Dynamic Monitoring of Financial Intermediaries with Subordinated

... riskier are hypothesized to have larger observable subordinated yield spreads [1]. Crosssectional studies cannot provide a relevant and prompt signal mechanism to regulators or market participants mainly for two reasons. First, they rely on public accounting measures that are announced in a quarterl ...

... riskier are hypothesized to have larger observable subordinated yield spreads [1]. Crosssectional studies cannot provide a relevant and prompt signal mechanism to regulators or market participants mainly for two reasons. First, they rely on public accounting measures that are announced in a quarterl ...

Peterson Foundation - Financial Management Services, Inc.

... national priorities and allocate resources among the many federal programs. They also determine how to finance those decisions, whether through collecting taxes from individuals and businesses, assessing various premiums or fees, or borrowing from domestic and international lenders. Up until the Gre ...

... national priorities and allocate resources among the many federal programs. They also determine how to finance those decisions, whether through collecting taxes from individuals and businesses, assessing various premiums or fees, or borrowing from domestic and international lenders. Up until the Gre ...

Prepare for Rising Rates - JP Morgan Asset Management

... you own and to assess your portfolio’s overall allocation to fixed income given the possibility for higher rates and a more significant price movement. ...

... you own and to assess your portfolio’s overall allocation to fixed income given the possibility for higher rates and a more significant price movement. ...

Economic Crisis 2008 - Common Sense Economics

... FACTOR 2: The Fed’s manipulation of interest rates during 2002-2006 • Fed's prolonged Low-Interest Rate Policy of 2002-2004 increased demand for, and price of, housing. • The low short-term interest rates made adjustable rate loans with low down payments highly attractive. • As the Fed pushed short- ...

... FACTOR 2: The Fed’s manipulation of interest rates during 2002-2006 • Fed's prolonged Low-Interest Rate Policy of 2002-2004 increased demand for, and price of, housing. • The low short-term interest rates made adjustable rate loans with low down payments highly attractive. • As the Fed pushed short- ...

Outlook - KMG Private Wealth Management

... The hard-fought election will likely be followed by more fighting in a divisive and bitter “lame duck” session in Congress running through year-end 2012. The stakes are high as those on Capitol Hill seek to mitigate the budget bombshell of tax increases and spending cuts, known as the fiscal cliff, ...

... The hard-fought election will likely be followed by more fighting in a divisive and bitter “lame duck” session in Congress running through year-end 2012. The stakes are high as those on Capitol Hill seek to mitigate the budget bombshell of tax increases and spending cuts, known as the fiscal cliff, ...

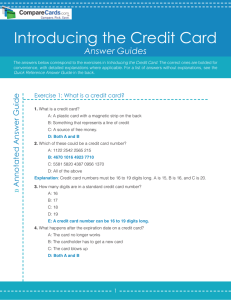

Introduction to Credit Card Answer Guide | CompareCards.com

... 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

... 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

FCA staff - The Farm Credit Council

... a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond offering must be independent of any institution that may purchase the bond and must also be offered to accredited investors in the offer’s local area ...

... a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond offering must be independent of any institution that may purchase the bond and must also be offered to accredited investors in the offer’s local area ...

Download attachment

... The relationship of the price of the stock in relation to EPS is expressed as the Price to Earnings Ratio or P / E Ratio. Investors often refer to the P / E Ratio as a rough indicator of value for a company. A high P / E Ratio would imply that investors are very optimistic (bullish) about the future ...

... The relationship of the price of the stock in relation to EPS is expressed as the Price to Earnings Ratio or P / E Ratio. Investors often refer to the P / E Ratio as a rough indicator of value for a company. A high P / E Ratio would imply that investors are very optimistic (bullish) about the future ...

Credit-driven busiuess cycles in the Eurace agent

... This paper presents the design of an housing market and a related mortgage market for the Eurace macroeconomic model and simulator. Eurace is a fullyspecified agent-based model of a complete economy that includes different types of agents and integrates different types of markets. Agents include hou ...

... This paper presents the design of an housing market and a related mortgage market for the Eurace macroeconomic model and simulator. Eurace is a fullyspecified agent-based model of a complete economy that includes different types of agents and integrates different types of markets. Agents include hou ...

top fund fortissimo - (c)

... Equity risk is "the financial risk involved in holding equity in a particular investment." Equity risk often refers to equity in companies through the purchase of stocks, and does not commonly refer to the risk in paying into real estate or building equity in properties. Information ratio The inform ...

... Equity risk is "the financial risk involved in holding equity in a particular investment." Equity risk often refers to equity in companies through the purchase of stocks, and does not commonly refer to the risk in paying into real estate or building equity in properties. Information ratio The inform ...

