As financial flows start moving towards the “periphery” an economic expansion follows, as demand, both private and public, is fed by the additional purchasing power provided from abroad. In ad ...

... entering at the same time and independently of their own circumstances in a wave of borrowing (Rey 2013). 2 As financial flows start moving towards the “periphery” an economic expansion follows, as demand, both private and public, is fed by the additional purchasing power provided from abroad. In ad ...

Chapter11: Money in the Modern Economy

... Liquidity is how close a given account is to money, a means of making an immediate purchase. Near monies are highly liquid. 4. The book also mentions L as a broad measure of money where L includes M1, M2, and short-term debt instruments (less than 1-year to maturity). I. Banking involves a “fraction ...

... Liquidity is how close a given account is to money, a means of making an immediate purchase. Near monies are highly liquid. 4. The book also mentions L as a broad measure of money where L includes M1, M2, and short-term debt instruments (less than 1-year to maturity). I. Banking involves a “fraction ...

Growth and fiscal policy: a positive theory

... effect: public debt grows faster than GDP, provision of public goods and infrastructure grows slower than GDP, and the tax rate declines. Effectively, as the economy converges to its balanced growth path, a decreasing fraction of GDP is devoted to providing public services. These findings, along with ...

... effect: public debt grows faster than GDP, provision of public goods and infrastructure grows slower than GDP, and the tax rate declines. Effectively, as the economy converges to its balanced growth path, a decreasing fraction of GDP is devoted to providing public services. These findings, along with ...

credit risk management: the next great financial challenge

... Basic Architecture of an Internal Ratings-Based (IRB) Approach to Capital • In order to become eligible for the IRB approach, a bank would first need to demonstrate that its internal rating system and processes are in accordance with the minimum standards and sound practice guidelines which will be ...

... Basic Architecture of an Internal Ratings-Based (IRB) Approach to Capital • In order to become eligible for the IRB approach, a bank would first need to demonstrate that its internal rating system and processes are in accordance with the minimum standards and sound practice guidelines which will be ...

Chapter 1 Simple and compound interest

... period of 5 years. Which of the following investments would be best for him? A 6.7% p.a. simple interest B 6.75% p.a. compound interest with yearly rests C 6.5% p.a. compound interest with quarterly rests D 6.25% p.a. compound interest with monthly rests E 6% compound interest with daily rests. ...

... period of 5 years. Which of the following investments would be best for him? A 6.7% p.a. simple interest B 6.75% p.a. compound interest with yearly rests C 6.5% p.a. compound interest with quarterly rests D 6.25% p.a. compound interest with monthly rests E 6% compound interest with daily rests. ...

US Loans Scheme

... SMART OPTION STUDENT LOAN - A private,credit-based loan for undergraduate and graduate students. This loan helps fund education expenses not already covered by federal student loans. Designed to reduce the overall loan costs and help shorten the amount of time it takes to pay off the loan, the Smart ...

... SMART OPTION STUDENT LOAN - A private,credit-based loan for undergraduate and graduate students. This loan helps fund education expenses not already covered by federal student loans. Designed to reduce the overall loan costs and help shorten the amount of time it takes to pay off the loan, the Smart ...

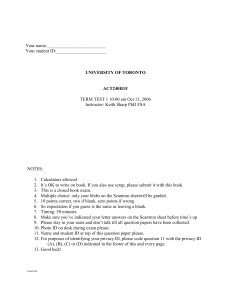

ACT 240H1F F06 Term Test 1 Privacy ID A v07

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

What caused the eurozone crisis?

... the savings-investment gap. When the Global Crisis broke out in 2008, those foreign investors got cold feet. They stopped lending across borders. This triggered a “sudden stop with monetary-union characteristics”. That is, it did not – as in the case of Iceland – manifest itself as an abrupt implosi ...

... the savings-investment gap. When the Global Crisis broke out in 2008, those foreign investors got cold feet. They stopped lending across borders. This triggered a “sudden stop with monetary-union characteristics”. That is, it did not – as in the case of Iceland – manifest itself as an abrupt implosi ...

A Policy Model for Analyzing Macroprudential and Monetary Policies Sami Alpanda Gino Cateau

... bank loan issued in t 1 priced in period t as (δ/π t ) PI ,t ; allows recursive formulation for banks’cash-‡ow (ABS) Alpanda, Cateau, Meh (Bank of Canada) ...

... bank loan issued in t 1 priced in period t as (δ/π t ) PI ,t ; allows recursive formulation for banks’cash-‡ow (ABS) Alpanda, Cateau, Meh (Bank of Canada) ...

Advanced Accounting by Hoyle et al, 6th Edition

... Contractual arrangements limit returns to equity holders yet participation rights provide increased profit potential and risks to sponsor. Risks and rewards are not distributed according to stock ownership but by other variable interests. Sponsor’s economic interest vary depending on the VIE’s succe ...

... Contractual arrangements limit returns to equity holders yet participation rights provide increased profit potential and risks to sponsor. Risks and rewards are not distributed according to stock ownership but by other variable interests. Sponsor’s economic interest vary depending on the VIE’s succe ...