Understanding the dollar standard in order to improve ecological

... without government intervention, the value of the yuan would have appreciated very sharply. The surge in the value of the currency would have made Chinese exports less competitive, which would have caused China’s export growth and economic growth to slow. A slowdown in growth was not part of the Chi ...

... without government intervention, the value of the yuan would have appreciated very sharply. The surge in the value of the currency would have made Chinese exports less competitive, which would have caused China’s export growth and economic growth to slow. A slowdown in growth was not part of the Chi ...

No.305 / November 2009 Emerging Markets Capital Structure and Financial Integration

... are outstanding international bond issues and outstanding loans from non-resident banks (both as a percentage of GDP). The data come from the Financial Development and Structure Database produced by World Bank. Quantity-based de facto measures try to underline how much a country is integrated with i ...

... are outstanding international bond issues and outstanding loans from non-resident banks (both as a percentage of GDP). The data come from the Financial Development and Structure Database produced by World Bank. Quantity-based de facto measures try to underline how much a country is integrated with i ...

To view this press release as a file

... held by Israelis was accompanied by an increase of $1.1 billion (2 percent) in the prices of foreign bonds held by Israelis. In addition, there were net investments in foreign bonds totaling about $480 million. The value of direct investments abroad increased by about $8.8 billion (9.6 percent) in t ...

... held by Israelis was accompanied by an increase of $1.1 billion (2 percent) in the prices of foreign bonds held by Israelis. In addition, there were net investments in foreign bonds totaling about $480 million. The value of direct investments abroad increased by about $8.8 billion (9.6 percent) in t ...

Discussion Paper

... resort to international sources of financing to fund their investment needs. Increasingly, many of these countries are able to raise finance in international capital markets.1 However, an important share of their financing still comes in the form of official public finance, both concessional and non ...

... resort to international sources of financing to fund their investment needs. Increasingly, many of these countries are able to raise finance in international capital markets.1 However, an important share of their financing still comes in the form of official public finance, both concessional and non ...

Answers

... company to invest in all projects with a positive net present value, but this is theoretically possible only in a perfect capital market, i.e. a capital market where there is no limit on the finance available. Since investment funds are limited in the real world, it is not possible in the real world ...

... company to invest in all projects with a positive net present value, but this is theoretically possible only in a perfect capital market, i.e. a capital market where there is no limit on the finance available. Since investment funds are limited in the real world, it is not possible in the real world ...

Unit 5 - KU Campus

... Maria has a credit card. She had a beginning balance on the card of $500 for May (May 1 through May 31). She paid $200 on May 9, charged purchases of $50 on May 11, $100 on May 18, and $40 on May 29. Her Annual Percentage Rate (APR) on the credit card is 19% of the unpaid balance, and interest is ch ...

... Maria has a credit card. She had a beginning balance on the card of $500 for May (May 1 through May 31). She paid $200 on May 9, charged purchases of $50 on May 11, $100 on May 18, and $40 on May 29. Her Annual Percentage Rate (APR) on the credit card is 19% of the unpaid balance, and interest is ch ...

Ekonomicke rozhlady II_jun 2015_166x240.indd

... internal finance, and verify restricted access to external finance, then they decrease the level of investment. The investments also depend on enterprise’s liquidity. If firms have the capacity to generate liquidity, they will be able to increase investment [16]. The generation of higher cash flows may ...

... internal finance, and verify restricted access to external finance, then they decrease the level of investment. The investments also depend on enterprise’s liquidity. If firms have the capacity to generate liquidity, they will be able to increase investment [16]. The generation of higher cash flows may ...

Merrill Lynch Fall Media Preview Conference

... downgrades affected approximately 1 percent of the $565.3 billion in first-lien subprime residential mortgage-backed securities that S&P rated between the fourth quarter of 2005 and the end of 2006. Of course, S&P will continue to assess the ongoing creditworthiness of these securities. A final poin ...

... downgrades affected approximately 1 percent of the $565.3 billion in first-lien subprime residential mortgage-backed securities that S&P rated between the fourth quarter of 2005 and the end of 2006. Of course, S&P will continue to assess the ongoing creditworthiness of these securities. A final poin ...

Firm Life Cycle and Corporate Financing Choices

... periods as the mature stage of a firm’s life cycle. 7 We then retain observations that occur after 1970 due to the availability of flow of funds data from Compustat. Following standard practice, we exclude financial firms and regulated utilities and consider only firms that have securities with CRS ...

... periods as the mature stage of a firm’s life cycle. 7 We then retain observations that occur after 1970 due to the availability of flow of funds data from Compustat. Following standard practice, we exclude financial firms and regulated utilities and consider only firms that have securities with CRS ...